Tariffs on Irish and European beef exports to Japan are expected to be slashed at a summit in Brussels on Thursday.

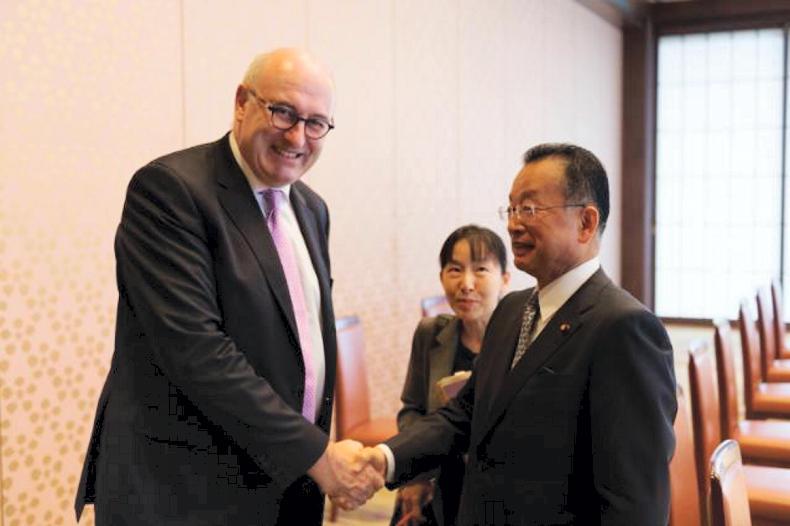

The deal follows marathon talks involving European Commissioner for Agriculture Phil Hogan and his trade counterpart Cecilia Malmström with their Japanese equivalents last weekend.

The move will result in increased access for Irish beef, and other agricultural products, to the lucrative Japanese market.

Ireland is already a supplier of beef offal, pigmeat and dairy, particularly cheese, to Japan but it is expected volumes of sales will grow significantly under a new tariff regime.

Japan is one of the most protected agricultural markets in the world.

It is expected that tariffs on beef, currently at 38.5%, will fall immediately to 27.5%, and progressively be reduced to 9% over the next 15 years.

The move means that the EU, and Ireland, will be on par or better than the US, New Zealand and Australia for tariffs, who are currently the big suppliers to Japan.

Industry insiders suggest that Japan could be a 20,000t beef market in the short to medium term. This would bring it ahead of Ireland’s other main third country beef markets, Hong Kong and the Philippines.

Japan is retaining the right to safeguard imports with a safeguard quota of 43,500t rising to 50,000t over 15 years. This would only be used if there is a surge in volume of imports and is not price related.

If Japan does not use its safeguard quota, there will be full trade liberalisation on beef at a 9% tariff. That would put the EU in as good a trading position as either the US or Australia, which currently supply 90% of Japan’s beef imports.

Dairy

On dairy, it is expected there will be a phasing out of all duties and full liberalisation over 15 years.

A tariff-related quota is expected on soft cheeses with a 15-year phasing out of tariffs, with progress also on whey and skim milk powder.

On pigmeat, the tariffs are expected to be 4.3% and 8.5% on processed pork, which is described as virtual free access.

Read more

Milestone trade deal for EU

Read everything we've written on Japan

Tariffs on Irish and European beef exports to Japan are expected to be slashed at a summit in Brussels on Thursday.

The deal follows marathon talks involving European Commissioner for Agriculture Phil Hogan and his trade counterpart Cecilia Malmström with their Japanese equivalents last weekend.

The move will result in increased access for Irish beef, and other agricultural products, to the lucrative Japanese market.

Ireland is already a supplier of beef offal, pigmeat and dairy, particularly cheese, to Japan but it is expected volumes of sales will grow significantly under a new tariff regime.

Japan is one of the most protected agricultural markets in the world.

It is expected that tariffs on beef, currently at 38.5%, will fall immediately to 27.5%, and progressively be reduced to 9% over the next 15 years.

The move means that the EU, and Ireland, will be on par or better than the US, New Zealand and Australia for tariffs, who are currently the big suppliers to Japan.

Industry insiders suggest that Japan could be a 20,000t beef market in the short to medium term. This would bring it ahead of Ireland’s other main third country beef markets, Hong Kong and the Philippines.

Japan is retaining the right to safeguard imports with a safeguard quota of 43,500t rising to 50,000t over 15 years. This would only be used if there is a surge in volume of imports and is not price related.

If Japan does not use its safeguard quota, there will be full trade liberalisation on beef at a 9% tariff. That would put the EU in as good a trading position as either the US or Australia, which currently supply 90% of Japan’s beef imports.

Dairy

On dairy, it is expected there will be a phasing out of all duties and full liberalisation over 15 years.

A tariff-related quota is expected on soft cheeses with a 15-year phasing out of tariffs, with progress also on whey and skim milk powder.

On pigmeat, the tariffs are expected to be 4.3% and 8.5% on processed pork, which is described as virtual free access.

Read more

Milestone trade deal for EU

Read everything we've written on Japan

SHARING OPTIONS