Irish dairy, livestock and tillage farmers are all getting better prices offered for their produce and the immediate outlook appears positive as life begins the process of returning to normal with vaccinations for COVID-19 rolling out.

With hospitality reopening across Europe and consumers out spending money saved during the lockdown, the expectation is that demand will continue to be firm, while output of beef on global markets is constrained by the Argentinian suspension of exports and herd rebuilding continues in Australia.

The same applies to the sheep flock in Australia, while New Zealand’s focus on the Chinese market means supplies in Europe are tight at the time of the year when lamb prices normally dip.

Dairy markets have surged over the past year, with whole milk powder up 20% on a year ago, skimmed milk powder up 30% and butter up 40%.

China is driving increased global demand for dairy produce and it is the same with grain. Grain prices have been increasing since August last year. China’s move to biosecure industrial pig units instead of domestic production fuelled demand, with grain based feed replacing household food waste.

Rising farm costs

Strong market demand has been reflected in better farmgate prices. However, farmers aren’t getting to keep all the extra sales revenue as the cost of production has been progressively increasing over the past year as well.

Everyday costs like feed and fertiliser are the big expenditure items for livestock farmers, with tillage farmers also big users of fertiliser.

As well as the purchase price of these items, the other big variable for farmers is weather. When there is a late spring and grass growth is slow, cattle need more meal and rehousing, as has frequently happened, increased the need for both meal and silage.

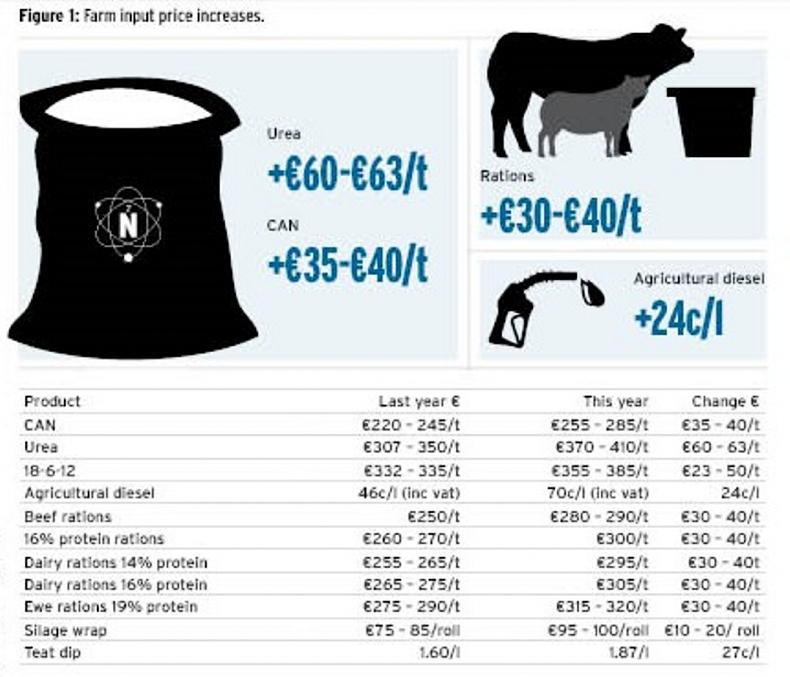

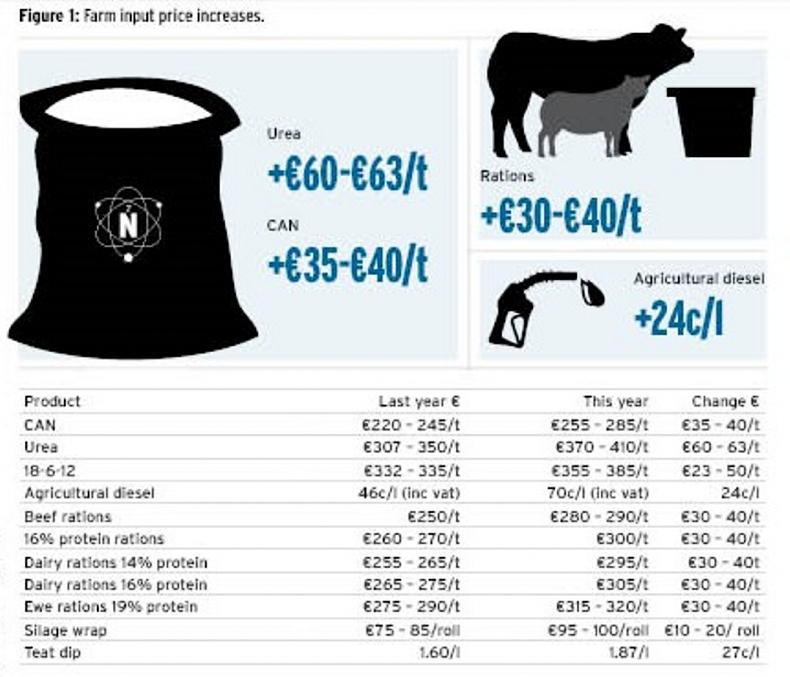

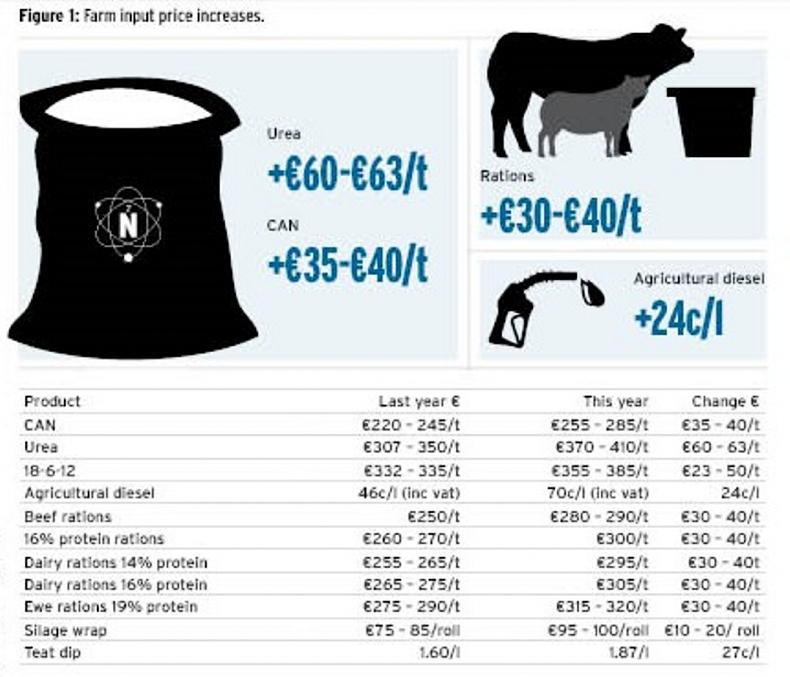

Figure 1 shows the increased cost of a range of farm input costs this spring compared with a year ago. Animal feed rations are running at €30t to €40t higher than a year ago, reflecting the global demand for grain and the stronger prices being offered to Irish tillage growers for this year’s crops. These levels were last experienced in 2012-2013, and feed sales reps spoken to by the Irish Farmers Journal this week don’t foresee a reduction in animal feed prices over the coming months.

Figure 1.

All farmers to a greater or lesser extent use fertiliser to boost grass and crop production apart from the small number of organic producers. All of the main fertilisers used on Irish farms are between €23 and €50/t more expensive than they were a year ago. Fertiliser production costs are affected by oil prices and these collapsed during the first lockdown in March 2020. Oil prices have since recovered and fertiliser prices have been increasing. Livestock farmers who bought fertiliser early will have benefited, as the main price increases have kicked in from the early part of 2021.

Similarly, diesel and lubricant oils have also been increasing, with tractor diesel costs now 25c/l higher than this time last year. Oil prices also influence the price of plastic and as a result silage wrap is costing €20 more per roll than a year ago with the prospect of further price increases in the coming weeks.

Deferred costs will

still bite in time

Andy Doyle

The main cost increase for tillage farmers is fertiliser. Like in other sectors, some growers had bought a big proportion of their needs before the biggest of the price rises and so are somewhat insulated from this cost this year, but it is still coming down the track. However, most growers are likely to see higher fertiliser costs eat into their margins.

Chemicals have not suffered major increases yet, but one can sense that this is coming, given the way all other raw materials have increased. Some escalation in cost did occur with the arrival of new actives. Seed will also have cost slightly more for this year, given the higher harvest prices last season.

There will be other cost increases that apply across farming. Fuel and lubricant price increases will be noted, especially by those who dry their own grain, as will tyres. Higher costs are also likely to be felt by those buying parts for machines and especially for soil-working parts. Bale wraps will also be an issue.

Replacement machinery could be a big additional cost also for anyone changing up this year, and possibly beyond, unless steel prices fall back.

NI farmers exposed to concentrate feed price

David Wright

Since this time last year, fertiliser prices in Northern Ireland (NI) are up by around £60 – £80/t (€69 – €92/t) with concentrate feed up £40 – £50/t (€46 – €57/t).

While fertiliser is up more, concentrate price rises have a greater impact on production costs on NI livestock farms.

The dairy sector is one of the hardest hit, given the predominance of medium- to high-input systems. Since 2004/05 CAFRE benchmarking data shows that concentrate fed per cow has risen from 1.8t to 2.6t, with average production now over 8,000l per cow. Purchased feed currently accounts for 60 – 70% of variable costs, and for a farmer feeding 0.4kg concentrate per litre, the increase in concentrate price over the last 12 months has added around 2p/l to costs.

On beef and sheep farms, rising costs are also eating into margins, despite higher end prices. For a typical grazing unit applying four bags/acre of nitrogen over the season (133kg N/ha), grazing costs will increase by approximately £16/acre. Higher fertiliser costs will also add £1.50 to £2/t to the cost of producing silage. For a typical steer finished over 100 days next winter, that would only put £3 to £4 onto feed costs. However, with concentrate prices set to remain high, if we assume the average increase works out at £40/t, it would increase costs by around £32/head or 8p/kg on a 400kg carcase.

Glennons purchases Balcas sawmill

Glennon Brothers Ltd has bought Co Fermanagh sawmill Balcas in a major deal not only for the two sawmills but also for the Irish timber processing sector.

Glennon Brothers, founded in 1913, is Ireland’s longest-established mill.

Since the Longford-based mill bought the Smurfit-owned Fermoy sawmill in 1998, the joint managing directors – Pat and Mike Glennon – have made a number of major acquisitions in Ireland and Scotland beginning with Windymains Timber near Edinburgh in 2005. This was followed by Dempsey Timber Engineering, Arklow and Scottish plants Adam Wilsons and Alexanders Timber Design.

This will give Glennons access to timber throughout the island of Ireland. In addition, the mill has been the largest importer of logs from Scotland. This is likely to continue at least until the felling licence debacle is resolved as there is still a major shortfall of logs in the south.

This latest acquisition dramatically increases the company’s share of the Irish and UK market. The purchase is not expected to be opposed by competition regulators in either jurisdiction as there are still six highly competitive medium to large sawmills in Ireland.

“We are looking forward to welcoming Balcas to the group,” said Mike Glennon while his brother Pat described the deal as “another milestone in the history of Glennon Brothers”.

Brian Murphy, chief executive of Balcas, said: “We are excited to be joining Glennon Brothers, a business with a deep rooted history in the timber processing sector and values aligned to our own”.

Irish dairy, livestock and tillage farmers are all getting better prices offered for their produce and the immediate outlook appears positive as life begins the process of returning to normal with vaccinations for COVID-19 rolling out.

With hospitality reopening across Europe and consumers out spending money saved during the lockdown, the expectation is that demand will continue to be firm, while output of beef on global markets is constrained by the Argentinian suspension of exports and herd rebuilding continues in Australia.

The same applies to the sheep flock in Australia, while New Zealand’s focus on the Chinese market means supplies in Europe are tight at the time of the year when lamb prices normally dip.

Dairy markets have surged over the past year, with whole milk powder up 20% on a year ago, skimmed milk powder up 30% and butter up 40%.

China is driving increased global demand for dairy produce and it is the same with grain. Grain prices have been increasing since August last year. China’s move to biosecure industrial pig units instead of domestic production fuelled demand, with grain based feed replacing household food waste.

Rising farm costs

Strong market demand has been reflected in better farmgate prices. However, farmers aren’t getting to keep all the extra sales revenue as the cost of production has been progressively increasing over the past year as well.

Everyday costs like feed and fertiliser are the big expenditure items for livestock farmers, with tillage farmers also big users of fertiliser.

As well as the purchase price of these items, the other big variable for farmers is weather. When there is a late spring and grass growth is slow, cattle need more meal and rehousing, as has frequently happened, increased the need for both meal and silage.

Figure 1 shows the increased cost of a range of farm input costs this spring compared with a year ago. Animal feed rations are running at €30t to €40t higher than a year ago, reflecting the global demand for grain and the stronger prices being offered to Irish tillage growers for this year’s crops. These levels were last experienced in 2012-2013, and feed sales reps spoken to by the Irish Farmers Journal this week don’t foresee a reduction in animal feed prices over the coming months.

Figure 1.

All farmers to a greater or lesser extent use fertiliser to boost grass and crop production apart from the small number of organic producers. All of the main fertilisers used on Irish farms are between €23 and €50/t more expensive than they were a year ago. Fertiliser production costs are affected by oil prices and these collapsed during the first lockdown in March 2020. Oil prices have since recovered and fertiliser prices have been increasing. Livestock farmers who bought fertiliser early will have benefited, as the main price increases have kicked in from the early part of 2021.

Similarly, diesel and lubricant oils have also been increasing, with tractor diesel costs now 25c/l higher than this time last year. Oil prices also influence the price of plastic and as a result silage wrap is costing €20 more per roll than a year ago with the prospect of further price increases in the coming weeks.

Deferred costs will

still bite in time

Andy Doyle

The main cost increase for tillage farmers is fertiliser. Like in other sectors, some growers had bought a big proportion of their needs before the biggest of the price rises and so are somewhat insulated from this cost this year, but it is still coming down the track. However, most growers are likely to see higher fertiliser costs eat into their margins.

Chemicals have not suffered major increases yet, but one can sense that this is coming, given the way all other raw materials have increased. Some escalation in cost did occur with the arrival of new actives. Seed will also have cost slightly more for this year, given the higher harvest prices last season.

There will be other cost increases that apply across farming. Fuel and lubricant price increases will be noted, especially by those who dry their own grain, as will tyres. Higher costs are also likely to be felt by those buying parts for machines and especially for soil-working parts. Bale wraps will also be an issue.

Replacement machinery could be a big additional cost also for anyone changing up this year, and possibly beyond, unless steel prices fall back.

NI farmers exposed to concentrate feed price

David Wright

Since this time last year, fertiliser prices in Northern Ireland (NI) are up by around £60 – £80/t (€69 – €92/t) with concentrate feed up £40 – £50/t (€46 – €57/t).

While fertiliser is up more, concentrate price rises have a greater impact on production costs on NI livestock farms.

The dairy sector is one of the hardest hit, given the predominance of medium- to high-input systems. Since 2004/05 CAFRE benchmarking data shows that concentrate fed per cow has risen from 1.8t to 2.6t, with average production now over 8,000l per cow. Purchased feed currently accounts for 60 – 70% of variable costs, and for a farmer feeding 0.4kg concentrate per litre, the increase in concentrate price over the last 12 months has added around 2p/l to costs.

On beef and sheep farms, rising costs are also eating into margins, despite higher end prices. For a typical grazing unit applying four bags/acre of nitrogen over the season (133kg N/ha), grazing costs will increase by approximately £16/acre. Higher fertiliser costs will also add £1.50 to £2/t to the cost of producing silage. For a typical steer finished over 100 days next winter, that would only put £3 to £4 onto feed costs. However, with concentrate prices set to remain high, if we assume the average increase works out at £40/t, it would increase costs by around £32/head or 8p/kg on a 400kg carcase.

Glennons purchases Balcas sawmill

Glennon Brothers Ltd has bought Co Fermanagh sawmill Balcas in a major deal not only for the two sawmills but also for the Irish timber processing sector.

Glennon Brothers, founded in 1913, is Ireland’s longest-established mill.

Since the Longford-based mill bought the Smurfit-owned Fermoy sawmill in 1998, the joint managing directors – Pat and Mike Glennon – have made a number of major acquisitions in Ireland and Scotland beginning with Windymains Timber near Edinburgh in 2005. This was followed by Dempsey Timber Engineering, Arklow and Scottish plants Adam Wilsons and Alexanders Timber Design.

This will give Glennons access to timber throughout the island of Ireland. In addition, the mill has been the largest importer of logs from Scotland. This is likely to continue at least until the felling licence debacle is resolved as there is still a major shortfall of logs in the south.

This latest acquisition dramatically increases the company’s share of the Irish and UK market. The purchase is not expected to be opposed by competition regulators in either jurisdiction as there are still six highly competitive medium to large sawmills in Ireland.

“We are looking forward to welcoming Balcas to the group,” said Mike Glennon while his brother Pat described the deal as “another milestone in the history of Glennon Brothers”.

Brian Murphy, chief executive of Balcas, said: “We are excited to be joining Glennon Brothers, a business with a deep rooted history in the timber processing sector and values aligned to our own”.

SHARING OPTIONS