At some point over the last few years, I’m sure that you have heard, read or even used terms like “agtech” or “agritech”. They’ve increasingly featured as part of conversations between farmers or those in the farming community for a number of years.

Although we can all identify with the broad sense of what they mean, trying to tie them down to an exact definition can be more of a challenge. For the purpose of simplicity, the terms are often interchangeable with agtech, the most commonly used in an Irish context. In its broadest sense, agtech is the use of technology to enhance any aspect along the agricultural journey, from farm to fork.

The past: A brief history of agtech

The term agtech may just be seen as another passing buzzword. It fits in quite nicely alongside other trendy buzzwords like “fintech” or “medtech” but in reality, agtech is not something new. Technology and its application in the world of agriculture has been happening since the early humans. So, before we can start to look into the potential of agriculture and technology to further impact the lives of farmers in Ireland, it is worth looking back at how technological advancements over the course of recent history have already changed the sector (see timeline).

The present: Global hotspots

While our recent history paints a positive picture, is the agriculture sector still applying technologies as well as we used to? The simple answer is no. According to the McKinsey Global Institute, agriculture is now the least digitalised sector out of 22 sectors analysed, including healthcare and real estate. Despite relatively low levels of digitalisation, global investment into agtech continues to rise representing €15.4bn in funding across 1,450 investments last year. There are a few countries that are leading the way when it comes to agtech.

USA

The USA invests the most in agtech related start-ups; in 2018, $8bn was invested in US agrifood tech start-ups across 576 investments. The USA has created an environment where agtech companies can flourish through an array of accelerators, places where early stage agtech companies can learn the basics about running a business, an experienced investment community and an openness to trial new solutions in the market. President of the US Donald Trump, thorugh his policies on trade and immigration, has hit the agriculture industry in the USA hard.

Israel

According to Start-up Nation Central, in 2018 Israel had over 350 start-ups connected to agtech. That represents just over 5% of the total start-ups in the country. The agtech scene in Israel is extremely active and reflects a close connection between investors, community organisers, corporates and start-ups. Large scale events like “AgriIsrael 4.0” and “Agrifood Week” provide the breeding ground for early stage agtech companies to find partners, suppliers and funders.

Brazil

According to the latest Radar Agtech report, there are 1,125 agtech start-ups in Brazil representing a 300% increase since 2018. The boost has been driven by increased investment, the introduction of new incubators like Agtech Garage, and well established domestic farming know-how. Brazil’s agricultural sector has come under increased scrutiny after parts of the Amazon rainforest were set on fire to deforest the land for farming and ranching.

China

With a rising consumer middle class and a public shift towards healthier eating, Chinese agtech companies are responding rapidly. According to recent research by Tracxn, there are 160 agtech start-ups in China. Some of the leading Chinese agtech companies are focusing on e-commerce (such as Meicai), supply management (Dfs168) and agricultural loans (Nongfadai).

The potential: Agtech and Ireland’s future

The rise of agtech and the increasing need to deliver more food to a growing global population (it’s predicted that there will be over nine billion people on the planet by 2050) means that the focus and application of technology as part of farming life will only continue into the future. The adoption of agtech is not linear, however.

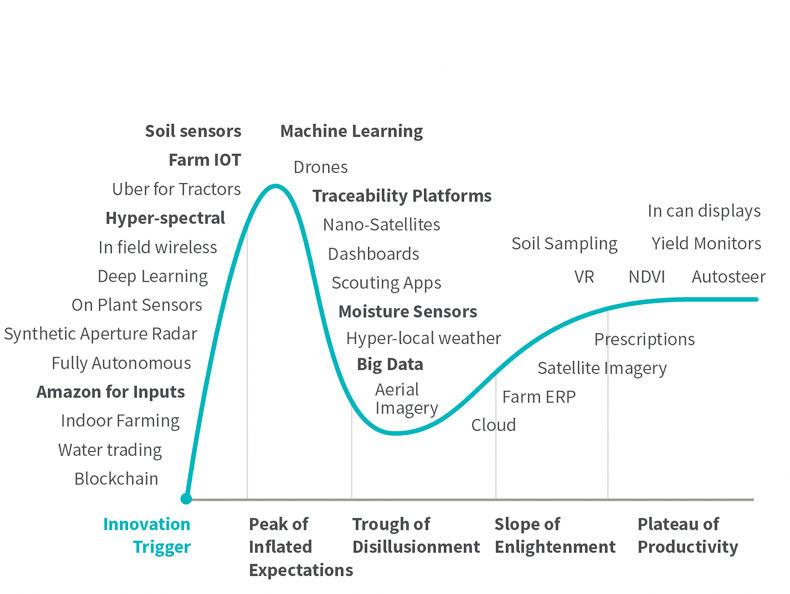

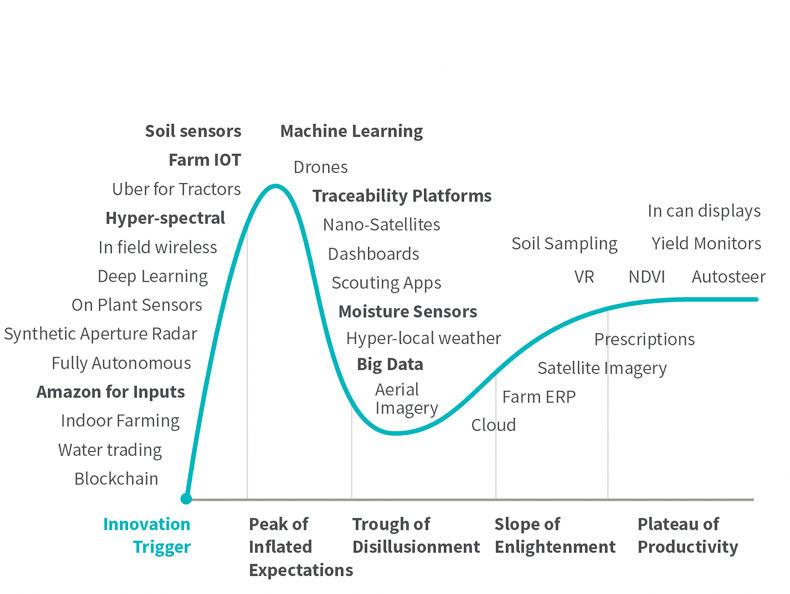

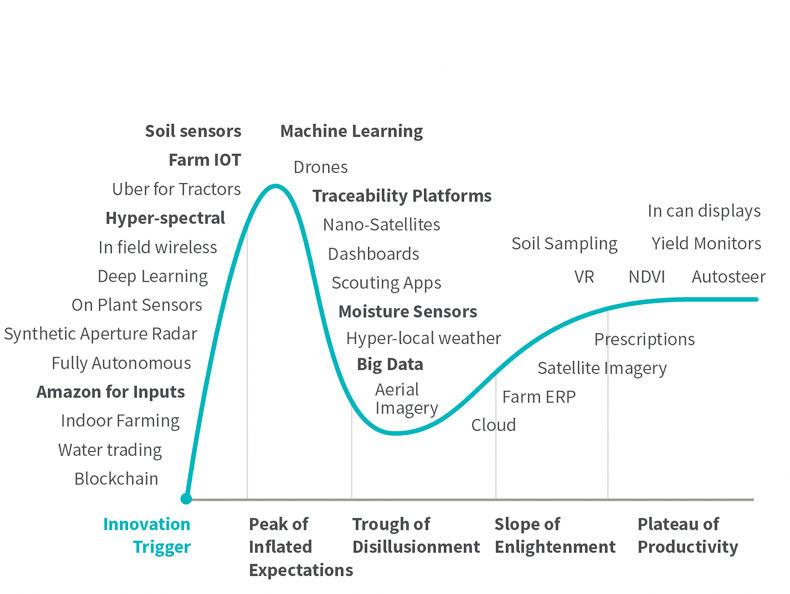

The Monsanto version of the Gartner Cycle, showing the progression of technological developments in agriculture.

As represented in the Monsanto version of the Gartner Cycle, (see Figure 1) new technologies emerge all the time. Some of these technologies fail to deliver initially, before finding their place in the market. Of course, some technologies also rise in a burst of hysteria but come crashing back to the ground before ever realising any commercial gains. This reality creates a challenge for everyone involved, including entrepreneurs, public policy makers, investors, researchers and of course, our farmers.

Change is the only constant that we can rely on. Before tractors, the horse and plough were deemed to be the best way to deliver farm efficiencies. The challenge with this period is the potential speed of change is different. Farmers historically may have had the luxury to adapt at their own pace, but with emerging technologies this may no longer be the case.

The Irish Government, for its own part, is looking at the global rise of agtech and has started to invest in some of the required infrastructures and financial supports that are needed to ensure that Irish agtech companies can deliver world class solutions for Irish farmers and producers.

One example of this was the launch of the €20m Ireland Agtech Fund in 2017, a partnership between the Ireland Strategic Investment Fund (ISIF) and California-based Finistere Ventures. This access to investment is key to ensure that we have local leaders able to compete in the global agtech environment.

Of course, Irish farmers have every right to be concerned about change, but ignoring the rise of technologies as part of day-to-day farm life is not necessarily the answer. As Henry Ford said in response to questions about his new technology, “If I had asked people what they wanted, they would have said faster horses.” As a sector, we need to embrace the right technologies at the right time so that they can enhance our businesses and our ways of life. Agtech will be a key enabler to keep many of our Irish farms viable into the future.

In these challenging times, some but certainly not all of the answers, may be found through the wider application of agtech by the Irish farming community.

Emerging Irish agtech companies are always looking at innovative ways to disrupt or enhance their respective sectors. Having the ability to create and foster local leaders like these will ensure that Ireland remains to the fore of agricultural innovations.

Poultry

Iamus Technologies (www.iamus.ai): Iamus Technologies is an Irish company looking to improve animal welfare and performance standards through agricultural robotics. They use machine learning to turn visual, environmental and biometric bird and farm information into actionable data for poultry producers. They are trialing their solution with processing partners before bringing their product to market in 2020.Beef

Micron Agritech (www.micronagritech.com): This agtech start-up wants to use technology to make the testing of animals for parasites quicker and easier. Their first product, the Tástáil kit, is patent pending and will allow farmers to test their animals for parasites on their own farm, saving time and money.Dairy

HerdEye: (www.herdeye.ie): HerdEye, an agtech start-up based in Co Roscommon, uses vision technology and machine learning to deliver an innovative system for livestock health monitoring.Horticulture

Beotanics (www.beotanics.com): Beotanics provide the food and drinks industry with access to a range of unique sources of plant-based ingredients. Their in-house expertise has been built up through extensive research and the use of technologies to deliver category leading yields, nutrition and functional values.Raw materials management

Farmhedge: (www.farmhedge.io): Farmhedge, a brainchild of John Garvey, is a Limerick University spin-out that is making it easier for farmers to source and purchase materials through their smartphones. The app already has customers in Germany, Austria and Ireland and enjoys financial backing from Enterprise Ireland and industry heavy weights BAYWA.Internet of things

Cognition (www.cognition.world): The integration of data into agriculture is happening all around us. Emerging companies like Cognition are using on-farm data collection to help farm managers understand real-time performance of farm conditions through actionable insights. The use of their sensor technology is helping farmers and food producers to increase their production efficiencies.

At some point over the last few years, I’m sure that you have heard, read or even used terms like “agtech” or “agritech”. They’ve increasingly featured as part of conversations between farmers or those in the farming community for a number of years.

Although we can all identify with the broad sense of what they mean, trying to tie them down to an exact definition can be more of a challenge. For the purpose of simplicity, the terms are often interchangeable with agtech, the most commonly used in an Irish context. In its broadest sense, agtech is the use of technology to enhance any aspect along the agricultural journey, from farm to fork.

The past: A brief history of agtech

The term agtech may just be seen as another passing buzzword. It fits in quite nicely alongside other trendy buzzwords like “fintech” or “medtech” but in reality, agtech is not something new. Technology and its application in the world of agriculture has been happening since the early humans. So, before we can start to look into the potential of agriculture and technology to further impact the lives of farmers in Ireland, it is worth looking back at how technological advancements over the course of recent history have already changed the sector (see timeline).

The present: Global hotspots

While our recent history paints a positive picture, is the agriculture sector still applying technologies as well as we used to? The simple answer is no. According to the McKinsey Global Institute, agriculture is now the least digitalised sector out of 22 sectors analysed, including healthcare and real estate. Despite relatively low levels of digitalisation, global investment into agtech continues to rise representing €15.4bn in funding across 1,450 investments last year. There are a few countries that are leading the way when it comes to agtech.

USA

The USA invests the most in agtech related start-ups; in 2018, $8bn was invested in US agrifood tech start-ups across 576 investments. The USA has created an environment where agtech companies can flourish through an array of accelerators, places where early stage agtech companies can learn the basics about running a business, an experienced investment community and an openness to trial new solutions in the market. President of the US Donald Trump, thorugh his policies on trade and immigration, has hit the agriculture industry in the USA hard.

Israel

According to Start-up Nation Central, in 2018 Israel had over 350 start-ups connected to agtech. That represents just over 5% of the total start-ups in the country. The agtech scene in Israel is extremely active and reflects a close connection between investors, community organisers, corporates and start-ups. Large scale events like “AgriIsrael 4.0” and “Agrifood Week” provide the breeding ground for early stage agtech companies to find partners, suppliers and funders.

Brazil

According to the latest Radar Agtech report, there are 1,125 agtech start-ups in Brazil representing a 300% increase since 2018. The boost has been driven by increased investment, the introduction of new incubators like Agtech Garage, and well established domestic farming know-how. Brazil’s agricultural sector has come under increased scrutiny after parts of the Amazon rainforest were set on fire to deforest the land for farming and ranching.

China

With a rising consumer middle class and a public shift towards healthier eating, Chinese agtech companies are responding rapidly. According to recent research by Tracxn, there are 160 agtech start-ups in China. Some of the leading Chinese agtech companies are focusing on e-commerce (such as Meicai), supply management (Dfs168) and agricultural loans (Nongfadai).

The potential: Agtech and Ireland’s future

The rise of agtech and the increasing need to deliver more food to a growing global population (it’s predicted that there will be over nine billion people on the planet by 2050) means that the focus and application of technology as part of farming life will only continue into the future. The adoption of agtech is not linear, however.

The Monsanto version of the Gartner Cycle, showing the progression of technological developments in agriculture.

As represented in the Monsanto version of the Gartner Cycle, (see Figure 1) new technologies emerge all the time. Some of these technologies fail to deliver initially, before finding their place in the market. Of course, some technologies also rise in a burst of hysteria but come crashing back to the ground before ever realising any commercial gains. This reality creates a challenge for everyone involved, including entrepreneurs, public policy makers, investors, researchers and of course, our farmers.

Change is the only constant that we can rely on. Before tractors, the horse and plough were deemed to be the best way to deliver farm efficiencies. The challenge with this period is the potential speed of change is different. Farmers historically may have had the luxury to adapt at their own pace, but with emerging technologies this may no longer be the case.

The Irish Government, for its own part, is looking at the global rise of agtech and has started to invest in some of the required infrastructures and financial supports that are needed to ensure that Irish agtech companies can deliver world class solutions for Irish farmers and producers.

One example of this was the launch of the €20m Ireland Agtech Fund in 2017, a partnership between the Ireland Strategic Investment Fund (ISIF) and California-based Finistere Ventures. This access to investment is key to ensure that we have local leaders able to compete in the global agtech environment.

Of course, Irish farmers have every right to be concerned about change, but ignoring the rise of technologies as part of day-to-day farm life is not necessarily the answer. As Henry Ford said in response to questions about his new technology, “If I had asked people what they wanted, they would have said faster horses.” As a sector, we need to embrace the right technologies at the right time so that they can enhance our businesses and our ways of life. Agtech will be a key enabler to keep many of our Irish farms viable into the future.

In these challenging times, some but certainly not all of the answers, may be found through the wider application of agtech by the Irish farming community.

Emerging Irish agtech companies are always looking at innovative ways to disrupt or enhance their respective sectors. Having the ability to create and foster local leaders like these will ensure that Ireland remains to the fore of agricultural innovations.

Poultry

Iamus Technologies (www.iamus.ai): Iamus Technologies is an Irish company looking to improve animal welfare and performance standards through agricultural robotics. They use machine learning to turn visual, environmental and biometric bird and farm information into actionable data for poultry producers. They are trialing their solution with processing partners before bringing their product to market in 2020.Beef

Micron Agritech (www.micronagritech.com): This agtech start-up wants to use technology to make the testing of animals for parasites quicker and easier. Their first product, the Tástáil kit, is patent pending and will allow farmers to test their animals for parasites on their own farm, saving time and money.Dairy

HerdEye: (www.herdeye.ie): HerdEye, an agtech start-up based in Co Roscommon, uses vision technology and machine learning to deliver an innovative system for livestock health monitoring.Horticulture

Beotanics (www.beotanics.com): Beotanics provide the food and drinks industry with access to a range of unique sources of plant-based ingredients. Their in-house expertise has been built up through extensive research and the use of technologies to deliver category leading yields, nutrition and functional values.Raw materials management

Farmhedge: (www.farmhedge.io): Farmhedge, a brainchild of John Garvey, is a Limerick University spin-out that is making it easier for farmers to source and purchase materials through their smartphones. The app already has customers in Germany, Austria and Ireland and enjoys financial backing from Enterprise Ireland and industry heavy weights BAYWA.Internet of things

Cognition (www.cognition.world): The integration of data into agriculture is happening all around us. Emerging companies like Cognition are using on-farm data collection to help farm managers understand real-time performance of farm conditions through actionable insights. The use of their sensor technology is helping farmers and food producers to increase their production efficiencies.

SHARING OPTIONS