Margaret Leahy considers herself consumer savvy. A manager for a funding organisation, she has worked in banks in the past and has plenty of experience with most common financial issues.

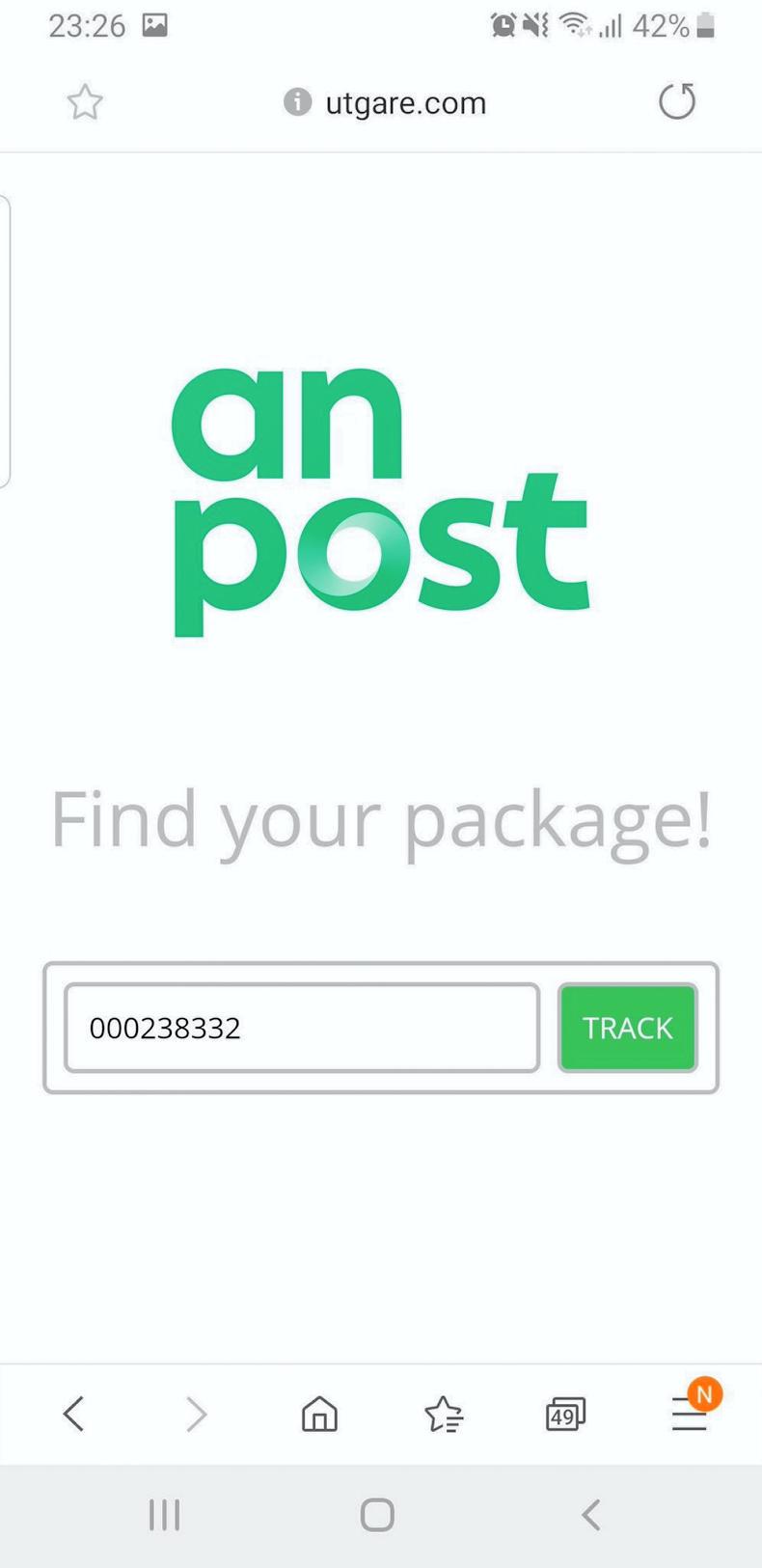

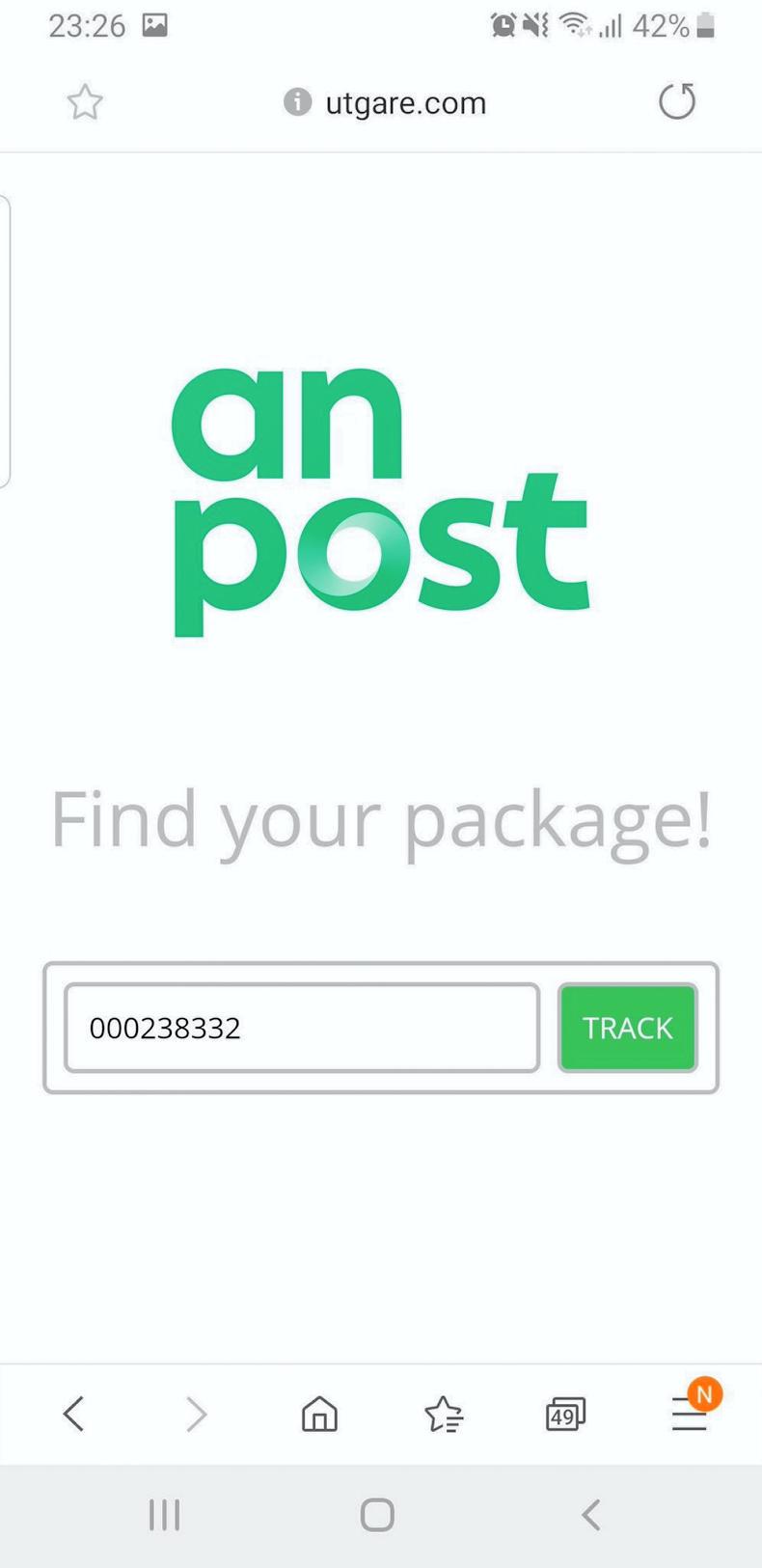

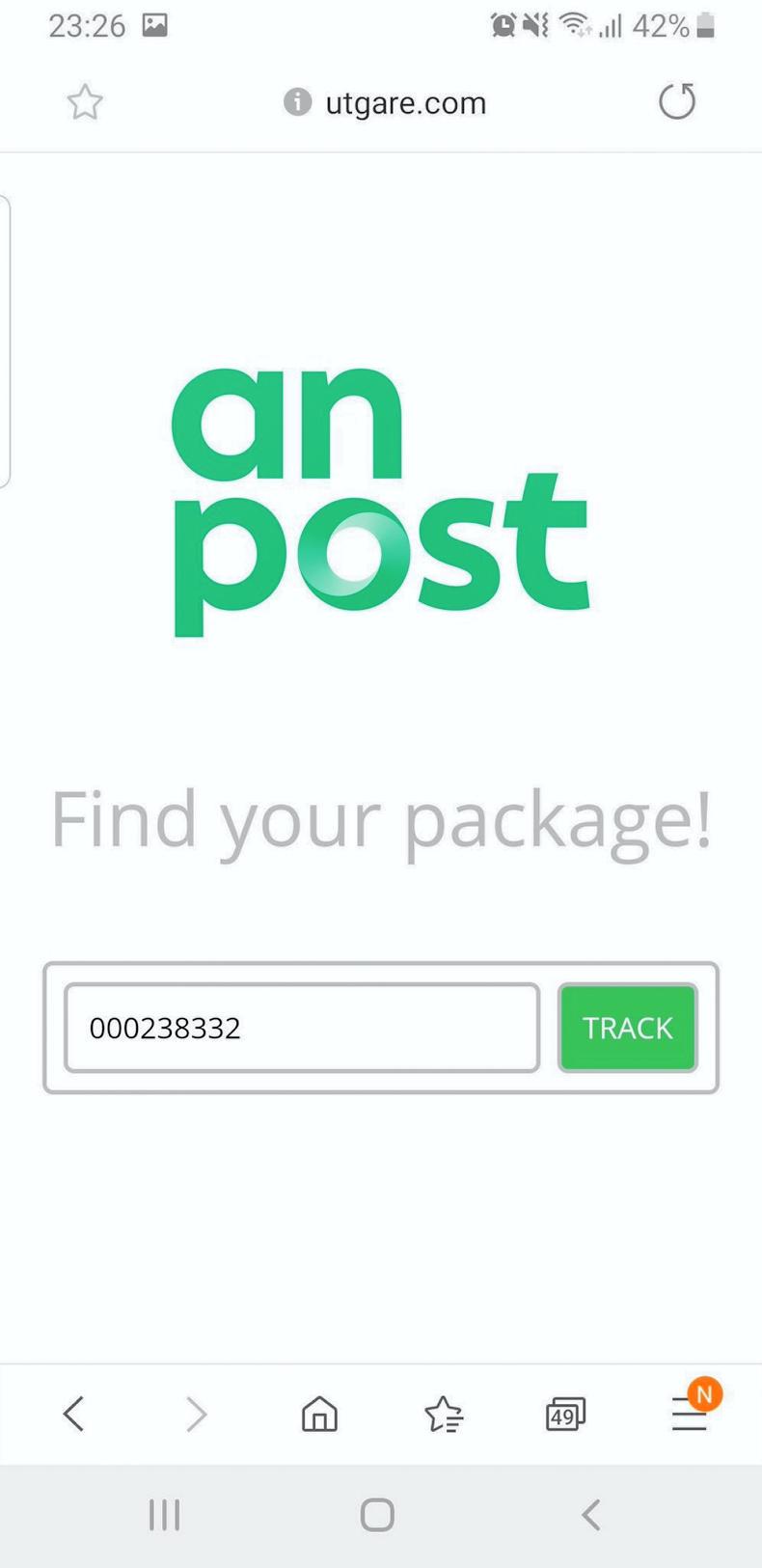

This is part of the reason why the Connemara resident was so shocked when she realised she had been scammed via text message; by an online website impersonating An Post.

“I literally used to think, ‘How could they have fallen for that?’,” she says of other people falling victim to scams. “That’s why I went public about this; I was angrier at myself for falling for it than I was with them.”

Stories like Margaret’s are becoming all too common; someone with an understanding and awareness of scams falls victim to one because of the way they are evolving, and how quickly.

“Part of the issue is that [people] are getting better at scamming,” she admits. “The other part is just circumstantial. I never shop online, and if it hadn’t had been my birthday, I wouldn’t have thought anything would be delivered to me – I would have ignored [the text message].

“It’s only because my son has posted stuff before and there were problems with the postage,” she continues. “When I got this message that said there was postage due, I messaged my son and he said, ‘Oh yeah, Mom, I sent you a birthday present’. It was only €2, so I put in my credit card details and it was declined, so then I put in my debit card details, which were accepted – so they had two cards on me.”

No sooner had Margaret paid for the “postage” (and after receiving some impressively branded tracking messages) did she realise she had been scammed. She noticed an email from an adult website, thanking her for signing up to their monthly subscription service. The message said they had taken nearly €40 from her credit card and, in much smaller font at the bottom of the email, stated they would be taking a monthly fee of €149, the first such payment to be taken within 24 hours.

Quick thinking

“Luckily, I knew how to cope once it had happened,” she says. “I had taken screenshots (pictured right) of the transaction, I threatened [the website] with the police and I was straight on the phone with AIB. This was all within minutes.

“I have to say, I didn’t think there would be people to actually talk to you at nearly midnight on a Sunday evening and [AIB] did, which I really think was great,” she says. “They also knew about the An Post scam.”

Public affairs manager for An Post Angus Laverty says this scam (commonly known as a “phishing” scam) has become common in the weeks since they first posted about it on their website (15 January). He says, in correspondence with Irish Country Living, that An Post is not the only business being impersonated.

“The latest batch of scam attempts hit us last week, but they are part of a growing trend hitting all sorts of organisations including financial institutions,” he writes. “We have been asking customers to be ‘scam aware’ when receiving these kinds of messages from An Post and other service providers, like banks.”

Angus maintains that the sources of the scams change constantly. While An Post have been successful in the past in getting some of them taken down, the work is continuous as new scams develop.

“It is fair to say that such scam attempts are becoming a feature in all of our lives,” he adds.

When I was going through the process, the messages kept talking about the delivery and the depot – the language made so much sense

Thanks to some quick action, Margaret’s bank was able to cancel both her debit and credit card and her entire bank account until they were certain the scammers did not have direct access to any of her pin numbers. It only took a few minutes to cancel everything, but Margaret was without a debit card for several days afterward. She was left feeling angry about the experience and took to social media to warn others about what happened.

“When I was going through the process, the messages kept talking about the delivery and the depot – the language made so much sense and it wasn’t complicated; it was very simple,” she says. “Luckily, I kept screenshots of everything, just because I do that when I pay for anything online. The bank personnel were very appreciative of that.”

Garda efforts

Detective chief superintendent Pat Lordan of An Garda Síochána says that while the gardaí are usually successful in catching those involved in fraudulent activity; that doesn’t mean the victims of these crimes will ever see their money again.

“Arden Forestry was a fraudulent company recently convicted – they were looking for investors all over the world,” he says. “They looked for individuals to invest in forestry land in Ireland – land that never actually existed. Those responsible went to jail, but the people who invested in that scheme (valued at over €5m) never got their money back.”

Lordan says a bit of research into an online business can go a long way. For example, if you’re considering an investment in an online scheme, it makes sense to look for reviews on the company, ask investment experts and – above all – never give anyone your personal details over the phone or online.

If you think you may have been scammed, call the bank any time – day or night

“Look at where you’re investing your money,” he says. “Is there any chance you will lose everything?”

After her experience of being scammed, Margaret believes her habit of taking a screenshot of her online transactions was worthwhile.

“If you don’t know how to take a screenshot, ask a family member to teach you. If you think you may have been scammed, call the bank any time – day or night,” she says. “Because my cards were cancelled, I had to physically go to the bank if I needed money (for a while). This has taught me to take a €50 note and hide it somewhere in the house, just in case.”

Advice on avoiding scams from the Competition and Consumer Protection

Commission:

Never give personal, bank or credit card details to an unknown party. Never click on links within emails from friends or acquaintances which they wouldn’t normally send. Think twice before responding to a friend’s message requesting money. Always use bank and credit cards safely and securely. If offered an investment deal, always check that the firm is authorised on the Central Bank’s registers website.Take care when buying or selling goods online. If putting an item for sale in the local newspaper or on a website never accept a cheque or draft for an amount over the asking price.

Margaret Leahy considers herself consumer savvy. A manager for a funding organisation, she has worked in banks in the past and has plenty of experience with most common financial issues.

This is part of the reason why the Connemara resident was so shocked when she realised she had been scammed via text message; by an online website impersonating An Post.

“I literally used to think, ‘How could they have fallen for that?’,” she says of other people falling victim to scams. “That’s why I went public about this; I was angrier at myself for falling for it than I was with them.”

Stories like Margaret’s are becoming all too common; someone with an understanding and awareness of scams falls victim to one because of the way they are evolving, and how quickly.

“Part of the issue is that [people] are getting better at scamming,” she admits. “The other part is just circumstantial. I never shop online, and if it hadn’t had been my birthday, I wouldn’t have thought anything would be delivered to me – I would have ignored [the text message].

“It’s only because my son has posted stuff before and there were problems with the postage,” she continues. “When I got this message that said there was postage due, I messaged my son and he said, ‘Oh yeah, Mom, I sent you a birthday present’. It was only €2, so I put in my credit card details and it was declined, so then I put in my debit card details, which were accepted – so they had two cards on me.”

No sooner had Margaret paid for the “postage” (and after receiving some impressively branded tracking messages) did she realise she had been scammed. She noticed an email from an adult website, thanking her for signing up to their monthly subscription service. The message said they had taken nearly €40 from her credit card and, in much smaller font at the bottom of the email, stated they would be taking a monthly fee of €149, the first such payment to be taken within 24 hours.

Quick thinking

“Luckily, I knew how to cope once it had happened,” she says. “I had taken screenshots (pictured right) of the transaction, I threatened [the website] with the police and I was straight on the phone with AIB. This was all within minutes.

“I have to say, I didn’t think there would be people to actually talk to you at nearly midnight on a Sunday evening and [AIB] did, which I really think was great,” she says. “They also knew about the An Post scam.”

Public affairs manager for An Post Angus Laverty says this scam (commonly known as a “phishing” scam) has become common in the weeks since they first posted about it on their website (15 January). He says, in correspondence with Irish Country Living, that An Post is not the only business being impersonated.

“The latest batch of scam attempts hit us last week, but they are part of a growing trend hitting all sorts of organisations including financial institutions,” he writes. “We have been asking customers to be ‘scam aware’ when receiving these kinds of messages from An Post and other service providers, like banks.”

Angus maintains that the sources of the scams change constantly. While An Post have been successful in the past in getting some of them taken down, the work is continuous as new scams develop.

“It is fair to say that such scam attempts are becoming a feature in all of our lives,” he adds.

When I was going through the process, the messages kept talking about the delivery and the depot – the language made so much sense

Thanks to some quick action, Margaret’s bank was able to cancel both her debit and credit card and her entire bank account until they were certain the scammers did not have direct access to any of her pin numbers. It only took a few minutes to cancel everything, but Margaret was without a debit card for several days afterward. She was left feeling angry about the experience and took to social media to warn others about what happened.

“When I was going through the process, the messages kept talking about the delivery and the depot – the language made so much sense and it wasn’t complicated; it was very simple,” she says. “Luckily, I kept screenshots of everything, just because I do that when I pay for anything online. The bank personnel were very appreciative of that.”

Garda efforts

Detective chief superintendent Pat Lordan of An Garda Síochána says that while the gardaí are usually successful in catching those involved in fraudulent activity; that doesn’t mean the victims of these crimes will ever see their money again.

“Arden Forestry was a fraudulent company recently convicted – they were looking for investors all over the world,” he says. “They looked for individuals to invest in forestry land in Ireland – land that never actually existed. Those responsible went to jail, but the people who invested in that scheme (valued at over €5m) never got their money back.”

Lordan says a bit of research into an online business can go a long way. For example, if you’re considering an investment in an online scheme, it makes sense to look for reviews on the company, ask investment experts and – above all – never give anyone your personal details over the phone or online.

If you think you may have been scammed, call the bank any time – day or night

“Look at where you’re investing your money,” he says. “Is there any chance you will lose everything?”

After her experience of being scammed, Margaret believes her habit of taking a screenshot of her online transactions was worthwhile.

“If you don’t know how to take a screenshot, ask a family member to teach you. If you think you may have been scammed, call the bank any time – day or night,” she says. “Because my cards were cancelled, I had to physically go to the bank if I needed money (for a while). This has taught me to take a €50 note and hide it somewhere in the house, just in case.”

Advice on avoiding scams from the Competition and Consumer Protection

Commission:

Never give personal, bank or credit card details to an unknown party. Never click on links within emails from friends or acquaintances which they wouldn’t normally send. Think twice before responding to a friend’s message requesting money. Always use bank and credit cards safely and securely. If offered an investment deal, always check that the firm is authorised on the Central Bank’s registers website.Take care when buying or selling goods online. If putting an item for sale in the local newspaper or on a website never accept a cheque or draft for an amount over the asking price.

SHARING OPTIONS