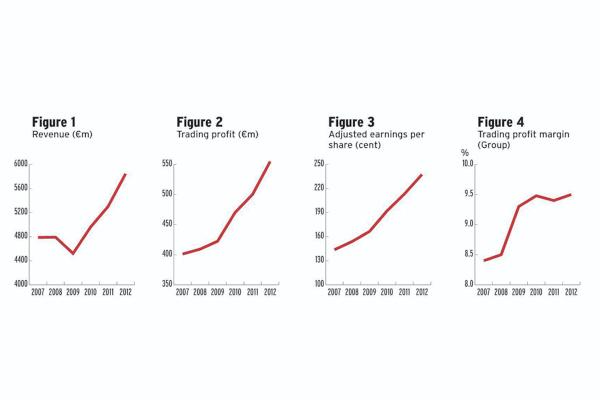

Kerry delivered a robust set of results for 2012 with sales rising by 10.3% to €5.8bn and trading profits increasing by 10.8% to €555m, according to its annual results published on Tuesday.

This equates to a rise 1.7% when acquisitions and currency fluctuations are excluded from the figures.

Trading margin rose by 0.1% to 9.5% while cash flow hit a record €380m for the first time on the back of the Kerry Group’s “ acquisition spree “ in 2011 which had the effect of further strengthening the group’s balance sheet.

Kerry are recommending a final dividend of 25 cent per share- a rise of 11.2% to 35.8 cent and its adjusted earnings per share (EPS) is up by 11.3% to 237.6 cent per share.

The group expect to achieve 7% to 11% growth in adjusted EPS this year.

The Kerry results’ statement did not envisage any major new acquisitions over the next two years apart from “ bolt on “ purchases for which €200m has been set aside.

Its Ingredients and Flavour divisions continues to underpin sales and profit growth and recorded 15% rise in trading profits to €506m during the year -the equivalent of a 12% trading margin.

Consumer Foods had to deal with depressed consumer sentiment during the year and a more value conscious shopper in Ireland and Britain. Trading profits here remained flat at €130m.

Kerry chief executive, Stan McCarthy outlined at Tuesday’s results’ announcement;”There are more health conscious and affluent consumers across all markets now, not just in developed western markets. This offers ever more opportunities for Kerry to satisfy such nutrition and dietary trends”.

Consumers’ increasing awareness of calories and dietary options plays well into Kerry’s model,” McCarthy added.

Kerry intended to capitalise on these trends in close association with their multi-national customers, such as Nestle and the likes, McCarthy emphasised.

He said Kerry’s competitive advantage came from its investment in R&D which is recent years saw a spend of almost 5% of annual sales-€186m last year

It allowed Kerry to offer he best global development and application models while underpinning regional development and customised systems of their diverse customer base.

Kerry trades on a PE of 16 times and its shares rose almost 3% in recent days.

By Division

Ingredients & Flavours

Revenues rose by 14% to €4,225m or a rise of 3.4% on a like-for-like basis. This division now accounts for 71% of group revenues and 80% of trading profits.

Demand for new product development remains strong across Kerry’s global customers, driven by consumer health and wellness trends such as; high fibre, heart healthy, reduced calories etc.

The Americas region, the largest for Kerry, grew solidly (+16%) during the year to €1.8bn .

Stan McCarthy told the Irish Farmers Journal this week that he remained “ bullish on the US economy” despite the ongoing fiscal adjustments in the United States.

European, the Middle East and Africa delivered a ‘satisfactory’ performances despite the well documented challenges, across Europe in particular.

Its operations in the Asia-Pacific region recorded excellent growth during the year- up 19.9% to €726m.

Consumer Foods

Despite the difficult trading conditions in Ireland and Britain, this division recorded a 2.3% rise in revenues to €1.7bn and maintained profits at 2011 levels.

It was a solid performance considering the 0.2% decline in trading margin to 7.6% during the year.

Brands hold the key in this division with Kerry’s Richmond and Mattessons brands doing particularly well. Its frozen meals section contracted as the group’s production facilities were consolidated last year into one site in Carrickmacross.

In Ireland, the Denny and Dairygold brands performed well and McCarthy believes these markets have “turned the corner”. McCarthy said the consequences of the horsemeat controversy would affect many other raw material/input providers outside the meat industry.

Financials

After tax, profits fell 26% during the year due to the once-off costs associated with integrating acquisitions.

Kerry continued to invest heavily in its Kerryconnect project (€46m in 2012).

Kerry’s strong cash generating business model and prudent financial management produced an extremely healthy balance sheet and leaves Kerry with significant headroom to continue to grow its business.

Net debt stands at €1.2bn.

Net debt to EBITDA ratio stands at 1.8 times and with 13.8 times interest cover.

The only blot on Kerry’s copy book appears to be its €245m pension deficit.

Here some €42m was invested last year to further defray this deficit.

SHARING OPTIONS