Average dairy farm incomes are forecast to reach €80,000 in 2017, which means farmers are looking at higher tax payments in 2018, with a knock-on into 2019, unless they take action.

Now is the time to focus on minimising your tax liability and maximising the after-tax profits you can retain.

The stakes are high in good income years, so it is a good idea to take professional advice.

1 Capital investments

The first step in your tax planning is to consider whether any new capital expenditure is required. Ask yourself:

What new investments within the farm gate would contribute to future farm profits?What effect would this capital expenditure have on my tax bill?Can I afford the expenditure and how will I fund it? 2 Inside the farm gate

Within the farm gate, there are several areas to consider:

Family wages. From a tax perspective, it can be advantageous to pay wages to children who contribute commercially to the farm. However, it is important that proper procedures are followed. Where children work on the farm part-time, no employer PRSI or employee PRSI is due. Farm repairs can be claimed against tax but the VAT on these expenses cannot be reclaimed.Bringing forward capital expenditure. Where capital expenditure is planned for 2018, it may make sense to bring this forward into 2017 to avail of the relevant capital allowance this year.Check that the add-backs in your adjusted profit computation for the personal element of motor, electricity and telephone expenses are not too high. Consider whether to purchase extra stock to avail of up to 100% stock relief.Review your use of income averaging.3 Off-farm opportunities

There are two main off-farm opportunities in tax planning:

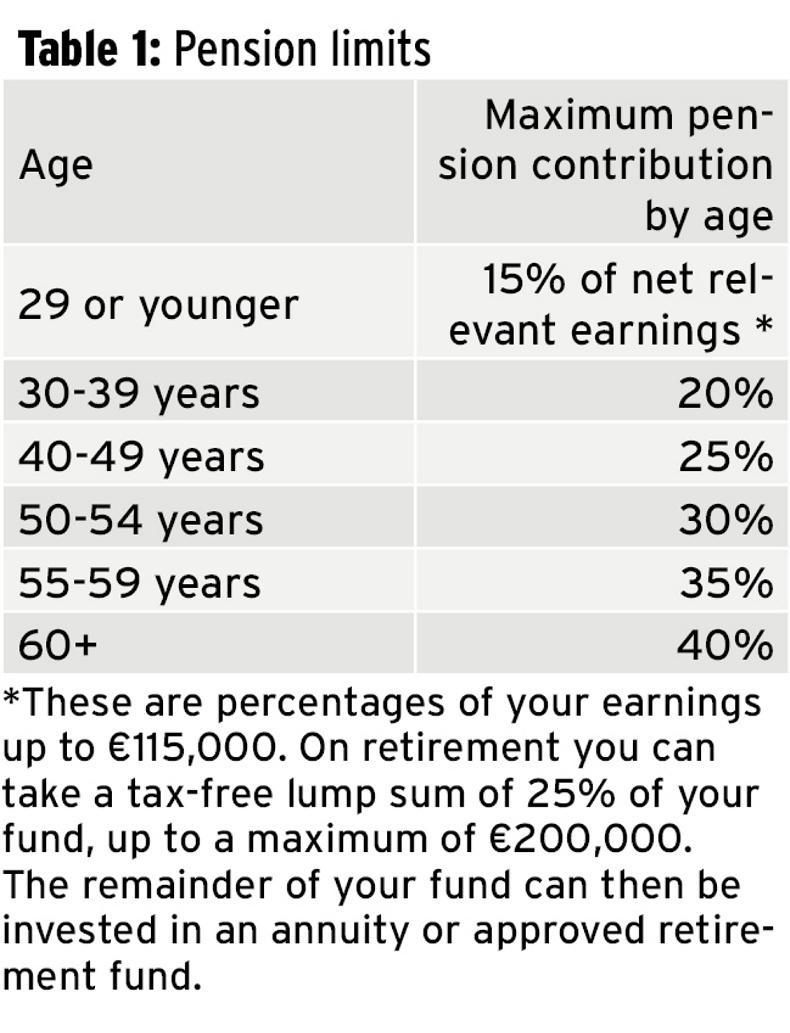

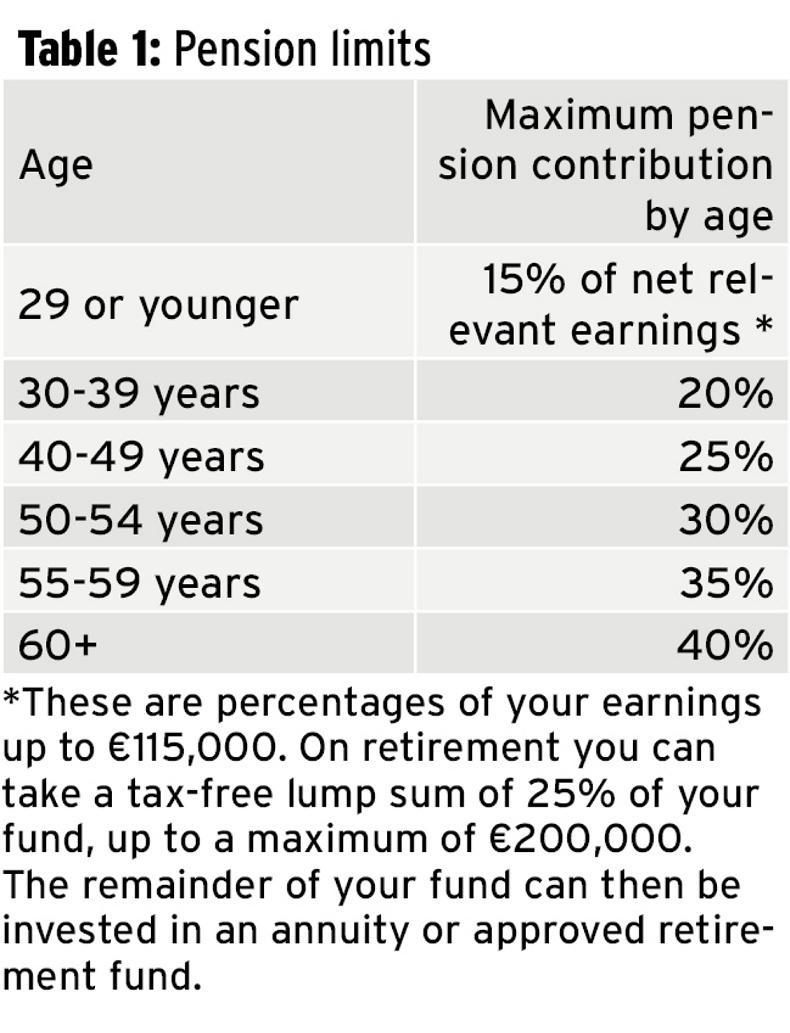

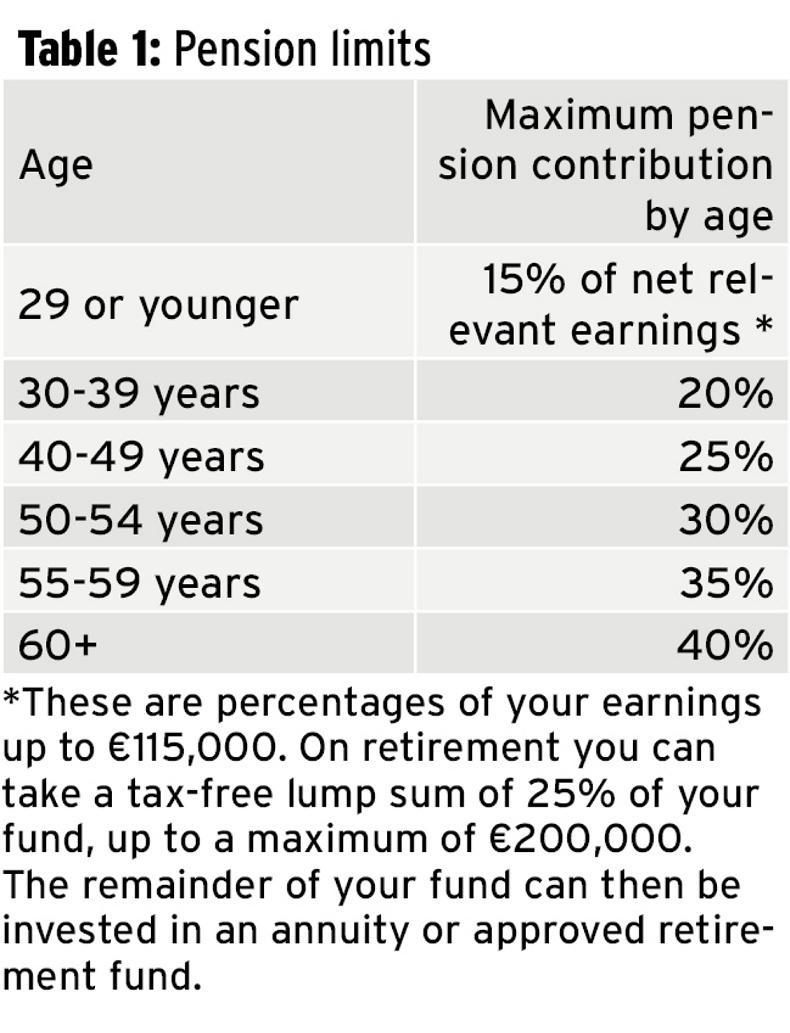

Pension payments. Subject to certain limits (see details in Table 1), payments from a farmer’s taxable profits to an approved pension scheme are fully allowable against tax. Some types of income, for example rental income and deposit interest, are excluded when calculating taxable farm profits. Farmers taking early retirement should note that, since 2002, it is no longer necessary for earned taxable profits to continue in order to receive a tax allowance for pension contributions. Employment and Incentive Investment Scheme (EIIS). This is a euro-for-euro tax relief for investment in certain companies up to an annual maximum of €150,000. Shares must be held for three years and the maximum rate of tax is now 40%. 4 Tax credits

A comprehensive list of tax credits and reliefs is available on the Revenue website, www.revenue.ie. These include reliefs in respect of incapacitated persons, deductions for maintenance payments and certain medical and dental expenses.

5 Farm business structure

When considering tax planning, it is worth reviewing whether your farm business could benefit from a change of business structure such as a farm partnership or forming a limited company.

Preliminary tax

Self-employed individuals and companies are required to pay preliminary tax.

Preliminary tax – income tax

Income tax is paid on a current year basis. This means that in 2017 you make a payment on account of your 2017 liability, using one of the following options to avoid penalties and underpayment:

Pay 90% or more of your total tax bill for 2017.Pay an amount of 100% of your 2016 tax bill.Pay an amount of 105% of your 2015 income tax liability, by direct debit.Pick the best option that is available for you.

Preliminary tax – corporation tax

Companies self-assess their corporation tax liability and pay using the Pay & File system. The requirements are:

Compute and pay preliminary tax by a specified date.File tax return within nine months of the accounting period.Pay any balance of tax due when lodging the return, ie within nine months of the end of the accounting period.

Average dairy farm incomes are forecast to reach €80,000 in 2017, which means farmers are looking at higher tax payments in 2018, with a knock-on into 2019, unless they take action.

Now is the time to focus on minimising your tax liability and maximising the after-tax profits you can retain.

The stakes are high in good income years, so it is a good idea to take professional advice.

1 Capital investments

The first step in your tax planning is to consider whether any new capital expenditure is required. Ask yourself:

What new investments within the farm gate would contribute to future farm profits?What effect would this capital expenditure have on my tax bill?Can I afford the expenditure and how will I fund it? 2 Inside the farm gate

Within the farm gate, there are several areas to consider:

Family wages. From a tax perspective, it can be advantageous to pay wages to children who contribute commercially to the farm. However, it is important that proper procedures are followed. Where children work on the farm part-time, no employer PRSI or employee PRSI is due. Farm repairs can be claimed against tax but the VAT on these expenses cannot be reclaimed.Bringing forward capital expenditure. Where capital expenditure is planned for 2018, it may make sense to bring this forward into 2017 to avail of the relevant capital allowance this year.Check that the add-backs in your adjusted profit computation for the personal element of motor, electricity and telephone expenses are not too high. Consider whether to purchase extra stock to avail of up to 100% stock relief.Review your use of income averaging.3 Off-farm opportunities

There are two main off-farm opportunities in tax planning:

Pension payments. Subject to certain limits (see details in Table 1), payments from a farmer’s taxable profits to an approved pension scheme are fully allowable against tax. Some types of income, for example rental income and deposit interest, are excluded when calculating taxable farm profits. Farmers taking early retirement should note that, since 2002, it is no longer necessary for earned taxable profits to continue in order to receive a tax allowance for pension contributions. Employment and Incentive Investment Scheme (EIIS). This is a euro-for-euro tax relief for investment in certain companies up to an annual maximum of €150,000. Shares must be held for three years and the maximum rate of tax is now 40%. 4 Tax credits

A comprehensive list of tax credits and reliefs is available on the Revenue website, www.revenue.ie. These include reliefs in respect of incapacitated persons, deductions for maintenance payments and certain medical and dental expenses.

5 Farm business structure

When considering tax planning, it is worth reviewing whether your farm business could benefit from a change of business structure such as a farm partnership or forming a limited company.

Preliminary tax

Self-employed individuals and companies are required to pay preliminary tax.

Preliminary tax – income tax

Income tax is paid on a current year basis. This means that in 2017 you make a payment on account of your 2017 liability, using one of the following options to avoid penalties and underpayment:

Pay 90% or more of your total tax bill for 2017.Pay an amount of 100% of your 2016 tax bill.Pay an amount of 105% of your 2015 income tax liability, by direct debit.Pick the best option that is available for you.

Preliminary tax – corporation tax

Companies self-assess their corporation tax liability and pay using the Pay & File system. The requirements are:

Compute and pay preliminary tax by a specified date.File tax return within nine months of the accounting period.Pay any balance of tax due when lodging the return, ie within nine months of the end of the accounting period.

SHARING OPTIONS