Before looking at the options to finance a new machine, I will first assume that the decision makes sense from a business point of view. There are many cases where farmers have their investment priorities in the wrong order.

I would consider an investment in soil fertility a higher priority than a new tractor, as the return on investment of spreading phosphorus and lime is almost 10:1. It is extremely difficult to get this kind of a return from a tractor. I would hope that the reason behind the decision is sound and not based on “the accountant told me to purchase something to keep down tax”.

If this is the case, you should complete a review of the business operation and make investment decisions on your targets for the business for the next 10 years.

The financing options

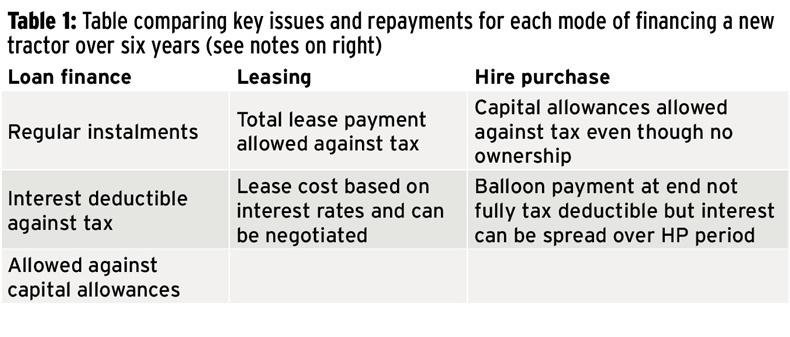

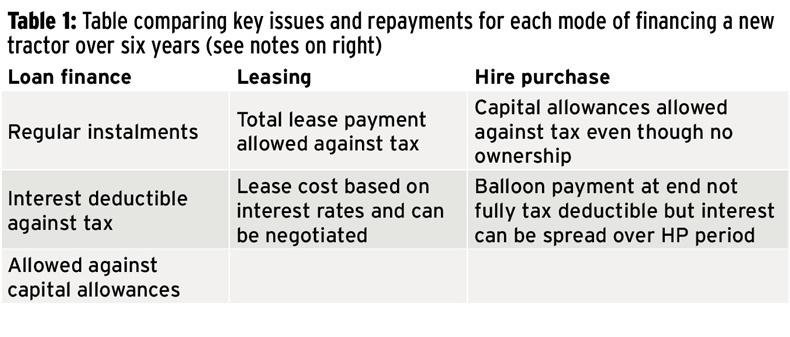

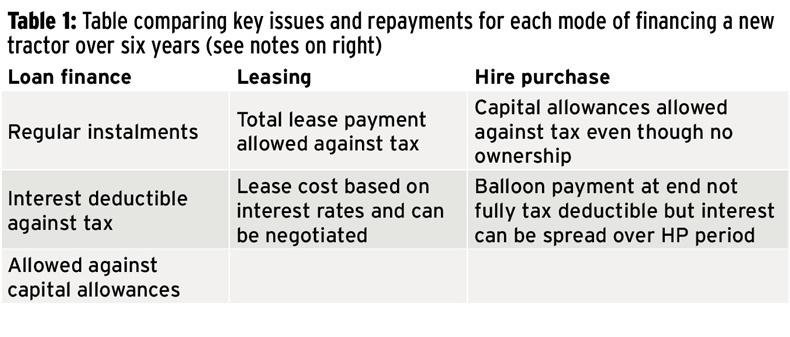

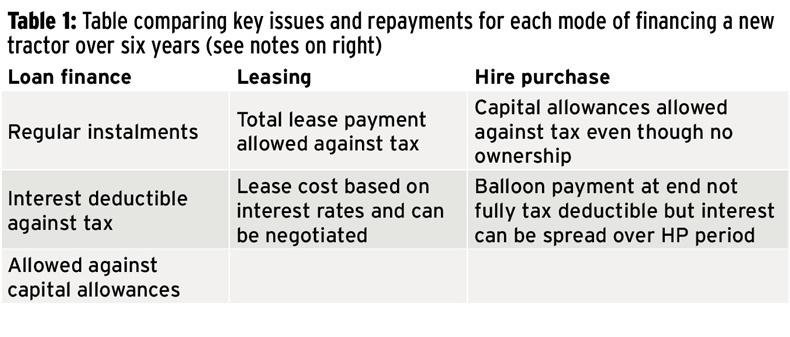

The method of finance used is generally driven by the tax implications, which should be discussed with your tax adviser. There are three types of finance available – a straight loan, a lease or a hire-purchase (HP).

Loan finance

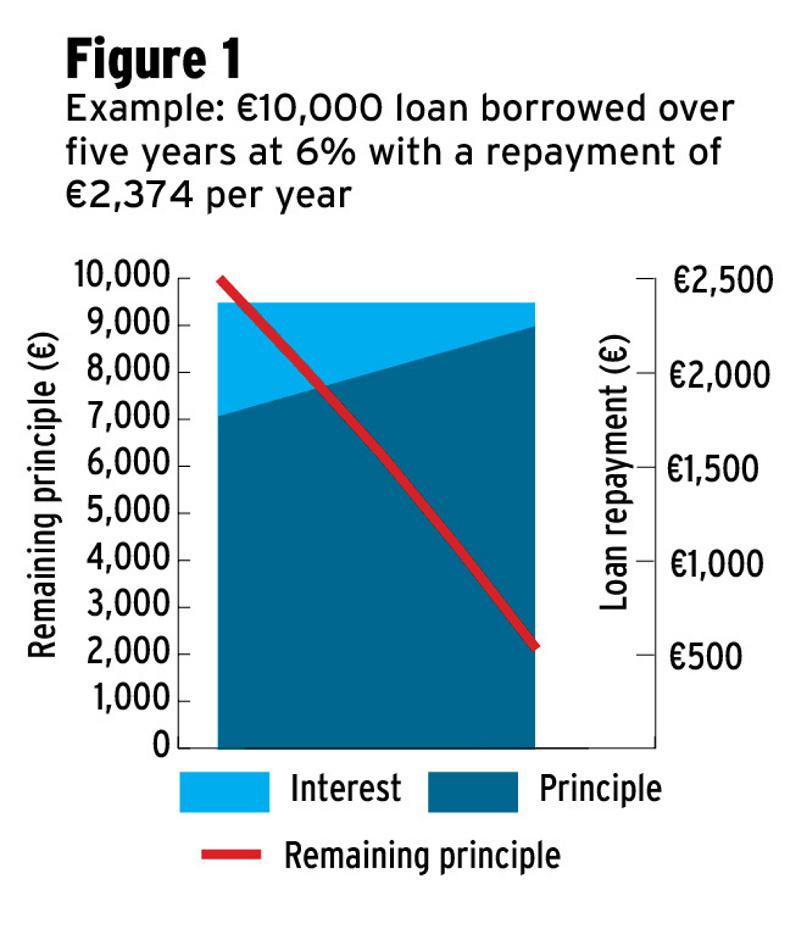

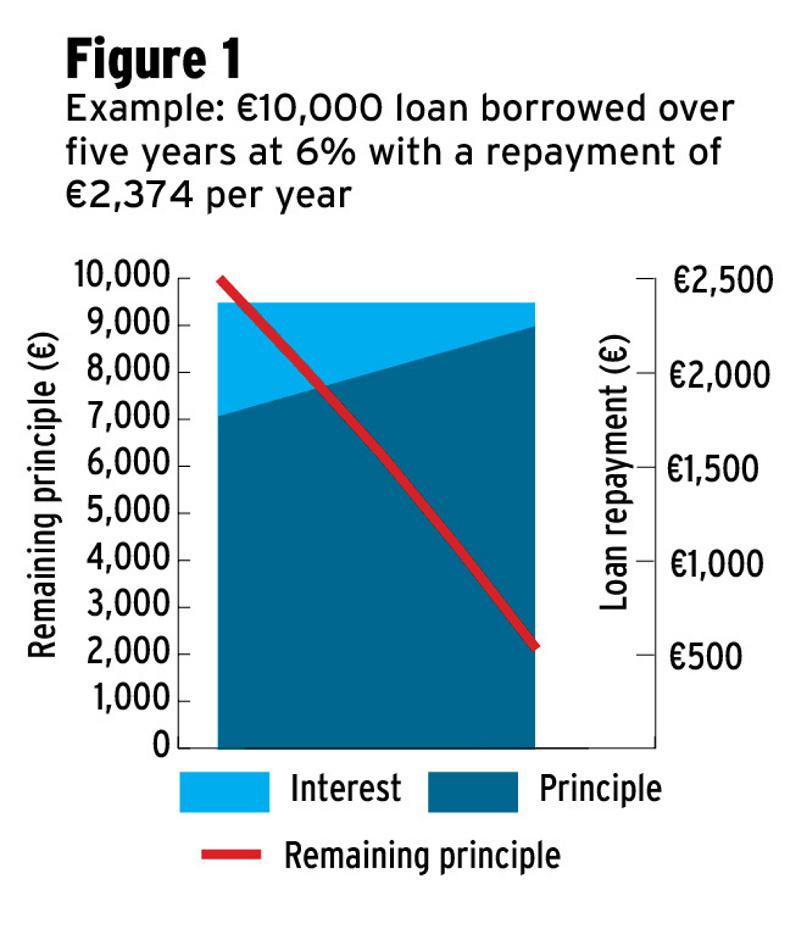

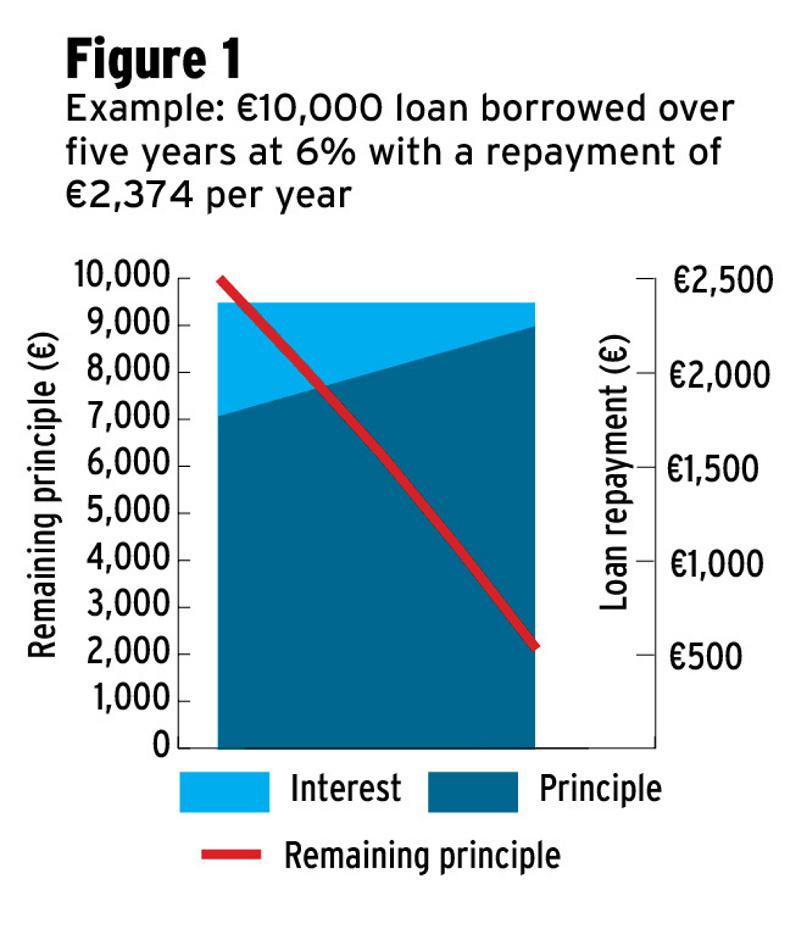

Most loans are structured so that the initial amount borrowed is paid back in instalments over a certain period. Each of these loan repayments is made up of two components – the capital portion and the interest portion. A feature of setting the repayments is that they stay more or less constant during the repayment period but the capital and interest components change as the loan is gradually repaid.

In the early stages, the repayment is largely made up of interest with a small capital portion, but nearing the end of the loan term the interest part is fairly small. As we already stated, it is only the interest paid that is regarded as a tax- deductible expense.

So the tax relief is greater in the early stages after taking out a loan, when the interest is higher and gradually declines as the loan is repaid.

The other part of the equation is that by using a loan to acquire an asset you acquire the ownership of the asset and for a qualifying capital asset this means that you can avail of capital allowances (see note below).

Leasing

Leasing is often used to finance the purchase of machinery. The leasing company buys the machine and then leases the machine in return for a regular payment. Essentially the asset is being rented out by the leasing company.

Since you are renting the asset and do not own it, capital allowances cannot be claimed. So the only tax relief available is on the total lease payments made during the year. The lease payment is determined by the lease cost as well as the likely residual value of machine at the end of the lease. The lease cost is based on interest rates and can be negotiated.

The residual value, which is the estimated worth of the machine at the end of the lease, will be closely tied to the number of hours of use of the machine. A lower usage will improve the residual value and will lower the lease payment.

While you have the use of the leased asset you will never legally own it unless you buy it from the leasing company at the end of the agreed lease period. Buying the machine can create tax problems in that it may sometimes result in a clawback of the tax relief obtained from the lease payments. This can result in a higher than usual income tax liability in this final year.

The key area to watch here is the residual value of the leased machine at the end of the lease agreement. The lower the value at the end of the lease, the fewer tax problems will result. The leasing company will generally agree to extend the lease term or create a secondary lease period which will get over this problem. They will also facilitate trading in the machine against a newer one and restarting the lease again.

Generally, leasing is only suitable for assets that have a high rate of depreciation and will have low resale values at the end of the lease or for assets that are going to be traded up for new models on a regular basis.

Hire purchase

Hire purchase or HP finance is also commonly used to fund machinery purchases. This type of finance is very similar to a straight loan in that interest is chargeable by the hire purchase company for the funds used to buy the machine.

The main difference between the two is that under a hire purchase, legal ownership does not pass until the final instalment is paid. Even though the user of the machine does not legally own it from a tax viewpoint, the user is the beneficial owner and therefore is entitled to claim capital allowances on the net value of the machine.

The actual cost of buying a machine under hire purchase is the difference between the cash price and the full hire purchase price. For example, if the cash price of the machine is €30,000 and the HP price is €42,000, the hire purchase cost is €12,000.

One area of complication with hire purchase agreements is that they normally have a large final payment or balloon payment. This is not fully tax-deductible in the year in which it is made but the interest portion must be spread over the full hire purchase period.

Getting finance for a machine is easier that a building, because if you default on a payment, the finance company or bank can take the machine away. For all three finance types, the two questions that need answers are:

What will be allowable as a write off against tax?What will this mean in terms of a tax saving?What will be allowable as a write-off against tax?

A general rule of thumb for tax-deductible expenses is that they must be costs associated with running the business for the year. These types of expenses can be used to reduce your tax-assessible income so then will reduce your eventual tax bill. The interest cost that must be paid for using borrowed money is an obvious category of tax-deductible expense.

The other consideration is whether the item purchased is regarded as a capital item, which is an item not purchased for resale and which is generally going to be used in the running of the business for a number of years. Examples of capital purchases would be buildings erected and machinery or equipment purchased for use on the farm.

All these assets generally lose value as they are used in the course of business, ie they depreciate. So depreciation is allowable as an expense against business income. Revenue has very strict rules on how this depreciation allowance is to be applied and they even give it their own name – capital allowances.

A key rule in relation to capital allowances is that only the actual owner of the asset can avail of the allowances. Capital allowances can be claimed over eight years for machinery and seven years for buildings.

What tax saving will result?

Establishing the allowable deductible expense is one thing but the real saving will only become apparent when you determine the marginal rate (or top rate) of tax that is being paid – 20% or 40%.

About the Author: James McDonnell, Teagasc financial management specialist. Read more

Special focus: agri finance

Before looking at the options to finance a new machine, I will first assume that the decision makes sense from a business point of view. There are many cases where farmers have their investment priorities in the wrong order.

I would consider an investment in soil fertility a higher priority than a new tractor, as the return on investment of spreading phosphorus and lime is almost 10:1. It is extremely difficult to get this kind of a return from a tractor. I would hope that the reason behind the decision is sound and not based on “the accountant told me to purchase something to keep down tax”.

If this is the case, you should complete a review of the business operation and make investment decisions on your targets for the business for the next 10 years.

The financing options

The method of finance used is generally driven by the tax implications, which should be discussed with your tax adviser. There are three types of finance available – a straight loan, a lease or a hire-purchase (HP).

Loan finance

Most loans are structured so that the initial amount borrowed is paid back in instalments over a certain period. Each of these loan repayments is made up of two components – the capital portion and the interest portion. A feature of setting the repayments is that they stay more or less constant during the repayment period but the capital and interest components change as the loan is gradually repaid.

In the early stages, the repayment is largely made up of interest with a small capital portion, but nearing the end of the loan term the interest part is fairly small. As we already stated, it is only the interest paid that is regarded as a tax- deductible expense.

So the tax relief is greater in the early stages after taking out a loan, when the interest is higher and gradually declines as the loan is repaid.

The other part of the equation is that by using a loan to acquire an asset you acquire the ownership of the asset and for a qualifying capital asset this means that you can avail of capital allowances (see note below).

Leasing

Leasing is often used to finance the purchase of machinery. The leasing company buys the machine and then leases the machine in return for a regular payment. Essentially the asset is being rented out by the leasing company.

Since you are renting the asset and do not own it, capital allowances cannot be claimed. So the only tax relief available is on the total lease payments made during the year. The lease payment is determined by the lease cost as well as the likely residual value of machine at the end of the lease. The lease cost is based on interest rates and can be negotiated.

The residual value, which is the estimated worth of the machine at the end of the lease, will be closely tied to the number of hours of use of the machine. A lower usage will improve the residual value and will lower the lease payment.

While you have the use of the leased asset you will never legally own it unless you buy it from the leasing company at the end of the agreed lease period. Buying the machine can create tax problems in that it may sometimes result in a clawback of the tax relief obtained from the lease payments. This can result in a higher than usual income tax liability in this final year.

The key area to watch here is the residual value of the leased machine at the end of the lease agreement. The lower the value at the end of the lease, the fewer tax problems will result. The leasing company will generally agree to extend the lease term or create a secondary lease period which will get over this problem. They will also facilitate trading in the machine against a newer one and restarting the lease again.

Generally, leasing is only suitable for assets that have a high rate of depreciation and will have low resale values at the end of the lease or for assets that are going to be traded up for new models on a regular basis.

Hire purchase

Hire purchase or HP finance is also commonly used to fund machinery purchases. This type of finance is very similar to a straight loan in that interest is chargeable by the hire purchase company for the funds used to buy the machine.

The main difference between the two is that under a hire purchase, legal ownership does not pass until the final instalment is paid. Even though the user of the machine does not legally own it from a tax viewpoint, the user is the beneficial owner and therefore is entitled to claim capital allowances on the net value of the machine.

The actual cost of buying a machine under hire purchase is the difference between the cash price and the full hire purchase price. For example, if the cash price of the machine is €30,000 and the HP price is €42,000, the hire purchase cost is €12,000.

One area of complication with hire purchase agreements is that they normally have a large final payment or balloon payment. This is not fully tax-deductible in the year in which it is made but the interest portion must be spread over the full hire purchase period.

Getting finance for a machine is easier that a building, because if you default on a payment, the finance company or bank can take the machine away. For all three finance types, the two questions that need answers are:

What will be allowable as a write off against tax?What will this mean in terms of a tax saving?What will be allowable as a write-off against tax?

A general rule of thumb for tax-deductible expenses is that they must be costs associated with running the business for the year. These types of expenses can be used to reduce your tax-assessible income so then will reduce your eventual tax bill. The interest cost that must be paid for using borrowed money is an obvious category of tax-deductible expense.

The other consideration is whether the item purchased is regarded as a capital item, which is an item not purchased for resale and which is generally going to be used in the running of the business for a number of years. Examples of capital purchases would be buildings erected and machinery or equipment purchased for use on the farm.

All these assets generally lose value as they are used in the course of business, ie they depreciate. So depreciation is allowable as an expense against business income. Revenue has very strict rules on how this depreciation allowance is to be applied and they even give it their own name – capital allowances.

A key rule in relation to capital allowances is that only the actual owner of the asset can avail of the allowances. Capital allowances can be claimed over eight years for machinery and seven years for buildings.

What tax saving will result?

Establishing the allowable deductible expense is one thing but the real saving will only become apparent when you determine the marginal rate (or top rate) of tax that is being paid – 20% or 40%.

About the Author: James McDonnell, Teagasc financial management specialist. Read more

Special focus: agri finance

SHARING OPTIONS