The past two decades have witnessed huge changes in the world of crop protection and in particular the world of crop protection product producers.

So many names that were once global companies, such as ICI, May & Baker, Schering, Hoechst, etc, evolved into other entities such as Aventis, Zeneca, etc, which have also since vanished in turn.

But the past year has seen more aggressive change, with the coming together of giants such as Bayer and Monsanto, Dow CropScience and DuPont/Pioneer and ChemChina and Syngenta.

It suggests that in the 1980s about 33% of the AgChem Company R&D was targeted at the EU. This had fallen to about 25% in the 1990s and, today, the equivalent figure is less than 8%

It seems that the drive for scale in these multinational businesses is never ending. Any of these were big to begin with and then they become giants. But as they grow as one, it is also common that these giants begin to hive off parts of the business that is no longer regarded as core. This then enables smaller businesses to be created with a specific focus that they can use to their advantage.

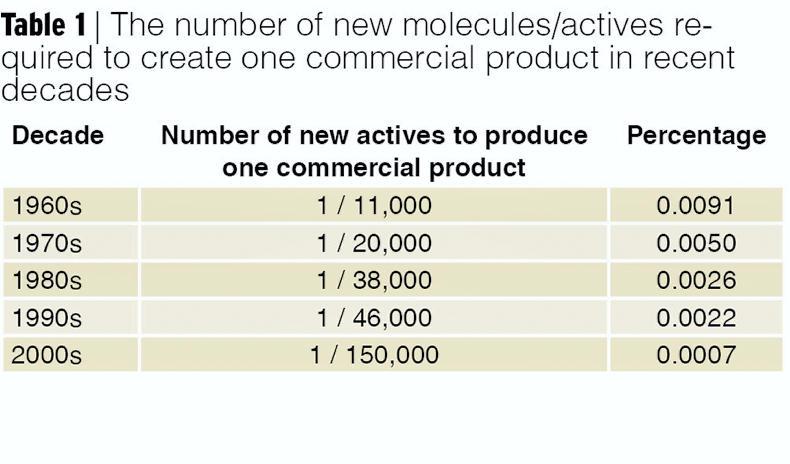

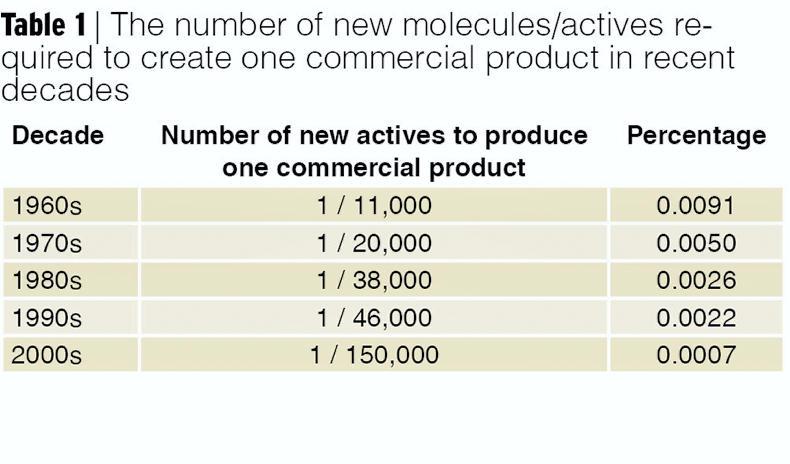

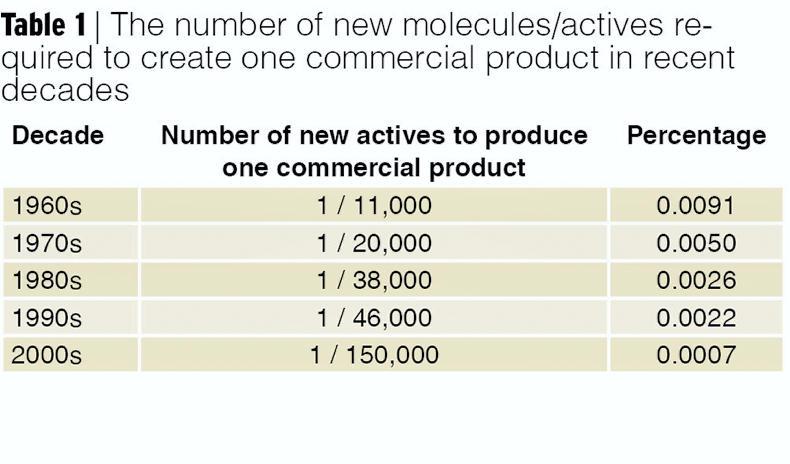

For these businesses, life has also become more complicated and this is not just in the EU. In the 1960s, roughly one in 11,000 of the new actives synthesised produced a new commercial product (see Table 1).

This fell dramatically to one in 38,000 two decades later and to one in 150,000 this century. These numbers represent the background against which innovative plant protection companies have to work and it signifies the cost base involved in the business.

R&D trends

There are many different figures used for the cost of developing a new commercial active. Whatever about the small change, this cost is now generally regarded as being north of €300m and an estimated two-thirds of that total is now required to prove environmental safety.

Companies continue to say that they are still investing hugely in the search for new solutions and this is undoubtedly true. But the focus of this spend has changed significantly and many companies now see over half of their R&D programmes devoted to genetic research rather than chemical R&D.

As well as this, we are witnessing a drifting of research focus and investment away from EU markets. The big companies are, understandably, concentrating more on markets that offer a more predictable path to registration, more hectares to target and where markets do not have universal objection to the use of new biotechnology tools in the creation of new genetic solutions for field crops.

A study conducted by the European Crop Protection Association has attempted to quantify this drift in R&D investment within the EU. It suggests that in the 1980s about 33% of the AgChem Company R&D was targeted at the EU. This had fallen to about 25% in the 1990s and, today, the equivalent figure is less than 8%.

Fewer products will be present in chemical stores as actives are not registered for a range of reasons. Fewer products will be present in chemical stores as actives are not registered for a range of reasons.

The fact that the EU is still not allowing the use of any of the new biotechnology tools in plant breeding is making our market increasingly unattractive to these companies who continue to look more towards genetic solutions. And any prospect of change is slow at best.

One could be forgiven for assuming that the international drive towards increased genetic solutions is very much behind the most recent upscaling moves.

The fusing of Bayer and Monsanto sees a huge mainly chemical company join with a huge predominantly seed company. It seems likely that ChemChina’s interest in Syngenta was helped by its significant interests in plant breeding technology, while Dow with DuPont Pioneer will certainly bring additional capacity on both fronts.

Corteva Agriscience

The Dow DuPont Pioneer deal, announced in late 2015, is described as a merger of equals. The merger was completed last September when it was announced that the combined Dow/DuPont global business is to evolve into three standalone businesses. These are:

Materials. Speciality.Agriculture. As promised from the onset, the DowDuPontTM agriculture division, which was created in the deal, is to become a standalone company called Corteva Agriscience TM. The name itself is said to be derived from a combination of words meaning heart and nature. Corteva AgriscienceTM brings together DuPont Crop Protection, DuPont Pioneer and Dow AgroSciences to create a standalone agriculture company with strengths in seed technologies, crop protection and also digital agriculture.

As with any large company merger, competition authorities in different parts of the world intervene to force change in product portfolios to try to ensure that there will still be competition in different markets. And as companies can be strong in different markets, it can be expected that the divestment obligations imposed will be different in different regions.

Under the terms of the agreement for the EU, it is recommended that FMC will acquire DuPont’s cereal broadleaf herbicide and chewing insecticide portfolios. In addition, FMC will acquire the DuPont crop protection research and development pipeline and organisation, excluding seed treatment, nematicides, and late-stage R&D programmes, which DuPont will continue to develop and bring to market. The assets being divested generated revenues in 2016 of about $1.4bn.

Industry is looking more towards bigger crop markets and outside of the EU.Industry is looking more towards bigger crop markets and outside of the EU.

Bayer/Monsanto

The Bayer-Monsanto deal only recently received approval from the EU authorities and so much less is known about its consequences in terms of what products will have to be divested by both companies. The few that are known happened as a promise in the original deal.

In this, Bayer committed to off-load all of its seeds business, as it too had been in the plant development business and had owned the alternative GM herbicide trait LibertyLink, as well as some other traits. In a parallel move, Monsanto agreed to sell off its take-all control seed dressing, Latitude.

It seems likely that there will be many other product adjustments ordered as this deal settles in.

ChemChina/

Syngenta

The deal between ChemChina and Syngenta generated even more product adjustments because many of the actives divested by Syngenta went to Adama, which is another ChemChina-owned company. So as well as Syngenta having to divest, so had Adama.

In the EU, Syngenta had to divest its Shirlan and Fusilade Max range. It also has to transfer to Adama its isopyrazam fungicide range, Aphox and Plenum. So all of these will come from a different stable in the future.

Products moving and shaking

Every passing year brings significant changes to the tools that are available for plant protection. For most of three decades, the list of actives in the market continued to increase, but this situation has reversed in this decade. Farmers are acutely aware of the absence of actives now to control specific problems such as leather-jackets and they are becoming acutely conscious of the increasing challenge to control some cereal diseases, resistant weeds and aphids.

Many different factors influence the loss of products. For some, it is failure to meet the requirements of a higher-spec environmental profile. For others, it is the cost involved in providing a modern portfolio for registration relative to the likely return from the market. Some actives have been superseded in the market, while others have lost their usefulness. Others still are falling foul of increasingly stringent registration requirements.

Whatever the reason, it is worth noting a number of the well-known brands that have departed the market for this year alone. The long-serving Folicur is no longer to be sold, but tebuconazole will continue in the market in generic form and in mixtures. Bayer will also cease to carry Cheetah Extra (fenoxaprop-P), but it too will continue to be available in generic formats. Consento will also be discontinued because the decision has been made not to re-register the product.

In the Syngenta camp, growers may notice that Axial is on a use-up requirement for PCS number 02282. All stocks of this product must be used by 30 June 2019. However, a new formulation with a new PCS number will replace it next season and this may have its full complement of adjuvant built in. Traxos, a mix of Axial and Topik, has also been discontinued, as has the morpholine mildewicide Tern.

One other Syngenta active, which continues to be essential for disease control in Ireland in wheat and barley, is Bravo or chlorothalonil. Its current registration ends in October of this year and there is considerable concern as to its fate thereafter. It seems that as time goes by, there are an increasing number of concerns with regard to its registration. Its importance as a product is far more significant for Ireland than anywhere else, so we must consider the possibility that it may not be re-registered and we must begin to take action accordingly.

While most news is of products that are going from the market, it is good to hear of one that may be coming. Syngenta is attempting to bring a new seed dressing for cereals that is already on the market in countries such as France and the UK (see new products on page 17).

It seems that we will lose fenpropimorph (Corbel) next year also, as BASF is not going to apply for re-registration on a cost-benefit basis.

Changing PCS details

As individual products come up for re-registration, they are being evaluated under a more stringent set of evolving rules. So many products are having some of their details altered in different ways and they are being given new PCS numbers to reflect this. Many products on our listings of fungicides, herbicides, insecticides and plant growth regulators this year show two PCS numbers for the same product.

In most instances, this implies that there are actually two specific forms of the product available, each with a different number. But one of these has been revoked (discontinued) and it is currently in its use-up phase, as indicated by the date in the use-by date column. So where a specific product has a use-by date, take care not to have it in stock beyond that date.

Last year, I mentioned that some products are now being given a maximum application rate to be applied over a three-year period. Metazachlor is one such active and good records will become increasingly important. This is especially an issue for vegetable producers who may be using it in different parts of the same field in different years.

Risk to water and aquatic organisms is also coming to the fore, with a number of actives seeing their minimum buffer width increased, in some instances from 5m to 20m. This can be seen with products such as Aylora and Bonolan. However, these widths remain subject to reduction where STRIPE nozzles are fitted on the sprayer.

Some products now also have added to their labels a requirement that the specific container of the product be used within three years of the date of manufacture which is written on the can. This seems to be new and it is happening because of the lack of stability of some products or formulations over time.

There has been an amount of talk this year about the fact that the morpholine fungicides may be in trouble for re-registration. While there is some scope for this opinion, there is no definite single stumbling block identified at this point in time.

However, the fact remains that Syngenta has discontinued with Tern and BASF seems unlikely to re-register Corbel due to the lack of return relative to the cost of registration. This is worrying news, with mildew appearing to increase in importance in crops in recent years.

The investment in new plant protection products for Europe appears to be decreasing over time. It seems likely that the PPP companies will focus more on markets outside of Europe where they will also look more to genetic solutions using new technologies.A number of company mergers and acquisitions have been completed in the past year.Change continues in our listings of products and we must be concerned about the loss of morpholine fungicides and increasing fears for the future of mildew control.

The past two decades have witnessed huge changes in the world of crop protection and in particular the world of crop protection product producers.

So many names that were once global companies, such as ICI, May & Baker, Schering, Hoechst, etc, evolved into other entities such as Aventis, Zeneca, etc, which have also since vanished in turn.

But the past year has seen more aggressive change, with the coming together of giants such as Bayer and Monsanto, Dow CropScience and DuPont/Pioneer and ChemChina and Syngenta.

It suggests that in the 1980s about 33% of the AgChem Company R&D was targeted at the EU. This had fallen to about 25% in the 1990s and, today, the equivalent figure is less than 8%

It seems that the drive for scale in these multinational businesses is never ending. Any of these were big to begin with and then they become giants. But as they grow as one, it is also common that these giants begin to hive off parts of the business that is no longer regarded as core. This then enables smaller businesses to be created with a specific focus that they can use to their advantage.

For these businesses, life has also become more complicated and this is not just in the EU. In the 1960s, roughly one in 11,000 of the new actives synthesised produced a new commercial product (see Table 1).

This fell dramatically to one in 38,000 two decades later and to one in 150,000 this century. These numbers represent the background against which innovative plant protection companies have to work and it signifies the cost base involved in the business.

R&D trends

There are many different figures used for the cost of developing a new commercial active. Whatever about the small change, this cost is now generally regarded as being north of €300m and an estimated two-thirds of that total is now required to prove environmental safety.

Companies continue to say that they are still investing hugely in the search for new solutions and this is undoubtedly true. But the focus of this spend has changed significantly and many companies now see over half of their R&D programmes devoted to genetic research rather than chemical R&D.

As well as this, we are witnessing a drifting of research focus and investment away from EU markets. The big companies are, understandably, concentrating more on markets that offer a more predictable path to registration, more hectares to target and where markets do not have universal objection to the use of new biotechnology tools in the creation of new genetic solutions for field crops.

A study conducted by the European Crop Protection Association has attempted to quantify this drift in R&D investment within the EU. It suggests that in the 1980s about 33% of the AgChem Company R&D was targeted at the EU. This had fallen to about 25% in the 1990s and, today, the equivalent figure is less than 8%.

Fewer products will be present in chemical stores as actives are not registered for a range of reasons. Fewer products will be present in chemical stores as actives are not registered for a range of reasons.

The fact that the EU is still not allowing the use of any of the new biotechnology tools in plant breeding is making our market increasingly unattractive to these companies who continue to look more towards genetic solutions. And any prospect of change is slow at best.

One could be forgiven for assuming that the international drive towards increased genetic solutions is very much behind the most recent upscaling moves.

The fusing of Bayer and Monsanto sees a huge mainly chemical company join with a huge predominantly seed company. It seems likely that ChemChina’s interest in Syngenta was helped by its significant interests in plant breeding technology, while Dow with DuPont Pioneer will certainly bring additional capacity on both fronts.

Corteva Agriscience

The Dow DuPont Pioneer deal, announced in late 2015, is described as a merger of equals. The merger was completed last September when it was announced that the combined Dow/DuPont global business is to evolve into three standalone businesses. These are:

Materials. Speciality.Agriculture. As promised from the onset, the DowDuPontTM agriculture division, which was created in the deal, is to become a standalone company called Corteva Agriscience TM. The name itself is said to be derived from a combination of words meaning heart and nature. Corteva AgriscienceTM brings together DuPont Crop Protection, DuPont Pioneer and Dow AgroSciences to create a standalone agriculture company with strengths in seed technologies, crop protection and also digital agriculture.

As with any large company merger, competition authorities in different parts of the world intervene to force change in product portfolios to try to ensure that there will still be competition in different markets. And as companies can be strong in different markets, it can be expected that the divestment obligations imposed will be different in different regions.

Under the terms of the agreement for the EU, it is recommended that FMC will acquire DuPont’s cereal broadleaf herbicide and chewing insecticide portfolios. In addition, FMC will acquire the DuPont crop protection research and development pipeline and organisation, excluding seed treatment, nematicides, and late-stage R&D programmes, which DuPont will continue to develop and bring to market. The assets being divested generated revenues in 2016 of about $1.4bn.

Industry is looking more towards bigger crop markets and outside of the EU.Industry is looking more towards bigger crop markets and outside of the EU.

Bayer/Monsanto

The Bayer-Monsanto deal only recently received approval from the EU authorities and so much less is known about its consequences in terms of what products will have to be divested by both companies. The few that are known happened as a promise in the original deal.

In this, Bayer committed to off-load all of its seeds business, as it too had been in the plant development business and had owned the alternative GM herbicide trait LibertyLink, as well as some other traits. In a parallel move, Monsanto agreed to sell off its take-all control seed dressing, Latitude.

It seems likely that there will be many other product adjustments ordered as this deal settles in.

ChemChina/

Syngenta

The deal between ChemChina and Syngenta generated even more product adjustments because many of the actives divested by Syngenta went to Adama, which is another ChemChina-owned company. So as well as Syngenta having to divest, so had Adama.

In the EU, Syngenta had to divest its Shirlan and Fusilade Max range. It also has to transfer to Adama its isopyrazam fungicide range, Aphox and Plenum. So all of these will come from a different stable in the future.

Products moving and shaking

Every passing year brings significant changes to the tools that are available for plant protection. For most of three decades, the list of actives in the market continued to increase, but this situation has reversed in this decade. Farmers are acutely aware of the absence of actives now to control specific problems such as leather-jackets and they are becoming acutely conscious of the increasing challenge to control some cereal diseases, resistant weeds and aphids.

Many different factors influence the loss of products. For some, it is failure to meet the requirements of a higher-spec environmental profile. For others, it is the cost involved in providing a modern portfolio for registration relative to the likely return from the market. Some actives have been superseded in the market, while others have lost their usefulness. Others still are falling foul of increasingly stringent registration requirements.

Whatever the reason, it is worth noting a number of the well-known brands that have departed the market for this year alone. The long-serving Folicur is no longer to be sold, but tebuconazole will continue in the market in generic form and in mixtures. Bayer will also cease to carry Cheetah Extra (fenoxaprop-P), but it too will continue to be available in generic formats. Consento will also be discontinued because the decision has been made not to re-register the product.

In the Syngenta camp, growers may notice that Axial is on a use-up requirement for PCS number 02282. All stocks of this product must be used by 30 June 2019. However, a new formulation with a new PCS number will replace it next season and this may have its full complement of adjuvant built in. Traxos, a mix of Axial and Topik, has also been discontinued, as has the morpholine mildewicide Tern.

One other Syngenta active, which continues to be essential for disease control in Ireland in wheat and barley, is Bravo or chlorothalonil. Its current registration ends in October of this year and there is considerable concern as to its fate thereafter. It seems that as time goes by, there are an increasing number of concerns with regard to its registration. Its importance as a product is far more significant for Ireland than anywhere else, so we must consider the possibility that it may not be re-registered and we must begin to take action accordingly.

While most news is of products that are going from the market, it is good to hear of one that may be coming. Syngenta is attempting to bring a new seed dressing for cereals that is already on the market in countries such as France and the UK (see new products on page 17).

It seems that we will lose fenpropimorph (Corbel) next year also, as BASF is not going to apply for re-registration on a cost-benefit basis.

Changing PCS details

As individual products come up for re-registration, they are being evaluated under a more stringent set of evolving rules. So many products are having some of their details altered in different ways and they are being given new PCS numbers to reflect this. Many products on our listings of fungicides, herbicides, insecticides and plant growth regulators this year show two PCS numbers for the same product.

In most instances, this implies that there are actually two specific forms of the product available, each with a different number. But one of these has been revoked (discontinued) and it is currently in its use-up phase, as indicated by the date in the use-by date column. So where a specific product has a use-by date, take care not to have it in stock beyond that date.

Last year, I mentioned that some products are now being given a maximum application rate to be applied over a three-year period. Metazachlor is one such active and good records will become increasingly important. This is especially an issue for vegetable producers who may be using it in different parts of the same field in different years.

Risk to water and aquatic organisms is also coming to the fore, with a number of actives seeing their minimum buffer width increased, in some instances from 5m to 20m. This can be seen with products such as Aylora and Bonolan. However, these widths remain subject to reduction where STRIPE nozzles are fitted on the sprayer.

Some products now also have added to their labels a requirement that the specific container of the product be used within three years of the date of manufacture which is written on the can. This seems to be new and it is happening because of the lack of stability of some products or formulations over time.

There has been an amount of talk this year about the fact that the morpholine fungicides may be in trouble for re-registration. While there is some scope for this opinion, there is no definite single stumbling block identified at this point in time.

However, the fact remains that Syngenta has discontinued with Tern and BASF seems unlikely to re-register Corbel due to the lack of return relative to the cost of registration. This is worrying news, with mildew appearing to increase in importance in crops in recent years.

The investment in new plant protection products for Europe appears to be decreasing over time. It seems likely that the PPP companies will focus more on markets outside of Europe where they will also look more to genetic solutions using new technologies.A number of company mergers and acquisitions have been completed in the past year.Change continues in our listings of products and we must be concerned about the loss of morpholine fungicides and increasing fears for the future of mildew control.

SHARING OPTIONS