My aunt recently passed away unexpectedly and left me her farm in her will. The land is valued at €1.2m. We hadn’t spoken about this, so the inheritance came as a surprise. My parents are encouraging me to hold onto the land, and I’d like to – but I’m extremely anxious about the inheritance tax. I’ve looked into Agricultural Relief but I don’t think I qualify. I’m not sure if I should consider selling, leasing, or if there’s another route that would allow me to keep the land without facing a huge tax bill. What are my options?

ANSWER: First of all, we’re very sorry for your loss. Inheriting a farm, especially when it comes unexpectedly, can be a daunting experience. Alongside the emotional aspects of bereavement, you’re now facing a significant financial decision. It’s important to take a calm, step-by-step approach – and you’re right to seek advice early, particularly given the value involved, which could mean a large tax bill if relief isn’t available.

Where to begin?

Let’s start with Agricultural Relief, since that’s the area causing concern. You mentioned you don’t believe you qualify, but before ruling it out, we recommend looking a little deeper. Agricultural Relief depends on two separate criteria: the Farmer Asset Test and the Active Farmer Test. Both must be satisfied but understanding which conditions you may not satisfy is essential, as, there are workarounds in some cases.

The Farmer Asset Test looks at whether at least 80% of everything you own is made up of ‘agricultural property’ on the date Revenue values your inheritance. This includes land, farm buildings, livestock and machinery. If you own a lot of non-farming assets – like shares, cash, or other property – you might fail this test. But if you’re just under the 80% mark, there may be ways to adjust your assets before the valuation date to qualify.

Next is the Active Farmer Test, which looks at your farming activity. If you’re not actively farming, that doesn’t automatically disqualify you – there are approved ways to meet this requirement. For instance, you can lease the land to a farmer who meets the active farmer requirements, for six years following the inheritance, so you may still qualify. However, the lease must meet the relief conditions, so professional advice is important here.

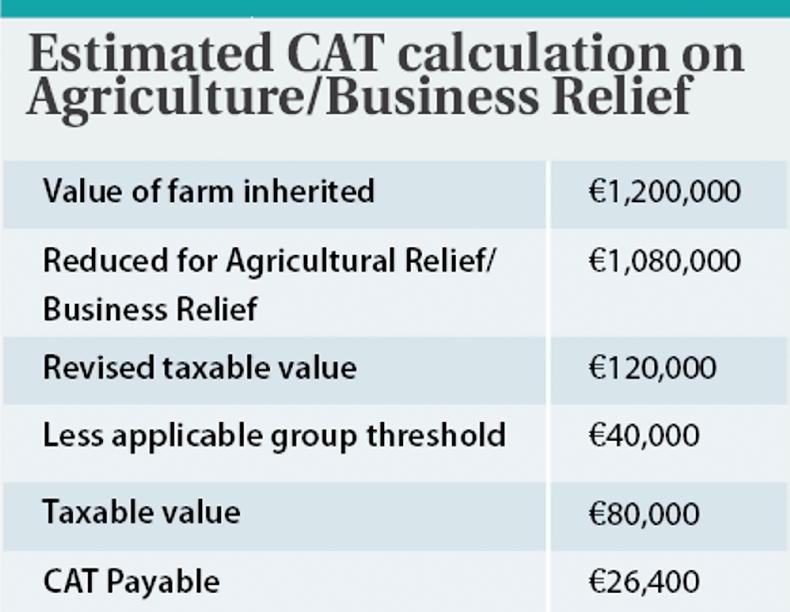

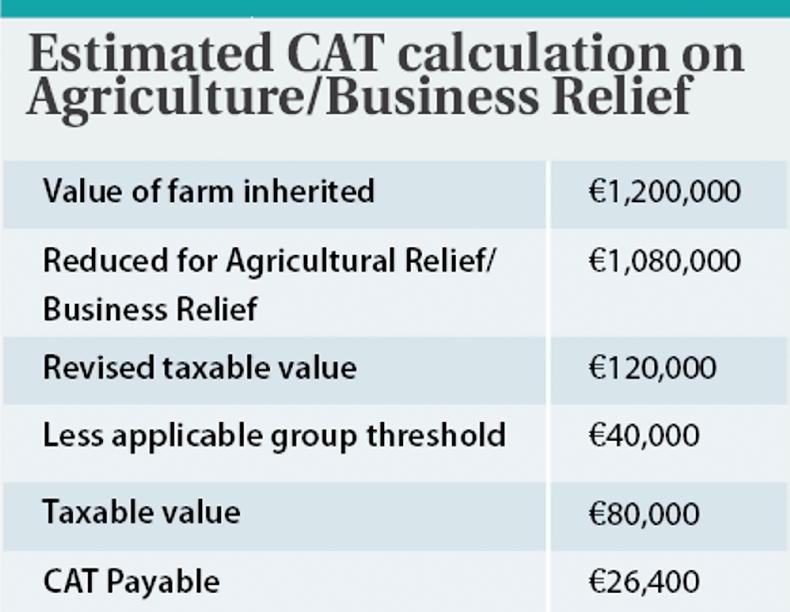

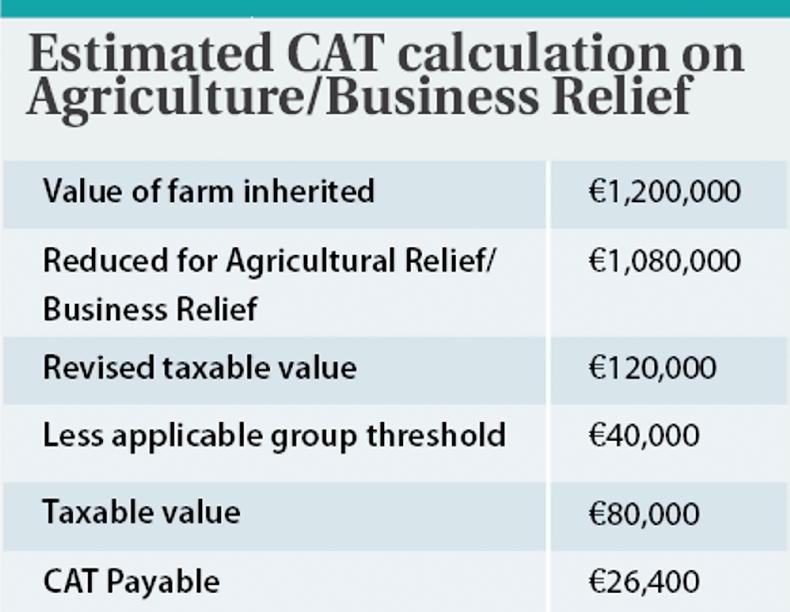

Table 1.

Timing is also critical. From what you’ve said, it sounds like probate may not yet have been granted. Reliefs are evaluated based on the valuation date, which is not always the date of death. If your aunt had any outstanding debts, including the Fair Deal Scheme, or pension overpayments, her estate must settle those debts first. This can delay the valuation date and gives you time to adjust.

If, after a full review, you still don’t qualify for Agricultural Relief, you might consider Business Relief.

This offers a similar 90% reduction in the taxable value but applies differently. Business Relief only applies to assets used in an ongoing business – so to qualify, the land must pass along with machinery or livestock, and your aunt must have been farming right up until her death.

Residential property (such as a farmhouse) is not subject to Business Relief, although if you were living with your aunt prior to her passing, Dwelling House Relief may be considered.

Although a minor point, it’s also worth noting that you are entitled to the Group B tax-free threshold of €40,000, which applies to inheritances from aunts, uncles, grandparents, and siblings. Provided you have not previously received gifts or inheritances from such relatives, this threshold will reduce the taxable amount of your inheritance regardless of whether you qualify for either relief.

Remember early planning protects the future of the farm and the financial well-being of the next generation, by allowing management of the tax burden.

Marty Murphy.

Marty Murphy is head of tax at ifac, the professional services firm for farming, food and agribusiness.

My aunt recently passed away unexpectedly and left me her farm in her will. The land is valued at €1.2m. We hadn’t spoken about this, so the inheritance came as a surprise. My parents are encouraging me to hold onto the land, and I’d like to – but I’m extremely anxious about the inheritance tax. I’ve looked into Agricultural Relief but I don’t think I qualify. I’m not sure if I should consider selling, leasing, or if there’s another route that would allow me to keep the land without facing a huge tax bill. What are my options?

ANSWER: First of all, we’re very sorry for your loss. Inheriting a farm, especially when it comes unexpectedly, can be a daunting experience. Alongside the emotional aspects of bereavement, you’re now facing a significant financial decision. It’s important to take a calm, step-by-step approach – and you’re right to seek advice early, particularly given the value involved, which could mean a large tax bill if relief isn’t available.

Where to begin?

Let’s start with Agricultural Relief, since that’s the area causing concern. You mentioned you don’t believe you qualify, but before ruling it out, we recommend looking a little deeper. Agricultural Relief depends on two separate criteria: the Farmer Asset Test and the Active Farmer Test. Both must be satisfied but understanding which conditions you may not satisfy is essential, as, there are workarounds in some cases.

The Farmer Asset Test looks at whether at least 80% of everything you own is made up of ‘agricultural property’ on the date Revenue values your inheritance. This includes land, farm buildings, livestock and machinery. If you own a lot of non-farming assets – like shares, cash, or other property – you might fail this test. But if you’re just under the 80% mark, there may be ways to adjust your assets before the valuation date to qualify.

Next is the Active Farmer Test, which looks at your farming activity. If you’re not actively farming, that doesn’t automatically disqualify you – there are approved ways to meet this requirement. For instance, you can lease the land to a farmer who meets the active farmer requirements, for six years following the inheritance, so you may still qualify. However, the lease must meet the relief conditions, so professional advice is important here.

Table 1.

Timing is also critical. From what you’ve said, it sounds like probate may not yet have been granted. Reliefs are evaluated based on the valuation date, which is not always the date of death. If your aunt had any outstanding debts, including the Fair Deal Scheme, or pension overpayments, her estate must settle those debts first. This can delay the valuation date and gives you time to adjust.

If, after a full review, you still don’t qualify for Agricultural Relief, you might consider Business Relief.

This offers a similar 90% reduction in the taxable value but applies differently. Business Relief only applies to assets used in an ongoing business – so to qualify, the land must pass along with machinery or livestock, and your aunt must have been farming right up until her death.

Residential property (such as a farmhouse) is not subject to Business Relief, although if you were living with your aunt prior to her passing, Dwelling House Relief may be considered.

Although a minor point, it’s also worth noting that you are entitled to the Group B tax-free threshold of €40,000, which applies to inheritances from aunts, uncles, grandparents, and siblings. Provided you have not previously received gifts or inheritances from such relatives, this threshold will reduce the taxable amount of your inheritance regardless of whether you qualify for either relief.

Remember early planning protects the future of the farm and the financial well-being of the next generation, by allowing management of the tax burden.

Marty Murphy.

Marty Murphy is head of tax at ifac, the professional services firm for farming, food and agribusiness.

SHARING OPTIONS