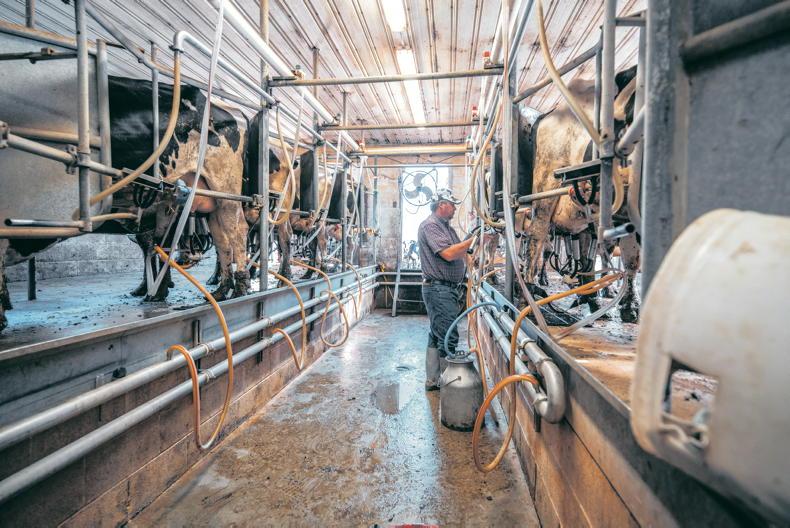

I’m a dairy farmer and had a surprisingly strong year for 2024, and this year is looking good too. Between a a relatively good milk price, stabilising costs, and a decent back end to the grazing season, my margins are better than expected. The problem is I didn’t factor any of this into my planning. I’m facing a far bigger tax bill than I’d budgeted for,

along with a hefty preliminary tax figure for the current year.

I didn’t make any major investments, so I’m wondering: is there anything I can still do at this point to ease the tax hit before the deadline? And how can I plan better for the future?

ANSWER: You’re not the first and certainly won’t be the last farmer to find themselves caught off guard by a “good year.” Relatively good prices, stabilising input costs, and improved grazing conditions have given margins a shot in the arm, but that silver lining often arrives with a larger tax bill.

The key point here is this: you still have options – but you need to act promptly.

Retirement planning

The most immediate and effective way to reduce your income tax bill – both for the year just gone and the preliminary tax for the current year – is to make a pension contribution.

You can claim tax relief on personal pension contributions made before the 31 October deadline (or mid-November if you pay and file online). If you make a lump-sum payment now, you can elect to have it applied to the 2024 tax year, knocking down the tax due this autumn. And by setting up regular monthly contributions your preliminary tax for 2025 will also reduce.

But here’s where the focus is often just on the tax relief – and that’s only half the story. A well-structured retirement plan also gives you:

A tax-efficient way to extract funds from your business.A ring-fenced asset that doesn’t interfere with farm viability.A crucial part of long-term succession planning.For example, if you’re hoping to pass the farm on to the next generation, having a substantial pension pot in your name may reduce your future dependence on drawing income from the farm itself – and lessen pressure on the successor to “buy you out” or for the farm to support two families.

Don’t underestimate the strategic value of this. The best succession plans don’t just move land; they move financial independence.

Review cashflow

A strong profit figure doesn’t always mean you’re flush with cash. Many farmers are now facing large tax bills after two good years, but without matching that income with a cashflow plan, it can catch you off guard. If the tax bill feels like a squeeze, it’s time to take a closer look at your liquidity and make informed decisions.

Here’s what I’d suggest:

Review cashflow across both business and personal accounts. How much available cash do you actually have?Ring-fence enough to cover tax, loan repayments, and household spending.Avoid knee jerk investments. Buying a tractor to “spend the tax away” is rarely smart unless it’s needed and aligns with long-term plans. There is no point buying a tractor for cash and finding yourself in an overdraft by Christmas.A pension contribution allows you to defer tax, build an asset, and retain flexibility. Compare that to a depreciating machine you didn’t need in the first place.

Get professional advice

Talk to a financial planner or agri adviser who understands the nuances of farming income and tax timing. It’s important they look at this year’s figures, but also model the impact of early retirement, farm transfer, state pension entitlements, and other reliefs.

Ask them to run different pension contribution scenarios and show you the net impact on tax, available cash, and long-term financial security.

This isn’t about “tick-the-box” advice – it’s about making sure every euro of margin you earned this year is put to work, not just handed over to Revenue.

The bottom line is, don’t look back and wonder there the cash went. You can turn this tax sting into a meaningful long-term gain. But only if you stop reacting to last year and start planning for the next ten.

Making yourself financially strong will have you set up and confident for when prices next take a dip.

Martin Glennon,head of financial planning, ifac

Martin Glennon is head of financial

planning at ifac, the professional

services firm for farming, food and

agribusiness

I’m a dairy farmer and had a surprisingly strong year for 2024, and this year is looking good too. Between a a relatively good milk price, stabilising costs, and a decent back end to the grazing season, my margins are better than expected. The problem is I didn’t factor any of this into my planning. I’m facing a far bigger tax bill than I’d budgeted for,

along with a hefty preliminary tax figure for the current year.

I didn’t make any major investments, so I’m wondering: is there anything I can still do at this point to ease the tax hit before the deadline? And how can I plan better for the future?

ANSWER: You’re not the first and certainly won’t be the last farmer to find themselves caught off guard by a “good year.” Relatively good prices, stabilising input costs, and improved grazing conditions have given margins a shot in the arm, but that silver lining often arrives with a larger tax bill.

The key point here is this: you still have options – but you need to act promptly.

Retirement planning

The most immediate and effective way to reduce your income tax bill – both for the year just gone and the preliminary tax for the current year – is to make a pension contribution.

You can claim tax relief on personal pension contributions made before the 31 October deadline (or mid-November if you pay and file online). If you make a lump-sum payment now, you can elect to have it applied to the 2024 tax year, knocking down the tax due this autumn. And by setting up regular monthly contributions your preliminary tax for 2025 will also reduce.

But here’s where the focus is often just on the tax relief – and that’s only half the story. A well-structured retirement plan also gives you:

A tax-efficient way to extract funds from your business.A ring-fenced asset that doesn’t interfere with farm viability.A crucial part of long-term succession planning.For example, if you’re hoping to pass the farm on to the next generation, having a substantial pension pot in your name may reduce your future dependence on drawing income from the farm itself – and lessen pressure on the successor to “buy you out” or for the farm to support two families.

Don’t underestimate the strategic value of this. The best succession plans don’t just move land; they move financial independence.

Review cashflow

A strong profit figure doesn’t always mean you’re flush with cash. Many farmers are now facing large tax bills after two good years, but without matching that income with a cashflow plan, it can catch you off guard. If the tax bill feels like a squeeze, it’s time to take a closer look at your liquidity and make informed decisions.

Here’s what I’d suggest:

Review cashflow across both business and personal accounts. How much available cash do you actually have?Ring-fence enough to cover tax, loan repayments, and household spending.Avoid knee jerk investments. Buying a tractor to “spend the tax away” is rarely smart unless it’s needed and aligns with long-term plans. There is no point buying a tractor for cash and finding yourself in an overdraft by Christmas.A pension contribution allows you to defer tax, build an asset, and retain flexibility. Compare that to a depreciating machine you didn’t need in the first place.

Get professional advice

Talk to a financial planner or agri adviser who understands the nuances of farming income and tax timing. It’s important they look at this year’s figures, but also model the impact of early retirement, farm transfer, state pension entitlements, and other reliefs.

Ask them to run different pension contribution scenarios and show you the net impact on tax, available cash, and long-term financial security.

This isn’t about “tick-the-box” advice – it’s about making sure every euro of margin you earned this year is put to work, not just handed over to Revenue.

The bottom line is, don’t look back and wonder there the cash went. You can turn this tax sting into a meaningful long-term gain. But only if you stop reacting to last year and start planning for the next ten.

Making yourself financially strong will have you set up and confident for when prices next take a dip.

Martin Glennon,head of financial planning, ifac

Martin Glennon is head of financial

planning at ifac, the professional

services firm for farming, food and

agribusiness

SHARING OPTIONS