Each year Irish farmers who are not registered for value-added tax (VAT) miss out on reclaiming significant sums of VAT paid by them as part of investments in farm buildings, land reclamation or other eligible equipment.

This VAT is not automatically redeemed as part of the process of filing end-of-year tax returns and, as such, an application needs to be submitted to Revenue.

VAT is redeemable on new agricultural constructions, such as new builds or extensions and shed alterations or reconstructions, but it is not refundable on costs associated with repairs to buildings.

Likewise, VAT can be redeemed on investments such as new farm roadways, underpasses, etc, but it is not payable on costs borne for their repair or maintenance.

Land works

In terms of land works, VAT is refundable on land drainage, reclamation and fencing for the purposes of an agricultural activity, while Revenue also highlights that VAT can be reclaimed on investments for planting new hedgerows.

It is also refundable on fixed equipment such as cattle handling facilities, but it cannot be reclaimed on mobile equipment such as a mobile sheep handling unit.

Revenue lists equipment used for micro-generation of electricity for use solely or mainly for a farm business as also being eligible.

VAT is also not refundable on the service and maintenance of equipment and machinery, ESB supply, agri-related fuels and inputs such as pesticides, animal medicines or farm plastics.

New procedure

A new process for claiming a VAT refund was introduced on 1 January 2019.

A VAT claim can now only be made for a calendar year or a period within a calendar year.

For example, if you have VAT to reclaim from the period September 2020 to March 2021, then two applications must be submitted – one to cover the period September to December 2020 and another to cover January to March 2021.

The claim must be for an amount greater than €125 to be deemed eligible for payment.

The claim cannot be older than four years, with 2017 the furthest year back for which a claim can be submitted.

Claims must also be completed online through the eRepayments facility on revenue.ie.

Required information

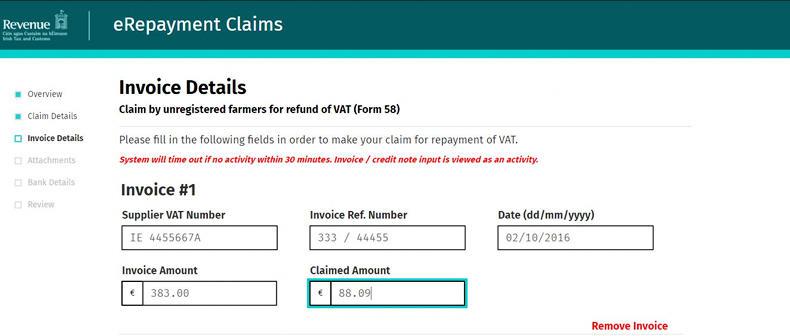

To submit a claim through the eRepayments facility, you will need the invoice number, the supplier’s VAT number and the amount of VAT being claimed.

It is no longer a requirement to submit a copy of the invoice unless it is requested.

However, it is advised to maintain the invoices for a period of six years, as they can be requested for assessment by the Revenue at a later date.

It is important to note that the application process times out after a period of 30 minutes of inactivity, so it is important to have the required documentation to hand at the outset.

VAT payments will be made directly into your bank account and this must also be registered on the system when making a claim.

You will need the international bank account number (IBAN) and the bank identifier code (BIC) of your bank account.

This information can typically be found on a copy of your bank statement.

Accessing eRepayments

The eRepayments facility can be accessed through the My Account login on revenue.ie. Where you do not already have an account you will need to register for one.

There are two ways to do this. For both methods, you will need your PPS number, home address, date of birth, a mobile or landline number and an email address.

Instant access can be obtained by furnishing information from two of three optional sources, including your driving licence number, information from your P60 or information from your income tax notice or assessment or acknowledgement of self-assessment.

If this documentation is not to hand, you can request a password to be sent to you by post.

This will typically take up to five to 10 working days to process.

Once logged on to the system, click on the My Services area of My Account, followed by Other Services.

Then click on the e-repayment claims card. The facility can also be accessed through the Revenue Online Service (ROS) and by following the steps described above.

The process

The claim is quite easy to complete once the required documentation is to hand.

Revenue states an average claim takes five minutes to complete, but I would suggest where there is a claim involving a significant expenditure, such as shed construction, it will take longer.

Questions on the application can be submitted through revenue.ie.

The farming business to which the claim relates must be carried on for a period of not less than one year after the date the tax was incurred.

SHARING OPTIONS