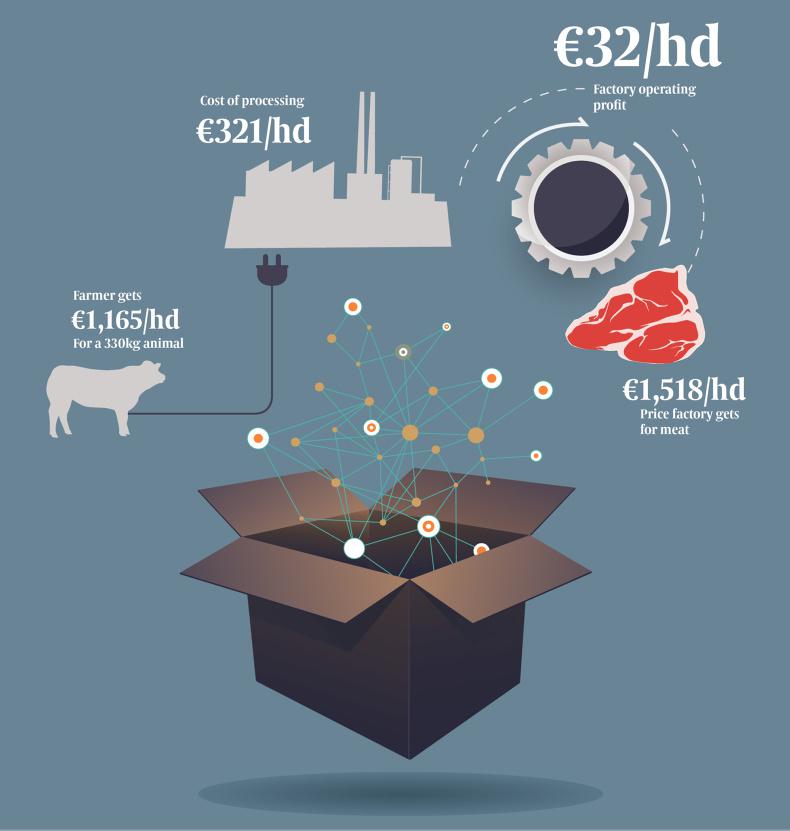

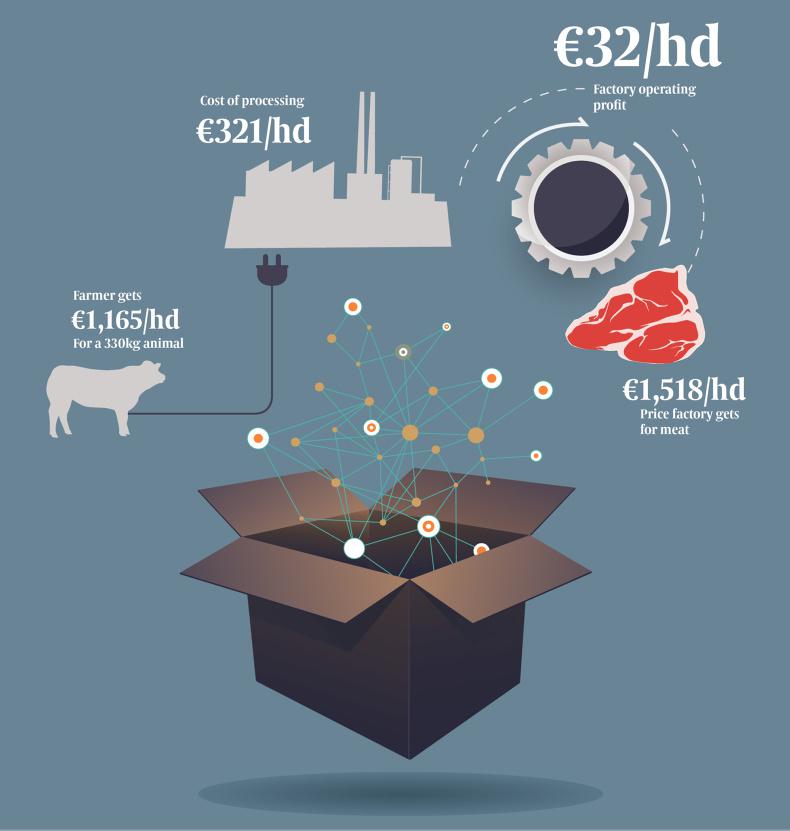

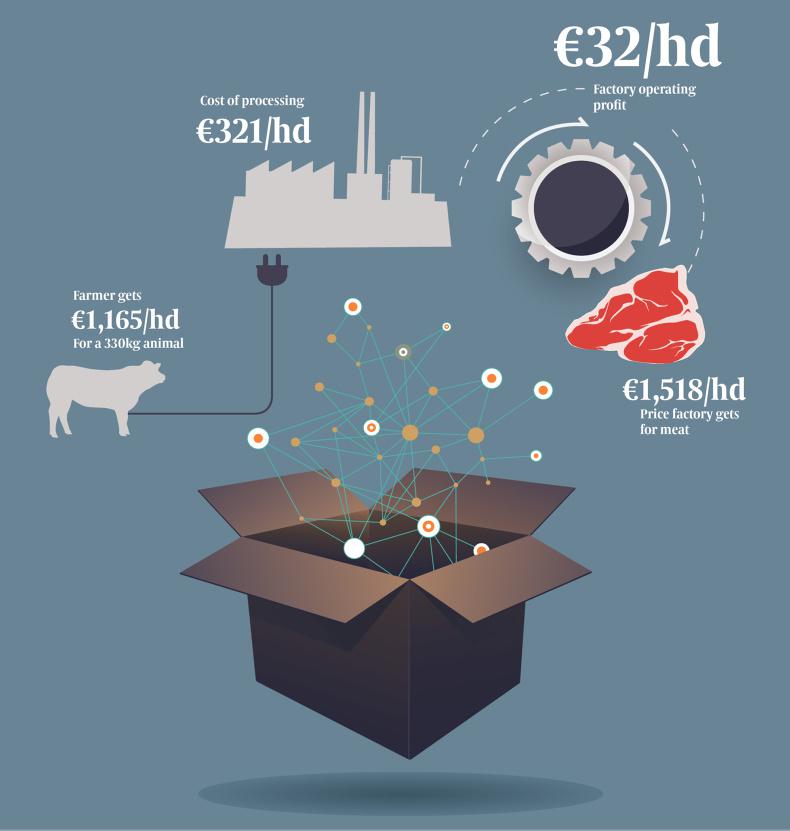

The Irish beef industry has often been equated to a black box – nobody really knows what’s going on in there and it’s very hard to look inside. The secrecy and opaqueness of almost all Irish beef companies’ financial performance means beef farmers have long held suspicions that processors have been reaping huge profits at their expense.

An Irish Farmers Journal analysis of the latest export figures from Bord Bia and Ireland’s domestic beef market shows that Ireland’s beef processing sector had a combined turnover of €2.8bn last year.

The total volume of beef available for sale last year stood at 615,000t. This means factories made an average return of €4.60/kg from the markets last year (including offal and hides).

Based on weekly beef prices provided to the Department of Agriculture by all meat factories and the national kill of 1.75m head of cattle last year, factories paid out a total of €2.1bn to beef farmers in 2017. The weighted average beef price paid to farmers was €3.53/kg in 2017.

With a combined turnover of €2.8bn and a total of €2.1bn paid to farmers for cattle last year, this leaves Ireland’s beef processors with a total gross profit of €680m, or €1.44/kg. This is the profit made by the processors before wages, interest and overheads are paid.

From here on it becomes difficult to ascertain what profits are made. Out of the eight processors, just two companies, Foyle Meats and Dunbia Ireland, publish financial accounts. This means there is no visibility of the financial performance for the remaining beef companies, which control a combined 90% of the national kill. Taking the accounts filed by Foyle over the last two years, the profit margin ranges from 1.6% to 1.9%. Assuming an estimated kill of 60,000hd per annum means that operating profits are 25c/kg or €83/hd.

Assuming a 2% operating margin for the sector with a turnover of €2.8bn, this means there are cumulative operating profits of €56m at processing level. Based on the 1.75m kill this equates to €32/hd or 10c/kg on average. This figure can vary between processors depending on the efficiencies and value add of the individual businesses.

Note: operating profit does not account for the cost of interest payments on debts, additional income from investments or taxes.

Prices paid to farmers

A total of 1.75m cattle were slaughtered by Irish meat factories last year. Of the total national kill, almost 40% or just over 680,000hd were classed as steers, while young bulls made up 11% of slaughterings.

Heifers comprised 26%, or 460,000hd, of the national kill in 2017, while cow numbers increased to 373,000hd, or 21% of the overall kill.

Based on Department of Agriculture figures on the classification of cattle via the EUROP grading system, a weighted average beef price can be calculated for each category of beef animal for 2017.

The average price paid for steers last year by Irish factories stood at €3.76/kg, which was closely followed by an average price of €3.73/kg for heifers. Young bulls attracted an average price of €3.66/kg last year, while factories paid an average of €2.93/kg for cows last year.

Taking these average prices for

each of these categories, along with the distribution of the national kill

by grade, the average weighted

beef price in Ireland for 2017 was €3.53/kg.

Beef industry turnover

Taking Bord Bia’s value of beef exports (including offals) in 2017 of €2.5bn, along with the domestic market for beef which is valued at €265m per annum, the combined turnover of the Irish beef factories in 2017 was €2.8bn when hides are included.

This turnover figure does not include live export sales.

With 100,000 farms having a beef enterprise and factories employing some 10,000 people directly, the sector is of huge economic importance. Therefore, transparency around the financial health of the industry is clearly in the interest of farmers, the Government and those who depend on it up and down the supply chain. A complex web of creative company structures has protected Ireland’s largest and most successful agribusiness families from the risks of unlimited liability while keeping their accounts private. However, new legislation which was signed into law last year aims to lift the veil of financial secrecy in unlimited companies. It will require some of Ireland’s largest food and agribusiness families to publicly file their financial statements for the first time. We wait to see how effective this legislation will be in uncovering the facts.

Attempting to understand meat factory profitability highlights the lack of published information on the performance of meat companies and is a complete contrast with other sectors.

It is unbelievable in this era of transparency, openness and partnering that a sector accounting for 30% of agri-food exports and turning over €3bn is hidden behind a veil of secrecy.

While this analysis makes widespread assumptions on the financial performance of the entire industry, it is an attempt to give farmers some insight into the profit levels in the industry. Where difficulties arise it is in estimating the operating profit levels of individual companies. Using published accounts from one company is unlikely to truly reflect the other companies that report prices paid to farmers weekly. However, given that it is the only information we have on a factory’s performance, it provides the only estimate for the rest of the industry.

Farmers should applaud this single company for standing out and consistently publishing its financial accounts over the past decade. What is evident from this set of accounts and this analysis is that the beef sector is not making excessive margins – usually around 1-2%, which is similar to those in the dairy sector. But farmers’ suspicion is aroused when there is no evidence.

Read more

The specialist views on SOS

The Irish beef industry has often been equated to a black box – nobody really knows what’s going on in there and it’s very hard to look inside. The secrecy and opaqueness of almost all Irish beef companies’ financial performance means beef farmers have long held suspicions that processors have been reaping huge profits at their expense.

An Irish Farmers Journal analysis of the latest export figures from Bord Bia and Ireland’s domestic beef market shows that Ireland’s beef processing sector had a combined turnover of €2.8bn last year.

The total volume of beef available for sale last year stood at 615,000t. This means factories made an average return of €4.60/kg from the markets last year (including offal and hides).

Based on weekly beef prices provided to the Department of Agriculture by all meat factories and the national kill of 1.75m head of cattle last year, factories paid out a total of €2.1bn to beef farmers in 2017. The weighted average beef price paid to farmers was €3.53/kg in 2017.

With a combined turnover of €2.8bn and a total of €2.1bn paid to farmers for cattle last year, this leaves Ireland’s beef processors with a total gross profit of €680m, or €1.44/kg. This is the profit made by the processors before wages, interest and overheads are paid.

From here on it becomes difficult to ascertain what profits are made. Out of the eight processors, just two companies, Foyle Meats and Dunbia Ireland, publish financial accounts. This means there is no visibility of the financial performance for the remaining beef companies, which control a combined 90% of the national kill. Taking the accounts filed by Foyle over the last two years, the profit margin ranges from 1.6% to 1.9%. Assuming an estimated kill of 60,000hd per annum means that operating profits are 25c/kg or €83/hd.

Assuming a 2% operating margin for the sector with a turnover of €2.8bn, this means there are cumulative operating profits of €56m at processing level. Based on the 1.75m kill this equates to €32/hd or 10c/kg on average. This figure can vary between processors depending on the efficiencies and value add of the individual businesses.

Note: operating profit does not account for the cost of interest payments on debts, additional income from investments or taxes.

Prices paid to farmers

A total of 1.75m cattle were slaughtered by Irish meat factories last year. Of the total national kill, almost 40% or just over 680,000hd were classed as steers, while young bulls made up 11% of slaughterings.

Heifers comprised 26%, or 460,000hd, of the national kill in 2017, while cow numbers increased to 373,000hd, or 21% of the overall kill.

Based on Department of Agriculture figures on the classification of cattle via the EUROP grading system, a weighted average beef price can be calculated for each category of beef animal for 2017.

The average price paid for steers last year by Irish factories stood at €3.76/kg, which was closely followed by an average price of €3.73/kg for heifers. Young bulls attracted an average price of €3.66/kg last year, while factories paid an average of €2.93/kg for cows last year.

Taking these average prices for

each of these categories, along with the distribution of the national kill

by grade, the average weighted

beef price in Ireland for 2017 was €3.53/kg.

Beef industry turnover

Taking Bord Bia’s value of beef exports (including offals) in 2017 of €2.5bn, along with the domestic market for beef which is valued at €265m per annum, the combined turnover of the Irish beef factories in 2017 was €2.8bn when hides are included.

This turnover figure does not include live export sales.

With 100,000 farms having a beef enterprise and factories employing some 10,000 people directly, the sector is of huge economic importance. Therefore, transparency around the financial health of the industry is clearly in the interest of farmers, the Government and those who depend on it up and down the supply chain. A complex web of creative company structures has protected Ireland’s largest and most successful agribusiness families from the risks of unlimited liability while keeping their accounts private. However, new legislation which was signed into law last year aims to lift the veil of financial secrecy in unlimited companies. It will require some of Ireland’s largest food and agribusiness families to publicly file their financial statements for the first time. We wait to see how effective this legislation will be in uncovering the facts.

Attempting to understand meat factory profitability highlights the lack of published information on the performance of meat companies and is a complete contrast with other sectors.

It is unbelievable in this era of transparency, openness and partnering that a sector accounting for 30% of agri-food exports and turning over €3bn is hidden behind a veil of secrecy.

While this analysis makes widespread assumptions on the financial performance of the entire industry, it is an attempt to give farmers some insight into the profit levels in the industry. Where difficulties arise it is in estimating the operating profit levels of individual companies. Using published accounts from one company is unlikely to truly reflect the other companies that report prices paid to farmers weekly. However, given that it is the only information we have on a factory’s performance, it provides the only estimate for the rest of the industry.

Farmers should applaud this single company for standing out and consistently publishing its financial accounts over the past decade. What is evident from this set of accounts and this analysis is that the beef sector is not making excessive margins – usually around 1-2%, which is similar to those in the dairy sector. But farmers’ suspicion is aroused when there is no evidence.

Read more

The specialist views on SOS

SHARING OPTIONS