The UK is a poorer performer on weaning percentage in suckler cows, according to international benchmark figures.

A study of the major beef producing nations in the world shows that the UK is weaning 85 to 86 cows per 100. This is similar to Canada and Australia, but behind the 90-plus weaned in the US, France and Ireland.

Heifers in the UK are also bred at an older age at 30 to 31 months, which is the same as in France.

Ireland breeds slightly younger at 26 months, with Australia, Canada and the US typically 24 months. Bos Indicus cattle from Brazil are the oldest-bred cattle at 36 months.

Replacement rates in the UK are typically 20%, the same as Australia and Brazil, although it should be noted that Australia and Brazil’s replacement rates can be driven by drought conditions and the need to destock.

France typically has a higher replacement rate at 23%, which can be put down to a strong market for cow beef.

The other countries have replacement rates between 13% and 17%, which helps to keep replacement costs down through selecting and managing cows to remain productive for longer.

Weaning age varies, with Australia and Canada weaning around 200 days of age, US at 210 days, the UK typically 226 days, France and Brazil around 240 days and Ireland around 250 days.

However, when weaning weights are adjusted to a consistent 200 days of age, most countries are typically achieving 250kg at 200 days, with the exception of Brazil’s Bos Indicus cattle weighing 145kg and Australia at 225kg.

Beef finishing

The suckler farms in the study showed that, in the UK, the typical age at slaughter is 20 to 24 months of age, which is in line with Australia.

In Ireland, finished cattle are slightly later at closer to 24 months of age. In France, consumers prefer beef from cows or heifers, so a lot of entire male suckler calves are sold at weaning to Italy.

The typical age at slaughter in France is 16 months and this is the typical age of cattle finished in the US in open yards.

In Canada, the slaughter age is typically 19 to 20 months of age. In Brazil, Bos Indicus cattle tend to be later finishing than cattle with British breed backgrounds.

Grass-finished cattle in Brazil are typically finished around 36 months of age, but grain-finished cattle are typically finished earlier at 27 months of age.

Carcase weights in the UK were 325kg to 340kg; in Ireland 350kg; in France and Canada 370kg; and in the US on open yard finishing 380kg to 400kg.

In Brazil, the carcase weights are lower, with grass-finished cattle typically 250kg to 280kg and grain-finished cattle 280kg to 295kg.

In Australia, carcase weights can vary on an annual basis due to production system and the impact of drought conditions.

There is a wide variation in grass-finished cattle, but typically around 250kg for British native breeds animals and with grain finished cattle heavier, typically around 340kg carcase weight.

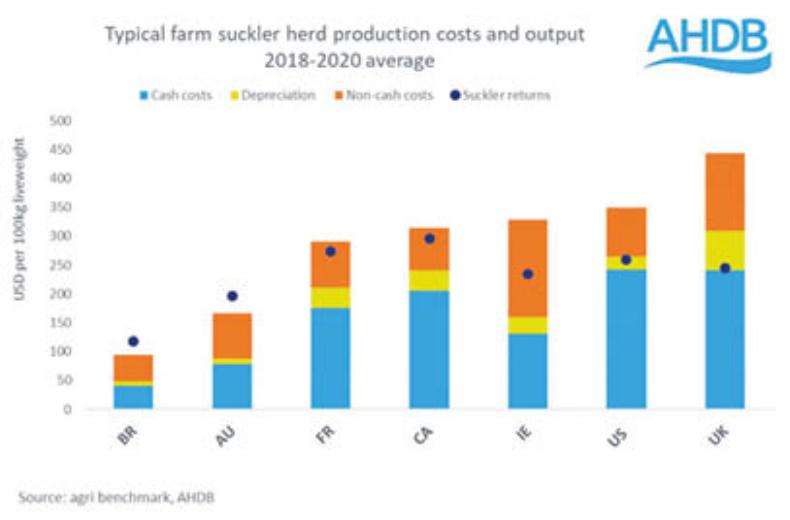

Graph 1: British beef expensive to produce

The farms in these charts are ranked in ascending order of total costs.

Cash costs include all paid expenses and non-cash costs include the value of family labour and rental value of owner-occupied land.

Depreciation (machinery, equipment and buildings) is shown separately.

Returns do not include decoupled payments typically received by some farms, such as the EU land-based payments, nor the returns from other enterprises on the farm.

The UK includes a typical lowland farm in the southwest that finishes weaned calves on farm and a typical upland farm in north Yorkshire that sells its calves at weaning.

Returns will include the value of calves at weaning, as well as cull or breeding cow sales.

The main differences are that countries such as Australia, Canada, Brazil and the US manage more cows per labour unit than typical UK farms.

They will also have little machinery and equipment investment and rely on grazed grass year-round, with no housing in the winter.

Many farms around the world (from Europe, the North and South Americas, South Africa and Namibia, to Australia and New Zealand) typically practice rotational or paddock grazing by measuring and managing forage access and production.

Graph 2: Ireland has highest costs to finish cattle

The left-hand side of Figure 2 shows countries which typically finish homebred calves.

These will be finished on grass and/or in yards and fed homegrown forage and concentrates, which could be home-grown or purchased.

The right-hand side of the chart shows farms that are finishing purchased animals.

These cattle may have been purchased as young calves from dairy herds or purchased as stores from suckler herds. Calves from suckler herds would typically be purchased around 10 to 12 months of age and would be finished on grazed grass and/or in yards.

Many cattle ranchers do not have the facilities or grass quality to finish cattle and therefore they are sold to finishing specialists as stores.

In Australia, Brazil, Canada and the US, it is typical to finish cattle in specialist open yards or feedlots where they are fed on locally produced forage and locally-produced grain, corn or byproducts.

However, in Australia there are many farms finishing homebred suckler calves on grazed grass and in Brazil, over 90% of cattle are finished on grazed grass.

The price of a steak in the UK is just over three times the value of mince, which is higher than most large beef-producing nations.

Ireland, USA, Canada and Australia all price their steak meat at roughly double the price of mince.

Switzerland was highest in the AHDB figures, where steak meat cost nearly four times the price of mince. The lowest ration in the study was South Africa, which priced steaks as 1.6 times the value of mince.

Nations consuming less beef tend to be willing to pay more for steak, with Germany and Switzerland both eating 14kg of beef annually per person, while the US and Australia consume 26kg.

The mince price was calculated with a combination of standard and premium mince across the nations in the study. The UK, which pays a larger premium for steak meat, had some of the lowest valued mince at an average of £5/kg, which is similar to South Africa.

Canada and the US both valued ground beef higher at closer to £7/kg, which reflects their larger market for burgers.

On the steak front, the UK had some of the highest prices for sirloin at an average of close to £17/kg. Ireland, Australia, the US and Canada all have sirloin prices closer to £12 to £14/kg.

Exports

Looking at exports, the UK’s lower mince price means it can compete with Australia, Ireland and the US. However, it might struggle to export higher-value cuts.

Consumers in countries such as Australia and the US only have to pay double to trade up from mince to steak. This may explain why they eat 8kg more beef per year – the equivalent of 27 steaks.

SHARING OPTIONS