The recent discovery of two atypical cases of BSE in Brazil has had an immediate impact on Brazil’s beef business, with an immediate suspension of beef exports to China pending investigation.

This has been confirmed by ABIEC, Brazil’s meat exporters’ association, as having come into effect on Saturday 4 September.

This will be a familiar experience for Irish farmers and exporters.

In May 2020, an atypical case of BSE was discovered in Ireland and exports to China were duly suspended as per the protocol.

Unfortunately, despite a full investigation and engagement between the Department of Agriculture and the Chinese authorities, Irish beef has not been cleared to resume exports to China.

Scale of beef trade between Brazil and China

Brazil’s most recent discovery of an atypical BSE case was identified in 2019 and then exports to China were also suspended, but were cleared to resume 15 days later. Brazil is the main source of China’s beef imports, supplying 431,000t out of the 1.1m tonnes or 38% of all beef imported in the first six months of 2021.

China’s demand for beef has exploded over the past decade, moving from around 100,000t in total for 2011 to over 2m tonnes being predicted for 2021.

Parallel to this demand has been the growth in supply to China from Brazil.

Looking again at the figures for the first half of the year, in 2019, China’s beef imports from Brazil were 149,000t or just one-third of what they are in 2021. China is dependent on Brazil for beef supply but Brazil is also dependant on China as a market for its beef exports.

China’s demand for beef has exploded over the past decade

A report published by ABIEC for the first 11 months of 2020 shows that out of Brazil’s 2m tonnes of beef exports, 780,000t went to China, which was an increase of 88% on the same period in 2019.

Similarities between Brazil-China and Ireland-UK

There is a massive level of mutual dependency between China and Brazil for beef trade, not dissimilar to that between the UK and Ireland.

China needs supplies way beyond what it can produce and Brazil produces way beyond what it needs for its domestic market.

Hence the natural fit between a major exporting and importing country for beef trading.

This should hasten the process for a speedy investigation and resolution of trade between Brazil and China for beef.

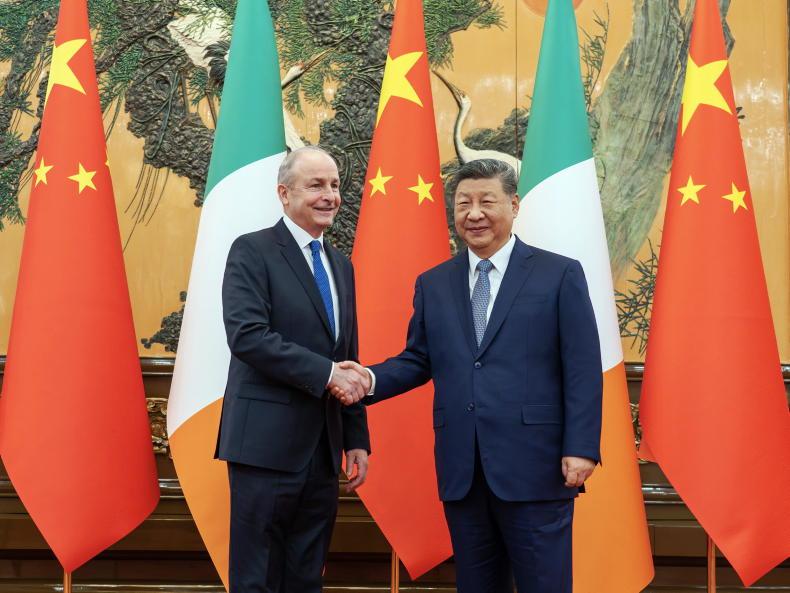

The question now is can the Irish Government get the resumption of Irish beef exports to China, 15 months after our discovery of an atypical BSE case?

The circumstances are exactly the same, with the same procedures followed.

The big difference was the ability of Brazil to get trade resumed after 15 days in 2019 while 15 months after the Irish case in May 2020, Irish beef exports to China have not resumed. With Brazil now under the spotlight in China again, it is surely an opportunity for the Irish Government to persuade China to consider Ireland in the same context as Brazil.

EU Impact

Brazil is the largest supplier of beef imported by the EU, accounting for 84,000t carcase weight equivalent, 38% of the 224,000t EU total.

This is a particularly sensitive issue for Irish farmers because Brazil does not have a full national traceability system in place for its national cattle herd of 188m cattle.

In fact, for its export business with the EU, all that is required is that cattle are tagged and registered 90 days prior to slaughter for export unlike Ireland where calves have to be tagged and registered within 28 days of birth.

Market reaction

The immediate reaction in Brazil at the end of the week was for factories to pause on cattle slaughtering and a 3% dip in prices according to South American agricultural media.

If Brazil secures a quick resumption of trade with China, the market impact will be minimal. If Brazil is out for a prolonged period, then the EU market will be again targeted for larger volumes of beef exports.

This is where the impact would be felt by Irish farmers as increased supply would depress EU markets.

On the other hand, if the EU were to adopt China’s policy and suspend imports from Brazil, then the EU and world markets would have a huge deficit in supply which would only drive Irish prices up.

Regionalisation not an option dealing with Brazil

In terms of size, the entire EU would comfortably fit inside Brazil’s land mass, and given that some Brazilian states are the size of large EU countries like France and Spain, these are huge administrative areas in their own right.

Animal health is dealt with in general on a member state basis to an EU standard, hence some countries have more international trade approvals than others.

In the past, Brazil has sought to operate on a state-by-state basis for trade on issues like foot-and-mouth disease.

However, for that to work properly, a full national traceability system is necessary given the potential for cattle to move from one region to another. In its absence, such trade should not take place.

History of unsatisfactory audits

The EU’s most recent Food and Veterinary Office (FVO) audit report on Brazil was scathing in its criticism of how controls are operated in the country.

As the summary noted, it wasn’t a one-off occurrence either: “It is of particular concern that most of the shortcomings detected during this audit were the subject of recommendations in previous DG SANTE audits.

“The Brazilian competent authorities had provided written guarantees that the issues concerned by the previous recommendations had been addressed. However, the findings of this audit demonstrate that those previous guarantees were not reliable on some key EU requirements.”

Restrictions

Given the restrictions imposed on Irish and EU farmers in operating their farms, the relaxed EU approach to trade with Brazil angers farmers.

When this report was published in 2017, then IFA president Joe Healy said the audit revealed that Brazil “cannot guarantee European consumers that meat products exported to the EU have been produced in accordance with EU requirements”.

Former IFA livestock chair Angus Woods and former IFA president Joe Healy protesting against Mercosur at the European Commission offices in Dublin. \ Finbarr O'Rourke

Brazil discovering two cases of atypical BSE is not in itself a particular issue.

Atypical BSE cases occur from time to time in older cattle and are regarded as complete outliers with no impact on BSE negligible risk status with the OIE, which is responsible for global animal health. The issue does pose a couple of questions though.

First, if Brazil can fast-track the resumption of beef exports to China, why can the Irish Government not achieve the same for Irish exporters.

The other question is around wider BSE monitoring in Brazil. These two atypical BSE cases were discovered by the animal’s erratic behaviour prior to slaughter.

Brazil claims to never have had a classic case of BSE, the version that is related to contaminated animal feed. In the absence of a national traceability system, BSE monitoring cannot be as comprehensive as it is in Ireland.

The repeated failings in Brazil’s system, as found in successive FVO reports, clearly indicates that Brazil functions to a different level than what is required from Irish and EU producers.

This is an issue that was actively campaigned on by Irish farm organisations in the decade preceding the 2017 EU report but has been dormant, especially since the Mercosur trade deal was announced in June 2019 and Farm to Fork became the policy structure for EU agriculture.

Sustainability has been the primary focus in recent times when assessing Brazil’s trade with the EU but the wider standards debate has also to return to the fore.

The recent discovery of two atypical cases of BSE in Brazil has had an immediate impact on Brazil’s beef business, with an immediate suspension of beef exports to China pending investigation.

This has been confirmed by ABIEC, Brazil’s meat exporters’ association, as having come into effect on Saturday 4 September.

This will be a familiar experience for Irish farmers and exporters.

In May 2020, an atypical case of BSE was discovered in Ireland and exports to China were duly suspended as per the protocol.

Unfortunately, despite a full investigation and engagement between the Department of Agriculture and the Chinese authorities, Irish beef has not been cleared to resume exports to China.

Scale of beef trade between Brazil and China

Brazil’s most recent discovery of an atypical BSE case was identified in 2019 and then exports to China were also suspended, but were cleared to resume 15 days later. Brazil is the main source of China’s beef imports, supplying 431,000t out of the 1.1m tonnes or 38% of all beef imported in the first six months of 2021.

China’s demand for beef has exploded over the past decade, moving from around 100,000t in total for 2011 to over 2m tonnes being predicted for 2021.

Parallel to this demand has been the growth in supply to China from Brazil.

Looking again at the figures for the first half of the year, in 2019, China’s beef imports from Brazil were 149,000t or just one-third of what they are in 2021. China is dependent on Brazil for beef supply but Brazil is also dependant on China as a market for its beef exports.

China’s demand for beef has exploded over the past decade

A report published by ABIEC for the first 11 months of 2020 shows that out of Brazil’s 2m tonnes of beef exports, 780,000t went to China, which was an increase of 88% on the same period in 2019.

Similarities between Brazil-China and Ireland-UK

There is a massive level of mutual dependency between China and Brazil for beef trade, not dissimilar to that between the UK and Ireland.

China needs supplies way beyond what it can produce and Brazil produces way beyond what it needs for its domestic market.

Hence the natural fit between a major exporting and importing country for beef trading.

This should hasten the process for a speedy investigation and resolution of trade between Brazil and China for beef.

The question now is can the Irish Government get the resumption of Irish beef exports to China, 15 months after our discovery of an atypical BSE case?

The circumstances are exactly the same, with the same procedures followed.

The big difference was the ability of Brazil to get trade resumed after 15 days in 2019 while 15 months after the Irish case in May 2020, Irish beef exports to China have not resumed. With Brazil now under the spotlight in China again, it is surely an opportunity for the Irish Government to persuade China to consider Ireland in the same context as Brazil.

EU Impact

Brazil is the largest supplier of beef imported by the EU, accounting for 84,000t carcase weight equivalent, 38% of the 224,000t EU total.

This is a particularly sensitive issue for Irish farmers because Brazil does not have a full national traceability system in place for its national cattle herd of 188m cattle.

In fact, for its export business with the EU, all that is required is that cattle are tagged and registered 90 days prior to slaughter for export unlike Ireland where calves have to be tagged and registered within 28 days of birth.

Market reaction

The immediate reaction in Brazil at the end of the week was for factories to pause on cattle slaughtering and a 3% dip in prices according to South American agricultural media.

If Brazil secures a quick resumption of trade with China, the market impact will be minimal. If Brazil is out for a prolonged period, then the EU market will be again targeted for larger volumes of beef exports.

This is where the impact would be felt by Irish farmers as increased supply would depress EU markets.

On the other hand, if the EU were to adopt China’s policy and suspend imports from Brazil, then the EU and world markets would have a huge deficit in supply which would only drive Irish prices up.

Regionalisation not an option dealing with Brazil

In terms of size, the entire EU would comfortably fit inside Brazil’s land mass, and given that some Brazilian states are the size of large EU countries like France and Spain, these are huge administrative areas in their own right.

Animal health is dealt with in general on a member state basis to an EU standard, hence some countries have more international trade approvals than others.

In the past, Brazil has sought to operate on a state-by-state basis for trade on issues like foot-and-mouth disease.

However, for that to work properly, a full national traceability system is necessary given the potential for cattle to move from one region to another. In its absence, such trade should not take place.

History of unsatisfactory audits

The EU’s most recent Food and Veterinary Office (FVO) audit report on Brazil was scathing in its criticism of how controls are operated in the country.

As the summary noted, it wasn’t a one-off occurrence either: “It is of particular concern that most of the shortcomings detected during this audit were the subject of recommendations in previous DG SANTE audits.

“The Brazilian competent authorities had provided written guarantees that the issues concerned by the previous recommendations had been addressed. However, the findings of this audit demonstrate that those previous guarantees were not reliable on some key EU requirements.”

Restrictions

Given the restrictions imposed on Irish and EU farmers in operating their farms, the relaxed EU approach to trade with Brazil angers farmers.

When this report was published in 2017, then IFA president Joe Healy said the audit revealed that Brazil “cannot guarantee European consumers that meat products exported to the EU have been produced in accordance with EU requirements”.

Former IFA livestock chair Angus Woods and former IFA president Joe Healy protesting against Mercosur at the European Commission offices in Dublin. \ Finbarr O'Rourke

Brazil discovering two cases of atypical BSE is not in itself a particular issue.

Atypical BSE cases occur from time to time in older cattle and are regarded as complete outliers with no impact on BSE negligible risk status with the OIE, which is responsible for global animal health. The issue does pose a couple of questions though.

First, if Brazil can fast-track the resumption of beef exports to China, why can the Irish Government not achieve the same for Irish exporters.

The other question is around wider BSE monitoring in Brazil. These two atypical BSE cases were discovered by the animal’s erratic behaviour prior to slaughter.

Brazil claims to never have had a classic case of BSE, the version that is related to contaminated animal feed. In the absence of a national traceability system, BSE monitoring cannot be as comprehensive as it is in Ireland.

The repeated failings in Brazil’s system, as found in successive FVO reports, clearly indicates that Brazil functions to a different level than what is required from Irish and EU producers.

This is an issue that was actively campaigned on by Irish farm organisations in the decade preceding the 2017 EU report but has been dormant, especially since the Mercosur trade deal was announced in June 2019 and Farm to Fork became the policy structure for EU agriculture.

Sustainability has been the primary focus in recent times when assessing Brazil’s trade with the EU but the wider standards debate has also to return to the fore.

SHARING OPTIONS