Phelim O’Neill (PO’N): Export performance in 2018, a fall on the year before or second best ever?

Minister Creed (MC): Both of those things. When exporting to 185 countries there are many variables impacting on the outcome. A snapshot in time doesn’t give an accurate picture, but if you look at the picture through from 2010 to 2018 in a very difficult recession, the picture is generally positive.

Looking at individual examples such as live exports to Turkey, due to issues entirely outside our control that market collapsed. Generally, the direction of travel for our industry over the period is solid. There is a blip in the value but the volume is growing and I would hope in a different set of trading circumstances the value would equally grow.

PO’N: Overall thought it’s satisfactory?

MC: Absolutely.

PO’N: What was the high point of the year for you?

MC: In many ways it is the resilience of the sector…

PO’N: That’s a bit too general

MC: There are all these issues that are outside our control yet the industry keeps performing at a very high level. I think that is what struck me in my tenure here in the Department, these results are a reflection of our primary producers, our companies, the state agencies ...

PO’N: I thought you might have singled out China and the long road that was travelled to get approval?

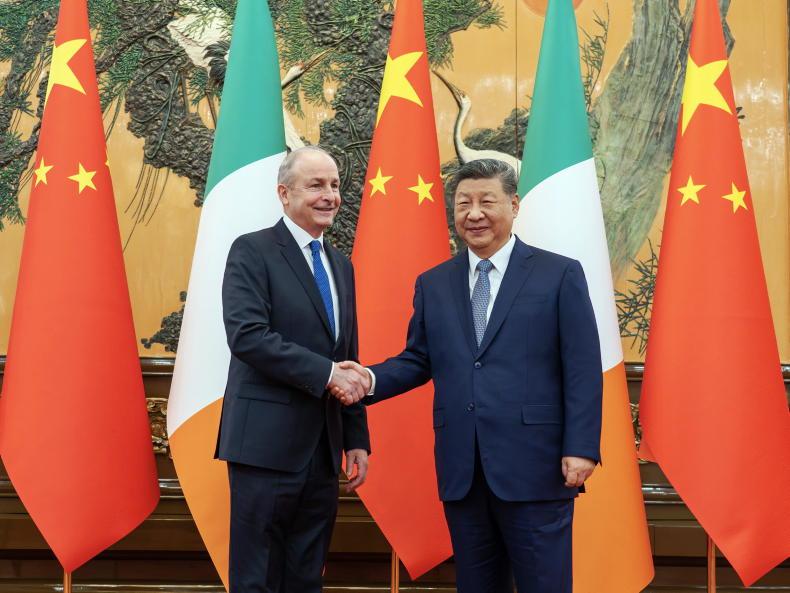

MC: Undoubtedly, beef access to China was the icing on the cake in 2018, it was the cumulative endeavour of many people in the industry, the Department, my predecessor the Tánaiste, our diplomatic service. It is really significant in terms of the scale of that market. I don’t think we will see that reflected this year but I am sure we will in years to come.

PO’N: We have six factories approved [for China] have we any more in the pipeline?

MC: Secretary General Brendan Gleeson (Sec Gen): We have 12 more undergoing the approval process.

PO’N: What were the negatives of 2018?

MC: Turkey for live exports … live exports are really important. It is a market we put a lot of emphasis into – I visited it [Turkey] early last year and got commitments that the market would in fact be liberalised for the private sector to undertake exports and that didn’t materialise. We will be looking at new opportunities for live exports in 2019, particularly across North Africa.

PO’N: We are looking at the performance and prospects report 2018-2019 that is being launched by Bord Bia. We have a very comprehensive review of the performance, and there is much to be commended in that. There is much less in terms of prospects and 2019 is probably one of the most uncertain years that we will ever face in terms of farming and agriculture. We have a once in a lifetime event with Brexit – should we not have been looking more at Brexit in the context of prospects? Was that not worth a chapter on its own?

MC: You could argue that point in the context of what 2019 might bring, but I think that it is important that the agencies such as Bord Bia focus on their primary objectives, which is selling and looking for new markets and working with the industry to use the additional resources we have put in. In this Department we are engaged in a cross-Government Brexit planning process and I think that is where that issue rightly rests in terms of Brexit preparations and contingency planning.

I am not sure that Bord Bia’s report giving a health warning ahead of what might happen is, personally speaking, and you could argue this both ways, is what they should be at. I think everyone is acutely aware of the challenges faced and we are obviously doing a lot of preparations in that context. We are ratcheting up our preparations for the prospect of a no-deal scenario. That is where that issue rightly rests rather than in this report.

PO’N: That, Minister, leads me into the logical next step … you are saying that this comes right to the heart of Government and you have referred to the cross departmental preparation. What exactly is that to a farmer that is reading the [Irish] Farmers Journal? It is a fine ethos and a fine statement and a year ago, it was a perfectly satisfactory answer but now we are at a point where we need more.

MC: It is a lot of different things and I understand that. I was at a farmers’ meeting in Lisavaird this week and that is what is of concern for farmers. What is in it in the case of worst case scenario? Whether it is a crash out on 29 March or whether it is the withdrawal agreement and the negotiation of a future trading relationship in the transition period, the impact of Brexit is unclear yet, and will remain so until we see the terms under which they leave.

PO’N: I would have thought it is very clear if there is no deal … it’s a catastrophe?

MC: I would argue it is not entirely clear because it is a question of what the UK’s response is going to be. Are they going to maintain regulatory alignment? Will the British consumer accept a drop in standards so that they can have cheaper food? Hormone treated beef, chlorine washed chicken or are they going to say we want to maintain standards but open up the market? Is our market access going to be protected or is the value of the market going to be diminished?

PO’N: Mercosur by the back door?

MC: They are all issues we don’t know the answer to yet. What we have done in the last budget is to make €77m available, of which €44m is for farmers, with the bulk of the rest of it for the food processing industry. We have been working in detailed negotiations on the withdrawal agreement with the EU and it is unreasonable to expect in the middle of that process you would also say we want to prepare a compensation package, for the want of a better term, for our industry. The Commissions view is that we have a withdrawal agreement and we want to get a future trading relationship that is as close as possible to what we currently have and that is what we have been advocating for. It is unreasonable to say that we need to have a package that is ready to roll on 30 March 2019 when they [the UK] leave. The Commission won’t buy into a compensation agreement on the basis of supposition or anecdote, they will want … if there is a very significant hit, which I acknowledge there could well be, they will want to see the evidence of it.

PO’N: So we have to have the ‘hit’ and then the response?

MC: Absolutely. That is always been the case. If you look at when the Russian market closed, under current CMO regulations, it responded by compensating the member state. We have had it in the dairy sector – it is always after the event.

PO’N: The Russian market was a tea party relative to what Brexit would be for Ireland?

MC: Yes, very significantly so

Sec Gen – It was a tea party for us it wasn’t for everybody

PO’N: I am looking at this from the view of the farmer that wakes up on 30 March, just as we woke up on 24 June 2016 and wondered has this really happened … the factories won’t be killing that day?

MC: In some respects Brexit has been happening incrementally because we have had currency fluctuations which have adversely impacted already. Come 30 March what is the UK going to say to our exporters? Is it going to say business as usual, is it going to say WTO tariffs, is it going to have quota restrictions, is it going to have regulatory alignment? These are all issues we don’t have the answer to yet. We have modelled a whole range of scenarios.

PO’N: Can you share that modelling with us?

MC: Well I don’t think it is appropriate to put a lot of that in the public realm at this stage

PO’N: Would it be fair to say there are a lot of scary models in there?

MC: There are a lot of pretty bleak scenarios

PO’N: Come the 30 March the UK Government is facing a situation where their [import] suppliers pay the WTO tariff which drives hyper food inflation, or throw the doors open with a zero tariff. Either way, Ireland is doomed?

MC: Part of what we have been involved in in the Commission is creating the awareness of our exposure at EU level, and that endeavour will stand to us because while we will be the most impacted state, the impact will be pan-European because we could be looking for a home for almost 300,000t of beef. That would make it a Dutch, French, German etc. problem, and the Commission recognise that this could be a pan-European problem and it is not the case as some outlets have reported of the Irish putting out the begging bowl. This is an issue that will have to be dealt with at a policy level

PO’N: Has the EU addressed it in this context yet, I note that you were widely quoted in the media last week as saying that you were going to raise this at the Luxembourg Council, but that is after [the proposed date of] Brexit. Is this not something that has been well flagged and that the EU is well prepared for with a plan on the shelf to pull down on 30 March?

MC: I don’t think that we are going to have a plan that is ready – the Commission are going to have to see the quantifiable impact

PO’N: This is comparable to the BSE export ban in the North [Northern Ireland]in 1996 when there was months of hell for farmers and indeed factories before there was a programme put in place to buy cattle off the market. Is that what we are looking at here?

MC: There is no sugar coating Brexit – it is damage limitation, and the biggest damage is in a no-deal Brexit scenario. We are in difficult times but I am still optimistic that we will not have a no-deal Brexit scenario. We are planning for all eventualities and we have created awareness about what that means for us [in Europe].

Sec Gen: there is a toolbox available and there is a regulatory basis for using that toolbox and there is a regulatory basis for exceptional measures under the CMO regulation and we are going to be talking to the commission about that

PO’N: Is it realistic to expect an awful period of time before those are put in place?

MC: The flip side of that question is that I don’t think the commission will move in on day one without quantifiable evidence of what the impact is

PO’N: I am not seeing here that we have a plan that is ready to hit the ground on 30 March that will make life easier for Irish farmers, and while there is no good Brexit it looks like we will have to go through some months of hell.

MC: The message I would like to send to farmers is that we are acutely aware of all the potential outcomes that follow various different types of Brexit. They are predicated on UK responses to being outside the EU, and we have to wait and see what their response will be in terms of tariffs, quota – the impact on the UK economy and the impact on Sterling. Until we have this it is unrealistic to knit together a response to that. We are aware of all the moving parts and how they may impact.

PO’N: Is there a specific date for the loans scheme?

MC: I expect that product will be in the market place during the first quarter of 2019.

SHARING OPTIONS