Shares in Kerry Group closed on Monday at €76.25, the lowest level since July last year and 26.5% below the price of €103.70 seen in early March.

The shares suffered a more than 10% drop in value when the company announced its half-year results at the end of July, and have moved lower since.

There has been no trading update from the company since the end of July, and the next news from Kerry will be the announcement of the company’s third-quarter results in late October or early November.

Kerry’s share buyback scheme also continues, with around 3m shares purchased and cancelled by the company since the start of March. Kerry market capitalisation – the number of shares in issue multiplied by the share price – has dropped from €17.18bn in March to €12.4bn this week.

There appears to be no clear catalyst for the weakness in the company’s stock-market performance. The drop in the wake of the half-year results came as a surprise to many analysts as the results were in line with expectations on the earnings side, and full-year earnings guidance was maintained. Of the 17 professional analysts covering the company, 10 have it as a “buy”, with seven recommending “hold”. None of the analysts have a “sell” recommendation on the company’s shares.

There are some headwinds facing the company, mostly coming from the US where to weakness in the dollar – down around 15% against the euro this year – coupled with government policy under health secretary Robert F Kennedy JR, which favours less processed foods could potentially hit earnings.

But these factors have been well known for some time, so are unlikely to be driving prices at the moment.

The wider ISEQ Index of Irish shares has gained 17% so far this year and is 14.6% ahead of where it was 12 months ago.

Shares in Kerry Group closed on Monday at €76.25, the lowest level since July last year and 26.5% below the price of €103.70 seen in early March.

The shares suffered a more than 10% drop in value when the company announced its half-year results at the end of July, and have moved lower since.

There has been no trading update from the company since the end of July, and the next news from Kerry will be the announcement of the company’s third-quarter results in late October or early November.

Kerry’s share buyback scheme also continues, with around 3m shares purchased and cancelled by the company since the start of March. Kerry market capitalisation – the number of shares in issue multiplied by the share price – has dropped from €17.18bn in March to €12.4bn this week.

There appears to be no clear catalyst for the weakness in the company’s stock-market performance. The drop in the wake of the half-year results came as a surprise to many analysts as the results were in line with expectations on the earnings side, and full-year earnings guidance was maintained. Of the 17 professional analysts covering the company, 10 have it as a “buy”, with seven recommending “hold”. None of the analysts have a “sell” recommendation on the company’s shares.

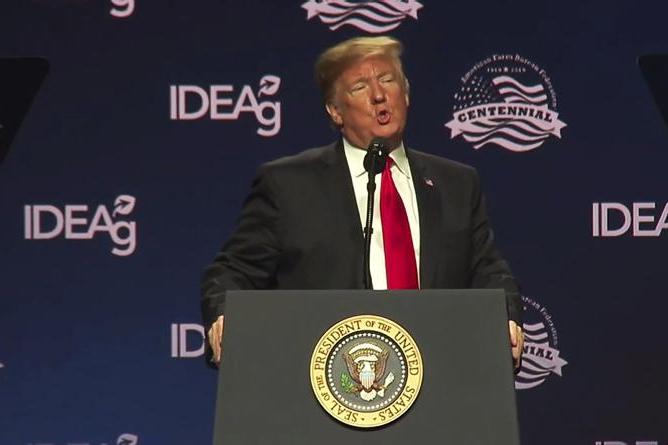

There are some headwinds facing the company, mostly coming from the US where to weakness in the dollar – down around 15% against the euro this year – coupled with government policy under health secretary Robert F Kennedy JR, which favours less processed foods could potentially hit earnings.

But these factors have been well known for some time, so are unlikely to be driving prices at the moment.

The wider ISEQ Index of Irish shares has gained 17% so far this year and is 14.6% ahead of where it was 12 months ago.

SHARING OPTIONS