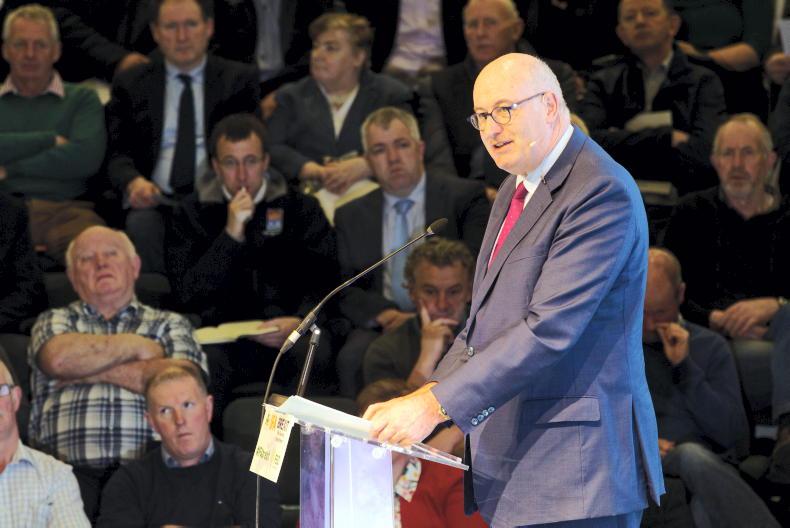

The opening of the €300m Future Growth Loan Scheme has been announced by Minister for Agriculture Michael Creed and Minister for Business Heather Humphreys.

Farmers will have access to €50m of the fund and must go through a two-stage application process with the Strategic Banking Corporation of Ireland (SBCI) and the banking lender of their choice.

Businesses and farmers will be able to apply for loan eligibility through the SBCI from 17 April. Three finance providers - AIB, Bank of Ireland and KBC - have agreed to participate in the scheme and negotiations are ongoing with another two.

Interest rates are set at up to 4.5% or less for loans up to €249,999 and 3.5% and less for loans greater than or equal to €250,000.

The loan term is between eight and 10 years with an emphasis put on young and new-entrant farmers receiving loans.

Farmers must draw down a minimum of €50,000 to avail of a loan, with up to €500,000 available on an unsecured basis.

The maximum loan amount available is €3m.

16% of €300m fund

The loan scheme was announced 18 months ago in Budget 2018 and has been strongly criticised for repeated delays. There was also disappointment from some farmers that they would have access to just 16% of the overall fund, after the Department of Agriculture provided 40% of the seed money to leverage the loan scheme.

However, Minister Creed has said that the amount set aside for agriculture can be reviewed if farmer uptake is strong.

“This scheme is flexible in the sense that that’s the first tranche that’s ringfenced for agriculture. If the demand exceeds that figure, it’s something that we can revisit in terms of the configuration of the package,” Minister Creed told the Irish Farmers Journal.

He added that this was the first loan scheme to deal with capital investments.

“I think that the product we’re bringing to market will be unequalled and in many respects unavailable in other formats from the banking sector presently,” he said.

When asked by the Irish Farmers Journal if he thought the €50,000 minimum drawdown would be prohibitive to smaller farmers getting loans, the minister said it was in line with average investment rates on farms.

“Any investment in any kind of facility now, whether it’s on the dairy side in terms of milking facilities or on the beef side for slatted units, very few if any of them are coming in under that investment.”

Read more

Cattle not included in low-cost loans

Minimum €50,000 draw-down for low-cost loans

The opening of the €300m Future Growth Loan Scheme has been announced by Minister for Agriculture Michael Creed and Minister for Business Heather Humphreys.

Farmers will have access to €50m of the fund and must go through a two-stage application process with the Strategic Banking Corporation of Ireland (SBCI) and the banking lender of their choice.

Businesses and farmers will be able to apply for loan eligibility through the SBCI from 17 April. Three finance providers - AIB, Bank of Ireland and KBC - have agreed to participate in the scheme and negotiations are ongoing with another two.

Interest rates are set at up to 4.5% or less for loans up to €249,999 and 3.5% and less for loans greater than or equal to €250,000.

The loan term is between eight and 10 years with an emphasis put on young and new-entrant farmers receiving loans.

Farmers must draw down a minimum of €50,000 to avail of a loan, with up to €500,000 available on an unsecured basis.

The maximum loan amount available is €3m.

16% of €300m fund

The loan scheme was announced 18 months ago in Budget 2018 and has been strongly criticised for repeated delays. There was also disappointment from some farmers that they would have access to just 16% of the overall fund, after the Department of Agriculture provided 40% of the seed money to leverage the loan scheme.

However, Minister Creed has said that the amount set aside for agriculture can be reviewed if farmer uptake is strong.

“This scheme is flexible in the sense that that’s the first tranche that’s ringfenced for agriculture. If the demand exceeds that figure, it’s something that we can revisit in terms of the configuration of the package,” Minister Creed told the Irish Farmers Journal.

He added that this was the first loan scheme to deal with capital investments.

“I think that the product we’re bringing to market will be unequalled and in many respects unavailable in other formats from the banking sector presently,” he said.

When asked by the Irish Farmers Journal if he thought the €50,000 minimum drawdown would be prohibitive to smaller farmers getting loans, the minister said it was in line with average investment rates on farms.

“Any investment in any kind of facility now, whether it’s on the dairy side in terms of milking facilities or on the beef side for slatted units, very few if any of them are coming in under that investment.”

Read more

Cattle not included in low-cost loans

Minimum €50,000 draw-down for low-cost loans

SHARING OPTIONS