The Global Dairy Trade price index was up 0.2%, led by a big jump in the butter milk powder index, which was up 6.7%.

Skim milk powder (SMP) also recorded a healthy increase, up 2.7%, as did lactose, up 1.8%. The key whole milk powder (WMP) index fell slightly (down 0.2%), as did the butter index, while the cheddar index recorded the biggest fall, down 3.4%.

Speaking to those in the trade, the results were largely in line with analysts’ expectations.

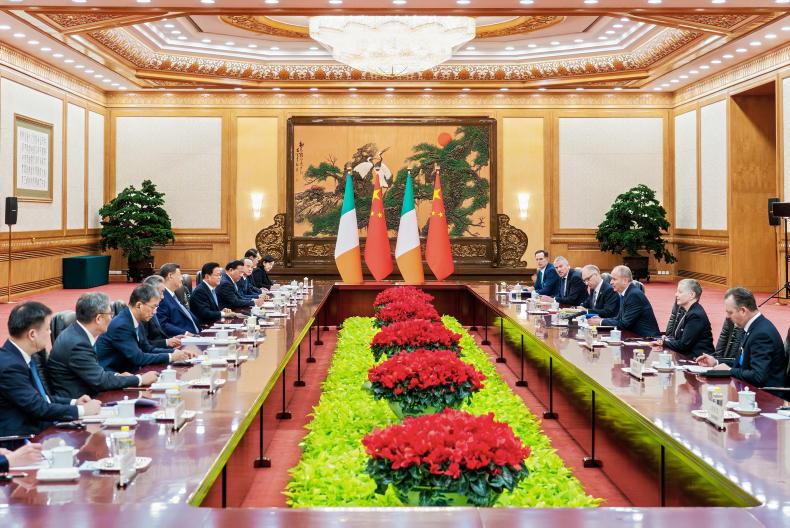

China continues to drive the demand, especially from New Zealand. China is the world’s biggest dairy importer and despite recent slowing of the economy there and weakening of its currency due to the US trade war, we understand the household sector and food purchases are holding.

The relative strength of the Chinese household sector appears one key factor underpinning global dairy prices according to traders. China is now importing as much as it did at the previous peak in 2013.

Overall global milk supply remains tight, particularly in the northern hemisphere and Australia. Despite Fonterra’s financial trials and tribulations, New Zealand has had a reasonable start to its supply season, with production up about 2% in August compared with the same month last year.

Rabobank suggests the global dairy market looks set to remain firm in the next six months, with the outlook for demand more than enough to absorb the modest volumes of increasing milk flows.

Read more

Dairy markets: prices continue to rally in Europe

The Global Dairy Trade price index was up 0.2%, led by a big jump in the butter milk powder index, which was up 6.7%.

Skim milk powder (SMP) also recorded a healthy increase, up 2.7%, as did lactose, up 1.8%. The key whole milk powder (WMP) index fell slightly (down 0.2%), as did the butter index, while the cheddar index recorded the biggest fall, down 3.4%.

Speaking to those in the trade, the results were largely in line with analysts’ expectations.

China continues to drive the demand, especially from New Zealand. China is the world’s biggest dairy importer and despite recent slowing of the economy there and weakening of its currency due to the US trade war, we understand the household sector and food purchases are holding.

The relative strength of the Chinese household sector appears one key factor underpinning global dairy prices according to traders. China is now importing as much as it did at the previous peak in 2013.

Overall global milk supply remains tight, particularly in the northern hemisphere and Australia. Despite Fonterra’s financial trials and tribulations, New Zealand has had a reasonable start to its supply season, with production up about 2% in August compared with the same month last year.

Rabobank suggests the global dairy market looks set to remain firm in the next six months, with the outlook for demand more than enough to absorb the modest volumes of increasing milk flows.

Read more

Dairy markets: prices continue to rally in Europe

SHARING OPTIONS