Analysis of MartWatch prices this year has shown that farmers are becoming increasingly focused on animal quality when buying cattle. This has particularly been the case in the bullock categories.

Analysis of the average price paid in 2017 for a 450kg bullock and 550kg bullock shows that the differential between the price paid for the bottom third of cattle compared with the top third has widened once again.

In the case of 400kg to 500kg steers, there is an 87c/kg differential between the top- and bottom-quality cattle, which translates into a staggering €390/head.

In the case of forward stores from 500kg to 600kg, the difference between the top third and bottom third was 71c/kg or €391/head. In the past year, the differential between the top third and bottom third has increased by €20 to €25/head.

The gap has increased year on year for the last five years, with 2015 being the exception. High cattle prices in 2015 resulted in farmers opting to buy lesser-quality cattle, while in contrast, in years where cattle are more plentiful, farmers tend to focus harder on securing better-quality cattle.

In the case of store heifers, the differential between the top third and bottom third has held steady at 69c/kg in the case of 400kg to 500kg heifers and 60c/kg in the case of heavier 500kg to 600kg heifers.

On a per-head basis, this equates to a price gap of €310/head between top- and bottom-quality 400kg to 500kg stores and up to €330/head of a gap in forward store heifers.

Dairy crosses feel pain

Angus and Hereford bullocks from the dairy herd have been met with reduced demand at marts right across the country.

Dairy calf births continue to increase year on year, with almost 165,000 additional dairy births recorded per year between 2014 and 2016.

The majority of the increased calves are Angus and Hereford, resulting in much more choice for specialist finishers.

As a result of the increased supply and reduction in the quality of cattle on offer, prices have been affected.

In autumn 2016, Angus bullocks and heifers with dairy genetics sold fairly freely from €1.95/kg to €2.05/kg. However, in 2017, most marts reported prices averaging €1.80kg to €1.90/kg at a time when better-quality continental bullocks saw prices running a little ahead of the same time last year.

Furthermore, several mart managers have commented that the quality of Angus calves on offer in 2017 was back on 2016 levels, which raises questions over the prices of the 2017 crop going forward.

In real terms, Angus bullocks and heifers saw prices drop by about €50 to €100/head when compared with the same time in 2016.

But in some cases where plainer cattle have gone for sale that would not be well enough conformed to meet the factory specifications in order to attain bonus payments, these cattle have been back by up to €150/head on last year.

In the case of Angus-crosses, finishers are no longer just looking for black cattle with AAX on the card, but are focused on an animal that will achieve a carcase grade of O= or better.

Those who are selling Angus and Hereford-cross cattle at weights of 500kg and upwards are faring better than those selling a slightly more backward animal at 400kg to 450kg. It is these lighter, plainer stores that are being met with a more variable trade at times.

Average store prices up

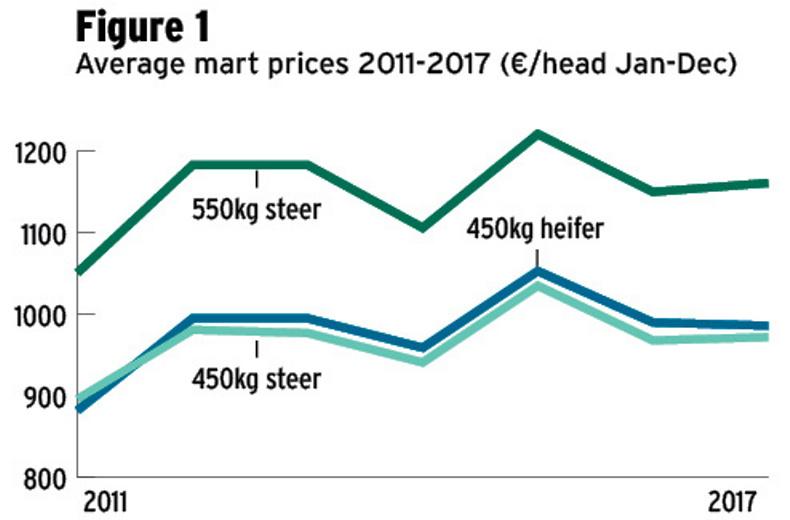

Further analysis of the figures shows that the average 450kg bullock price increased by about €10/head on last year, while heavier bullocks saw average prices running at about € 10 to €12/head above last year.

The top third of bullocks saw a much greater increase in prices, with the average price paid for the top third of 400kg to 500kg bullocks increasing by €12 to €15/head.

In the case of heavy bullocks over 500kg and 600kg, prices of the top third pushed ahead by about €25/head on 2016.

In the case of heavy heifers, a very similar trend was evident, with the average 550kg heifer price running €11/head above last year’s average, while the top third saw prices in 2017 running €16 to €17/head above the 2016 levels.

While this is positive, we must bear in mind that while 2017 saw prices move in a positive direction, the uncertainty caused by Brexit in 2016 had a downward effect on prices in that year when compared with the highs of 2015.

Five-year average

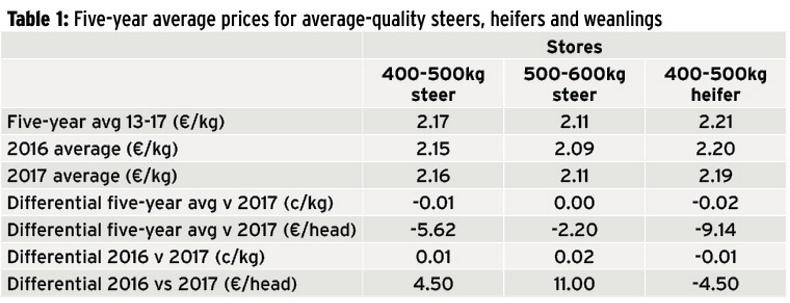

The average price paid for bullocks and heifers in 2017 is on par with the five-year average.

The price paid for a 550kg steer over the past five years was €1,161/head, with the average 450kg steer making €977/head.

In 2017, forward stores are on par, but lighter store heifer and bullock prices are running only marginally behind the five-year average. However, in 2015 the average price paid was €60/head above the five-year average.

Stronger summer months

Another feature of the trade in 2017 was the flow of cattle through the marts. In previous years, we saw increasing seasonality year after year where numbers peaked in March/April and again in October/November, with very low numbers on offer in the summer months.

However, in 2017, almost all marts reported throughput well up on previous years.

While there is no exact science behind the reason for this, one can only presume that strong demand and prices meant that sellers were tempted out week after week with cattle to the marts in order to make use of the steady prices paid.

This feature continued right through the year. While numbers peaked in October/ November, there was no real glut of cattle through the marts in any given period, which helped keep prices and demand steady.

All in all, the majority of marts reported that numbers were up in 2017. In the majority of cases, this is down to large numbers of cull cows passing through marts.

Cull cow numbers up

Changes in the Brucellosis testing regimes in autumn 2015 had a positive impact on the number of cows being traded through marts for that year and this has continued since then. Mart managers in many areas have reported record cow entries for 2017 compared with 2016. There are a few reasons for this.

The first is that, in the south, there are increased numbers of dairy cull cows coming to the fore, in line with the increased national dairy herd.

In addition, the number of dairy farmers holding cull cows on and finishing them to beef has decreased in recent years.

In the north, northwest and midlands, a poor autumn and early housing of stock has placed pressure on fodder reserves. This in turn has resulted in more farmers opting to scan and sell cull cows early, creating many large weekly cow sales at marts.

The final reason is a strong beef trade. In 2017, the average price paid for O grade cows increased by 16c/kg on 2016 levels. In addition, R grade cows saw prices rise by 19c/kg on 2016 levels.

With better prices paid in factories for cull cows and improved demand for manufacturing beef, factory agents have been very active for all types of cull cows.

This has led to improved prices paid at marts for culls, with more and more farmers opting to sell live than go straight to the factory.

In some cases, where farmers would only be slaughtering small numbers at any one time, they can do better in the mart than going straight for slaughter, particularly in the case of well-fleshed heavy cows.

SHARING OPTIONS