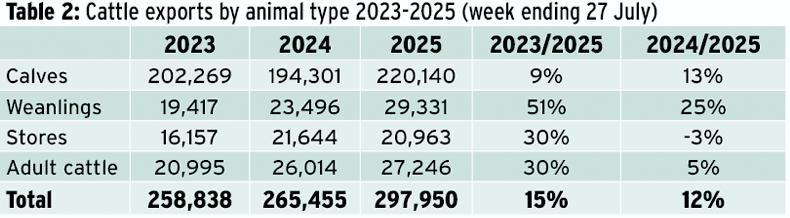

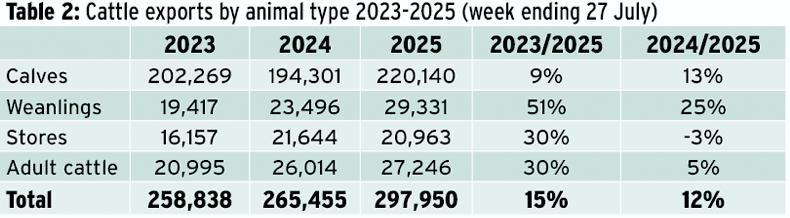

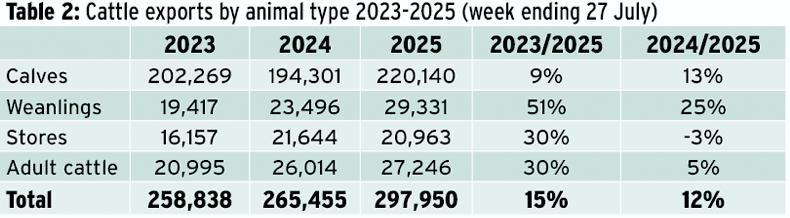

The first eight months of 2025 have been a whirlwind few months for live cattle exports. Almost all categories of stock have seen a growth in exports in 2025. Calves have been one of the big success stories of 2025 with calf exports up 13% on 2024 levels. There have been 220,410 calves exported so far in 2025 with a large proportion going to the Netherlands market.

This market also received a boost during the year for Irish calf exports in 2026. The Netherlands was going to implement a ban on Irish imported calves due to its IBR control policy.

This ban was to come into effect on 1 January 2026 but it has now extended the implementation of the ban until the middle of 2026 which should see the majority of Irish calves that were destined for this market exported during this time. However, it’s just a temporary fix with markets to be found for the 85,000 calves that were exported there in 2025.

Spain and Poland

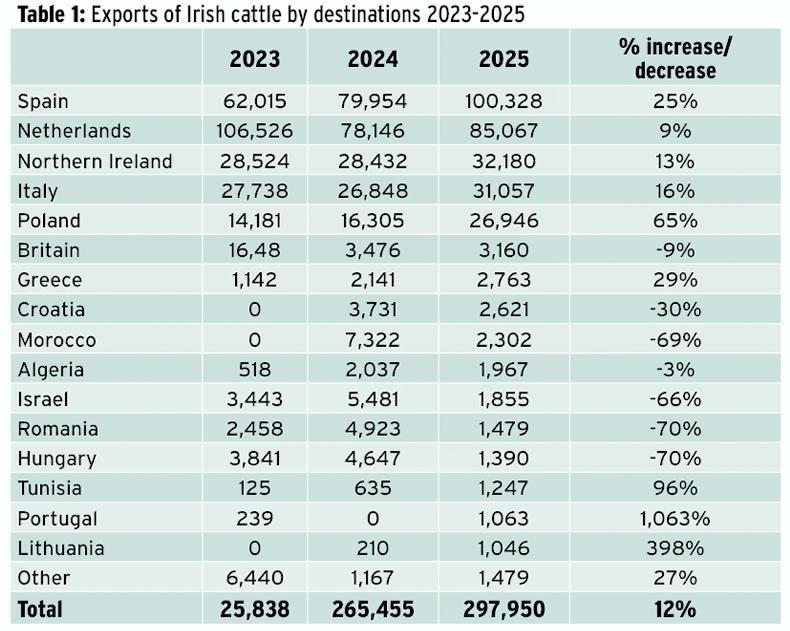

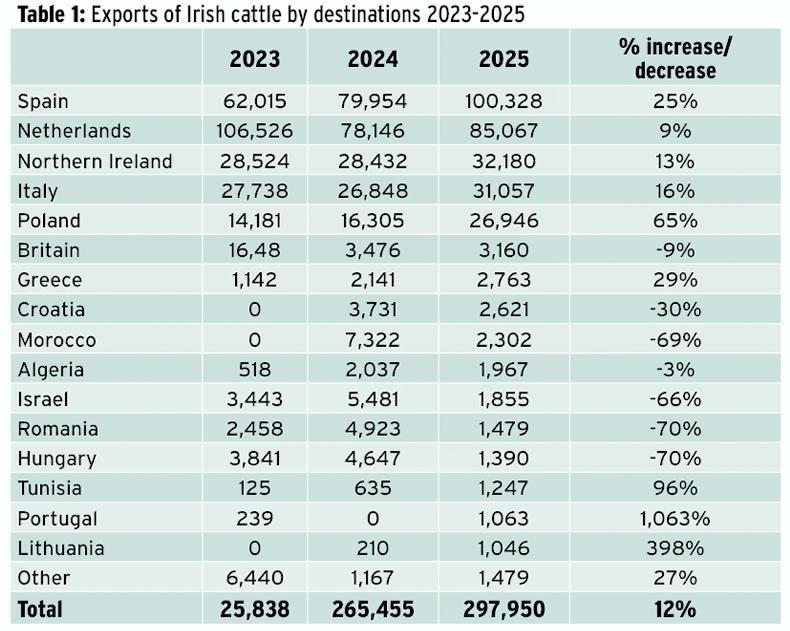

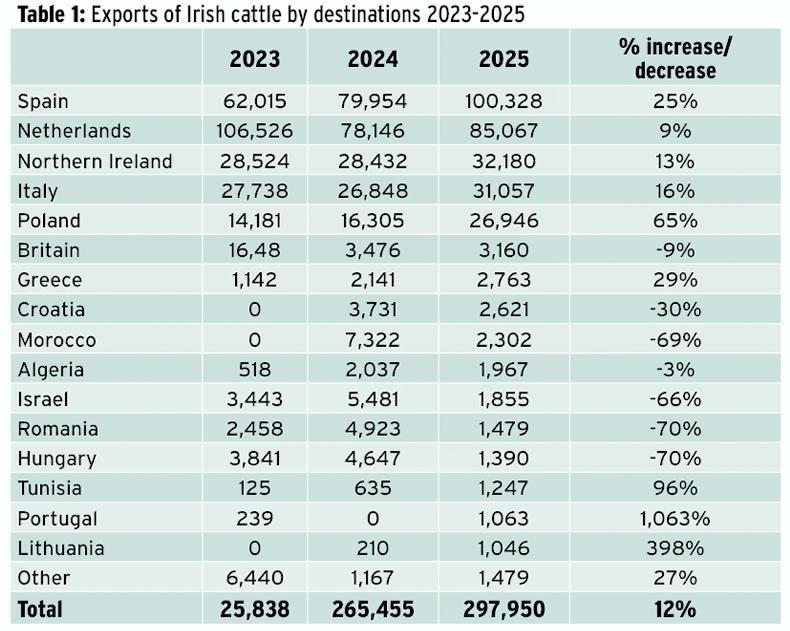

Spain has seen a big lift in Irish cattle imports in 2025 with a mixture of calves and weanlings now heading to the Spanish market. Live exports of Irish cattle to Spain is up 25% and it is hoped that the market for calves in particular will grow further in the future to take up some of the lost market in the Netherlands.

The fact that sexed semen usage is increasing is lowering the number of dairy x dairy male calves being born and increasing the number of traditionally bred calves being born, a calf that the Spanish market wants.

Table 1.

There has also been strong eastern European demand for Irish calves right up into the summer months this year with calf exporters still very active in marts around the country buying young calves and reared calves for European customers.

Calf exports to Poland, for example, are up to almost 27,000 for the first seven months of 2025, and up over 10,000 calves on 2024.

A bluetongue-ravaged mainland Europe has meant movement restrictions of calves and cattle have been put in place across much of Europe and this has been a big factor in Irish cattle being the cattle of choice for many European customers.

Speaking to the Irish Farmers Journal, Seamus McMenamin, manager for sheep meat and livestock at Bord Bia, said: “The year got off to a very strong start, however, trade has levelled off in the last few weeks.

Table 2.

“The calf export season was very strong, with firm demand for strong calves in continental markets despite tighter domestic supplies.”

The first eight months of 2025 have been a whirlwind few months for live cattle exports. Almost all categories of stock have seen a growth in exports in 2025. Calves have been one of the big success stories of 2025 with calf exports up 13% on 2024 levels. There have been 220,410 calves exported so far in 2025 with a large proportion going to the Netherlands market.

This market also received a boost during the year for Irish calf exports in 2026. The Netherlands was going to implement a ban on Irish imported calves due to its IBR control policy.

This ban was to come into effect on 1 January 2026 but it has now extended the implementation of the ban until the middle of 2026 which should see the majority of Irish calves that were destined for this market exported during this time. However, it’s just a temporary fix with markets to be found for the 85,000 calves that were exported there in 2025.

Spain and Poland

Spain has seen a big lift in Irish cattle imports in 2025 with a mixture of calves and weanlings now heading to the Spanish market. Live exports of Irish cattle to Spain is up 25% and it is hoped that the market for calves in particular will grow further in the future to take up some of the lost market in the Netherlands.

The fact that sexed semen usage is increasing is lowering the number of dairy x dairy male calves being born and increasing the number of traditionally bred calves being born, a calf that the Spanish market wants.

Table 1.

There has also been strong eastern European demand for Irish calves right up into the summer months this year with calf exporters still very active in marts around the country buying young calves and reared calves for European customers.

Calf exports to Poland, for example, are up to almost 27,000 for the first seven months of 2025, and up over 10,000 calves on 2024.

A bluetongue-ravaged mainland Europe has meant movement restrictions of calves and cattle have been put in place across much of Europe and this has been a big factor in Irish cattle being the cattle of choice for many European customers.

Speaking to the Irish Farmers Journal, Seamus McMenamin, manager for sheep meat and livestock at Bord Bia, said: “The year got off to a very strong start, however, trade has levelled off in the last few weeks.

Table 2.

“The calf export season was very strong, with firm demand for strong calves in continental markets despite tighter domestic supplies.”

SHARING OPTIONS