It is now 18 months since Irish Grass-fed Beef was launched by then-Agriculture Minister Charlie McConalogue and his counterpart in Northern Ireland, Andrew Muir in a cross-border promotional initiative.

This was followed up with a launch in the Esselunga supermarket group in Italy and in May last year the Irish Farmers Journal reported on PGI grass-fed beef supplied by ABP on sale there.

Since then there has been little mention of it and this week the Irish Farmers Journal spoke with Joe Burke, senior manager for meat and livestock with Bord Bia, to find out what has happened since.

One significant customer

According to Burke, sales of PGI beef in Italy have been going well but Esselunga remains the only substantial customer for the product. When it was launched, Bord Bia undertook comprehensive research which identified other countries in Europe that would be receptive to a PGI beef offering.

Joe Burke of Bord Bia.

When this was put to Joe Burke, he said that “presentations have been made and there has been plenty of customer engagement, but the market place for beef has changed greatly since the first launch”.

He was referring to what he described as “the welcome increase in cattle prices”, and the “tightness” of cattle supply this year making customers and their processor suppliers more focused on maintaining overall beef supply as opposed to building a market for a new brand.

Burke explained that around 70% of all steers and heifers killed in Irish factories last year met the specification for Irish grass-fed beef. That meant that 30% of prime cattle were outside the specification and many processors were unwilling to invest in building a brand that excluded a considerable percentage of their throughput.

EU designations that recognise regional food and drinks or products with special characteristics.

Industry sources have told the Irish Farmers Journal that they made Bord Bia aware of this issue and have sought to have the specification widened to include a greater percentage of the kill.

Factories luke warm on PGI

This issue was alluded to by Dawn Meats CEO Niall Browne in an interview with the Irish Farmers Journal in May last year.

Then he referred to the introduction of “PGI grass fed with consultations [between] Brussels, Bord Bia and the Dept of Agriculture”, and that it “is going to be a slower burn because we do PGI in Wales, Scotland and south west Britain, but the rules around the Irish PGI are much more onerous”.

In hindsight, this was a clear indicator that at least one major processor wasn’t fully invested in the PGI grass-fed beef brand.

The fact that nothing meaningful has happened elsewhere confirms that this view is more widely held among factories, as sources have been telling the Irish Farmers Journal. A typical comment has been: “We are interested in the longer term but not right now with the scarcity of cattle.”

When Burke was asked about this, he confirmed that Bord Bia have been in discussions with the industry since early this year about the specification.

He said that there is “general agreement that a request should be made to extend the specification to include O-3 grading cattle with a fat score between 2+ and 4+. If this is accepted it would increase the percentage of the steer and heifer kill that qualified for the PGI from 70% to over 80%”.

Dale Crammond, director of Meat Industry Ireland, confirmed that “MII and members held discussions with Bord Bia, seeking some modifications to maximise the commercial opportunities under the Grass Fed PGI.”

A complex process to amend

specification

This cannot be done on a whim, however. According to Burke a case has to be made in Brussels for a change to the specification and this has to be done by DAFM.

A case has been prepared to support the request and it is based on the fact that the profile of the Irish cattle herd and, therefore, grades has been changing.

“Looking back, Irish beef cattle were dominated by large continental breeds with particularly good confirmation,” he said. “However over recent years, we have seen a return to more traditional Hereford and Angus breeding which means more O- grades and there is general acceptance that these should now be included in Irish grass-fed PGI.”

He could not give any indication of how long this process would take or what stage the process is at because this is in the hands of DAFM to progress with the EU.

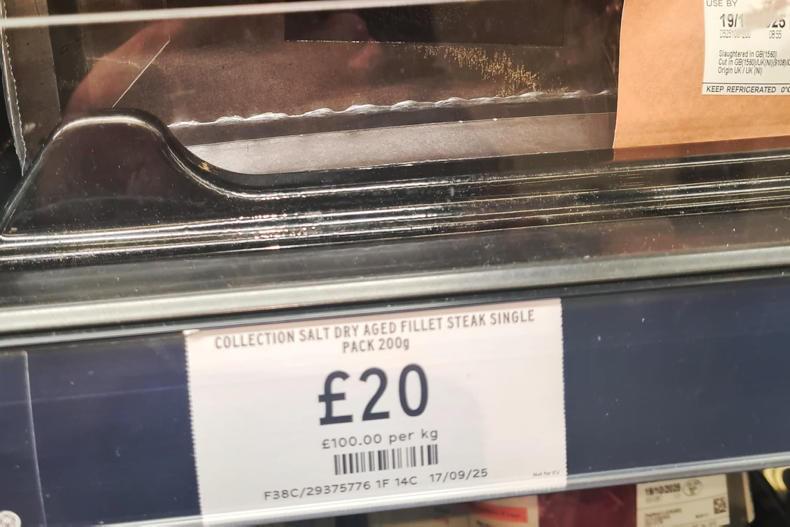

PGI Irish Grass-fed Beef on sale in Italy.

Comment: Beef PGI is

at a crossroads

Any effort to build a brand for Irish beef is doomed if it doesn’t have factory as well as farmer buy-in.

They are the immediate point of contact with the customer and if they are unable or unwilling to invest in supplying PGI grass-fed beef, then it simply can’t succeed on a wider scale.

Burke puts a brave face on the lack of progress to date by suggesting that there is a benefit from the halo effect of the PGI for Irish beef in general.

He says that “we are getting reputational benefit and customers now recognise it as part of our infrastructure and it is in our portfolio when we are out marketing Irish beef”.

There is validity in this point, but it is still the consolation prize. Just a year and a half ago, the ambition was to build a brand that would create a premium for Irish beef in international markets using the PGI tool.

However scarcity of supply has left factories scrambling for cattle and this has served PGI’s purpose of giving farmers a decent lift for livestock prices.

If we were sure current price levels would be sustained into the future, a case could easily be made for forgetting about branding Irish beef altogether.

However, following the principle that the best time to fix the roof is on a dry day, the specification should be modified in the way to get maximum factory buy-in.

If they are still not interested after that or despite what Bord Bia research says, customers are not interested, then the PGI initiative will be confined to limited niche opportunities.

PGI Irish grass-fed beef launched in March 2024.Esselunga supermarket carried the range from launch.No other major customers have come on board since.Supply has been an issue as cattle became scarce this year.A request has been made to amend the specification to increase eligibility of current cattle supply.

It is now 18 months since Irish Grass-fed Beef was launched by then-Agriculture Minister Charlie McConalogue and his counterpart in Northern Ireland, Andrew Muir in a cross-border promotional initiative.

This was followed up with a launch in the Esselunga supermarket group in Italy and in May last year the Irish Farmers Journal reported on PGI grass-fed beef supplied by ABP on sale there.

Since then there has been little mention of it and this week the Irish Farmers Journal spoke with Joe Burke, senior manager for meat and livestock with Bord Bia, to find out what has happened since.

One significant customer

According to Burke, sales of PGI beef in Italy have been going well but Esselunga remains the only substantial customer for the product. When it was launched, Bord Bia undertook comprehensive research which identified other countries in Europe that would be receptive to a PGI beef offering.

Joe Burke of Bord Bia.

When this was put to Joe Burke, he said that “presentations have been made and there has been plenty of customer engagement, but the market place for beef has changed greatly since the first launch”.

He was referring to what he described as “the welcome increase in cattle prices”, and the “tightness” of cattle supply this year making customers and their processor suppliers more focused on maintaining overall beef supply as opposed to building a market for a new brand.

Burke explained that around 70% of all steers and heifers killed in Irish factories last year met the specification for Irish grass-fed beef. That meant that 30% of prime cattle were outside the specification and many processors were unwilling to invest in building a brand that excluded a considerable percentage of their throughput.

EU designations that recognise regional food and drinks or products with special characteristics.

Industry sources have told the Irish Farmers Journal that they made Bord Bia aware of this issue and have sought to have the specification widened to include a greater percentage of the kill.

Factories luke warm on PGI

This issue was alluded to by Dawn Meats CEO Niall Browne in an interview with the Irish Farmers Journal in May last year.

Then he referred to the introduction of “PGI grass fed with consultations [between] Brussels, Bord Bia and the Dept of Agriculture”, and that it “is going to be a slower burn because we do PGI in Wales, Scotland and south west Britain, but the rules around the Irish PGI are much more onerous”.

In hindsight, this was a clear indicator that at least one major processor wasn’t fully invested in the PGI grass-fed beef brand.

The fact that nothing meaningful has happened elsewhere confirms that this view is more widely held among factories, as sources have been telling the Irish Farmers Journal. A typical comment has been: “We are interested in the longer term but not right now with the scarcity of cattle.”

When Burke was asked about this, he confirmed that Bord Bia have been in discussions with the industry since early this year about the specification.

He said that there is “general agreement that a request should be made to extend the specification to include O-3 grading cattle with a fat score between 2+ and 4+. If this is accepted it would increase the percentage of the steer and heifer kill that qualified for the PGI from 70% to over 80%”.

Dale Crammond, director of Meat Industry Ireland, confirmed that “MII and members held discussions with Bord Bia, seeking some modifications to maximise the commercial opportunities under the Grass Fed PGI.”

A complex process to amend

specification

This cannot be done on a whim, however. According to Burke a case has to be made in Brussels for a change to the specification and this has to be done by DAFM.

A case has been prepared to support the request and it is based on the fact that the profile of the Irish cattle herd and, therefore, grades has been changing.

“Looking back, Irish beef cattle were dominated by large continental breeds with particularly good confirmation,” he said. “However over recent years, we have seen a return to more traditional Hereford and Angus breeding which means more O- grades and there is general acceptance that these should now be included in Irish grass-fed PGI.”

He could not give any indication of how long this process would take or what stage the process is at because this is in the hands of DAFM to progress with the EU.

PGI Irish Grass-fed Beef on sale in Italy.

Comment: Beef PGI is

at a crossroads

Any effort to build a brand for Irish beef is doomed if it doesn’t have factory as well as farmer buy-in.

They are the immediate point of contact with the customer and if they are unable or unwilling to invest in supplying PGI grass-fed beef, then it simply can’t succeed on a wider scale.

Burke puts a brave face on the lack of progress to date by suggesting that there is a benefit from the halo effect of the PGI for Irish beef in general.

He says that “we are getting reputational benefit and customers now recognise it as part of our infrastructure and it is in our portfolio when we are out marketing Irish beef”.

There is validity in this point, but it is still the consolation prize. Just a year and a half ago, the ambition was to build a brand that would create a premium for Irish beef in international markets using the PGI tool.

However scarcity of supply has left factories scrambling for cattle and this has served PGI’s purpose of giving farmers a decent lift for livestock prices.

If we were sure current price levels would be sustained into the future, a case could easily be made for forgetting about branding Irish beef altogether.

However, following the principle that the best time to fix the roof is on a dry day, the specification should be modified in the way to get maximum factory buy-in.

If they are still not interested after that or despite what Bord Bia research says, customers are not interested, then the PGI initiative will be confined to limited niche opportunities.

PGI Irish grass-fed beef launched in March 2024.Esselunga supermarket carried the range from launch.No other major customers have come on board since.Supply has been an issue as cattle became scarce this year.A request has been made to amend the specification to increase eligibility of current cattle supply.

SHARING OPTIONS