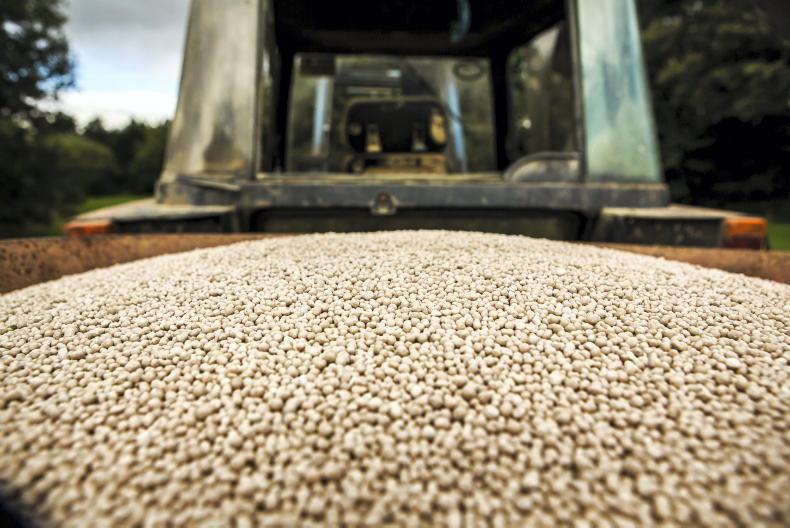

There is value to be availed of in fertiliser at present, particularly where farmers can pay straight away, but good deals on credit are also available.

However, prices are set to rise.

Some companies have already issued hikes in prices this week, while more are inevitable in the coming weeks.

Industry reports suggest the main reason for the price increase is increasing raw material prices, while COVID-19 is also upsetting the supply chains for those materials from some countries.

Input costs

With that expected increase in mind, farmers may need to move fast to lower input costs for the year ahead and purchase some of their fertiliser requirement for the season.

It is important to shop around and compare quotes, but this year buying early looks like it could have a big impact on cutting input costs and ultimately increasing farm profits.

Some merchants are still quoting at the low end of the scale, probably having purchased in large quantities at the backend of 2020.

Table 1 shows the range in prices this week.

However, there is plenty of movement in the market. Prices are based on big bags and immediate payment.

While there are plenty of variations available, the figures in Table 1 focus on standard products. Farmers can expect to pay from €350/t to €355/t for protected urea (46% N, no S). Standard urea is varying in price from approximately €315/t to €325/t.

Looking ahead to spring requirements and CAN (no S) is moving for between approximately €215/t and €230/t.

The price of 18-6-12 will give a good idea of where compound prices are sitting. It’s selling for between approximately €312/t and €330/t.

Prices may look more settled in the coming weeks, with less variation, but unfortunately this will be as more merchants hit the top end of the sales. However, according to industry sources, price increases look inevitable, with increases of €20-40/t expected on some products.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: