Despite the easy familiarity with the main players on the platform, there was an air of anxiety at the FBD Holdings AGM held in the Irish Farm Centre last Thursday. Having returned a loss of €3.3m for 2014, compared with a profit of over €44m the previous year, there were a number of penetrating questions.

In his address, long-standing chair Michael Berkery said that there would not be an interim dividend declared in August this year and that no decision on the final dividend would be given until the current year’s results were clear.

Berkery added that in general insurance, rates were hardening except on the home insurance side and that the last few years had been extremely turbulent in the sector.

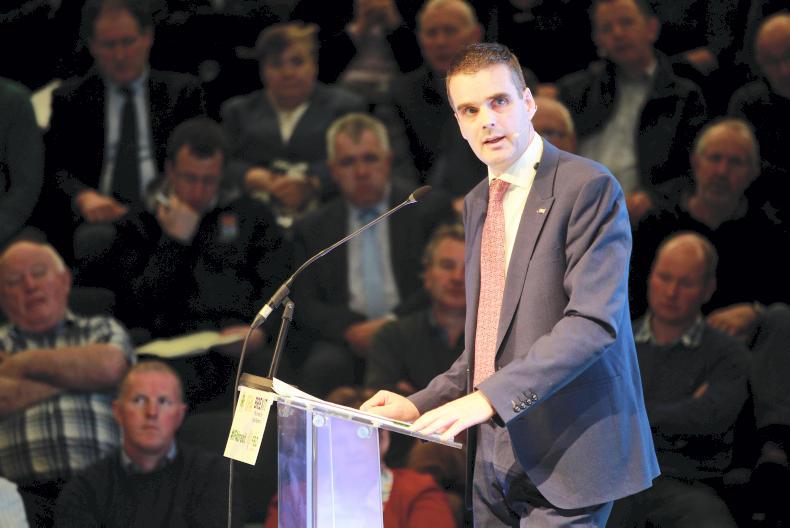

Chief executive Andrew Langford took the large attendance through what was being done to address the current difficulties facing the company.

He spoke of the pickup in economic activity leading to increased car claims and, most of all, the havoc wreaked by the storms of early 2014.

Langford said they were declining some types of new business, especially on the motor side, but said that the proportion of the business accounted for by farmers had increased from 22% in 2004 to 29% this year.

There were a large number of questions from the floor, varying from the rigour exercised in assessing potentially bogus claims to the need to safeguard future business by ensuring that farmers’ children were encouraged to insure with FBD. The issuing of two profit warnings and a large Central Bank fine were barely raised.

Former Fianna Fáil TD and large-scale Cork farmer, Ned O’Keeffe, suggested that he noted the sharp decline in the share price and said that extra capital by way of a script issue may be needed. This was rejected by the chair.

Nevertheless, in the reappointment of directors, it was noticeable that of the proxies filed, about 12% voted against the reappointment of some of the senior management.

All the other appointments and motions were voted through with little dissent.

SHARING OPTIONS