Following the recent demise of live cattle exporter TLT International (TLT) all unsecured trade creditors, including marts and farmers, will lose most or all of the funds owed from TLT. Should such buyers of cattle be licensed and regulated as livestock marts are?

The sale of cattle through marts is covered under the new Property Services (Regulation) Act, 2012.

Should the sale of cattle to all other commercial entities, like meat factories and live exporters, also be regulated under this Act, where the respective companies are licensed and regulated and annually pay into a fund to protect the sellers of livestock?

Mart regulation

The sale of cattle through marts was originally regulated under the 1947 House Agents Act, where marts were required to deposit a bond of €12,000 and renew their auctioneering licence each year by an application to the District Court.

Marts are also regulated by the Department of Agriculture under the 1967 Livestock Act.

Since 6 July last year, marts are regulated under the new Property Services Regulation Act, 2012.

This new regulation covers all property related transactions including livestock. The Property Services Regulatory Authority (PRSA) was established under the Act and they are now responsible for licensing and regulating all livestock marts.

The PRSA has extensive powers of inspection, can revoke mart licenses and impose fines of up to €250,000. It requires all marts to have professional indemnity insurance in place, for twice the mart’s annual commission income.

All marts must now make an annual contribution into a common fund that is available to help protect mart customers should a mart fail to pay them. This fund is targeted to have collected €4m by 2015.

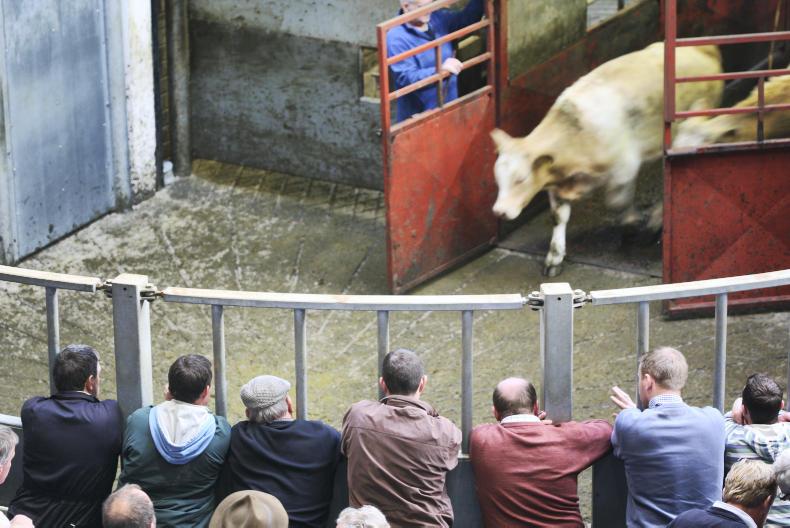

Marts collectively sell 1.7 million cattle and 700,000 sheep annually, and have a combined turnover of €1bn.

In their nearly 60-year history marts have offered an extremely secure, efficient and reliable sales outlet for all their customers and shareholders.

However, the increasing onset of part-time farmers, as well as the rise in specialised and time-poor full-time farmers has led to increasing levels of animals sold directly to meat factories and live exporters in recent years.

Is it not time these purchasers of livestock should also be licensed to protect these same farmers?

Other sectors

Equally, consumers capitalising their assets into investment products are also offered statutory protection under the remit of the Investor Compensation Act 1998, where investors can be compensated to the tune of 90% of their losses or to a maximum of €20,000.

Again, the commercial entities, which are licensed and regulated operators within this sector, contribute to this compensation fund to protect consumers.

Travel agents are also regulated by the Commission for Aviation Regulation and operate a similar fund to protect consumers who are sold holiday packages which prove to be unsuitable.

SHARING OPTIONS