The latest timber price data from Coillte and private growers shows a downturn in the third quarter this year for medium to large log size categories (Table 1).

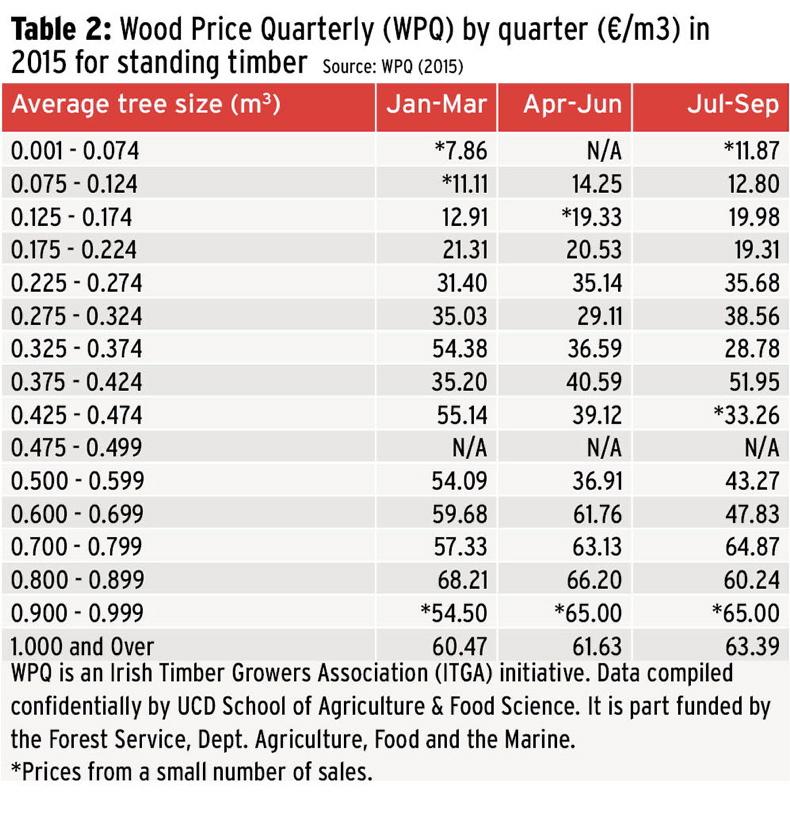

It is more difficult to assess price trends in smaller logs because these sales are not covered in Coillte data. While information has improved with the introduction of the Wood Price Quarterly (WPQ), prices are still based on a small number of sales. Allowing for this limitation, the prices achieved from July to September show an increase on previous quarters for two small log category sizes up to 0.174m3 (Table 2) but it is too early to say that an upward trend is emerging.

However, in log sizes over 0.174m3 prices are down in all categories except one (0.325-0.374m3) recorded in the Coillte data. Average quarterly price (€/m3) declined from €66.26 (January-March) to €61.53 (April-June) and trailed off at €57.10 in the third quarter. While average prices are down for the third quarter, they are marginally higher than the same period last year when they averaged €56.35/m3.

This is evident especially in the larger sawlog (Table 3), where Coillte and WPQ prices are consistently higher than 2014. Anecdotal evidence suggests that, like last year, there is unlikely to be a significant increase in timber prices by year end.

When we published prices last May, both Coillte and the sawmills maintained that log prices had decreased considerably since late March, and this has been borne out. At the time both Coillte and the sawmilling sector agreed that there was oversupply in the UK market, especially from Scandinavia, which exerted downward pressure on prices.

In addition, the windblow caused by Storm Darwin in February 2014 exacerbated the situation. It has taken 18 months to harvest, sell and process the windblow timber although there is still some overhang of this material.

Encouraging development

The WPQ, initiated by the Irish Timber Growers Association and compiled by UCD, is an encouraging development. The template for this survey was established in 2005 but now has a much broader base than previous price sources in terms of number of sales recorded, geographical spread and topicality of the information. Data will be made available to the Irish Farmers Journal and other stakeholders immediately after compilation. This week we feature information for three quarters up to 30 September (Table 2).

The industry needs comprehensive price information for logs of all sizes and species. The WPQ is an excellent initiative and all growers, forestry companies and consultants along with the networks of timber producer groups should support it by providing log prices to UCD, which are treated confidentially.

Wood Price Quarterly to improve timber price data for private sales

Providing quality information on timber prices in Ireland has been a major challenge for the forestry and forest products sector over the years. Coillte provides comprehensive data for timber sold to the sawmills but virtually all the logs in these sales are in the medium to large categories, with small logs retained for Coillte Panel Products or energy outlets.

However, most private forest owners with timber for sale are at the first and second thinning stage where the bulk of timber harvested is categorised as small logs averaging less than 0.22m3.

Price information for this material has been nonexistent or uneven at best in the past. As a result, private forest owners – mainly farmers – have had to rely on hearsay for small log prices.

This is changing thanks to work being carried out between Irish Timber Growers Association (ITGA) and UCD School of Agriculture and Food Science. While ITGA and UCD began compiling prices in 2005, they drew from a small number of sales which resulted in wide variation in prices.

Now, ITGA has announced Wood Price Quarterly (WPQ), for which growers, forestry companies and consultants can forward price information to Dr Aine Ni Dhubhain, UCD in strict confidence. Data on prices will then be compiled and made available to the Irish Farmers Journal and the forest industry.

SHARING OPTIONS