On New Zealand’s North Island, sitting on the banks of the winding Manawatu river, is Palmerston North, a small city where Ireland rugby coach Joe Schmidt began his coaching career at the local high school.

Palmerston is also home to Massey University, one of the world’s leading third-level institutions when it comes to agricultural science and research. The expertise and talent developed out of Massey made Palmerston the natural location for New Zealand’s agriculture industry when it came to research and development.

Just across from Massey’s tree-lined campus, located on the appropriately named dairy farm road, is a small cluster of research centres. AgResearch, the New Zealand grassland research body is based here, as is New Zealand’s research centre for agricultural greenhouse gases.

Fonterra, the New Zealand dairy co-op, also operates its world-class R&D centre at this site, where a number of world firsts have been developed such as spreadable butter and milk protein concentrates, which are used in cheese, yoghurt, sports nutrition and pharma products.

One of the newer entities located along the dairy farm road is a startup business incubator called Building Clever Companies, or BCC as its better known.

BCC traces its roots back to the late 1990s when entrepreneurs and businesses were looking for a way to develop the economy of the Manawatu district, which is the name for the wider geographical region around Palmerston.

To fund this incubator, the business community of the region established the Manawatu Investment Group (MIG) – an angel investment group for new startup companies. At the same time, a technology transfer partnership was also signed with Massey University to help bridge the gap between business and science.

People are getting more confident around on-farm applications and solutions

It was 2005 before BCC became fully operational and started to launch the first startup companies from its incubator. The new incubator grew over the years and began to expand its investment activities following the global financial crisis.

BCC has since evolved to focus on high-potential startup companies that can one day deliver employment, exports for New Zealand and a return on investment for the MIG angel investors. The BCC incubator has had particular success when it comes to startup companies involved in food, animal health, agritech and environmental technologies.

Dean Tilyard is chief executive of BCC and has been with the company since its inception.

“For me, agritech is the application of new technologies along the food supply chain,” says Tilyard. “BCC is focused on the startup pipeline and there are about 120 new technologies looking to come to market every year in New Zealand.”

BioLumic, one of the startup companies that came through the Sprout accelerator.

Surprisingly few dairy applications are coming through the startup pipeline in New Zealand, says Tilyard. Most of the pipeline to date is from companies looking to innovate in more niche sectors such as honey and horticulture.

Angel investors are plentiful in New Zealand, according to Tilyard, with most companies able to attract seed investment. However, venture capital required for the next phase growth is absent from New Zealand, which is forcing rapidly expanding companies to look abroad in places like California for next level finance.

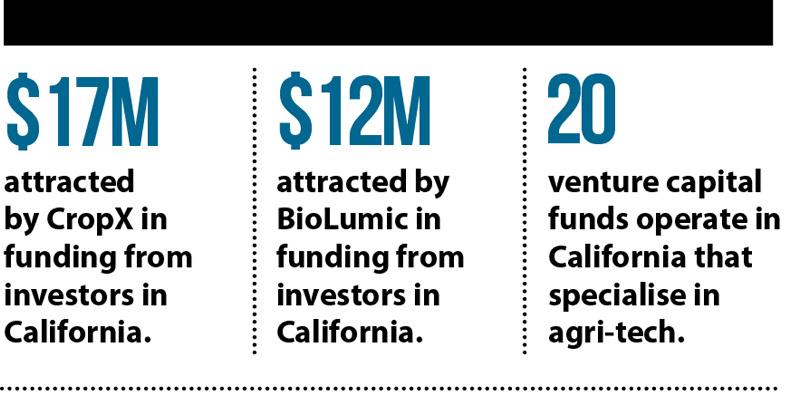

New Zealand agritech companies such as CropX and BioLumic have attracted $17m and $12m, respectively, in series A rounds of funding from investors in California. Series A funding is typically the first significant round of venture capital financing for a new company.

Tilyard says there are 20 venture capital funds operating in California that specialise in agritech investment.

“The big venture capital money was not previously going into on-farm applications. It first went to new innovations around food delivery and forms of indoor planting,” says Tilyard.

“But now people are getting more confident around on-farm applications and solutions. The seasonality of farming makes agritech development slower but that shouldn’t mean we use seasonality as an excuse,” he adds.

The absence of serious venture capital funding needed by growing startups has been a major weakness for the agritech movement in New Zealand. BCC has poured huge energy into developing clever ideas and innovations from its startup pipeline but has lost the fruits of this work when companies were forced to move abroad in search of next level funding.

CropX, one of the startup companies that came through the Sprout accelerator.

CropX, an analytics company that develops software for saving water and boosting crop yields, has moved its headquarters to Israel, with an additional office also located in San Francisco. Likewise, BioLumic, a New Zealand company that has developed a unique UV light treatment technology to boost crop yields and disease resistance, has recently opened an office in California. While BioLumic maintains its headquarters in Palmerston North, it is building its staff in the US and Mexico, which are seen as key markets.

For any country, the ultimate goal of fostering innovation and the development of new companies is to add to the domestic economy, particularly via job creation and future investment. However, the flight of New Zealand’s agritech startups to other parts of the world is eroding the future economic potential of New Zealand and losing it to agri-tech hotspots such as Israel, California and even Ireland.

Creating an environment of innovation and building a startup pipeline like BCC has done is admirable. However, the absence of capital investment to fund the next level growth of these companies only robs New Zealand of the future benefit they could deliver.

Given the rapid growth in agritech startups coming through its pipeline over recent years, BCC has developed a specialised accelerator programme for agritech companies called Sprout. Every year, the best eight to 10 agritech startups are identified in New Zealand and added to the Sprout accelerator programme.

These large corporate agribusinesses are involved with Sprout because they want a line of sight into the startup pipeline

Companies selected for the five-month Sprout accelerator are provided with expert mentorship and training from leaders in technology, research and business growth, on top of extra seed funding. Over the last three years, some of the largest agribusinesses and food companies in New Zealand, including the dairy giant Fonterra, have taken a hands-on approach to the Sprout accelerator.

According to Tilyard, New Zealand’s large agribusinesses are involved because they want to know what new innovations are coming that might potentially disrupt their business models.

“These large corporate agribusinesses are involved with Sprout because they want a line of sight into the startup pipeline. They want to see what’s going on so they can avoid being disrupted,” says Tilyard.

To avoid disruption, established agribusiness companies in New Zealand are asking how they can collaborate with the new innovations coming through the startup pipeline at Sprout.

SHARING OPTIONS