Irish Country Living recently visited Dundalk County Registrar Court, which is essentially the repossessions court. This was held in what looked like a brand-new courthouse – a product of the Celtic Tiger spending but which is now home to cases involving people who can no longer afford Celtic Tiger mortgages.

The law weighed heavily on the shoulders of the mortgage holders in Dundalk that day, most of whom were representing themselves. Suffice it to say, if they don’t have enough to pay their mortgage, they don’t have enough to pay legal fees. It was clear the banks were at a distinct advantage in terms of legal representation and even the banks’ legal representatives seemed to feel bad about this, some of them laying out their case in an almost apologetic tone.

One financial adviser was causing quite a stir in the courtroom that day and was certainly proving to be a frustration to the banks. He was going around the courtroom whispering in urgent tones in defendants’ ears as they waited for their case to be heard.

When these same defendants were called to face the court, many contended they were currently working on their finances with their financial adviser – although many conceded they had just met him that morning – or five minutes ago. Other defendants demanded their case be adjourned due to one legal technicality or another. They were speaking a language they didn’t understand, reciting exactly what the financial adviser had told them to say. It was all in a desperate attempt to buy more time – and it worked.

It may have been easy to be sceptical of the financial adviser, but there was no doubting his effectiveness, evidenced by the scowls of the banks’ solicitors and barristers.

There were 70 repossession cases on the county registrar’s list in Dundalk that day (a county registrar is not quite a judge, but someone who has been granted power to perform a number of quasi-judicial functions), but only two cases concluded with orders for repossession.

Many cases were adjourned to a later date, often to allow the defendants to acquire particular documents, while the registrar said that in one instance she hadn’t come across a similar application before so she was going to have to check the law on it. Some cases were struck out where the arrears had been cleared while others were transferred into the judge’s list if they required consideration by a higher authority.

One almost-repossession involved a very eloquent barrister who was very intent that this particular case was going to close the way he wanted it to – in repossession. He set out the case. A €225,000 mortgage was granted in 2007 and the repayments were €1,078 a month. In November 2009, the defendants went into arrears, which now stood at a total of €62,000. The last payment made was €282 in March 2013.

The defendant tried to fend off a repossession by stating: “I made a mistake rushing in to get the mortgage. I don’t want to rush again.”

The barrister looked at the registrar: “Effectively, there’s been no repayments in the last five years.”

He had a point.

The registrar looked depressed. Nobody enjoys repossessing houses. The case was adjourned until March for an affidavit to be filed.

Buying time was the name of game that day. But we wondered if buying time really is a solution – because it seems that, in some cases, repossession is inevitable, yet, understandably, some people aren’t ready to face that fact.

“Almost unsustainable” was the very term the registrar used to describe the circumstances of one couple where the balance on the mortgage was approximately €225,000. The arrears were €57,000 and the last payment made was €470 in March 2011.

In 2014 one final adjournment had been granted so the defendants could seek advice. On top of their financial woes, the defendants explained that the man hadn’t been well and was on disability (payments) and the lady had been in out of hospital, having undergone major surgery very recently. The defendants explained that they had offered €100 a week which was refused. The case was adjourned until May.

Will their circumstances have changed by then?

Who are we to judge?

Others were very accepting of their fate. One lady who was separated faced the registrar and said she didn’t know where her husband was. The original mortgage was for €295,000 and arrears of €70,228 had accumulated. The last repayment made was in July 2010. She said she wasn’t here to fight the case, that she didn’t have the money. Rather, she was seeking a stay so she could save money to rent somewhere else. The registrar made an order for repossession with a nine-month stay which allowed the lady to stay in the property for that duration.

Repossession with a three-month stay and an application for costs was awarded in another case where the arrears were €40,000 on a €290,000 loan drawn down in 2006. The last payment made was €600 in 2012.

In another case, the defendant winked at her friends and family when she was granted more time, albeit with a warning from the registrar: “See what you can do, but there’s no guarantee it will work.”

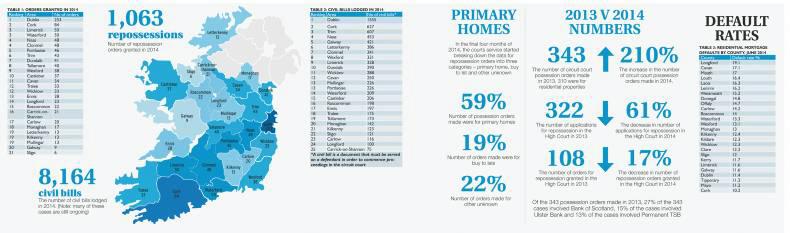

What happened in Dundalk that day is happening all over the country every week. In 2014 there were 1,063 repossession orders granted by circuit court judges in Ireland. At 253, Dublin had the most orders granted and was followed by Cork where 84 orders were granted. At six, Sligo had the least number of orders granted, followed by Galway where nine were granted (see full breakdown in table one). There were even more civil bills lodged by lenders applying for possession of all types of properties in the circuit courts in 2014 – 8,164 of them in fact. A civil bill is a document that must be served on a defendant in order to commence proceedings in the circuit court and while not all civil bills culminate in repossession, they are an indicator of just how many people are in difficulty.

The most civil bills were lodged in Dublin in 2014 – 1,555 of them, followed by 627 in Cork. At 75, Carrick-on-Shannon had the fewest lodged, followed by Longford where 100 were lodged.

Furthermore, there were 129 applications for possession in the High Court in 2014, with 90 orders made.

Helpline

If you have fallen into arrears with your mortgage or are concerned about your finances, contact MABS (Money Advice and Budgeting Service) on 0761-07-2000 or visit www.mabs.ie. It’s a free service and they can arrange for you to meet face-to-face with one of their advisers who will guide you through how to best manage your assets.

SHARING OPTIONS