Over the past few weeks we have been looking at the current state of play, in terms of banks enforcing security on non-performing loans.

As we made clear, it is rarely a bank that is actually forcing the sale of the assets.

Rather, the bank will sell a book of non-performing loans to an investor or vulture fund who in turn, will try to make as much money as they can from the transaction as quickly as possible.

This means that once a loan is sold to a vulture fund, the process generally tends to speed up considerably. It is still possible for the defaulted or distressed borrower to try to do a deal with the vulture fund to pay off the loan to avoid a forced sale of the property.

Secured loans

However, as secured loans, particularly on agricultural land, generally have a lot more equity than is needed to cover the outstanding loan, the vulture fund may be willing to proceed to a sale unless the borrower is in a position to make a full settlement.

In such cases, there is little room for negotiation of a significant discount on outstanding loan balances.

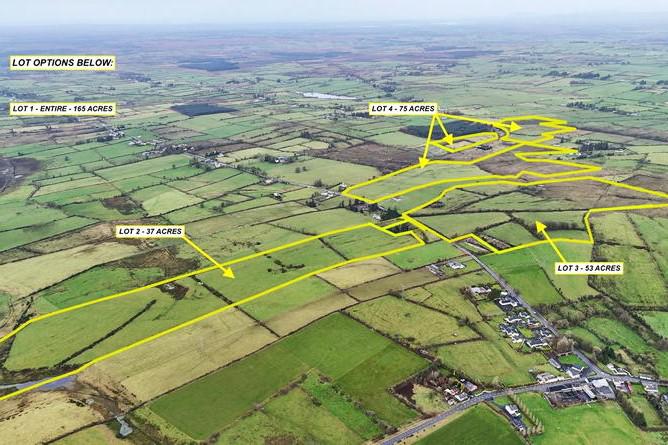

If there is no progress on coming to an agreement with the vulture fund, the land will be listed for sale. Currently, such land sales are handled through auctioneers who hold regular sales both online and in person.

Even when land is listed for sale, there is still time to come to an agreement with the vulture fund – it can be the case that the vulture fund lists land for sale with the intention of adding further pressure on the borrower to agree to a settlement.

From watching the regular auctions that are held by auctioneers such as Wilsons in Dublin, it is not unusual to see a property withdrawn from sale in the days before the scheduled auction. The withdrawal does not mean that an agreement has been reached.

The most active auctions, and those where the most sales are completed tend to happen at the end of the calendar year when the vulture fund wants to pump up their earnings as much as possible for their annual report to their investors.

As one insider told the Irish Farmers Journal, if your land is in a December auction, the only way to prevent it being sold is to turn up with a cheque to the vulture fund to clear their interest.

Some borrowers may be tempted to bring court cases to try to prevent the sale of the land, or even question whether the vulture fund or receiver has the legal right to sell the land.

Generally, these are unsuccessful as mortgage and loan agreements are very carefully written.

However, there was a case this year where a couple from Offaly successfully had almost €1m of debt it allegedly owed to Everyday Finance written off. The judgement, handed down in the High Court in February struck out proceedings against the couple.

Allied Irish Bank originally brought proceedings against the couple in 2013, and the judgement cited the “inordinate and inexcusable” delay between then and February 2024.

There were other circumstances in this case, such as the renegotiation of the loan in 2009, which means the ruling probably cannot be relied on for other borrowers.

But it does mean that vulture funds will be even less willing to delay too long before enforcing security on a loan if waiting is increasing the risk of having a loan written off by the courts.

Caveat Emptor

Anyone who regularly attends auctions knows that you are buying what you see and that there is little comeback for the purchaser if the goods do not meet expectations.

While this might not be a huge issue when purchasing some chairs at your local auction house, it can be a big problem if you are spending hundreds of thousands of euros on land.

Normally when property is sold there are several contractual obligations on the seller. The land must be as described, you will be told of any planning issues, and critically, the property must be delivered with vacant possession.

In a purchase from a receiver or vulture fund, who often have little knowledge or interest in the property, the sale contract will often be missing several of the usual guarantees.

The biggest one that makes headlines is that there may not be any obligation to deliver the land with vacant possession.

It is not unheard of for a buyer to purchase land at an auction and then when they get to the farm find that the gates are locked, signs are up warning trespassed will not be tolerated and that the fields are occupied by livestock.

Buyers who may think they have got a bargain on land purchased at auction for well below the market price may quickly find themselves back in court trying to take possession of that land.

One case currently before the High Court illustrates this well.

The plaintiffs, Westglade Unlimited Company and Timothy Carroll claim they are unable to access land in Co Limerick purchased from a receiver appointed by Everyday Finance.

They claimed the previous owners of the property, William and Anna Kennedy, had refused to give up vacant possession and were keeping horses on the land.

Counsel for the plaintiffs told the court that the Kennedys told them at a meeting that it was their problem if they had handed over money as the farm remained in the Kennedys’ possession and that “the next person who took the locks off my gate will be shot." The case is due for a hearing on 10 October.

By the time that case is heard almost a year will have passed since the land was purchased at auction.

The buyer has had to go to the trouble and extra expense of bringing a case to the High Court to try to get something – vacant possession – which in any other kind of sale between a willing buyer and a willing seller would have happened at the moment the sale closed.

No wonder then, that land sold by receivers tends to trade at much lower values than other kinds of sales. The moment the hammer falls can only be the start of the expense and stress for the buyer.

Comment

Forced sales of land and property by receivers usually happen after more than a decade of attempts to find other solutions to debt problems.

As we have previously pointed out if the borrower can find a way to agree with either their bank or (eventually) the vulture fund, it may be possible to keep some or all of the property.

Auctions are the last resort for everyone involved. The borrower has no interest in losing their property. The vulture fund would rather do a deal than go through the trouble of selling the property. A buyer – if one can be found – may have to face a long time in court trying to get what they thought they were buying.

Land sold at auction may seem cheap at the point of purchase, but buyers have to put a value on the time, effort and stress they may have to face before they can take possession of it.

Even when they do have it, there could be longer-running difficulties faced if there was local opposition to the lands being sold at all.

If a deal cannot be done with the vulture fund the land will be sold at auction.Legal challenges to sale have little chance of success.Land sold by receivers often sells below market value.Such land may not come with vacant possession.The process of taking possession can be difficult, and may end up in court.

Over the past few weeks we have been looking at the current state of play, in terms of banks enforcing security on non-performing loans.

As we made clear, it is rarely a bank that is actually forcing the sale of the assets.

Rather, the bank will sell a book of non-performing loans to an investor or vulture fund who in turn, will try to make as much money as they can from the transaction as quickly as possible.

This means that once a loan is sold to a vulture fund, the process generally tends to speed up considerably. It is still possible for the defaulted or distressed borrower to try to do a deal with the vulture fund to pay off the loan to avoid a forced sale of the property.

Secured loans

However, as secured loans, particularly on agricultural land, generally have a lot more equity than is needed to cover the outstanding loan, the vulture fund may be willing to proceed to a sale unless the borrower is in a position to make a full settlement.

In such cases, there is little room for negotiation of a significant discount on outstanding loan balances.

If there is no progress on coming to an agreement with the vulture fund, the land will be listed for sale. Currently, such land sales are handled through auctioneers who hold regular sales both online and in person.

Even when land is listed for sale, there is still time to come to an agreement with the vulture fund – it can be the case that the vulture fund lists land for sale with the intention of adding further pressure on the borrower to agree to a settlement.

From watching the regular auctions that are held by auctioneers such as Wilsons in Dublin, it is not unusual to see a property withdrawn from sale in the days before the scheduled auction. The withdrawal does not mean that an agreement has been reached.

The most active auctions, and those where the most sales are completed tend to happen at the end of the calendar year when the vulture fund wants to pump up their earnings as much as possible for their annual report to their investors.

As one insider told the Irish Farmers Journal, if your land is in a December auction, the only way to prevent it being sold is to turn up with a cheque to the vulture fund to clear their interest.

Some borrowers may be tempted to bring court cases to try to prevent the sale of the land, or even question whether the vulture fund or receiver has the legal right to sell the land.

Generally, these are unsuccessful as mortgage and loan agreements are very carefully written.

However, there was a case this year where a couple from Offaly successfully had almost €1m of debt it allegedly owed to Everyday Finance written off. The judgement, handed down in the High Court in February struck out proceedings against the couple.

Allied Irish Bank originally brought proceedings against the couple in 2013, and the judgement cited the “inordinate and inexcusable” delay between then and February 2024.

There were other circumstances in this case, such as the renegotiation of the loan in 2009, which means the ruling probably cannot be relied on for other borrowers.

But it does mean that vulture funds will be even less willing to delay too long before enforcing security on a loan if waiting is increasing the risk of having a loan written off by the courts.

Caveat Emptor

Anyone who regularly attends auctions knows that you are buying what you see and that there is little comeback for the purchaser if the goods do not meet expectations.

While this might not be a huge issue when purchasing some chairs at your local auction house, it can be a big problem if you are spending hundreds of thousands of euros on land.

Normally when property is sold there are several contractual obligations on the seller. The land must be as described, you will be told of any planning issues, and critically, the property must be delivered with vacant possession.

In a purchase from a receiver or vulture fund, who often have little knowledge or interest in the property, the sale contract will often be missing several of the usual guarantees.

The biggest one that makes headlines is that there may not be any obligation to deliver the land with vacant possession.

It is not unheard of for a buyer to purchase land at an auction and then when they get to the farm find that the gates are locked, signs are up warning trespassed will not be tolerated and that the fields are occupied by livestock.

Buyers who may think they have got a bargain on land purchased at auction for well below the market price may quickly find themselves back in court trying to take possession of that land.

One case currently before the High Court illustrates this well.

The plaintiffs, Westglade Unlimited Company and Timothy Carroll claim they are unable to access land in Co Limerick purchased from a receiver appointed by Everyday Finance.

They claimed the previous owners of the property, William and Anna Kennedy, had refused to give up vacant possession and were keeping horses on the land.

Counsel for the plaintiffs told the court that the Kennedys told them at a meeting that it was their problem if they had handed over money as the farm remained in the Kennedys’ possession and that “the next person who took the locks off my gate will be shot." The case is due for a hearing on 10 October.

By the time that case is heard almost a year will have passed since the land was purchased at auction.

The buyer has had to go to the trouble and extra expense of bringing a case to the High Court to try to get something – vacant possession – which in any other kind of sale between a willing buyer and a willing seller would have happened at the moment the sale closed.

No wonder then, that land sold by receivers tends to trade at much lower values than other kinds of sales. The moment the hammer falls can only be the start of the expense and stress for the buyer.

Comment

Forced sales of land and property by receivers usually happen after more than a decade of attempts to find other solutions to debt problems.

As we have previously pointed out if the borrower can find a way to agree with either their bank or (eventually) the vulture fund, it may be possible to keep some or all of the property.

Auctions are the last resort for everyone involved. The borrower has no interest in losing their property. The vulture fund would rather do a deal than go through the trouble of selling the property. A buyer – if one can be found – may have to face a long time in court trying to get what they thought they were buying.

Land sold at auction may seem cheap at the point of purchase, but buyers have to put a value on the time, effort and stress they may have to face before they can take possession of it.

Even when they do have it, there could be longer-running difficulties faced if there was local opposition to the lands being sold at all.

If a deal cannot be done with the vulture fund the land will be sold at auction.Legal challenges to sale have little chance of success.Land sold by receivers often sells below market value.Such land may not come with vacant possession.The process of taking possession can be difficult, and may end up in court.

SHARING OPTIONS