I started off talking to FBD’s Seamus Costello, asking him if farmers were engaging with FBD on pensions, now that commodity prices across all sectors – dairy, beef, sheep and cereals – were good.

He said engagement from farmers was better, but was very clear that tax relief was still one of the big drivers for putting money into a pension.

Most of Seamus’s clients are in the Tipperary and Kilkenny region, so they come from a mix of farm enterprises, big and small, young and old.

“For many, saving for retirement might seem a long way away, but with appropriate pension planning, it is one of those choices the earlier you start the brighter your future,” he said.

“Tax relief is by far the greatest advantage of saving in a pension. If you’re paying tax on your farm income at the highest rate, then you’re entitled to get a 40% saving on any pension contributions that you make personally up to certain limits.

“Take for example €200 per month invested into a pension for a 40% tax payer. The net cost to you is €120 per month, with the Government covering €80 per month in terms of tax relief. So, a €120 contribution a month from you, along with the €80 per month from the taxman, could grow to over €190,000 at age 65 for a 25-year-old.”

Early start essential

After the benefit of tax relief, starting early is the next best thing you can do for your pension. Over a 40-year period, a 25-year-old will generate a 60% greater return than the person starting 10 years later. Over the same period, that 25-year-old generates a 180% greater return than the person who waits until they are 45.

What drives pension performance?

I asked Seamus what made pensions successful or perform better. He said: “The investment choices you make along the way drive performance. Equity performance (share price) can often be the main driver of performance in your pension.

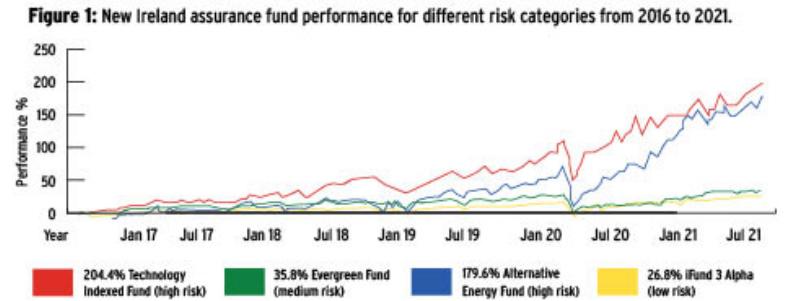

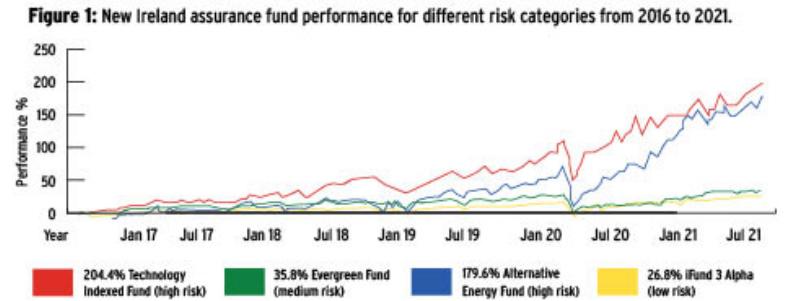

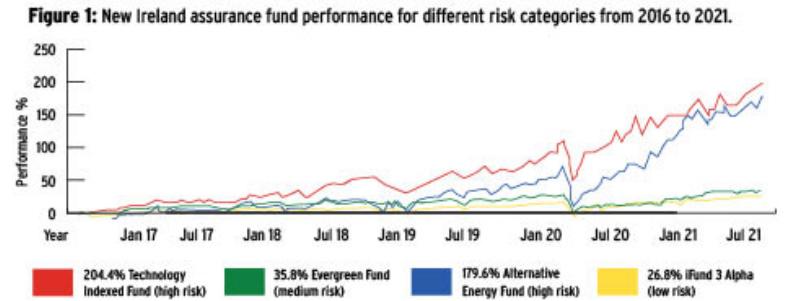

“Just look back at last year, where share price enjoyed a strong start to 2020, and was up over 7% for the first seven weeks of the year.

“However, what followed was share price falling the fastest in history, as stocks took just 16 trading days to fall 20%. That period of downward pressure ultimately came to a fall of 34% over a four-week period, driven predominately by concerns relating to the COVID-19 pandemic.

“Subsequently, stocks enjoyed a a very good second quarter of 2020, with the US market seeing its best 50 days in history. Global markets finished the year with a positive return of 7%, increasing to 15% up to the first half of 2021. Clients also need to be aware of fund charges as well as the returns.”

Seamus said this shows how important share price movements and other global political and social issues can affect pension performance.

Seamus said Figure 1 shows how the New Ireland assurance fund has moved in different risk categories over the last five years, with significant uplift in late 2020 and early 2021 visible.

Seamus Costello is one of many experienced financial advisers in the 34 branches of FBD.

Company benefits stand out

Given the geography of the region where Seamus works, some of the bigger dairy and tillage farmers are trading as a company rather than as a sole trader.

“If trading in a limited company, the contributions can be paid to the pension directly by the company. For many farmers, this is an effective tool for wealth extraction from the business,” he said.

Seamus’s tips for farmers trading in companies:

Company directors have a number of routes for wealth extraction available to them:

Leave the profits within the business — with profits subject to 12.5% corporation tax and potentially becoming liable for the close company surcharge for undistributed income. Additionally, profits may be subject to CGT of 33% on the sale of the company unless you are eligible for certain capital reliefs. Withdraw the profits as salary — profits withdrawn in this manner will be subject to income tax, PRSI and USC, which would be as high as 52% (income tax 40%, PRSI 4%, USC 8%).Withdraw the profits via an executive pension — extraction of company profits via an employer contribution to an executive pension is very popular with business owners. Profits withdrawn via an employer contribution to an executive pension plan result in a tax relief for the employer (subject to Revenue limits) and no immediate tax liability for the employee. Other key advantages include: - Corporation tax relief for the employer at 12.5% (subject to contribution limits).

- Generous limits for employers to contribute.

- No income tax, PRSI or USC liability for the employee following the contribution.

- No PRSI liability for the employer as a result of remunerating the employee in this way.

- Profits invested in pension fund, which allows tax-free growth until retirement.

- Opportunity to plan a business exit strategy with access to funds available as early as age 50, if all links with the business are severed, or anytime between age 60 – 70, without having to sever any links with the business.

- Pension lump sum at retirement, which is tax free up to the first €200,000 and subject to favourable rate of 20% for the next €300,000.

- Income in retirement via pension

annuity or approved retirement fund/approved minimum retirement fund.

- Possibility to pass wealth to spouse and children via approved retirement fund/approved minimum retirement fund.

‘What pension is needed?’ – farmers

don’t ever intend to retire

Martin Glennon has been working with ifac for over 30 years in financial planning, so he is no stranger to the pension swings and roundabouts.

“The way I see it at the moment, there are two movers in the market for pensions – firstly, the self employed people that want it to reduce the tax bill, and secondly, an increasing number of employers that are using it to further incentivise staff that have been with them for a number of years.”

Martin has seen the waves of engagement in other non-farming sectors, where a pension is seen as an investment for the future to maintain a lifestyle, with the tax break an added bonus. He explained that typically for a sole trader like a farmer, you see the pension used as a tax tool with a lump sum in one year, nothing the next year, something small the following year and so on. Essentially, the pension is used as a tax tool on an annual basis and it’s not until the farmer is in their late 50s that they start asking the question about retirement, because we all know farmers don’t ever intend to retire,” he said.

It is with this in mind that Martin prefers to ask the pension question a different way. “I always ask the farmer the question, ‘would you like an option of having an extra €100 per week on top of the State pension when you step back from farming, that would allow you options.’ Maybe it allows you stand back from farming a little earlier, but still be involved, if and when that time arrives, rather than be dependent on the farm to maintain your income all the way.”

On farmers in new companies, Martin is clear: “Typically, what I see is farmers switching from sole trader to trading as a company to solve a tax problem and allow them to invest or pay back borrowings. So the company piece fixes the tax problem. Then, as funds build up, they either do one of two things – buy land or start paying into a pension. There is definitely more scope to pay into a pension through the company structure.”

One group of farmers down through the years that Martin has seen come into the pension game early is those farmers that don’t get the farm transferred into their name until later in life.

“I see these people come early to discuss pensions, because they don’t want to be in the same situation – essentially, they are learning the lessons of the previous generation,” he said.

Martin Glennon is head of financial planning at ifac.

Balance important in

investments and pensions

FDC’s Seamus O’Mahoney is predominantly working with farmer clients where land quality is mixed, land fragmentation is an issue and many clients have part-time or off-farm work alongside a farming enterprise. I started off by asking Seamus if pensions are high on the agenda for a lot of his clients or if they are doing some other form of pension planning.

“My clients are, in the main, non-dairy farming and maybe slightly smaller scale operators, so pensions as a form of tax break are not a priority. However, it’s all relative. I would say they all have some sort of a pension plan in place, but it’s not as aggressively funded as bigger farming operators in other parts of the country would be,” he said.

Seamus explained that the trade-off for a lot of his clients is the return on the investment and locking the money up for 20 years versus the access of funds over a shorter time frame when the need arises.

“Very much the trade-off is accessibility versus tax relief and a lot of my clients are operating a system where they have a farming enterprise, some form of single farm payment and/or some form of other income, whether that is part-time, off-farm work or another partner working in the household. All this means is they don’t go aggressively down the pension route, but will make a play in that pension space.”

I asked Seamus if there is any other form of future planning going on, like purchasing of residential property for leasing and hoping for capital appreciation.

“No, that is not happening very much for many of our clients – by the time you purchase, spend on upkeep and pay your taxes, it doesn’t make sense at the moment,” he said.

“If we take an elderly couple that are retired from full-time employment, the threshold is €36,000. Now, if they both have a State pension, that brings income into €26,000 and then most have some form of other income coming in – that might be a land lease, a rental property or some form of farm income, which down around here is predominantly cattle and sheep sales.

“We have done a good bit of work in-house with our Cork regional manager Michael O’Driscoll on balancing savings and future planning. Looking at investment in the round is important for all clients, as each individual package is important and can be different depending on circumstances.”

Seamus O’Mahoney is a certified financial planner working with FDC in the Bandon, Skibbereen, Bantry and the Millstreet region in west Cork.

I started off talking to FBD’s Seamus Costello, asking him if farmers were engaging with FBD on pensions, now that commodity prices across all sectors – dairy, beef, sheep and cereals – were good.

He said engagement from farmers was better, but was very clear that tax relief was still one of the big drivers for putting money into a pension.

Most of Seamus’s clients are in the Tipperary and Kilkenny region, so they come from a mix of farm enterprises, big and small, young and old.

“For many, saving for retirement might seem a long way away, but with appropriate pension planning, it is one of those choices the earlier you start the brighter your future,” he said.

“Tax relief is by far the greatest advantage of saving in a pension. If you’re paying tax on your farm income at the highest rate, then you’re entitled to get a 40% saving on any pension contributions that you make personally up to certain limits.

“Take for example €200 per month invested into a pension for a 40% tax payer. The net cost to you is €120 per month, with the Government covering €80 per month in terms of tax relief. So, a €120 contribution a month from you, along with the €80 per month from the taxman, could grow to over €190,000 at age 65 for a 25-year-old.”

Early start essential

After the benefit of tax relief, starting early is the next best thing you can do for your pension. Over a 40-year period, a 25-year-old will generate a 60% greater return than the person starting 10 years later. Over the same period, that 25-year-old generates a 180% greater return than the person who waits until they are 45.

What drives pension performance?

I asked Seamus what made pensions successful or perform better. He said: “The investment choices you make along the way drive performance. Equity performance (share price) can often be the main driver of performance in your pension.

“Just look back at last year, where share price enjoyed a strong start to 2020, and was up over 7% for the first seven weeks of the year.

“However, what followed was share price falling the fastest in history, as stocks took just 16 trading days to fall 20%. That period of downward pressure ultimately came to a fall of 34% over a four-week period, driven predominately by concerns relating to the COVID-19 pandemic.

“Subsequently, stocks enjoyed a a very good second quarter of 2020, with the US market seeing its best 50 days in history. Global markets finished the year with a positive return of 7%, increasing to 15% up to the first half of 2021. Clients also need to be aware of fund charges as well as the returns.”

Seamus said this shows how important share price movements and other global political and social issues can affect pension performance.

Seamus said Figure 1 shows how the New Ireland assurance fund has moved in different risk categories over the last five years, with significant uplift in late 2020 and early 2021 visible.

Seamus Costello is one of many experienced financial advisers in the 34 branches of FBD.

Company benefits stand out

Given the geography of the region where Seamus works, some of the bigger dairy and tillage farmers are trading as a company rather than as a sole trader.

“If trading in a limited company, the contributions can be paid to the pension directly by the company. For many farmers, this is an effective tool for wealth extraction from the business,” he said.

Seamus’s tips for farmers trading in companies:

Company directors have a number of routes for wealth extraction available to them:

Leave the profits within the business — with profits subject to 12.5% corporation tax and potentially becoming liable for the close company surcharge for undistributed income. Additionally, profits may be subject to CGT of 33% on the sale of the company unless you are eligible for certain capital reliefs. Withdraw the profits as salary — profits withdrawn in this manner will be subject to income tax, PRSI and USC, which would be as high as 52% (income tax 40%, PRSI 4%, USC 8%).Withdraw the profits via an executive pension — extraction of company profits via an employer contribution to an executive pension is very popular with business owners. Profits withdrawn via an employer contribution to an executive pension plan result in a tax relief for the employer (subject to Revenue limits) and no immediate tax liability for the employee. Other key advantages include: - Corporation tax relief for the employer at 12.5% (subject to contribution limits).

- Generous limits for employers to contribute.

- No income tax, PRSI or USC liability for the employee following the contribution.

- No PRSI liability for the employer as a result of remunerating the employee in this way.

- Profits invested in pension fund, which allows tax-free growth until retirement.

- Opportunity to plan a business exit strategy with access to funds available as early as age 50, if all links with the business are severed, or anytime between age 60 – 70, without having to sever any links with the business.

- Pension lump sum at retirement, which is tax free up to the first €200,000 and subject to favourable rate of 20% for the next €300,000.

- Income in retirement via pension

annuity or approved retirement fund/approved minimum retirement fund.

- Possibility to pass wealth to spouse and children via approved retirement fund/approved minimum retirement fund.

‘What pension is needed?’ – farmers

don’t ever intend to retire

Martin Glennon has been working with ifac for over 30 years in financial planning, so he is no stranger to the pension swings and roundabouts.

“The way I see it at the moment, there are two movers in the market for pensions – firstly, the self employed people that want it to reduce the tax bill, and secondly, an increasing number of employers that are using it to further incentivise staff that have been with them for a number of years.”

Martin has seen the waves of engagement in other non-farming sectors, where a pension is seen as an investment for the future to maintain a lifestyle, with the tax break an added bonus. He explained that typically for a sole trader like a farmer, you see the pension used as a tax tool with a lump sum in one year, nothing the next year, something small the following year and so on. Essentially, the pension is used as a tax tool on an annual basis and it’s not until the farmer is in their late 50s that they start asking the question about retirement, because we all know farmers don’t ever intend to retire,” he said.

It is with this in mind that Martin prefers to ask the pension question a different way. “I always ask the farmer the question, ‘would you like an option of having an extra €100 per week on top of the State pension when you step back from farming, that would allow you options.’ Maybe it allows you stand back from farming a little earlier, but still be involved, if and when that time arrives, rather than be dependent on the farm to maintain your income all the way.”

On farmers in new companies, Martin is clear: “Typically, what I see is farmers switching from sole trader to trading as a company to solve a tax problem and allow them to invest or pay back borrowings. So the company piece fixes the tax problem. Then, as funds build up, they either do one of two things – buy land or start paying into a pension. There is definitely more scope to pay into a pension through the company structure.”

One group of farmers down through the years that Martin has seen come into the pension game early is those farmers that don’t get the farm transferred into their name until later in life.

“I see these people come early to discuss pensions, because they don’t want to be in the same situation – essentially, they are learning the lessons of the previous generation,” he said.

Martin Glennon is head of financial planning at ifac.

Balance important in

investments and pensions

FDC’s Seamus O’Mahoney is predominantly working with farmer clients where land quality is mixed, land fragmentation is an issue and many clients have part-time or off-farm work alongside a farming enterprise. I started off by asking Seamus if pensions are high on the agenda for a lot of his clients or if they are doing some other form of pension planning.

“My clients are, in the main, non-dairy farming and maybe slightly smaller scale operators, so pensions as a form of tax break are not a priority. However, it’s all relative. I would say they all have some sort of a pension plan in place, but it’s not as aggressively funded as bigger farming operators in other parts of the country would be,” he said.

Seamus explained that the trade-off for a lot of his clients is the return on the investment and locking the money up for 20 years versus the access of funds over a shorter time frame when the need arises.

“Very much the trade-off is accessibility versus tax relief and a lot of my clients are operating a system where they have a farming enterprise, some form of single farm payment and/or some form of other income, whether that is part-time, off-farm work or another partner working in the household. All this means is they don’t go aggressively down the pension route, but will make a play in that pension space.”

I asked Seamus if there is any other form of future planning going on, like purchasing of residential property for leasing and hoping for capital appreciation.

“No, that is not happening very much for many of our clients – by the time you purchase, spend on upkeep and pay your taxes, it doesn’t make sense at the moment,” he said.

“If we take an elderly couple that are retired from full-time employment, the threshold is €36,000. Now, if they both have a State pension, that brings income into €26,000 and then most have some form of other income coming in – that might be a land lease, a rental property or some form of farm income, which down around here is predominantly cattle and sheep sales.

“We have done a good bit of work in-house with our Cork regional manager Michael O’Driscoll on balancing savings and future planning. Looking at investment in the round is important for all clients, as each individual package is important and can be different depending on circumstances.”

Seamus O’Mahoney is a certified financial planner working with FDC in the Bandon, Skibbereen, Bantry and the Millstreet region in west Cork.

SHARING OPTIONS