Following over six months of price pressure from oversupply, it is of interest to see a sustained increase in the price of maize in the US.

The past few weeks and months have been dominated by news of increasing end-of-season stocks and lack of exports from the US, but the past week has seen a sustained increase in price on both the July and December contract positions.

As is frequently the case, weather is the primary driver of this sentiment reversal.

Floods have been a significant factor in parts of the US over the past six weeks or more and with them come the significant rainfall levels that cause the problem upstream of the floods.

While these facts were well-known, they had not been a big factor in the market because maize has good yield compensation ability in respect of late sowing.

However, now that the second half of May is with us and some earlier sown crops have to be resown due to wet, two options are being considered.

The first is a swap in use of the remaining acres from maize to soya beans. The second is the option to not plant and opt for crop insurance.

The fact that things have moved on to this point represents a real challenge to the acres sown to maize. This is the first tangible weather-related issue that has potential to have a real and permanent effect on production and so impact the market.

If things dried up in the morning many of these acres might still go into maize, so there is nothing absolute yet.

Maize supply and price

Some may still wonder why maize is of concern to us here in Ireland. The bottom line is that it has been more competitively priced than our cereals for the past season or more and, as such, it has taken over the market.

Maize did not have to fall in price to take market share – its price level gave it a considerable advantage. And the low price of maize was a combination of global production level, lack of exports from the US, cheap exports from south America arising from currency advantages and now higher than estimated production levels from that region.

The impact of possible reduced maize plantings is the major driver of this price recovery.

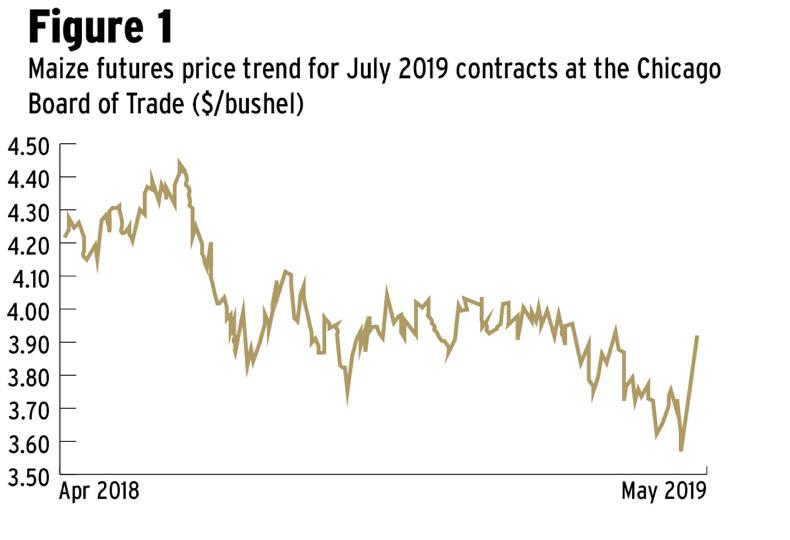

The July Chicago Board of Trade (CBOT) price had increased from a low of $3.43/bushel (bu) (€121.05/t) on 13 May to $3.896 (€137.49/t) on Monday of this week (Figure 1), and this increase has been uniform and consistent.

A higher price for maize in the US means a higher price for maize at ports, which should allow more price scope for cereals here.

Less cheap maize should help to keep the pressure off of small grain cereal prices

The price situation for December CBOT maize is broadly similar, but higher. It too hit a low of $3.636/bu (€128.32/t) on 13 May which recovered to $4.036/bu (€142.44/t) at the time of writing on Monday.

Less cheap maize should help to keep the pressure off of small grain cereal prices but these will be slower to recover because wheat is predicted to be in oversupply while maize itself was thought to be in deficit even before this production issue.

Wheat helped to a lesser degree

CBOT December wheat futures dropped to $4.422/bu (€145.65/t), also on 13 May, and this saw steady recovery to $4.94/bu (€162.72/t) by last Monday (Figure 2).

This mirrors the situation for July contracts except they are at a lower level.

As all cereals are interrelated in the feed market, it is hardly surprising that wheat is being pulled up by the recovery in maize.

If this price recovery continues for a few more weeks (wishful thinking) it could swing maize prices above our current estimates for harvest price here

However, neither of these recoveries can be taken as absolute, as we have seen many Lazarus-type recoveries in production in recent years. It will not be fact until after it has happened.

If this price recovery continues for a few more weeks (wishful thinking) it could swing maize prices above our current estimates for harvest price here.

While the French MATIF has increased from €173 to around €179/t for December wheat, it is likely to take a further problem in central Europe to add to optimism here.

Summary

The recovery in international grain prices over the past week is welcome, to say the least.

But this is a statement of sentiment in the futures market and may not directly transfer to physical or forward markets for the time being.

Often in the past we have seen the tremendous recovery potential of maize turn a poor start into a good output where growing conditions were favourable.

However, given that we are now in the second half of May, there is perhaps a bit more scope to be optimistic about reduced output for the coming season.

But we cannot forget that maize has already been on offer here in Ireland for as low as €165/t.

SHARING OPTIONS