With a population of 1.3bn people, the potential of China as a market for Irish food is immense. The country has 20% of the world’s population, but only 9% of its arable land area. Over the last decade it has started to import dairy products. Prior to that the consumption of dairy was confined to milk produced within China. Now almost 30% of the dairy consumed in China is imported. It is the largest importer of dairy in the world, with a liquid milk equivalent of around 12bn litres imported last year. About 32bn litres of milk is produced in China.

New Zealand is the most dominant exporter to China. According to Rabobank’s Sandy Chen, it exports 71% of the milk powders, 89% of the butter and fats and 51% of the cheese into China. A free-trade agreement allows for tariff-free access for NZ produce into China. In many respects, NZ is like the outside farm for China.

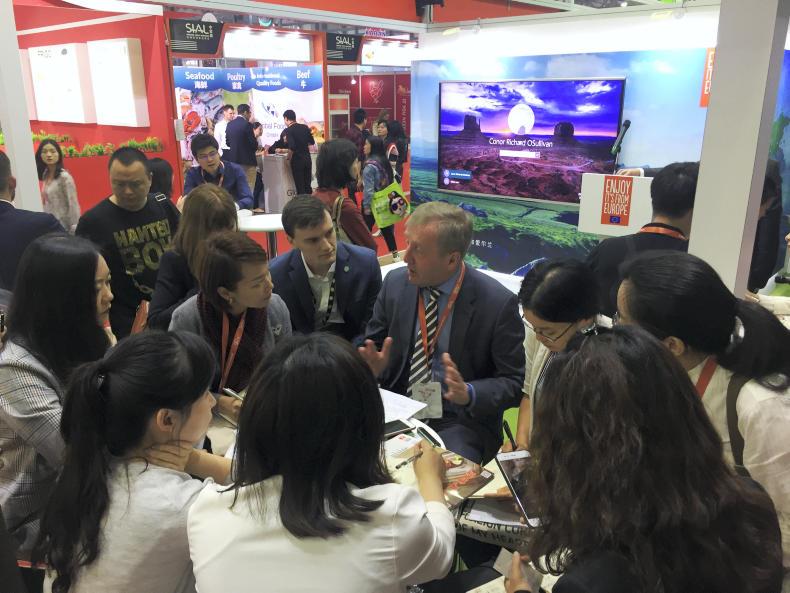

The Glanbia stand at the SIAL trade fair in China.

But the size of the population and the growth in dairy consumption allows room for others. The EU dominates the infant milk formula market, supplying 75% of the total imported by China. Ireland is just one of a number of players, accounting for 14% of the total imports.

In value terms, this accounts for around 95% of the total Irish dairy trade in China and, as China is the second-largest destination for Irish exports, the Chinese infant milk formula market is hugely important for Ireland.

Chen was speaking at a trade seminar in Shanghai organised by Bord Bia. Minister for Agriculture Michael Creed led a trade mission to China this week. The trade mission coincided with SIAL, the massive food trade fair held in Shanghai. Between SIAL and a big bakery trade fair last week, Irish dairy companies are out in force, trying to capture more of the Chinese market.

There are about nine huge halls at SIAL where countries and companies promote their food offerings covering all types of food.

Glanbia, Kerry and Dairygold have offices in China, with full-time employees on the ground making contacts and doing deals. Carbery had a stand at the bakery fair last week and had a presence at SIAL. It is pushing its mozzarella strongly. Mozzarella consumption is increasing in China, both on pizzas and in snacks. Carbery and Glanbia are investing in mozzarella production to reduce their dependence on cheddar.

Leaving aside Irish infant milk formula, which is marketed and sold by manufacturers such as Danone and Wyeth, €27m worth of other Irish dairy products were sold in China last year. This is small but growing, considering the size of the market. Glanbia has a consumer brand presence in China. It has launched a new UHT whipped cream, with a shelf life of six to nine months. Lakeland and Glanbia also have a presence in UHT milk.

Glanbia sell a range of UHT milk and creams in China

Of course, China is not without its challenges. The rate of population growth has declined, with 2m fewer babies born last year – a 14% drop. If this trend continues, it will affect the growth in the infant milk formula market.

The future relationship between imported and domestic product could be an issue. After the melamine food safety scares in the late 2000s, imported dairy products were seen as better quality and safer. However, people I spoke to in Shanghai are seeing a general change in the attitude of the Chinese. They are increasingly viewing Chinese made products as being superior to imported products, particularly in the area of manufacturing and technology.

The Bord Bia Irish trade stand at SIAL in Shanghai heavily promoted the green image of Ireland.

Whether the same perceptions will translate to food remains to be seen. As it stands, imported dairy products are cheaper and produced to a higher standard than Chinese. Demand for dairy in China is increasing by about 2% per year and is being matched by imports.

The structure of Chinese dairy farming is changing though, with the number of farms milking fewer than 100 cows halving since 2008 and the number of farms milking more than 1,000 cows increasing sixfold. Pollution and a scarcity of water and land will likely mean that no matter what the public perception is, China will always need the outside farm.

The Bord Bia Irish trade stand at SIAL trade fair in Shanghai, China.

With a population of 1.3bn people, the potential of China as a market for Irish food is immense. The country has 20% of the world’s population, but only 9% of its arable land area. Over the last decade it has started to import dairy products. Prior to that the consumption of dairy was confined to milk produced within China. Now almost 30% of the dairy consumed in China is imported. It is the largest importer of dairy in the world, with a liquid milk equivalent of around 12bn litres imported last year. About 32bn litres of milk is produced in China.

New Zealand is the most dominant exporter to China. According to Rabobank’s Sandy Chen, it exports 71% of the milk powders, 89% of the butter and fats and 51% of the cheese into China. A free-trade agreement allows for tariff-free access for NZ produce into China. In many respects, NZ is like the outside farm for China.

The Glanbia stand at the SIAL trade fair in China.

But the size of the population and the growth in dairy consumption allows room for others. The EU dominates the infant milk formula market, supplying 75% of the total imported by China. Ireland is just one of a number of players, accounting for 14% of the total imports.

In value terms, this accounts for around 95% of the total Irish dairy trade in China and, as China is the second-largest destination for Irish exports, the Chinese infant milk formula market is hugely important for Ireland.

Chen was speaking at a trade seminar in Shanghai organised by Bord Bia. Minister for Agriculture Michael Creed led a trade mission to China this week. The trade mission coincided with SIAL, the massive food trade fair held in Shanghai. Between SIAL and a big bakery trade fair last week, Irish dairy companies are out in force, trying to capture more of the Chinese market.

There are about nine huge halls at SIAL where countries and companies promote their food offerings covering all types of food.

Glanbia, Kerry and Dairygold have offices in China, with full-time employees on the ground making contacts and doing deals. Carbery had a stand at the bakery fair last week and had a presence at SIAL. It is pushing its mozzarella strongly. Mozzarella consumption is increasing in China, both on pizzas and in snacks. Carbery and Glanbia are investing in mozzarella production to reduce their dependence on cheddar.

Leaving aside Irish infant milk formula, which is marketed and sold by manufacturers such as Danone and Wyeth, €27m worth of other Irish dairy products were sold in China last year. This is small but growing, considering the size of the market. Glanbia has a consumer brand presence in China. It has launched a new UHT whipped cream, with a shelf life of six to nine months. Lakeland and Glanbia also have a presence in UHT milk.

Glanbia sell a range of UHT milk and creams in China

Of course, China is not without its challenges. The rate of population growth has declined, with 2m fewer babies born last year – a 14% drop. If this trend continues, it will affect the growth in the infant milk formula market.

The future relationship between imported and domestic product could be an issue. After the melamine food safety scares in the late 2000s, imported dairy products were seen as better quality and safer. However, people I spoke to in Shanghai are seeing a general change in the attitude of the Chinese. They are increasingly viewing Chinese made products as being superior to imported products, particularly in the area of manufacturing and technology.

The Bord Bia Irish trade stand at SIAL in Shanghai heavily promoted the green image of Ireland.

Whether the same perceptions will translate to food remains to be seen. As it stands, imported dairy products are cheaper and produced to a higher standard than Chinese. Demand for dairy in China is increasing by about 2% per year and is being matched by imports.

The structure of Chinese dairy farming is changing though, with the number of farms milking fewer than 100 cows halving since 2008 and the number of farms milking more than 1,000 cows increasing sixfold. Pollution and a scarcity of water and land will likely mean that no matter what the public perception is, China will always need the outside farm.

The Bord Bia Irish trade stand at SIAL trade fair in Shanghai, China.

SHARING OPTIONS