On Wednesday, China lifted its longstanding ban on the imports of British beef. The move comes more than 20 years after the Chinese government first imposed a ban on British beef in the wake of the BSE outbreak.

There have been several years of site inspections and negotiations between the UK and Chinese government officials to reach this point.

The UK government has estimated that the market could be worth £250m over the next five years, but this will depend on individual processors gaining access, which is not a simple procedure.

The move does mark a positive step in the right direction for UK and Scotch beef in a post-Brexit scenario, with China importing 750,000 tonnes of boneless beef in 2017. It has been predicted that this could increase to 2.2m tonnes by 2022.

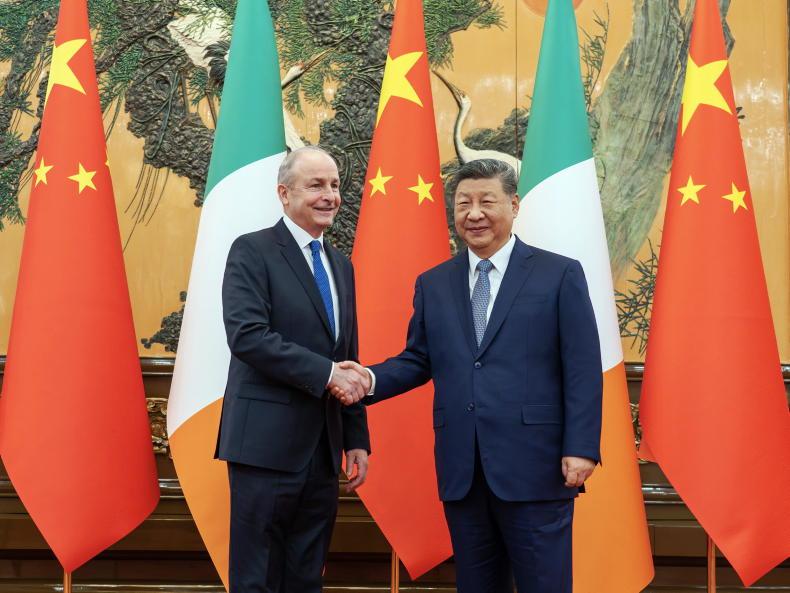

The next steps will involve further inspections of the national systems of traceability and food safety standards, among other aspects. The UK is now at the same point that Ireland was at in February 2015. Ireland became the first EU beef exporter to secure access to China in 2015.

However, it took over three years before individual Irish processors gained approval, and therefore access to, this market. To date, six Irish processors have received approval, including ABP.

Currently, it is still only frozen boneless beef that has gained access to the market, which is of a lower value than fresh beef. This initial approval by the Chinese authorities applied to product from cattle aged under 30 months. The 30-month age limit is a common feather of many international markets because of the BSE history and our controlled risk status.

Bone-in cuts are excluded as is offal, and it would be speculated that, were UK abattoirs to gain access, it would be a similar arrangement.

Current suppliers

While China is an attractive flourishing market with huge potential, there is still plenty of competition. The amount of beef traded in global markets is forecast by USDA to grow by 5% ,to 10.5m tonnes. This is driven by Brazil, Argentina, Australia and the USA.

The Brazilian meat-processing industry predicts it will grow 10% in 2018, having exported 460,000t of beef and offal to China and Hong Kong in 2017, half of which was to mainland China.

This is spectacular, given that Brazil just recommenced supplying China in June 2016.

SHARING OPTIONS