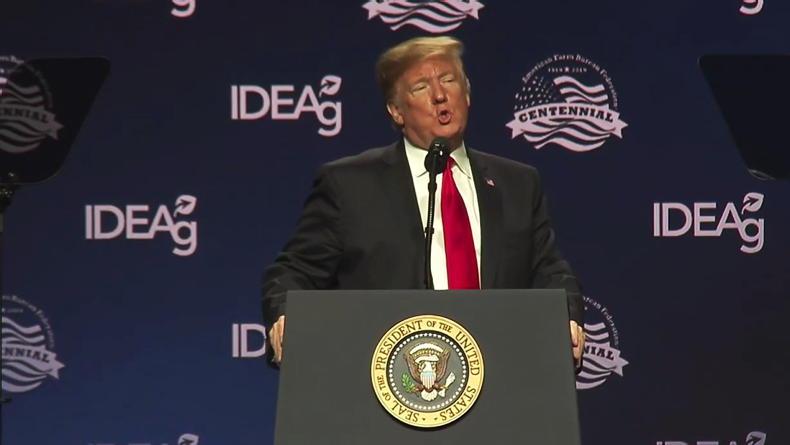

Last week, Donald Trump responded to Colombia refusing to allow military flights returning illegal immigrants from the US to land by announcing the imposition of 25% tariffs on imports from the country. A few phone calls later and an agreement was reached with the South American nation which meant the tariffs were never implemented.

This past weekend, the US president was at it again, announcing 25% tariffs on imports from both Canada and Mexico. Again, the announcement was followed by a round of diplomacy and phone calls during which both countries promised to meet some of Trump’s demands which has led to the tariffs being put on pause for the time being. China has reacted by announcing its own tariffs on US imports of between 10% and 15%

Perhaps unnoticed through all the noise was the imposition of an additional 10% tariff on all US imports from China. Those came into effect on Tuesday. China has reacted by announcing its own tariffs on US imports of between 10% and 15%.

Those Chinese measures are due to come into effect from February 10, but the leaders of both countries are scheduled to talk before the end of this week which could see some easing of measures.

However, indications are that China may be less conciliatory than Trump’s other recent targets, with analysts suggesting that Beijing may be more interested in taking advantage of the fallout from Trump’s policies elsewhere in the world than worrying about its trading relationship with the US.

European side

For Europe, there are – at the time of writing – no fresh tariffs announced, but it does feel like a matter of time before the EU is in Trump’s crosshairs.

This week the president complained that “they (the EU) don’t take our cars, they don’t take our farm products, they take almost nothing and we take everything from them. Millions of cars, tremendous amounts of food and farm products.”

He added that tariffs on EU goods could happen “pretty soon”.

This week, Phelim O'Neill looks at the impact the imposition of tariffs during the first Trump administration had on Irish food exports to the US – basically it was minimal.

Even in the unlikely event that Trump holds off on creating further disruption, the uncertainty he has already created will have knock-on effects

There is a wider question to be addressed with Trump’s policies and that surrounds the amount of uncertainty and risk it adds to international trade.

During the pandemic lessons were learned by everyone on the fallout from disruptions to long-established supply chains. Even in the unlikely event that Trump holds off on creating further disruption, the uncertainty he has already created will have knock-on effects.

For Irish food exporters the US market will be less attractive as the risks involved in trade where extra costs can be added on a whim may be viewed as to high.

Instead, key UK, EU and Asian markets will likely remain the main focus. There are certainly plenty of customers to be served in those markets and Ireland’s reputation for high-quality food exports should leave the country well positioned to weather any of Trump’s trade tantrums.

SHARING OPTIONS