Teagasc held a suckler farm walk on the farm of Gerard and Shane O’Connor who farm just outside Ballintubber, Co Roscommon.

The main theme of the evening was around farm succession as part of the Teagasc generational renewal week, which took place last week but also gave an overview of Gerard and Shane’s suckler herd.

Attendees also got a briefing from local Castlerea mart manager Brendan Egan on the cattle trade and what 2025 has been like so far, along with Anthony Dowd from Dawn Meats forecasting what the rest of the year will be like for beef prices.

Colm Murray led the Teaagsc team on the night with Colm explaining that the O’Connor farm extends to 100 acres, 80 of which is owned with a further 20 rented.

Typical of drystock farms in the west of Ireland, the farm is split across five blocks. Shane currently runs about 20 cows, bringing all through to the forward store stage and even toying with the idea of finishing some of them.

“We just want to keep things as simple as possible with a cow that calves easily and goes and does a job trouble-free for us. It has to fit in with work and family life,” Shane said.

Cow type is a Limousin cross cow, which is working really well when crossed with the Charolais or Limousin bull. The O’Connors are using 100% AI and have had good results with the Limousin bull, Powerful Proper and the Charolais bull Lapon in he past.

“We used to keep a Limousin bull up until six years ago but we wanted to keep his heifers so we went using AI and we are happy with it,” Shane said.

“The breed mix is working with weanlings weighed for SCEP on 9 September an a number of bull weanlings gaining over 1.5kg/day since birth.”

Health

Local vet John Gilmore outlined some autumn health tips for suckler farms including, advising farmers to look at vaccination as a tool to prevent pneumonia this autumn.

“Vaccines haven’t gone up in price that much in the last 10 years but weanling prices have probably tripled during that time so in my opinion, it’s a worthwhile investment. Cattle are worth too much now to be taking chances,” he said.

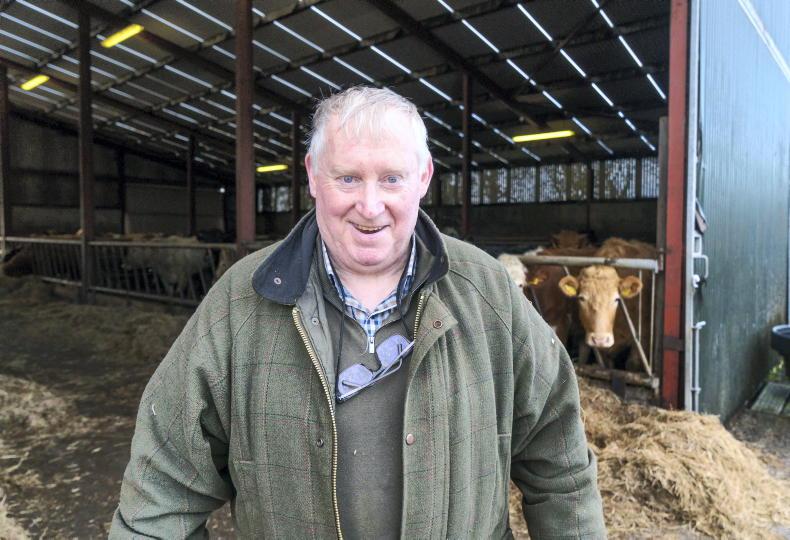

The O'Connors on their farm.

Trade Outlook

On the mart trade, Brendan Egan said: “Look, it’s been a super summer and one that we probably didn’t see coming. We are still seeing the exporters very hungry for stock and with big numbers leaving the country, that probably bodes well for the longer term into next year.

“We have seen the poorer quality dairy cross cattle back a little in the last week or so but quality cattle are still selling really well.

“On the factory side, Anthony Dowd from Dawn Meats in Ballyhaunis was also positive about price with the current blip in the trade expected to be short lived. We are only 4-5 weeks away from getting ready for the Christmas market,” he said.

When a question came up on quality assurance, both men differed in their opinion, with Brendan seeing very little difference in the mart ring at the moment between quality assured cattle and non-quality assured cattle.

Anthony, on the other hand, rounded on the importance of it from their customers’ point of view and even went as far as to say that there could be some added value in the market in the future for all-of-life quality assurance.

Anthony also pointed out to the farmers attending the walk that it was important if you start to feed finishing cattle meal, to get the value out of it and feed for six to eight weeks as opposed to two to three weeks.

“It will take a few weeks until you see the cover coming on bullocks and it’ll pay to hold out for that bit longer,” Anthony said.

Considerations when transferring

The O’Connor family farm is typical of thousands of farms across the country with family being at the core of the business. Gerard and his son Shane farm side-by-side with the family currently beginning the process of transferring the farm to the next generation.

Shane’s children also have the wellies on to follow in their father’s and grandfather’s footsteps.

The O’Connor farm has been in the family for generations, with Gerard inheriting the farm when he was in his early 20s from his own father. Gerard has three children but Shane always showed a keen interest in the farm from a young age so he was identified from an early age as being the likely successor to the farm.

Shane pursued his studies in construction studies with a diploma from Galway, a degree from Edinburgh and studying for his master’s degree in spatial planning in Dublin.

As a result of the economic recession in 2008, he decided he would complete a green cert in Teagasc, Roscommon in 2012 with a view to coming home and going full-time farming but an improvement in construction activity in 2014 put that on hold and he went back to work in construction.

Shane was still involved in the farm on a daily basis and started putting some plans in place for the future. This started with a conversation around Shane going onto the herd numbers as a joint herd owner.

Cows on the O'Connor farm.

This was the minimum requirement for Shane to qualify for the Young Farmers Scheme that was available at the time.

Talks about a transfer of farm ownership were put on hold at this stage as Shane was still unsure as to where his career would take him.

In 2015, the O’Connors were running close to 30 cows and selling all progeny as weanlings. This system evolved over time with a reduction in cow numbers to 20 to fit better with Shane’s off-farm job.

He now brings the cattle to the forward store stage with Gerard less involved in the day-to-day running of the farm. Plans are now being put in place for a transfer of ownership of the farm in 2026 before the BISS application is submitted.

There are a number of tax implications that the O’Connors need to think about before this transfer takes place.

Ruth Fennell from the Teagasc Farm Management and Rural Development team gave an excellent overview on the night of some of the issues involved with farm succession and some of the pitfalls that farm families sometimes fall into.

“Ireland’s farming population is aging with over one third aged over 65 and over and less than 6% under 35 which has huge implications for the future of our agricultural industry. We often find that farm succession is often delayed due to unclear transfer plans or family issues and tax concerns and this limits young farmer entry and land access.”

Gerard, the current farm owner, is classified as the disposer of the asset so the relevant tax applicable to him is Capital Gains Tax (CGT).

This is calculated based on the asset or farm value when Gerard received it from his father and its value now. Before any reliefs are applied, any increase in value is subject to CGT at the rate of 33%. In many cases, retirement relief may apply.

As Gerard has owned and farmed the land for over 10 years, is under 70 at the time of transfer, and is transferring it to his son, he can claim this relief, allowing up to €10 million in agricultural assets to be disposed of tax-free. This should ensure Gerard avoids CGT on the transfer of the farm.

For Shane, the beneficiary, there are two taxes relevant. First is stamp duty, currently 7.5% of the value of non-residential land.

Had this been an inheritance, stamp duty would not apply. On the night, Ruth highlighted that since Shane is no longer under 35, he doesn’t qualify for Young Trained Farmer Relief, which would have reduced the rate to 0%.

However, he qualifies for Consanguinity Relief, as he is receiving the farm from a blood relative and will actively farm it.

This reduces the stamp duty rate to 1%, resulting in significant savings.

The second relevant tax for Shane is Capital Acquisitions Tax (CAT). This applies to the value of the gifted asset.

Under a Category A relationship (parent to child), Shane can receive up to €400,000 tax-free.

Anything above that is liable for CAT at a rate of 33%. Agricultural Relief may apply, and this reduces the value of the agricultural asset by 90% for CAT.

The farm walk, held on the O'Connor farm.

To avail of this, two conditions must be met: (i) at least 80% of Shane’s total assets on the date of the gift must be agricultural assets, and (ii) he must hold a relevant qualification and/or spend at least 50% of his time farming, or lease the land to someone who does for a minimum of six years.

Where the conditions for retirement relief or agricultural relief cannot be met, there are alternatives such as Entrepreneurial relief and Business Asset relief. These alternatives should be discussed with your financial advisor should you need to avail of them.

Ruth finished up by saying ”Careful planning is essential to ensure a successful and tax-efficient transfer of farm assets. Professional legal and financial advice should be sought, and the Succession Planning Advice Grant (SPAG) can help finance this support.

Farm Facts

Land Area: 100 acres (80 owned, 20 rented) across 5 different blocks.System: suckling to store.Cow type: Limousin/Simmental.Sires used: 100% AI, Charolais and Aberdeen Angus on heifers.The O’Connors farm 20 sucklers, bringing everything through to forward store on their 100 acre farm in Roscommon.They are currently in the process of navigating the transfer of the farm from father to son.There are a number of important taxes to be aware of when transferring the family farm.The advice is to seek professional legal and accountancy advice when pursuing a farm transfer.

Teagasc held a suckler farm walk on the farm of Gerard and Shane O’Connor who farm just outside Ballintubber, Co Roscommon.

The main theme of the evening was around farm succession as part of the Teagasc generational renewal week, which took place last week but also gave an overview of Gerard and Shane’s suckler herd.

Attendees also got a briefing from local Castlerea mart manager Brendan Egan on the cattle trade and what 2025 has been like so far, along with Anthony Dowd from Dawn Meats forecasting what the rest of the year will be like for beef prices.

Colm Murray led the Teaagsc team on the night with Colm explaining that the O’Connor farm extends to 100 acres, 80 of which is owned with a further 20 rented.

Typical of drystock farms in the west of Ireland, the farm is split across five blocks. Shane currently runs about 20 cows, bringing all through to the forward store stage and even toying with the idea of finishing some of them.

“We just want to keep things as simple as possible with a cow that calves easily and goes and does a job trouble-free for us. It has to fit in with work and family life,” Shane said.

Cow type is a Limousin cross cow, which is working really well when crossed with the Charolais or Limousin bull. The O’Connors are using 100% AI and have had good results with the Limousin bull, Powerful Proper and the Charolais bull Lapon in he past.

“We used to keep a Limousin bull up until six years ago but we wanted to keep his heifers so we went using AI and we are happy with it,” Shane said.

“The breed mix is working with weanlings weighed for SCEP on 9 September an a number of bull weanlings gaining over 1.5kg/day since birth.”

Health

Local vet John Gilmore outlined some autumn health tips for suckler farms including, advising farmers to look at vaccination as a tool to prevent pneumonia this autumn.

“Vaccines haven’t gone up in price that much in the last 10 years but weanling prices have probably tripled during that time so in my opinion, it’s a worthwhile investment. Cattle are worth too much now to be taking chances,” he said.

The O'Connors on their farm.

Trade Outlook

On the mart trade, Brendan Egan said: “Look, it’s been a super summer and one that we probably didn’t see coming. We are still seeing the exporters very hungry for stock and with big numbers leaving the country, that probably bodes well for the longer term into next year.

“We have seen the poorer quality dairy cross cattle back a little in the last week or so but quality cattle are still selling really well.

“On the factory side, Anthony Dowd from Dawn Meats in Ballyhaunis was also positive about price with the current blip in the trade expected to be short lived. We are only 4-5 weeks away from getting ready for the Christmas market,” he said.

When a question came up on quality assurance, both men differed in their opinion, with Brendan seeing very little difference in the mart ring at the moment between quality assured cattle and non-quality assured cattle.

Anthony, on the other hand, rounded on the importance of it from their customers’ point of view and even went as far as to say that there could be some added value in the market in the future for all-of-life quality assurance.

Anthony also pointed out to the farmers attending the walk that it was important if you start to feed finishing cattle meal, to get the value out of it and feed for six to eight weeks as opposed to two to three weeks.

“It will take a few weeks until you see the cover coming on bullocks and it’ll pay to hold out for that bit longer,” Anthony said.

Considerations when transferring

The O’Connor family farm is typical of thousands of farms across the country with family being at the core of the business. Gerard and his son Shane farm side-by-side with the family currently beginning the process of transferring the farm to the next generation.

Shane’s children also have the wellies on to follow in their father’s and grandfather’s footsteps.

The O’Connor farm has been in the family for generations, with Gerard inheriting the farm when he was in his early 20s from his own father. Gerard has three children but Shane always showed a keen interest in the farm from a young age so he was identified from an early age as being the likely successor to the farm.

Shane pursued his studies in construction studies with a diploma from Galway, a degree from Edinburgh and studying for his master’s degree in spatial planning in Dublin.

As a result of the economic recession in 2008, he decided he would complete a green cert in Teagasc, Roscommon in 2012 with a view to coming home and going full-time farming but an improvement in construction activity in 2014 put that on hold and he went back to work in construction.

Shane was still involved in the farm on a daily basis and started putting some plans in place for the future. This started with a conversation around Shane going onto the herd numbers as a joint herd owner.

Cows on the O'Connor farm.

This was the minimum requirement for Shane to qualify for the Young Farmers Scheme that was available at the time.

Talks about a transfer of farm ownership were put on hold at this stage as Shane was still unsure as to where his career would take him.

In 2015, the O’Connors were running close to 30 cows and selling all progeny as weanlings. This system evolved over time with a reduction in cow numbers to 20 to fit better with Shane’s off-farm job.

He now brings the cattle to the forward store stage with Gerard less involved in the day-to-day running of the farm. Plans are now being put in place for a transfer of ownership of the farm in 2026 before the BISS application is submitted.

There are a number of tax implications that the O’Connors need to think about before this transfer takes place.

Ruth Fennell from the Teagasc Farm Management and Rural Development team gave an excellent overview on the night of some of the issues involved with farm succession and some of the pitfalls that farm families sometimes fall into.

“Ireland’s farming population is aging with over one third aged over 65 and over and less than 6% under 35 which has huge implications for the future of our agricultural industry. We often find that farm succession is often delayed due to unclear transfer plans or family issues and tax concerns and this limits young farmer entry and land access.”

Gerard, the current farm owner, is classified as the disposer of the asset so the relevant tax applicable to him is Capital Gains Tax (CGT).

This is calculated based on the asset or farm value when Gerard received it from his father and its value now. Before any reliefs are applied, any increase in value is subject to CGT at the rate of 33%. In many cases, retirement relief may apply.

As Gerard has owned and farmed the land for over 10 years, is under 70 at the time of transfer, and is transferring it to his son, he can claim this relief, allowing up to €10 million in agricultural assets to be disposed of tax-free. This should ensure Gerard avoids CGT on the transfer of the farm.

For Shane, the beneficiary, there are two taxes relevant. First is stamp duty, currently 7.5% of the value of non-residential land.

Had this been an inheritance, stamp duty would not apply. On the night, Ruth highlighted that since Shane is no longer under 35, he doesn’t qualify for Young Trained Farmer Relief, which would have reduced the rate to 0%.

However, he qualifies for Consanguinity Relief, as he is receiving the farm from a blood relative and will actively farm it.

This reduces the stamp duty rate to 1%, resulting in significant savings.

The second relevant tax for Shane is Capital Acquisitions Tax (CAT). This applies to the value of the gifted asset.

Under a Category A relationship (parent to child), Shane can receive up to €400,000 tax-free.

Anything above that is liable for CAT at a rate of 33%. Agricultural Relief may apply, and this reduces the value of the agricultural asset by 90% for CAT.

The farm walk, held on the O'Connor farm.

To avail of this, two conditions must be met: (i) at least 80% of Shane’s total assets on the date of the gift must be agricultural assets, and (ii) he must hold a relevant qualification and/or spend at least 50% of his time farming, or lease the land to someone who does for a minimum of six years.

Where the conditions for retirement relief or agricultural relief cannot be met, there are alternatives such as Entrepreneurial relief and Business Asset relief. These alternatives should be discussed with your financial advisor should you need to avail of them.

Ruth finished up by saying ”Careful planning is essential to ensure a successful and tax-efficient transfer of farm assets. Professional legal and financial advice should be sought, and the Succession Planning Advice Grant (SPAG) can help finance this support.

Farm Facts

Land Area: 100 acres (80 owned, 20 rented) across 5 different blocks.System: suckling to store.Cow type: Limousin/Simmental.Sires used: 100% AI, Charolais and Aberdeen Angus on heifers.The O’Connors farm 20 sucklers, bringing everything through to forward store on their 100 acre farm in Roscommon.They are currently in the process of navigating the transfer of the farm from father to son.There are a number of important taxes to be aware of when transferring the family farm.The advice is to seek professional legal and accountancy advice when pursuing a farm transfer.

SHARING OPTIONS