It is vital for Irish agriculture and the economy that we increase forestry planting to help offset agricultural emissions and deliver rural employment, as well as to sustain and develop the excellent export trade in timber products and fuel energy needs.

Farmers and landowners can only get a long-term economic return through timely thinnings and fellings of commercial crops. The experience of others is a major influence on those yet to plant or harvest. That experience can range from issues with the Forest Service on grant approvals and payments, licences to planning, taxation and a lack of knowledge – just some of the obstacles to expanding the forest area and timber production.

Roundwood production in Ireland has increased ten-fold in 50 years to over three million cubic metres. It can double within the next 15 years. Demand grew all during the worst of times over the last seven years, mainly thanks to the Irish processors who took on the UK market and handled the supplies from commercial forestry of the 1980s and 1990s. A further increase in demand is expected, with rapid growth in the Irish economy, a strengthening UK economy and steady exchange rates (if the UK doesn’t lose the run of itself, and the euro settles down). Energy demand for forest biomass is projected to increase at least 10% year on year.

So, where will the supply come from? The increase in supply will all come from farmers and private forest owners who need appropriate business processes, infrastructure, supports and confidence to deliver timber. There will be thousands of suppliers compared with the handful up to a few years ago. Storm Darwin helped to disguise some major issues that affect wood supply.

The storm thrown timber supply will dry up over the next few months; it could be 20 to 30 years before such a calamity is seen again. The flat planting programme and its significant non-commercial content are a major concern for the longer term. The timber supplies for the next 15 years are in the ground and only natural calamities should affect supply. But there are major obstacles. Tight supply might be positive for prices in the short-term, but bad for processing capacity, jobs, exports and also for agriculture.

COFORD recognised the need to identify issues affecting mobilisation of timber. Mike Glennon, drawing on the experience of a 100-year-old family business, knows a thing or two about timber markets and supplies. He chaired a wood mobilisation group. Its report was launched by Minister Hayes last March. I won’t go into all of the obstacles to getting timber to market; suffice to say that the report came up with 40 recommendations of which 24 were “priority one”.

Recommendations relating to taxation may be close to resolution. The continuation of road grants is welcome. Many others can be resolved by a commitment on the part of Government and the Department to recognising the significance of private ownership of younger woodlands and the urgent need to remove obstacles to wood supply and have appropriate business processes.

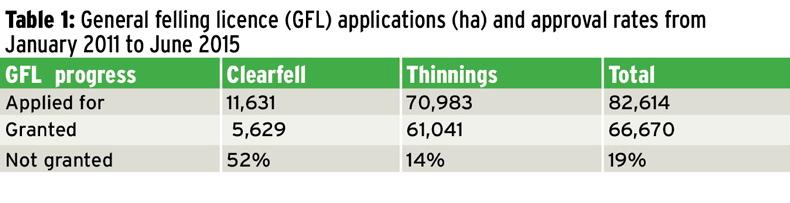

There are some key statistics on general felling licence applications sourced from the Forest Service monthly reports. I have compiled these for the period 1 January 2011 to 30 June 2015 for private forests (Table 1).

I picked a period of four and a half years to avoid duplication of licence applications for the same site (most licences are for five years). I don’t know the reasons for the 52% shortfall in clearfell licences and the 14% shortfall in thinning licences.

If I were a senior manager or minister, I would want to know whether the equivalent of a year’s production had not been licensed and see what should be done about it.

For the same period, and using grants (Form 2s) applied for as the definition of road construction, 412,407 metres of private forest roads were built. Using an average of 15 metres per hectare, this might bring about 27,500ha into production. That sounds impressive until you consider that in the five years from 1994 to 1998, total private planting was 67,320ha. This area should be largely in production by now.

There are reasons why roads may not be necessary but, overall, there seems to be a big divergence between actual road construction and that needed to get all commercial crops into production. There is a truism worth repeating – if there isn’t a first thinning, there won’t be a subsequent thinning. Therefore, the shortfall in future supply is compounded if crops are not first thinned.

Tackling the looming supply issue needs a Department focused on two key indicators – the potential cubic metres of annual production and the annual hectares of commercial species needed to build and maintain sustainable timber supply and emissions offsets – and accountability in making sure they are achieved. That needs a programme director who can strategise, plan and secure changes at the highest level and create a culture of enablement.

A lot of Forest Service time is spent on the administration of overly complicated schemes,not to mention the appeals system. It could be interesting to compare staff ratio to annual planting in 1994 and in 2014.

There are heavier workloads now, but how much contributes to delivering real needs? It would be more rewarding for the State and the sector if future emphasis would be on achieving key targets in a culture of “can do” rather than the fear that seems to lead to ever increasing complexities and scarce resources bogged down in the minutiae of rules.

Then there are long delays in implementing change – think single consent for roads and entrances, on the go since 2011, or a windthrow reconstitution scheme for the February 2014 storm.

The focus for 2016 must be on simplification of mechanisms to implement Government policy and the delivery of real national value.

Joined-up thinking within and across the Department of Agriculture and across relevant Government departments would be a start. Ensuring that Forest Service customers, and their advisers, are good news messengers for the challenge of raw material is essential.

John Phelan is managing director of Woodland Managers Limited, Merchants Dock, Galway.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: