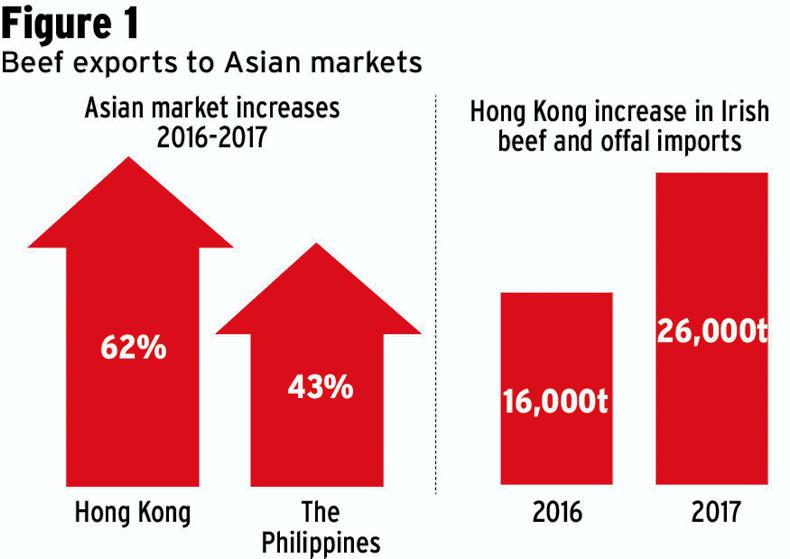

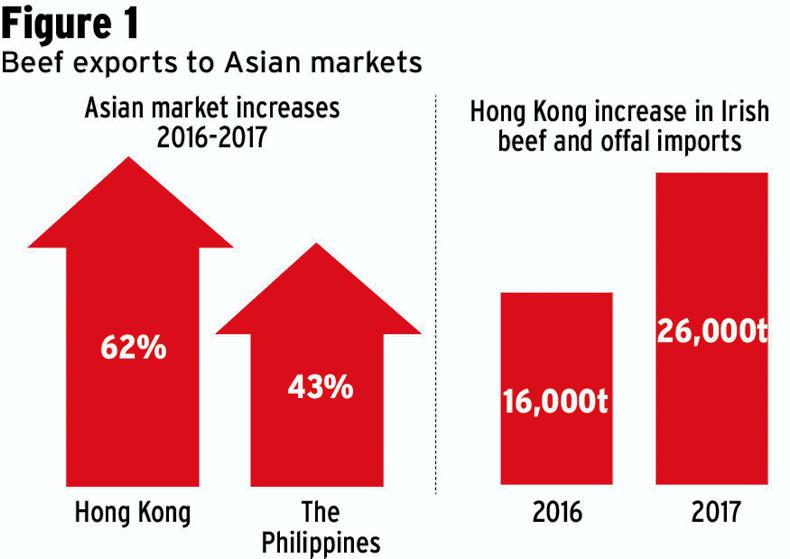

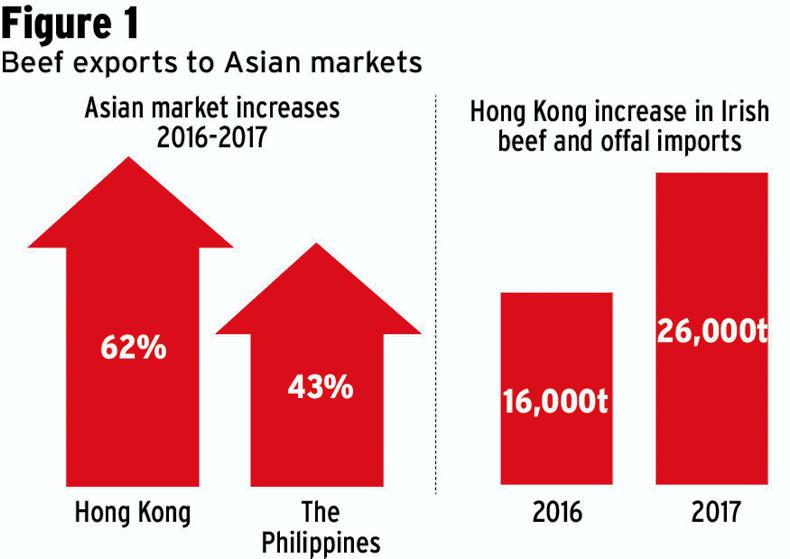

The final beef export figures for 2017 were revealed this week. While the UK remains the main market by a huge distance, taking 275,000t, it was the Asian markets that showed the most growth.

Hong Kong jumped 10,000t, from 16,000t in 2016 to 26,000t in 2017, for Irish beef and offal. This makes it the fourth most important market by volume of beef and offal, with France second to the UK on 52,000t and the Netherlands third on 39,000t.

The other important markets for large volumes of Irish beef are also in Europe, with Italy taking 25,000t in 2017 followed by Sweden on 24,000t. There is then a further gap back to Germany on 17,000t while Spain took 10,000t.

Meanwhile, at the other end of the scale, the USA took just 1,571t last year, which was even lower than the previous year when 1,778t of Irish beef went to the USA.

Movers in 2017

The Hong Kong and Philippines were the major story for sales in 2017, with respective increases of 62% and 43%. Elsewhere, the UK was up 10,000t on 2016, though in percentage terms this was less than a 4% growth. That reflects the fact that with the UK taking half of our total beef exports, this is a market that has achieved its potential.

Elsewhere in Europe, the French, Spanish and German markets remained almost the same last year as they were in 2016. The Netherlands was down slightly, while Sweden showed a larger fall of almost 3,000t. Italy recorded a 3,000t increase in purchases of Irish beef in 2017 compared with the previous year.

Value indicates type of cuts purchased

Looking at the value of sales to our main export destinations reveals the type of cut that is preferred by each country. The size of the UK market means that they buy most parts of the carcase though very little offal.

The fact that Hong Kong and the Philippines are among the lowest value markets of our main export destinations despite their relatively large volumes shows that they are buyers of the low value cuts and offal’s.

Germany on the other hand despite just taking 16,000t of beef, 10,000 less than Hong Kong, returns €138m in value compared to just €77m for Hong Kong. The Philippines is a buyer of even lower value product with its 20,000t returning a value of €39m.

Italy is also a particularly high value market with its 25,000t returning a value of €178m as is the Netherlands where 39,000t of product realised €194m.

France takes a mix of cuts and offal which is reflected in a middle of the road return on value at €218m from the 52,000t of product as is Sweden who is primarily a buyer of manufacturing beef for mincing and returning €99m from the 24,000t of product shipped.

Need for all markets

The fact that one market returns a greater price per kilo than another on average doesn’t properly reflect the true value of that market. That can only be calculated by comparing the same cut of beef produced to the same specification, information which is not available.

The value of the carcase is achieved by placing each part of it plus the hide and offal wherever is paying the most. Therefore, if the Philippines is buying a part that isn’t wanted elsewhere, it becomes a very important market even if the price per kilo looks low.

Read more

Exploring trading scenarios post-Brexit

Norway-Sweden border far from seamless

Can we tap into the 1m tonne US beef market?

The final beef export figures for 2017 were revealed this week. While the UK remains the main market by a huge distance, taking 275,000t, it was the Asian markets that showed the most growth.

Hong Kong jumped 10,000t, from 16,000t in 2016 to 26,000t in 2017, for Irish beef and offal. This makes it the fourth most important market by volume of beef and offal, with France second to the UK on 52,000t and the Netherlands third on 39,000t.

The other important markets for large volumes of Irish beef are also in Europe, with Italy taking 25,000t in 2017 followed by Sweden on 24,000t. There is then a further gap back to Germany on 17,000t while Spain took 10,000t.

Meanwhile, at the other end of the scale, the USA took just 1,571t last year, which was even lower than the previous year when 1,778t of Irish beef went to the USA.

Movers in 2017

The Hong Kong and Philippines were the major story for sales in 2017, with respective increases of 62% and 43%. Elsewhere, the UK was up 10,000t on 2016, though in percentage terms this was less than a 4% growth. That reflects the fact that with the UK taking half of our total beef exports, this is a market that has achieved its potential.

Elsewhere in Europe, the French, Spanish and German markets remained almost the same last year as they were in 2016. The Netherlands was down slightly, while Sweden showed a larger fall of almost 3,000t. Italy recorded a 3,000t increase in purchases of Irish beef in 2017 compared with the previous year.

Value indicates type of cuts purchased

Looking at the value of sales to our main export destinations reveals the type of cut that is preferred by each country. The size of the UK market means that they buy most parts of the carcase though very little offal.

The fact that Hong Kong and the Philippines are among the lowest value markets of our main export destinations despite their relatively large volumes shows that they are buyers of the low value cuts and offal’s.

Germany on the other hand despite just taking 16,000t of beef, 10,000 less than Hong Kong, returns €138m in value compared to just €77m for Hong Kong. The Philippines is a buyer of even lower value product with its 20,000t returning a value of €39m.

Italy is also a particularly high value market with its 25,000t returning a value of €178m as is the Netherlands where 39,000t of product realised €194m.

France takes a mix of cuts and offal which is reflected in a middle of the road return on value at €218m from the 52,000t of product as is Sweden who is primarily a buyer of manufacturing beef for mincing and returning €99m from the 24,000t of product shipped.

Need for all markets

The fact that one market returns a greater price per kilo than another on average doesn’t properly reflect the true value of that market. That can only be calculated by comparing the same cut of beef produced to the same specification, information which is not available.

The value of the carcase is achieved by placing each part of it plus the hide and offal wherever is paying the most. Therefore, if the Philippines is buying a part that isn’t wanted elsewhere, it becomes a very important market even if the price per kilo looks low.

Read more

Exploring trading scenarios post-Brexit

Norway-Sweden border far from seamless

Can we tap into the 1m tonne US beef market?

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: