Export data from USDA has revealed 2017 was the fourth-highest year on record for US beef exports, with 1.25m tonnes exported.

This is evidence that the herd rebuilding process following the droughts experienced in cattle-rearing states between 2012 and 2015 is complete. That this has been achieved at a time when Mercosur countries have also been growing their beef exports and with no negative effect on international beef price is also significant.

The Philippines and Hong Kong have served Ireland well in 2017 for offal and lower-value manufacturing beef

When farmers think of beef imports and exports, we immediately think of cattle. However, the beef industry is the opposite of the normal assembly line process of manufacturing industry; it breaks up the carcase and sells the component parts. The skill of the successful processor is to match each component part with the part of the world that values it the most.

Types of meat

Europe is the number one target for steak meat exporters. Other popular markets include Japan, Hong Kong, Singapore and other wealthy parts of the world.

African countries look to buy the maximum amount of protein for the minimum money and therefore will buy parts of the animal in which we have no interest.

China buys cheap cuts but is also upgrading, with middle-range cuts from the forequarter and hindquarter popular.

The Philippines and Hong Kong have served Ireland well in 2017 for offal and lower-value manufacturing beef.

Nowhere is the principle of putting each part of the carcase in its highest value market better demonstrated than in the US. As well as exporting 1.25m tonnes of beef in 2017, it was one of the world’s top importers of beef, taking in 965,000t.

We could do serious business in supplying manufacturing burger beef, but the different processing standards in the US means this is a less attractive market

This is because the US has a huge burger and manufacturing beef market that it cannot satisfy with domestic production.

It therefore makes more sense to sell the high-value cuts of beef abroad and import the lean forequarter beef for burger manufacture from abroad.

Irish exports to the US

That is why volume sales of Irish beef to the US have been so low since the market was opened three years ago. With the US being a huge exporter of steak meat, the opportunity for Irish product at this end is extremely limited.

So far, most of our business has been for lower-value cuts. We could do serious business in supplying manufacturing burger beef, but the different processing standards in the US means this is a less attractive market to Irish exporters than it otherwise would be.

US processors use acid to wash their carcases; in the EU we concentrate on producing clean carcases without adding the chlorine-based wash.

Therefore, there is a risk that Irish or EU product won’t have achieved the same standard and it being sent back. This is a risk that may be worth taking if the EU and UK markets for this type of beef were weak. However, over the past year the European market was particularly strong for this type of beef and the US wasn’t required as an outlet.

As a result, Ireland supplied just 2,255t this almost 1m tonne beef market, according to the USDA.

The big suppliers to the US in 2017 were Canada with 261,445t, Australia 236,045t, Mexico 184,238t and New Zealand 177,989t.

If the European market were weaker, Ireland could attempt to develop this market. However, it will not be a first-choice market given the difficulty there is in complying with US E coli standards using EU processing techniques.

Read more

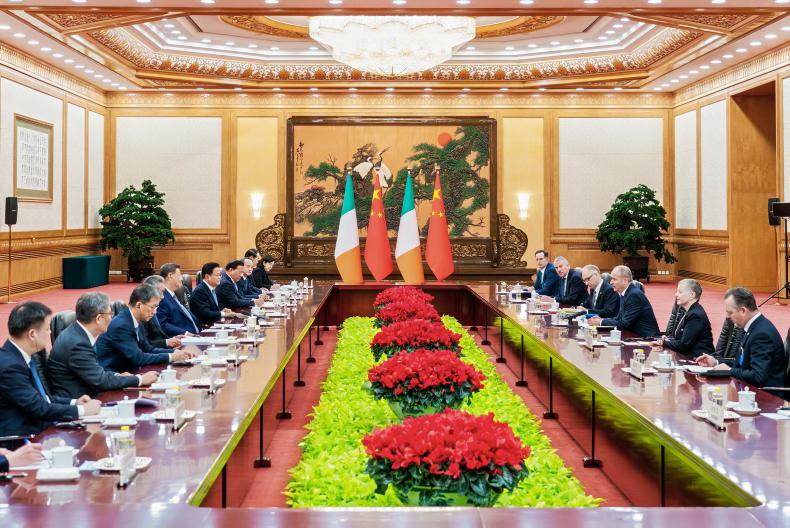

Irish officials in China over beef access

More than beef blocking Mercosur deal

Export data from USDA has revealed 2017 was the fourth-highest year on record for US beef exports, with 1.25m tonnes exported.

This is evidence that the herd rebuilding process following the droughts experienced in cattle-rearing states between 2012 and 2015 is complete. That this has been achieved at a time when Mercosur countries have also been growing their beef exports and with no negative effect on international beef price is also significant.

The Philippines and Hong Kong have served Ireland well in 2017 for offal and lower-value manufacturing beef

When farmers think of beef imports and exports, we immediately think of cattle. However, the beef industry is the opposite of the normal assembly line process of manufacturing industry; it breaks up the carcase and sells the component parts. The skill of the successful processor is to match each component part with the part of the world that values it the most.

Types of meat

Europe is the number one target for steak meat exporters. Other popular markets include Japan, Hong Kong, Singapore and other wealthy parts of the world.

African countries look to buy the maximum amount of protein for the minimum money and therefore will buy parts of the animal in which we have no interest.

China buys cheap cuts but is also upgrading, with middle-range cuts from the forequarter and hindquarter popular.

The Philippines and Hong Kong have served Ireland well in 2017 for offal and lower-value manufacturing beef.

Nowhere is the principle of putting each part of the carcase in its highest value market better demonstrated than in the US. As well as exporting 1.25m tonnes of beef in 2017, it was one of the world’s top importers of beef, taking in 965,000t.

We could do serious business in supplying manufacturing burger beef, but the different processing standards in the US means this is a less attractive market

This is because the US has a huge burger and manufacturing beef market that it cannot satisfy with domestic production.

It therefore makes more sense to sell the high-value cuts of beef abroad and import the lean forequarter beef for burger manufacture from abroad.

Irish exports to the US

That is why volume sales of Irish beef to the US have been so low since the market was opened three years ago. With the US being a huge exporter of steak meat, the opportunity for Irish product at this end is extremely limited.

So far, most of our business has been for lower-value cuts. We could do serious business in supplying manufacturing burger beef, but the different processing standards in the US means this is a less attractive market to Irish exporters than it otherwise would be.

US processors use acid to wash their carcases; in the EU we concentrate on producing clean carcases without adding the chlorine-based wash.

Therefore, there is a risk that Irish or EU product won’t have achieved the same standard and it being sent back. This is a risk that may be worth taking if the EU and UK markets for this type of beef were weak. However, over the past year the European market was particularly strong for this type of beef and the US wasn’t required as an outlet.

As a result, Ireland supplied just 2,255t this almost 1m tonne beef market, according to the USDA.

The big suppliers to the US in 2017 were Canada with 261,445t, Australia 236,045t, Mexico 184,238t and New Zealand 177,989t.

If the European market were weaker, Ireland could attempt to develop this market. However, it will not be a first-choice market given the difficulty there is in complying with US E coli standards using EU processing techniques.

Read more

Irish officials in China over beef access

More than beef blocking Mercosur deal

SHARING OPTIONS