While many farmers will employ an agricultural consultant to complete their application for them, it’s also important that a farmer has a good idea of what is involved in a TAMS III application.

Certain criteria associated with TAMS might make farmers reconsider applications.

Caution needs to be exercised as well around the materials used, workmanship, submission of relevant payment claims and certificates, as well as the implications that the breakdown of a registered farm partnership might have, even after grant aid has been given.

Measuring investments

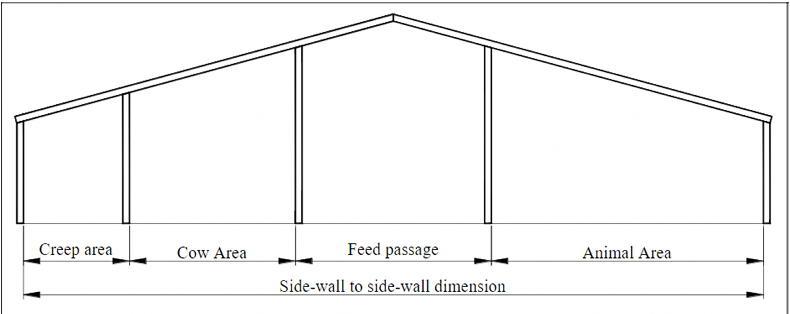

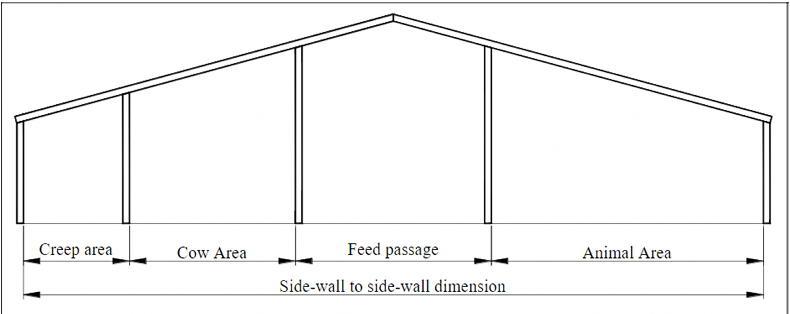

Different investments carry different levels of reference costs, eg slatted areas or creep areas and feed passages. Houses are measured internally, from the inner face of an external wall (Figure 1).

Figure 1: Side profile of a slatted shed, showing the measured areas in relation to the stanchions. \ Department of Agriculture, Food and the Marine

In a bovine house with a feed passage (internal or external), the animal area is measured from the back wall of the house (or from the inner flange of the stanchion where there are troughs or feed barriers hung) to the flange on the animal area side of the feed passage stanchion.

A creep area is measured from the back wall of the creep to the flange on the cow area side of the stanchion at the front of the creep.

The length of a building is to be taken internally, either between the internal faces of the gable walls, or if there are no walls, between the animal area side of the gable frame stanchions.

Feed passages are measured from the flange(s) on the animal area side of the stanchion, with the length of a drive-through feed passage measured between the internal faces of the building.

A single entrance feed passage (dead-end passage) is measured from the internal face at the entrance to the internal face of the back wall.

The length of a building for ancillary concrete shall be taken as the external length of the working side of the building.

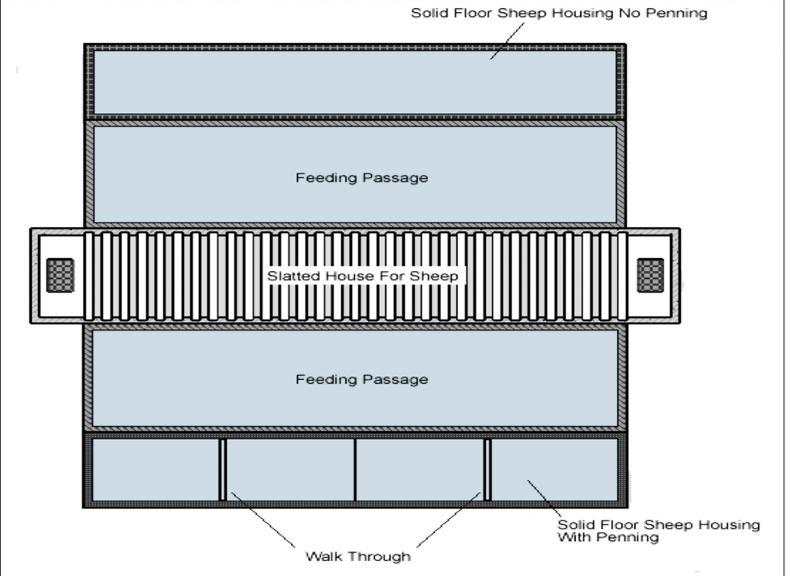

For sheep, goat or calf housing, there is no designated rate for internal or external feed passages, so the total structure will fall under the slatted/solid floor with/without penning for the chosen livestock.

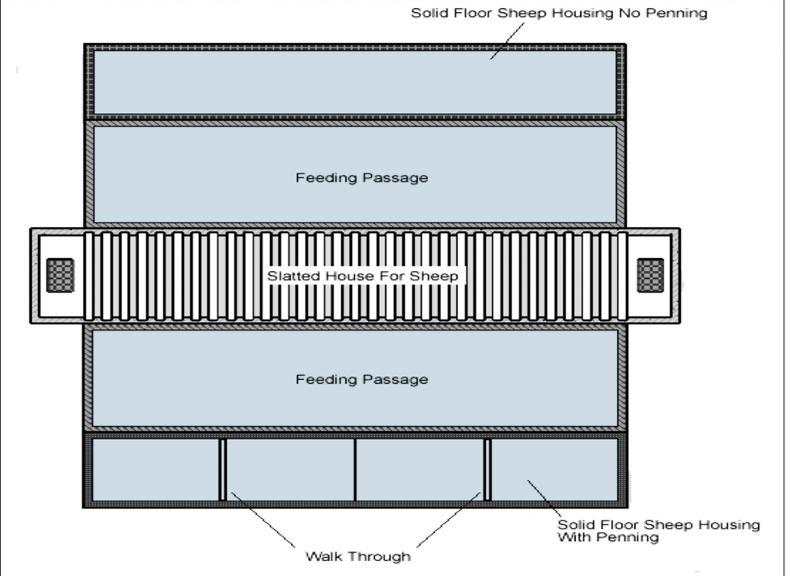

Where there are two types of sheep house within the one building (slatted and solid), the dividing line between the different types shall be taken as the centre line of the feed passage, or the centre of the pen divider as relevant (Figure 2).

Figure 2: Internal layout of a sheep shed with slatted and solid floor with and without penning. \ Department of Agriculture, Food and the Marine

The slatted area is taken as the width of the “slatted house for sheep’’, plus half of the width for each of the feed passages bordering it.

There are also penned and non-penned solid floor areas in this house, making it three separate costs.

Storage tanks for slurry located within buildings are a separate investment to livestock housing under TAMS. Therefore, a farmers can avail of TAMS to build a mass concrete slurry tank and build a non-grant spec livestock house on top of it if they so wish.

Grant aid for slurry stores include the costs of excavation, materials and labour costs of the tank plus the cost of backfilling.

There is no allowance made for difficult ground. However, an 8% allowance is given for construction of a new mass concrete tank in an existing animal building to allow for the confinement and the need to support the structure of the building.

To aid in calculating reference costs of slurry stores, the Department has created a spreadsheet online.

The applicant must input the tank length, width and depth, as well as the thickness of the external walls and any spine walls. From this, the applicant will receive the total cubic capacity of the tank as well as the reference cost per cubic metre, which should be input into the application. The reference costs include protective fencing and an agitation platform.

Replacement of slats over an existing tank, or for a new tank in an existing building, is covered under TAMS, as is retrofitting solid slabs in the place of slats. The replacement of beams, spine walls or any other features is not covered under TAMS.

The terms and conditions of TAMS III state that where planning permission is required for an investment, no application will be processed unless it is received with full planning permission attached.

Farmers thinking of applying for subsequent tranches should apply to their local council now to allow for any delays

Where applicable, a copy of the appropriate Environmental Impact Assessment undertaken as a requirement of the planning process must be submitted along with the grant of planning permission.

Applicants should note that planning permission takes between six and eight weeks to be granted, that is if there are no objections or issues that require further investigation.

While the window of time to have full planning permission received in time for tranche one of TAMS III is likely passed, farmers thinking of applying for subsequent tranches should apply to their local council now to allow for any delays.

Fencing (bovine or ovine) in general does not require planning permission.

However, if the proposed fencing (whether new or replacement) is in a Special Area of Conservation (SAC), a National Heritage Area (NHA), a Special Protection Area (SPA), or a Natura 2000 habitat or an upland or seaside area that has not been previously fenced or enclosed then planning permission or a declaration of exemption from the relevant local authority is also required at time of application. Grant aid will be awarded on a linear metre basis.

Registered farm partnerships

There are four separate issues that may arise from applying under a registered farm partnerships (RFP).

If a RFP dissolves prior to approval, then the application is null and void.

Where a RFP dissolves between the receipt of approval and submission of payment claim, then one of the former partners must be nominated as the recipient.

If an RFP dissolves after receipt of payment, the former partner(s) who have control of the land must undertake to use the investment for its intended purpose for a minimum of five years after receipt of grant aid.

This five-year period is also important regarding the RFP; should the RFP dissolve within the five-year period after receipt of grant aid, then the Department must be notified, with each case viewed on an independent basis.

The dissolution of a RFP can mean the reduction of payments, the reduction of the investment ceiling or the recoupment of payment. However, force majeure will be taken in to account and no monies will be recouped before the case is looked at.

Perhaps the most critical part of a TAMS grant is the submission of necessary certificates and receipts.

Any payments made (such as deposits) before written approval is granted are not eligible for grant aid. Payments made (including post payment cheques) made after the submission of payment claims are also ineligible.

Tax clearance certs must be provided for both the contractor involved in the project and the farmer receiving the grant

Materials used in the construction of investment must, where specified, be accompanied by relevant quality certificates (ready-mix concrete, slats etc). All quality certificates, tax clearance certificates and other relevant documentation must be lodged with the payment claim.

A payment claim may be rejected or reduced if required documentation is not lodged within the specified time frame.

Tax clearance certs must be provided for both the contractor involved in the project and the farmer receiving the grant.

Failure to comply with any of the above can result in part or all funding to be retracted.

Submission of an application for TAMS also gives permission to the Department to carry out unannounced inspections of the works carried out.

Other issues found during the inspection regarding animal welfare or nutrient storage issues may be reported to the relevant branch of the Department of Agriculture.

While many farmers will employ an agricultural consultant to complete their application for them, it’s also important that a farmer has a good idea of what is involved in a TAMS III application.

Certain criteria associated with TAMS might make farmers reconsider applications.

Caution needs to be exercised as well around the materials used, workmanship, submission of relevant payment claims and certificates, as well as the implications that the breakdown of a registered farm partnership might have, even after grant aid has been given.

Measuring investments

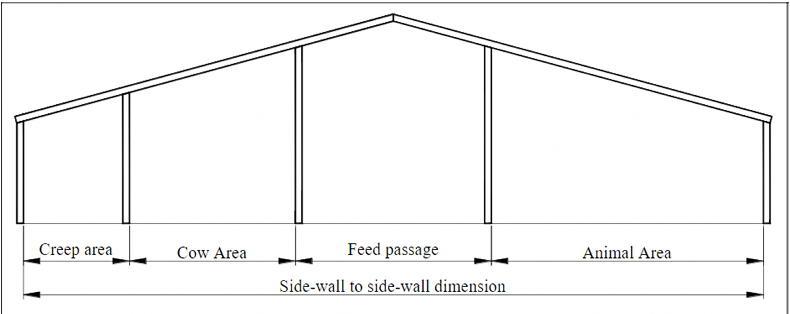

Different investments carry different levels of reference costs, eg slatted areas or creep areas and feed passages. Houses are measured internally, from the inner face of an external wall (Figure 1).

Figure 1: Side profile of a slatted shed, showing the measured areas in relation to the stanchions. \ Department of Agriculture, Food and the Marine

In a bovine house with a feed passage (internal or external), the animal area is measured from the back wall of the house (or from the inner flange of the stanchion where there are troughs or feed barriers hung) to the flange on the animal area side of the feed passage stanchion.

A creep area is measured from the back wall of the creep to the flange on the cow area side of the stanchion at the front of the creep.

The length of a building is to be taken internally, either between the internal faces of the gable walls, or if there are no walls, between the animal area side of the gable frame stanchions.

Feed passages are measured from the flange(s) on the animal area side of the stanchion, with the length of a drive-through feed passage measured between the internal faces of the building.

A single entrance feed passage (dead-end passage) is measured from the internal face at the entrance to the internal face of the back wall.

The length of a building for ancillary concrete shall be taken as the external length of the working side of the building.

For sheep, goat or calf housing, there is no designated rate for internal or external feed passages, so the total structure will fall under the slatted/solid floor with/without penning for the chosen livestock.

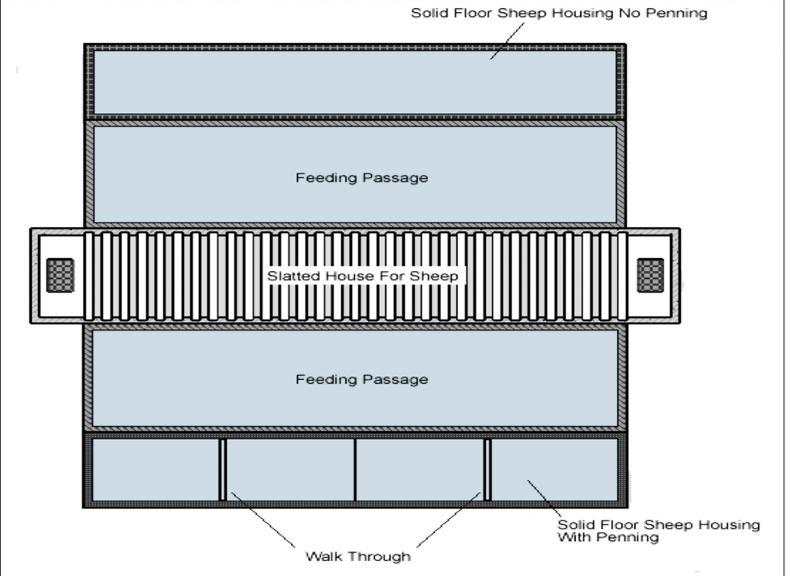

Where there are two types of sheep house within the one building (slatted and solid), the dividing line between the different types shall be taken as the centre line of the feed passage, or the centre of the pen divider as relevant (Figure 2).

Figure 2: Internal layout of a sheep shed with slatted and solid floor with and without penning. \ Department of Agriculture, Food and the Marine

The slatted area is taken as the width of the “slatted house for sheep’’, plus half of the width for each of the feed passages bordering it.

There are also penned and non-penned solid floor areas in this house, making it three separate costs.

Storage tanks for slurry located within buildings are a separate investment to livestock housing under TAMS. Therefore, a farmers can avail of TAMS to build a mass concrete slurry tank and build a non-grant spec livestock house on top of it if they so wish.

Grant aid for slurry stores include the costs of excavation, materials and labour costs of the tank plus the cost of backfilling.

There is no allowance made for difficult ground. However, an 8% allowance is given for construction of a new mass concrete tank in an existing animal building to allow for the confinement and the need to support the structure of the building.

To aid in calculating reference costs of slurry stores, the Department has created a spreadsheet online.

The applicant must input the tank length, width and depth, as well as the thickness of the external walls and any spine walls. From this, the applicant will receive the total cubic capacity of the tank as well as the reference cost per cubic metre, which should be input into the application. The reference costs include protective fencing and an agitation platform.

Replacement of slats over an existing tank, or for a new tank in an existing building, is covered under TAMS, as is retrofitting solid slabs in the place of slats. The replacement of beams, spine walls or any other features is not covered under TAMS.

The terms and conditions of TAMS III state that where planning permission is required for an investment, no application will be processed unless it is received with full planning permission attached.

Farmers thinking of applying for subsequent tranches should apply to their local council now to allow for any delays

Where applicable, a copy of the appropriate Environmental Impact Assessment undertaken as a requirement of the planning process must be submitted along with the grant of planning permission.

Applicants should note that planning permission takes between six and eight weeks to be granted, that is if there are no objections or issues that require further investigation.

While the window of time to have full planning permission received in time for tranche one of TAMS III is likely passed, farmers thinking of applying for subsequent tranches should apply to their local council now to allow for any delays.

Fencing (bovine or ovine) in general does not require planning permission.

However, if the proposed fencing (whether new or replacement) is in a Special Area of Conservation (SAC), a National Heritage Area (NHA), a Special Protection Area (SPA), or a Natura 2000 habitat or an upland or seaside area that has not been previously fenced or enclosed then planning permission or a declaration of exemption from the relevant local authority is also required at time of application. Grant aid will be awarded on a linear metre basis.

Registered farm partnerships

There are four separate issues that may arise from applying under a registered farm partnerships (RFP).

If a RFP dissolves prior to approval, then the application is null and void.

Where a RFP dissolves between the receipt of approval and submission of payment claim, then one of the former partners must be nominated as the recipient.

If an RFP dissolves after receipt of payment, the former partner(s) who have control of the land must undertake to use the investment for its intended purpose for a minimum of five years after receipt of grant aid.

This five-year period is also important regarding the RFP; should the RFP dissolve within the five-year period after receipt of grant aid, then the Department must be notified, with each case viewed on an independent basis.

The dissolution of a RFP can mean the reduction of payments, the reduction of the investment ceiling or the recoupment of payment. However, force majeure will be taken in to account and no monies will be recouped before the case is looked at.

Perhaps the most critical part of a TAMS grant is the submission of necessary certificates and receipts.

Any payments made (such as deposits) before written approval is granted are not eligible for grant aid. Payments made (including post payment cheques) made after the submission of payment claims are also ineligible.

Tax clearance certs must be provided for both the contractor involved in the project and the farmer receiving the grant

Materials used in the construction of investment must, where specified, be accompanied by relevant quality certificates (ready-mix concrete, slats etc). All quality certificates, tax clearance certificates and other relevant documentation must be lodged with the payment claim.

A payment claim may be rejected or reduced if required documentation is not lodged within the specified time frame.

Tax clearance certs must be provided for both the contractor involved in the project and the farmer receiving the grant.

Failure to comply with any of the above can result in part or all funding to be retracted.

Submission of an application for TAMS also gives permission to the Department to carry out unannounced inspections of the works carried out.

Other issues found during the inspection regarding animal welfare or nutrient storage issues may be reported to the relevant branch of the Department of Agriculture.

SHARING OPTIONS