A big push by the Brazilian minister for agriculture and his 100-member industry delegation this week has paid off with the announcement that exports to China can resume.

The decision applies to cattle slaughtered after 24 March. There is an expectation that beef in storage before 24 February, when the suspension came into effect, will also be cleared for export, but this hasn’t yet been confirmed.

The four-week disruption following the discovery of an atypical case of BSE in February contrasts with the prolonged suspension when a case had previously been found in September 2021.

Then the suspension lasted over three months until the middle of December that year.

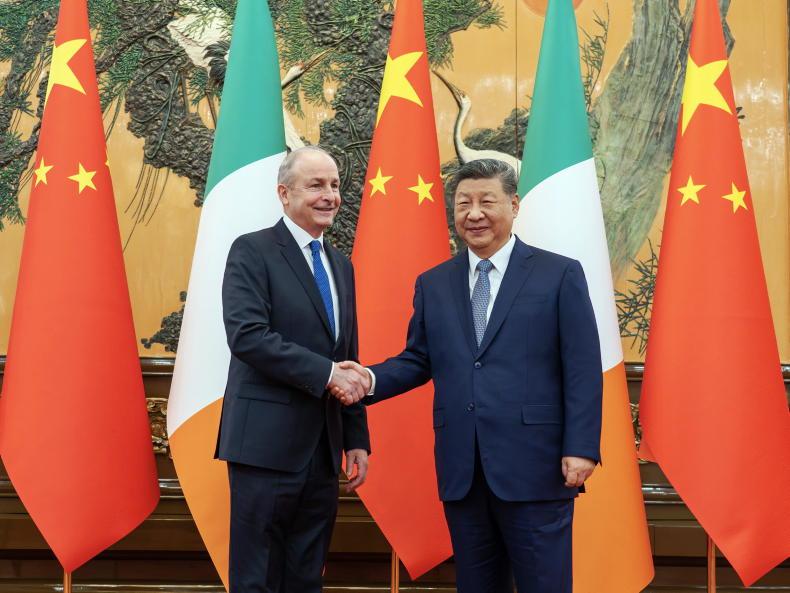

On this occasion, there was a huge political push to have the suspension lifted in time for Brazilian President Lula’s state visit, which was due to start this weekend but has been delayed a couple of days because of illness.

He is expected to travel this Sunday and meet the Chinese leader President Xi Jinping early next week.

This will be the Brazilian president’s third state visit following trips to Argentina and the US since his return to office late last year.

This week, Brazil’s minister for agriculture Carlos Favaro led a 100-strong delegation of exporters to lobby for the lifting of the suspension of beef imports from Brazil ahead of the presidential visit.

What this means

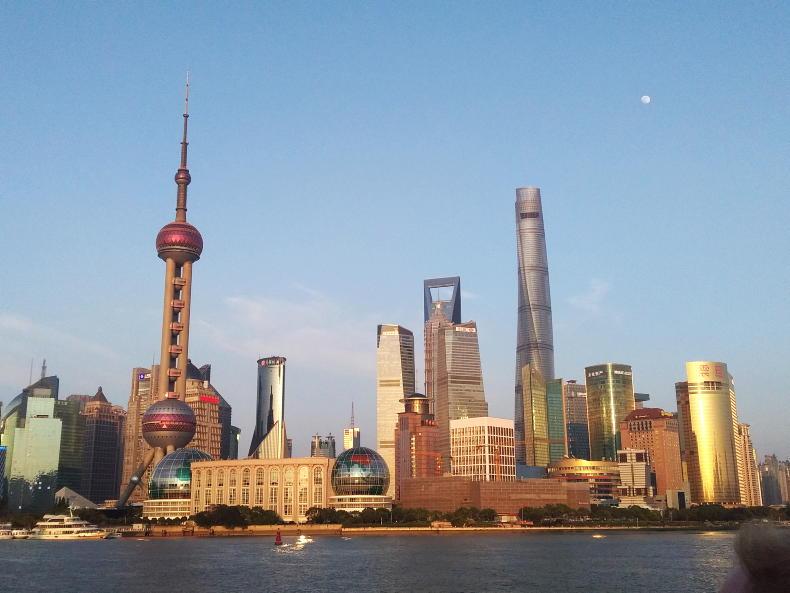

With Brazil being the world’s biggest exporter of beef and China the biggest importer, any prolonged disruption in trade between the countries has the potential to cause chaos in global beef markets.

It has been relatively calm in the international beef trade since the suspension began on 24 February in the expectation that it would be a short disruption.

With Brazil exporting over 2m tonnes of beef annually and supplying 1m tonnes or 40% of China’s beef imports (Table 1), there is simply no other global trade that comes close to matching this volume between two trade partners.

If there was longer-term disruption to this trade, Brazil would be searching desperately for alternative markets, which would cause serious downward pressure on prices.

On the other hand, if China had a deficit in supply of 1m tonnes, it would be scouring global markets for alternative supplies. This may mean higher prices but the extra supply of Brazilian beef on other markets would likely have curtailed any increase.

Relevance for Irish exports

It was timely that the suspension imposed on Irish beef exports back in May 2020 was lifted in January this year ahead of Brazil’s suspension.

The impact on demand for Irish beef in China will have been largely unaffected by the absence of Brazil because it was for such a short time.

However, the willingness of China to suspend trade with Brazil the same as it did with Ireland, though for a longer period, is a timely reminder that this market is vulnerable.

A single case of atypical BSE can torpedo sales at a stroke.

Brazil has been pressing China to review the protocol agreed in 2015 which agreed an export suspension in the event of discovering a BSE case. Given that an atypical case has no impact on a country’s BSE status, this would appear a logical scientific action.

Whether or not it happens and stabilises longer-term trade is very much a decision that will be made only by the Chinese.

Read more

BSE impact on Brazil’s beef exports

Batista in the Baptist role

Brazilian beef exporters to maintain grip on China

A big push by the Brazilian minister for agriculture and his 100-member industry delegation this week has paid off with the announcement that exports to China can resume.

The decision applies to cattle slaughtered after 24 March. There is an expectation that beef in storage before 24 February, when the suspension came into effect, will also be cleared for export, but this hasn’t yet been confirmed.

The four-week disruption following the discovery of an atypical case of BSE in February contrasts with the prolonged suspension when a case had previously been found in September 2021.

Then the suspension lasted over three months until the middle of December that year.

On this occasion, there was a huge political push to have the suspension lifted in time for Brazilian President Lula’s state visit, which was due to start this weekend but has been delayed a couple of days because of illness.

He is expected to travel this Sunday and meet the Chinese leader President Xi Jinping early next week.

This will be the Brazilian president’s third state visit following trips to Argentina and the US since his return to office late last year.

This week, Brazil’s minister for agriculture Carlos Favaro led a 100-strong delegation of exporters to lobby for the lifting of the suspension of beef imports from Brazil ahead of the presidential visit.

What this means

With Brazil being the world’s biggest exporter of beef and China the biggest importer, any prolonged disruption in trade between the countries has the potential to cause chaos in global beef markets.

It has been relatively calm in the international beef trade since the suspension began on 24 February in the expectation that it would be a short disruption.

With Brazil exporting over 2m tonnes of beef annually and supplying 1m tonnes or 40% of China’s beef imports (Table 1), there is simply no other global trade that comes close to matching this volume between two trade partners.

If there was longer-term disruption to this trade, Brazil would be searching desperately for alternative markets, which would cause serious downward pressure on prices.

On the other hand, if China had a deficit in supply of 1m tonnes, it would be scouring global markets for alternative supplies. This may mean higher prices but the extra supply of Brazilian beef on other markets would likely have curtailed any increase.

Relevance for Irish exports

It was timely that the suspension imposed on Irish beef exports back in May 2020 was lifted in January this year ahead of Brazil’s suspension.

The impact on demand for Irish beef in China will have been largely unaffected by the absence of Brazil because it was for such a short time.

However, the willingness of China to suspend trade with Brazil the same as it did with Ireland, though for a longer period, is a timely reminder that this market is vulnerable.

A single case of atypical BSE can torpedo sales at a stroke.

Brazil has been pressing China to review the protocol agreed in 2015 which agreed an export suspension in the event of discovering a BSE case. Given that an atypical case has no impact on a country’s BSE status, this would appear a logical scientific action.

Whether or not it happens and stabilises longer-term trade is very much a decision that will be made only by the Chinese.

Read more

BSE impact on Brazil’s beef exports

Batista in the Baptist role

Brazilian beef exporters to maintain grip on China

SHARING OPTIONS