Pursuing infant formula brands

FrieslandCampina, the Dutch based co-op which processed 10.7bn litres of milk last year, reported a 10% increase in sales for 2017 to just over €12bn.

However, operating profit in the business declined more than 20% to €444m, with profit margins falling from over 5% in 2016 to 3.7% last year.

In its latest annual report, FrieslandCampina said it wants to further leverage its brands by building on its “grass to glass” concept. The Dutch giant certainly has the financial muscle to pursue this strategy, with almost €540m invested last year in advertising and marketing promotions for its consumer brands.

The strategy of FrieslandCampina is clear – in order to manage dairy market volatility it is pushing further down the branded route for consumer products, therefore protecting milk prices and farmer incomes. No doubt the 500m potential consumers on its doorstep have cemented this branded strategy.

FrieslandCampina holds a strong position in terms of its established consumer brands such as Peak and Campina. Some 30% of revenues come from consumer brands across Europe and a further 25% from Asia.

FrieslandCampina’s branded strategy has also extended into the infant formula market, where they have created their own brand, Friso.

The Friso infant formula has grown rapidly in the lucrative Chinese market over recent years. In 2017, Friso held a 10% share of the infant nutrition market in China, making it the third largest infant formula brand in the market. Building a brand with an 11bn litre milk pool is much easier and Dutch farmers have captured the full potential of the lucrative infant formula market, where profit margins can be as high as 30%. It aims to achieve around 5% annual volume growth and sales of €15bn by 2020.

It is set to invest a further €100m in the Chinese market this year to increase production of the Friso brand and develop sales in smaller Chinese cities. It currently sells 30,000t of infant formula a year across over 120 Chinese cities.

FrieslandCampina also aims to increase its presence in the Chinese foodservice sector to capitalise on the growing demand for tea and coffee.

Brands to drive growth

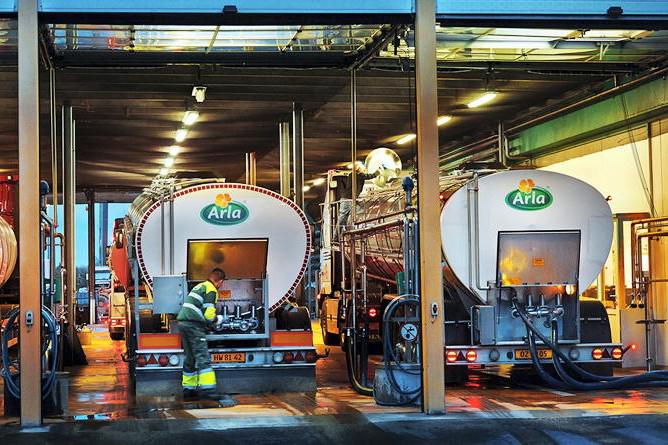

Arla reported sales growth of 8% for its 2017 financial year to reach €10.3bn and made operating profits of €385m last year. It delivered an operating margin of 3.7%. The dairy co-op, which processed 14bn litres in 2017 and collects milk from 11,000 farmers across the UK, Germany, Denmark, Sweden, Belgium and Luxemburg has seen little expansion in its milk pool in recent years.

Arla has prioritised growth via branded products as part of its latest five-year strategy. The co-op believes branded sales will help offset market and raw material price volatility, which it says has a much greater impact on non-branded products.

Arla says that “in the long run, the branded business will win over the commodity market through stability and prices”.

This branded business has grown rapidly in recent years to now account for almost half (45%) of all sales. Arla brands are sold in more than 80 countries and it says that the premium of the branded business is generating higher margins than other alternatives.

In 2017, the Arla brand delivered 3.4% volume growth and brand revenue grew 10% to €3bn compared to the prior year.

Revenue for Lurpak, its butter brand, increased 8% to €0.5bn in 2017. This was driven by sales price increases at double-digit rates in all core markets. However, in maximising these revenue gains, volumes decreased by 3%. The co-op plans to deliver branded volume growth of 1% to 3.5%, and a brand share greater than 45% in the coming years. It is pulling back from private label where sales declined 4% compared to last year.

As a key supplier to Starbucks, Arla is also aiming to further develop food service partnerships. Arla targets an annual net profit margin in the range of 2.8% to 3.2% of revenue.

A key measure expressing Arla’s overall performance is the performance price. This measures the value added to each kilogram of milk supplied by farmers. The performance price is calculated as the standardised prepaid milk price plus the share of profit for the year, divided by milk volume supplied. In 2017, the performance price was 38.1c/kg, an increase of 7.2c on 2016.

More volume to higher value

“We want to grow value by converting more of our farmers’ milk into higher-value products.”

That’s Fonterra’s claim. But are they doing it? At 23bn litres, Fonterra processes just over three times Ireland’s total milk pool, and had sales of €11bn, operating profits of €0.7bn and operating margins of 6% in 2017.

Fonterra has pivoted its business towards increased sales volumes of higher value products. Last year one-third of its milk went into base ingredients (down 11% on the previous year) while a further fifth of its volume was sold through the GDT and was also down (5%).

Its commodity ingredients business is still large, using 21bn litres of milk annually, and accounts for 80% of sales and profits.

And while milk volumes supplied fell 3% or 800m litres last year, Fonterra shifted 1bn more litres into higher value foodservice, consumer and advanced ingredients (whey protein isolate and medical grade lactose). Consumer and foodservice alone account for a third of group sales and grew by 600m litres to reach 5.5bn litres of milk equivalent. Fonterra aims to grow this volume to 10bn litres by 2025.

Fonterra is clear in its growth path. It has an ambition to process 30bn litres of milk around the world by 2025. Outside of New Zealand and Australia, it also produces 335m litres of milk from 35,000 cows on its own farms in China – a long way short of its original aim to produce 1bn litres of milk in China by 2018.

While the investment made a profit of €600,000 last year, Fonterra’s China farms racked up losses in excess of €60m in 2015 and 2016 as the co-op struggled to gain a handle on production costs in China.

Alongside supplementing its New Zealand milk by growing its global milk supply, Fonterra also wants to create more value from every drop of milk. It wants to do this through the right mix of products, services and global partnerships. But more importantly it wants to do this at pace. As an example, over the past four years Fonterra has invested more than €500m in plants dedicated to making foodservice products. This delivered 27% growth in volumes in foodservice last year. A strategy that looks set to ensure Fonterra remain the world’s largest force in dairy globally.

SHARING OPTIONS