For the second year in a row, west Cork co-op Lisavaird has topped the Irish Farmers Journal/KPMG Milk Price Review for 2017. Neighbouring co-op Barryroe is pushed into second position by 0.5 c/l. Lisavaird delivered a milk price of 38.46c/l excluding VAT, levies and collection charges to suppliers. The other three west Cork co-ops – Barryroe, Drinagh and Bandon – take up second, third and fourth position respectively (Table 1).

The average milk price paid in 2017 was 35.86c/litre, which is up significantly from 27.03c/litre in 2016. It is the highest average milk price since 2014 (Figure 5). Dairy farmers had two great milk price years in 2013 and 2014. The most recent peak was in 2013 when the price averaged 37.76c/litre.

The four west Cork co-ops that trade under the Carbery banner keep the big players out of the top four positions and in fifth place come Glanbia. Glanbia retrospectively topped up milk price for January to June last year by 0.95c/litre with the August milk cheque. Then in December it came along with another top-up of 1.04 c/l ex VAT for all milk supplied from July to December. All this combined helps to put Glanbia into fifth position in the review. Glanbia suppliers will be calling for a similar milk price top-up to pull the milk price out of the doldrums for this year.

There is only 0.29c/l separating Glanbia, Tipperary Co-op, Dairygold and Aurivo ranging from 35.58c/l for Glanbia down to 35.29c/l for Aurivo in eighth position in the table. So if we call Glanbia a strong price then all four have equally paid a strong price. Tipperary and Dairygold have been consistent in a similar position to last year (2016 results). Dairygold have finished seventh now for the last three years. Aurivo are probably the processor that has made the most considerable progress, moving from 11th position in 2016 to eight position for this year (2017 results). Farmers will argue that Tipperary, Dairygold and Aurivo actually paid a better milk price on the month and didn’t need a cumulative top-up to balance up halfway through the year and at the end.

Arrabawn comes next in ninth position at 34.99 c/l. They have come ninth for the last three years. It means Kerry is pushed out to 10th position in the milk price review table with 34.92 c/l, its worst ranking compared to the rest for the last 10 years. Lakeland comes next almost 0.85c/l behind Kerry, followed by LacPatrick, another 1.1 c/l behind Lakeland.

Difference

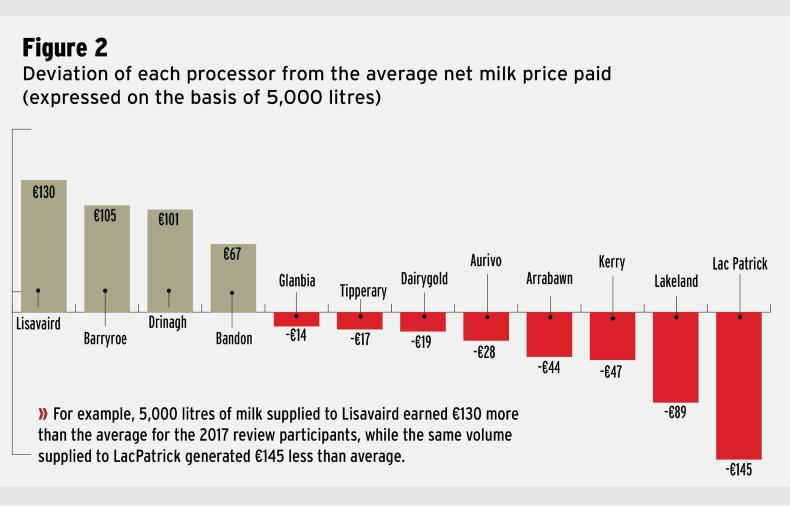

One of the standout messages from the review this year, similar to last year, is the gap between top and bottom. A 5,000 litre cow supplying Lisavaird would yield €1,923 in output value compared with a 5,000 litre cow delivering to LacPatrick yielding a value of €1,649 – that’s €274 less per cow. Last year there was about a €307 per cow difference between top and bottom but the year before that it was only €170 of a difference.

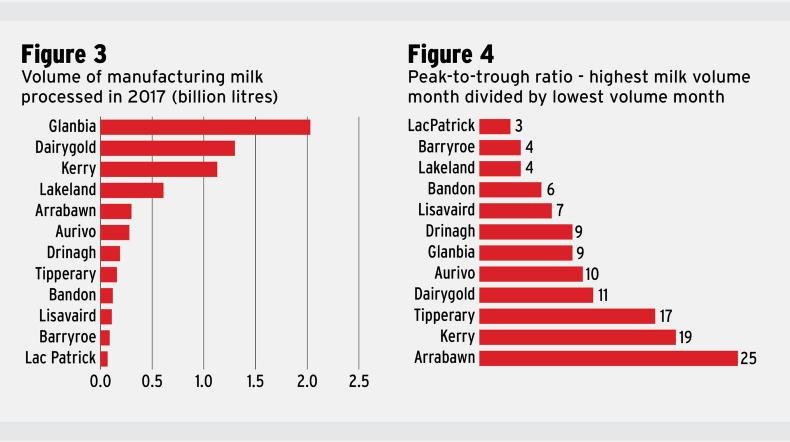

Some of this is explained by the fact the lower ranking processors get very poor fat and protein compared with the co-ops higher up the milk price review table. In the same way, however, they benefit from a higher proportion of milk delivered in November, December and January – a flatter milk supply profile with winter premiums included. You can see 12.87% and 14.77% is milk collected in November to January inclusive for Lakeland and LacPatrick (Table 1 and Figure 4). Much of this out-of-season milk qualifies for a winter milk bonus in an effort to compensate farmers for the higher costs of producing milk during the winter months. The IFJ/KPMG Milk Price Review examines the price paid for manufacturing milk and excludes all milk bought for or used in the liquid milk market.

SHARING OPTIONS