The current Active Bull List detailed in Table 1 is the list of the 75 highest EBI bulls that are considered active, in other words, have semen available.

To get on the Active Bull List a bull must have a calving proof, so many bulls that were used for the first time in 2024, are not on the list because they don’t have a calving proof.

The data used to generate the EBI is from the November 2024 evaluation, with no evaluation having taken place in January 2025 meaning the next evaluation will be at the end of this month.

This is why AI catalogues were printed and posted earlier this year – the data on a bull won’t have changed between November and the end of March.

Top bulls

Essentially, more up-to-date information on bulls will be available after the next run, but the majority of farmers will have picked their bulls by then

There shouldn’t be much change for the majority of bulls in the March run anyway, as very little new information will have been picked up in the meantime, except for calving traits and milk traits for first calved heifers of young sires that have been milk recorded.

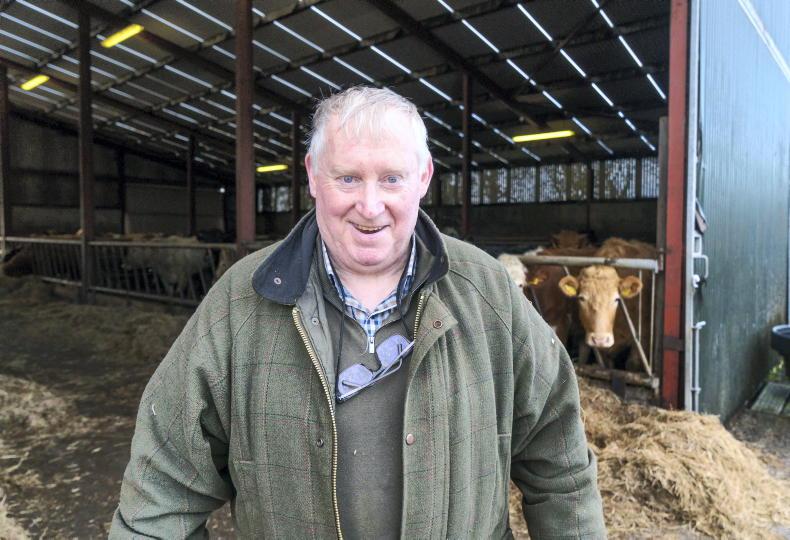

The top bull on the current list is FR8709 Olcastletown Mojo with an EBI of €375 bred by Robert Drake, Kildorrery, Co Cork.

Next on the list is FR8881 Barronstown Roger, bred by Tom and Eamonn Connelly, Loughmore, Co Tipperary. Interestingly, both bulls are sons of Saintbrigid Frank Joseph along with a number of other bulls on the list.

One interesting element to the current bull list is that there are 15 bulls on the list with a daughter proof. The highest EBI of these is FR7293 with an EBI of €348.

It’s important to remember that the only part of this bulls proof that is daughter proven is the milk element and this is based on milk recording data from 25 daughters in 23 herds, so the reliability of the proof will grow with time.

It is unusual though to see a daughter proven bull for milk make it on to the list, as more often than not the EBI of the young genomic bulls would bypass the older, recently daughter proven bulls.

TB

The inclusion of TB traits on the Active Bull List is a new departure and with the recent increase in TB incidence rate it is something that all farmers need to be mindful of when picking bulls.

It is outlined in greater detail on pages 56 and 57, but the colour coding indicates that some bulls are good for TB resistance, some need to be used with caution and others need to be avoided.

The question needs to be asked, should all bulls be screened on TB resistance before they make their way into AI?

An accurate TB status is known as soon as a calf is genotyped, yet, as we can see there are 15 bulls on the list that should not be used based on the likely increased prevalence of TB among their progeny.

There are 23 other bulls with an amber warning, meaning they should only be used with caution.

Intellectual property

One major change since the last Active Bull List was printed is the introduction of intellectual property (IP) rights on bulls. Each of the four big AI companies; Munster Bovine, Progressive Genetics; Dovea and Eurogene AI services all have IP rights attached to some of their AI bulls.

The affected bulls are primarily young Gene Ireland dairy bulls and young beef bulls that have entered stud and offered for sale for the first time this year.

The terms and conditions of the sale of these IP protected bulls is that the herdowner of the progeny of these bulls must get consent from the AI company the IP protected bull was purchased from, before selling the offspring to another AI company. The offspring are determined to be two generations.

So that includes sons and daughters of the IP protected bull, but also grandsons and granddaughters whether from the son or daughter line of the IP protected bull.

In the same way, the collection or sale of oocytes or embryos to other AI companies can only take place with the consent of the AI company that owns the IP protected bull.

These terms follow the animal, so if the animal is subsequently sold to another farmer, that farmer will need to obtain the required consent. It is not clear who is liable in the event that the required consents are not obtained.

The implications of the move won’t be fully known for some time. Certainly, the risk of different AI companies operating in genetic silos has increased. This could end up slowing down genetic gain in the breeding programme.

One thing we are seeing a lot more of is contract matings, whereby the AI company will propose to a farmer to use a certain bull on a certain cow and sign a contract stating they will give the AI company first option to buy that calf.

My understanding is, as that calf is already contracted, its birth won’t be visible to competing AI companies so they won’t be in a position to put an offer on that calf. This would mean the whole issue of cross licensing agreements between the AI companies would be futile. It’s an area thatwe will continue to monitor.

SHARING OPTIONS