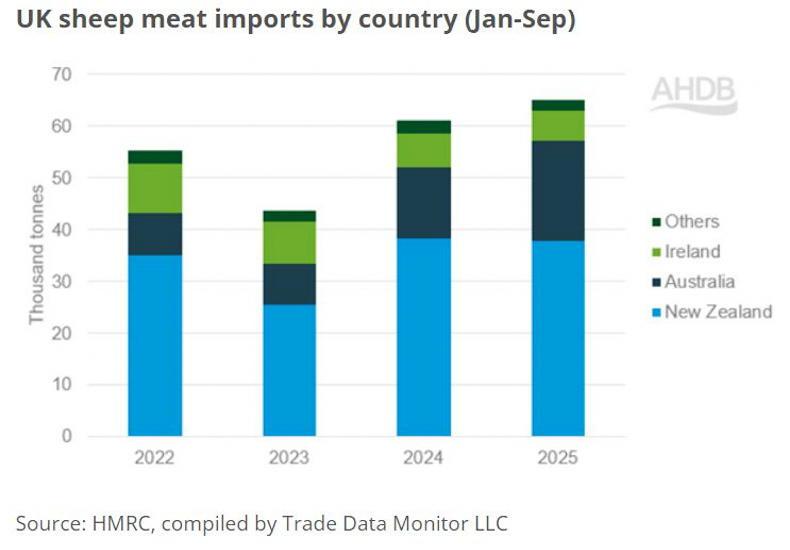

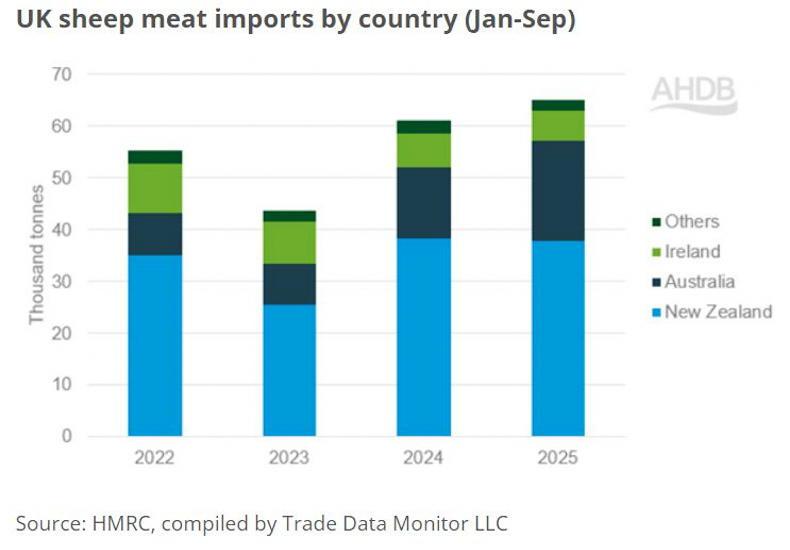

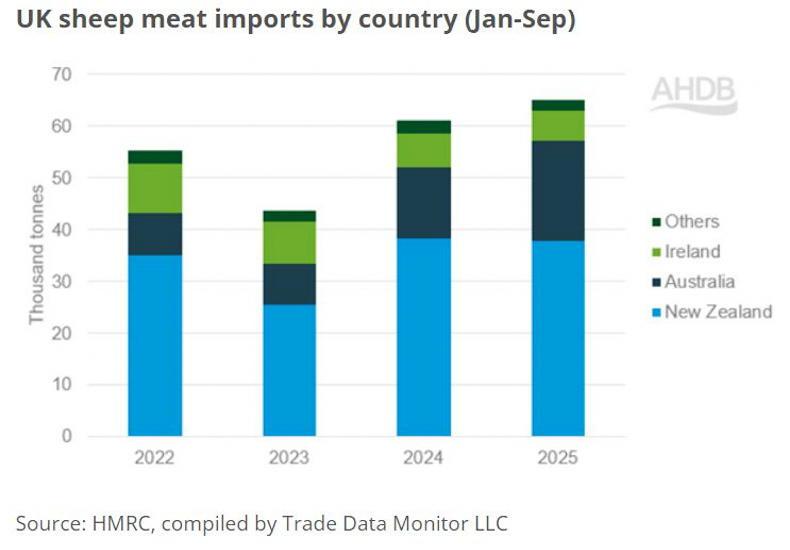

The latest UK sheepmeat trade data published by the Agriculture and Horticulture Development Board (AHDB) shows UK sheepmeat imports increasing by 7% in the first nine months of 2025 to reach 65,100t.

The value of such import volumes has increased by a much greater level, rising by 31% to £365m.

This has been underpinned by a significant increase in global sheepmeat prices, with the value of sheepmeat in Australia and New Zealand running at a considerably higher level than in 2024.

New Zealand remains the number one supplier of sheepmeat, despite import volumes declining marginally by 1% to 37,900t.

AHDB analyst Tom Spencer states that steady import volumes, despite New Zealand having lower availability of sheepmeat for export, shows that New Zealand exporters are balancing UK demand against opportunities in other markets in the EU and Asia.

Higher imports

In contrast, Australian exporters are taking advantage of a higher tariff-free quota, with the AHDB commenting that Australia has significantly expanded in the UK market.

Import volumes have increased year on year by 39%, as detailed in Figure 1, growing from 13,800t in quarter three 2024 to 19,200t in 2025.

Figure 1: UK sheepmeat imports by country

The AHDB comments that the increase in exports has resulted from Australia diverting product from what it describes as softer Asian markets.

In contrast, imports from Ireland were recorded at 5,800t, down 12% year on year.

This has stemmed from a combination of lower availability of sheepmeat for export and price competitiveness challenges from southern hemisphere sheepmeat.

Import cuts

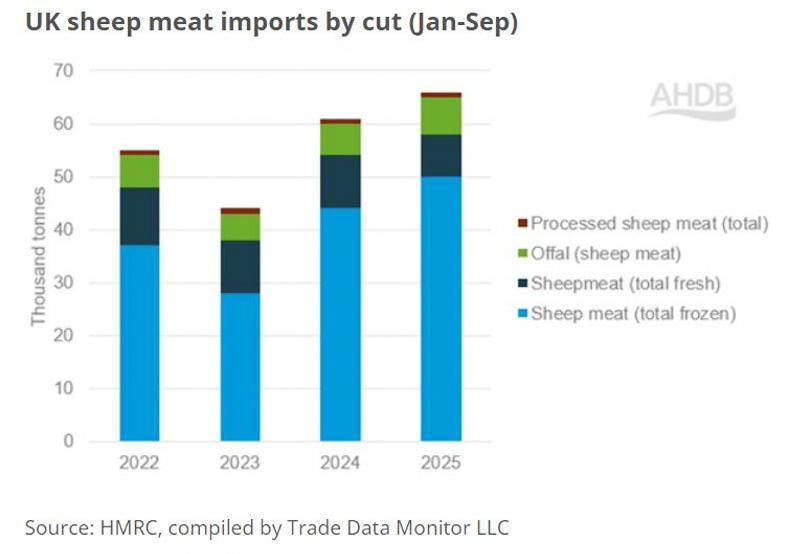

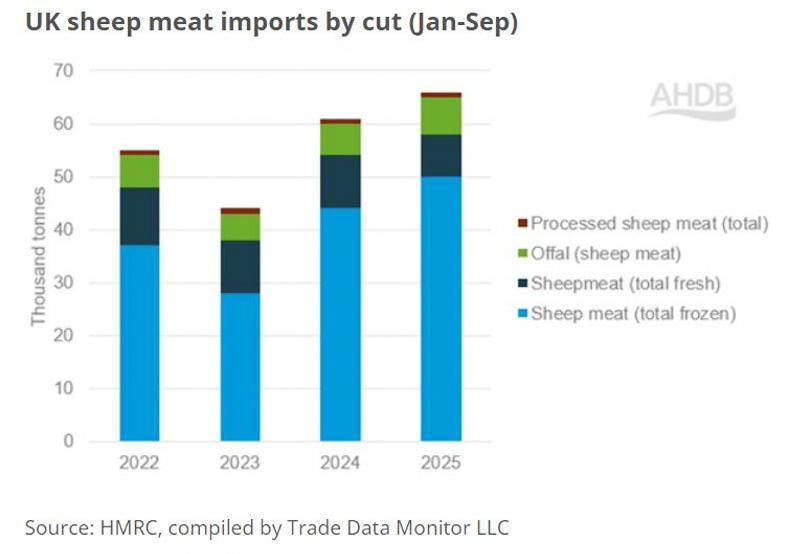

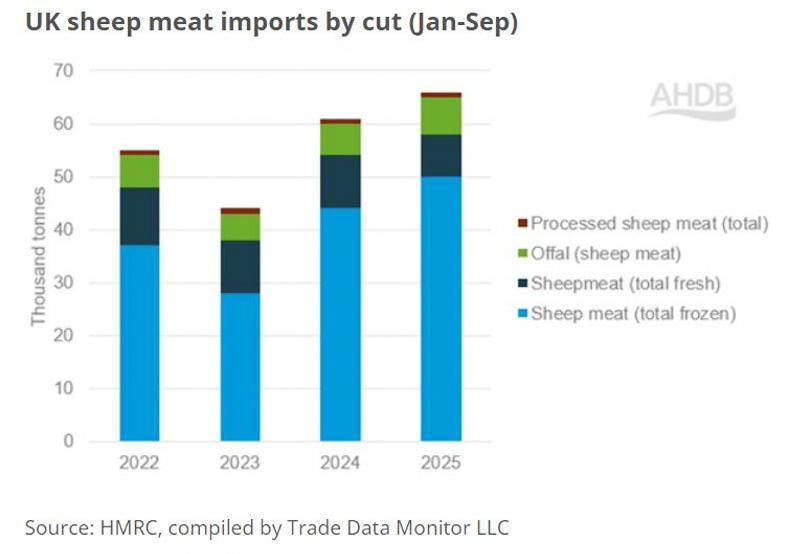

The type of product imported is mainly categorised as frozen sheepmeat. Frozen import volumes increased from 44,300t in January to September 2024 to 49,700t in the corresponding period in 2025, equating to growth of 12%.

Volumes of fresh sheepmeat imports fell sharply by 24% to 7,500t, with this reduction said to be driven by lower volumes of fresh meat imports from New Zealand. This is demonstrated in Figure 2.

Figure 2: UK sheepmeat imports by cut

Sheepmeat exports

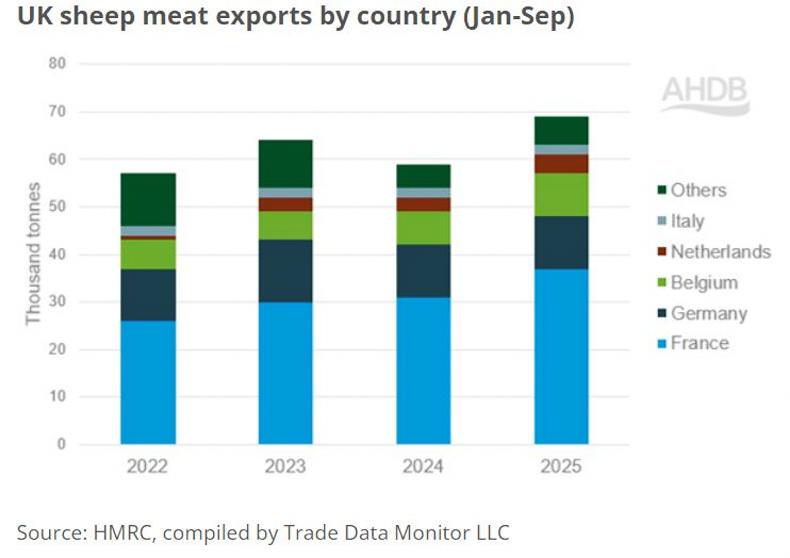

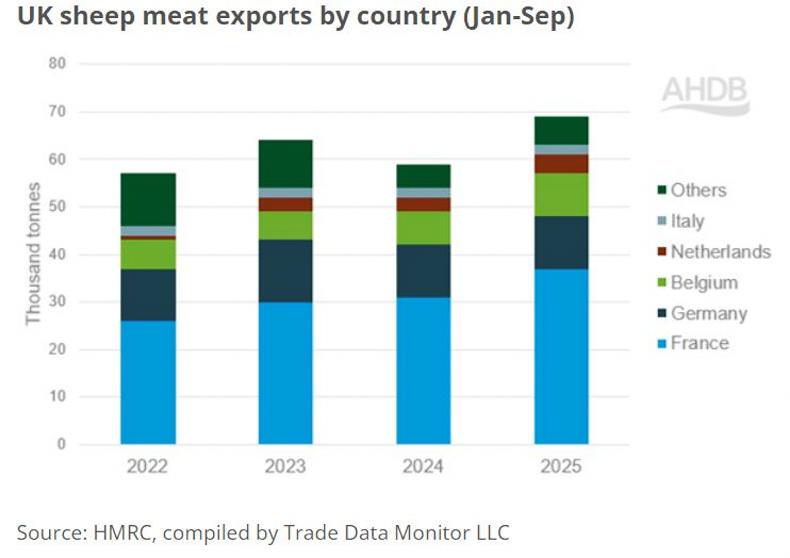

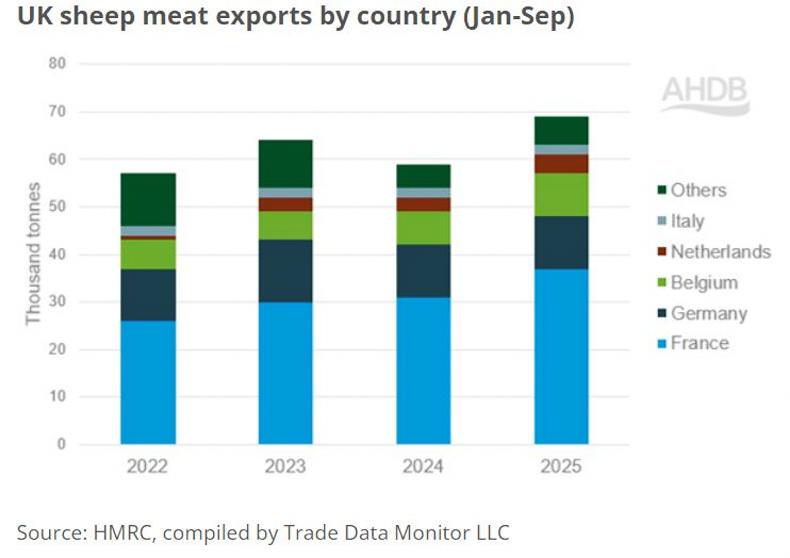

The volume of sheepemat exported from the UK increased by 15% to reach 68,300t.

The AHDB reports that “tight EU production and high EU prices increased demand for UK new-season lamb, despite UK supplies being somewhat limited year on year”. The value of exports increased by 16% to £493m.

Figure 3: UK sheepmeat exports by country

Total value of exports over this period has also lifted, up 16% compared with the same period a year ago to £493m.

The differential of almost £130m between export and import values despite imports running just 3,000t lower shows that the UK is benefitting from importing lower-priced sheepmeat and prioritising higher-value exports to the premium EU market.

“France remained the UK’s key destination, with volumes rising to 37,400 tonnes, up 20% year on year.

"This reflects firm French demand for UK lamb, particularly around key consumption periods.

Exports to Belgium also grew strongly, increasing by 34% to 8,800t, while shipments to the Netherlands climbed by 14%.”

The AHDB states that these gains highlighted above show the continued importance of nearby European markets for trade and in supporting domestic lamb prices.

Exports by cut type

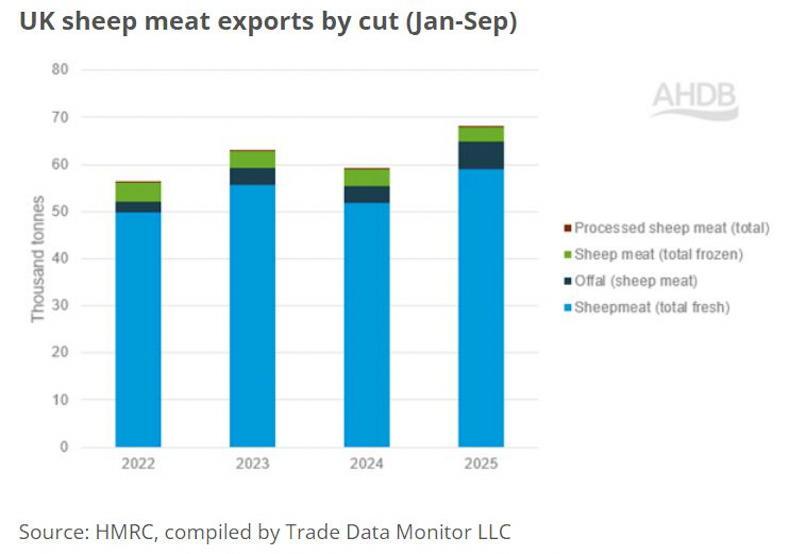

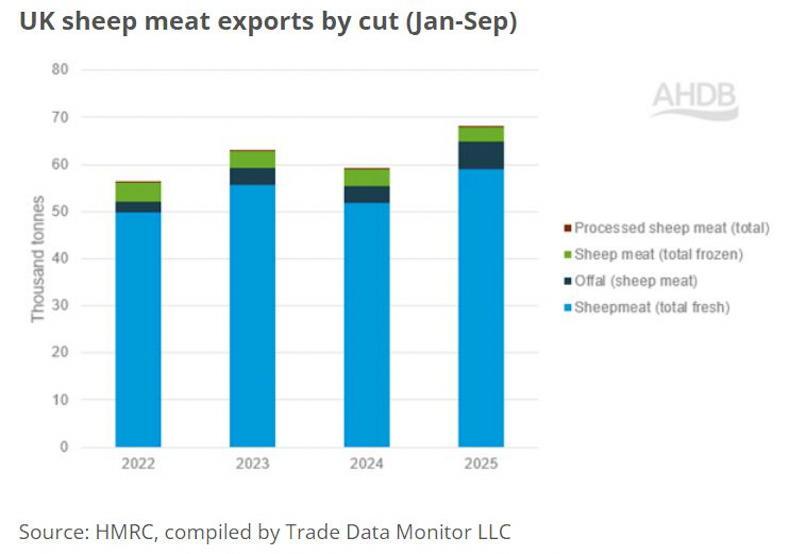

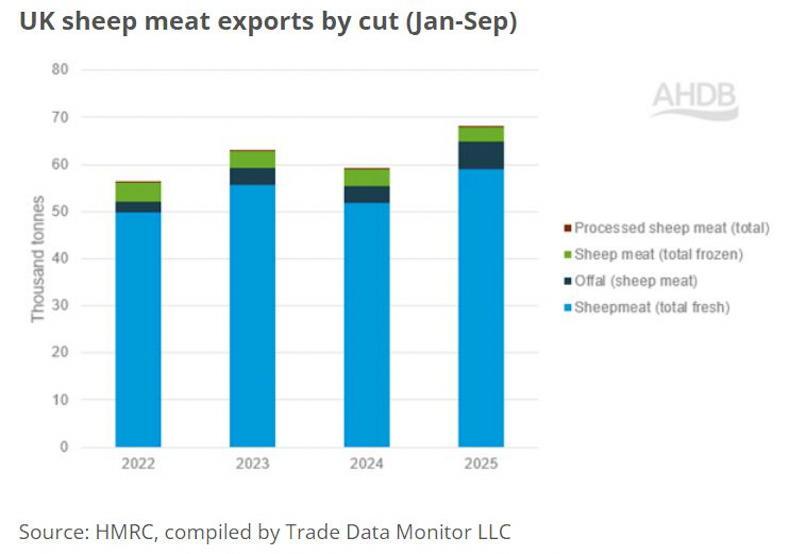

It adds that “within non-EU trade, a standout growth market was Côte d’Ivoire, where volumes more than doubled (up almost 150%) to 1,000 tonnes, underlining robust demand for offal in this market”.

Figure 4: UK sheepmeat exports by cut

Fresh meat remains the main product, with exports accounting for 59,100t of the 68,500t exported. This represents an increase of 14% on 2024, while exports of frozen sheepmeat declined by 15% to 3,100t.

“Offal exports recorded particularly strong growth, rising to 5,800 tonnes, up over 60% year on year, reflecting increased demand from EU and non-EU markets where lower-value cuts provide an important and affordable protein source.”

The latest UK sheepmeat trade data published by the Agriculture and Horticulture Development Board (AHDB) shows UK sheepmeat imports increasing by 7% in the first nine months of 2025 to reach 65,100t.

The value of such import volumes has increased by a much greater level, rising by 31% to £365m.

This has been underpinned by a significant increase in global sheepmeat prices, with the value of sheepmeat in Australia and New Zealand running at a considerably higher level than in 2024.

New Zealand remains the number one supplier of sheepmeat, despite import volumes declining marginally by 1% to 37,900t.

AHDB analyst Tom Spencer states that steady import volumes, despite New Zealand having lower availability of sheepmeat for export, shows that New Zealand exporters are balancing UK demand against opportunities in other markets in the EU and Asia.

Higher imports

In contrast, Australian exporters are taking advantage of a higher tariff-free quota, with the AHDB commenting that Australia has significantly expanded in the UK market.

Import volumes have increased year on year by 39%, as detailed in Figure 1, growing from 13,800t in quarter three 2024 to 19,200t in 2025.

Figure 1: UK sheepmeat imports by country

The AHDB comments that the increase in exports has resulted from Australia diverting product from what it describes as softer Asian markets.

In contrast, imports from Ireland were recorded at 5,800t, down 12% year on year.

This has stemmed from a combination of lower availability of sheepmeat for export and price competitiveness challenges from southern hemisphere sheepmeat.

Import cuts

The type of product imported is mainly categorised as frozen sheepmeat. Frozen import volumes increased from 44,300t in January to September 2024 to 49,700t in the corresponding period in 2025, equating to growth of 12%.

Volumes of fresh sheepmeat imports fell sharply by 24% to 7,500t, with this reduction said to be driven by lower volumes of fresh meat imports from New Zealand. This is demonstrated in Figure 2.

Figure 2: UK sheepmeat imports by cut

Sheepmeat exports

The volume of sheepemat exported from the UK increased by 15% to reach 68,300t.

The AHDB reports that “tight EU production and high EU prices increased demand for UK new-season lamb, despite UK supplies being somewhat limited year on year”. The value of exports increased by 16% to £493m.

Figure 3: UK sheepmeat exports by country

Total value of exports over this period has also lifted, up 16% compared with the same period a year ago to £493m.

The differential of almost £130m between export and import values despite imports running just 3,000t lower shows that the UK is benefitting from importing lower-priced sheepmeat and prioritising higher-value exports to the premium EU market.

“France remained the UK’s key destination, with volumes rising to 37,400 tonnes, up 20% year on year.

"This reflects firm French demand for UK lamb, particularly around key consumption periods.

Exports to Belgium also grew strongly, increasing by 34% to 8,800t, while shipments to the Netherlands climbed by 14%.”

The AHDB states that these gains highlighted above show the continued importance of nearby European markets for trade and in supporting domestic lamb prices.

Exports by cut type

It adds that “within non-EU trade, a standout growth market was Côte d’Ivoire, where volumes more than doubled (up almost 150%) to 1,000 tonnes, underlining robust demand for offal in this market”.

Figure 4: UK sheepmeat exports by cut

Fresh meat remains the main product, with exports accounting for 59,100t of the 68,500t exported. This represents an increase of 14% on 2024, while exports of frozen sheepmeat declined by 15% to 3,100t.

“Offal exports recorded particularly strong growth, rising to 5,800 tonnes, up over 60% year on year, reflecting increased demand from EU and non-EU markets where lower-value cuts provide an important and affordable protein source.”

SHARING OPTIONS