Most people are surprised when they hear that parts of Spain have the perfect conditions for dairy farming. The region of Galicia, in the northwest of the country, gets more rain than Cork and gets the same amount of sunshine as Milan in Italy. Soils are good and the land is green, just like in Ireland (most of the time).

Spain itself has a population of 46m and is a milk-deficit country, being a net importer of dairy products. Galicia has a population of approximately two million, but 1.5m of them own land. Therein lies the problem. Land fragmentation and forestry are the two biggest issues. One farm of 130ha has 156 different parcels each owned by a different person, which isn’t uncommon.

The majority of the landowners are not farmers, instead they lease their land to farmers or it is planted with trees. Over 65% of the land area is scrub or forestry with farming only using 20% of the total land area.

Despite this, the region has over 8,000 dairy farms producing 2.6bn litres of milk annually. While annual rainfall is high at over 1,200mm, the summers are dry. The fields normally burn up in July, but this year, Ireland seems to have gone drier earlier than Spain. About 20% of the cows in Galicia graze grass, while the rest are housed full-time.

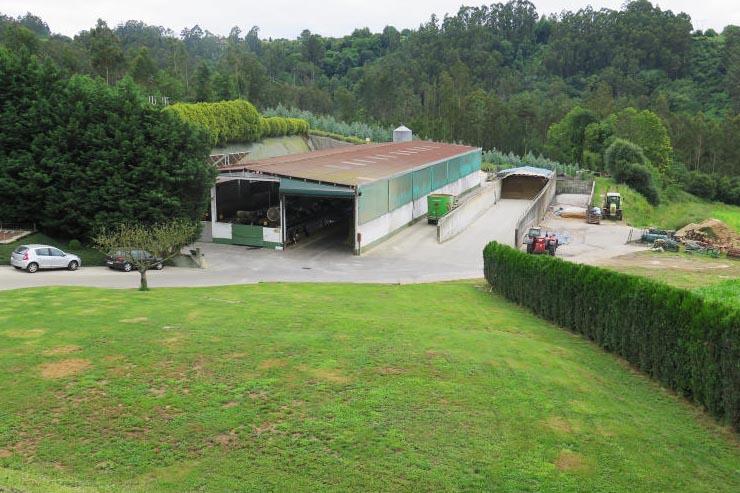

Granxa O Cancelo's farm in Galicia, Spain, which was visited as part of the EDF annual congress 2018.

Maize is the main crop. Nearly every field being farmed is growing maize at the moment. This will be harvested as silage in late September and many farmers will plaster it in slurry, plough it and sow hybrid and Italian ryegrass. This will be ready for first-cut silage in February or March and, weather permitting, ready for second cut in late April before being ploughed up for maize silage again. The double cropping system produces on average 18tDM/ha annually, with about 12t from maize and 6t from grass. In a good year, over 20t/ha of dry matter will be grown.

On most of the dairy farms, over half of the diet is bought-in concentrates, fed in a total mixed ration with the maize and grass silage. Management on the farms is good, with the three farms visited by the Irish Farmers Journal producing over 10,000 litres of milk per cow from high genetic potential Holstein Friesian cows, milked two to three times per day.

EDF

Galicia in Spain was the destination of the European Dairy Farmers (EDF) annual congress. The organisation is made up of 325 farmers from across Europe who share their costs of production figures. The Irish branch has 11 members from across the country. Ireland will host the congress in 2020.

Steffi Wille-Sonk collects and assimilates the cost of production data from each member. There are two key figures presented, the farm’s break-even point and the milk price received. The difference is the entrepreneur’s profit. The break-even point is the milk price needed to just break even after all the costs are paid, debt repayments are made, family and own labour is paid for and interest is charged on all assets, whether owned outright or borrowed for. Decoupled subsidies are excluded from this break-even point.

This levels the playing field between members and between countries. Table 1 shows the median break-even point and average milk prices for the EDF members in each country. It is important to note that this is not a representative sample or average for the country. It is simply the milk price and the break-even point for the EDF members from these countries. EDF members tend to be progressive farmers, so you would expect that their figures outperform the national average. All figures are based on energy corrected milk at 3.6% protein and 4% fat.

Most EDF members are not making a profit. The median break-even point is 33c/kg

It is important to note that not all countries are using the same time period. The data for most countries is based on the 2017 calendar year, which was generally a good year for milk price. But some countries (UK, Germany, France and Holland) include a proportion of 2016 data, which was a poor year for milk prices so their figures might look worse than they are when compared with 2017 figures for other countries.

Looking at the table, it is clear that the Irish farmers in EDF have a comparatively low median break-even point, the second lowest in Europe with only the Czech farmers lower at 28c/kg milk. But at 29c/kg, the Irish break-even point is considerably higher than the Teagasc profit monitor figures for 2017 which showed costs of production to be 22.4c/kg of milk.

Of course, the profit monitor doesn’t account for family labour or capital employed, so the EDF figures, albeit from a small number of farmers, are much more reflective of reality.

It shows that half of the Irish farmers in EDF need a milk price received of 29c/kg (28.13c/l) to get a full return on their labour and assets.

The other thing that jumps out is the fact that most EDF members are not making a profit. The median break-even point is 33c/kg. Steffi presented a chart showing the range in break-even point and milk price for EDF members over the last 10 years.

Median break-even point has ranged from 32c/kg to 38c/kg of milk while milk price has fluctuated more, going from 26c/kg to 39c/kg of milk. So farmers in high-cost production systems lose money as often as they make it. The other thing worth noting is that median break-even point for the Irish farmers in the study has increased over time, meaning costs of production on these farms is increasing.

Part of the congress involves visits to EDF member farms in Spain. One of the farms we visited was owned by a farmer co-operative. The Galician Co-operative Society offers technical advice to its members, a farm relief service and gives advice on purchasing inputs. This co-op owns two farms and an ice cream company. The ice cream is sold in shops owned by the co-op in Spanish cities and also to restaurants and other shops.

One of the co-op’s farms is Granxo O Cancelo. The 36ha farm produces 1.34m litres of milk from 90 cows milked three times daily. Cows are housed all year round and are milked all year round. One of the striking things about this farm is the low solids being produced. Average fat content is 2.76% while average protein is 3.33%. Only 10% of the milk produced actually goes for ice cream, the rest is sold on a price-per-litre basis.

The farm has 90 cows, 15 calves and 55 heifers which are all housed full-time. The herd is all Holstein Friesian from US genetics. The milking cows are fed a total of 26.5kg DM/day from a TMR mix of maize silage and purchased straights and brewers grains. The diet costs €5/cow/day and the average milk yield is 44 litres per cow per day.

Labour units

There are 2.5 labour units on the farm, operating in two shifts. The first shift starts at 4.45am and finishes at 2.30pm with a 30-minute break. The afternoon shift goes from 11am to 2.30pm and from 4.30pm to 10.30pm. Employees get six days off a month and get 30 days holidays a year. The hours worked per cow per person per year is 80.

The break-even costs for 2017 was 30.6c/kg of milk while the entrepreneur’s profit was 3.6c/kg milk or a profit of €48,000 before the basic payment was factored in.

Most people are surprised when they hear that parts of Spain have the perfect conditions for dairy farming. The region of Galicia, in the northwest of the country, gets more rain than Cork and gets the same amount of sunshine as Milan in Italy. Soils are good and the land is green, just like in Ireland (most of the time).

Spain itself has a population of 46m and is a milk-deficit country, being a net importer of dairy products. Galicia has a population of approximately two million, but 1.5m of them own land. Therein lies the problem. Land fragmentation and forestry are the two biggest issues. One farm of 130ha has 156 different parcels each owned by a different person, which isn’t uncommon.

The majority of the landowners are not farmers, instead they lease their land to farmers or it is planted with trees. Over 65% of the land area is scrub or forestry with farming only using 20% of the total land area.

Despite this, the region has over 8,000 dairy farms producing 2.6bn litres of milk annually. While annual rainfall is high at over 1,200mm, the summers are dry. The fields normally burn up in July, but this year, Ireland seems to have gone drier earlier than Spain. About 20% of the cows in Galicia graze grass, while the rest are housed full-time.

Granxa O Cancelo's farm in Galicia, Spain, which was visited as part of the EDF annual congress 2018.

Maize is the main crop. Nearly every field being farmed is growing maize at the moment. This will be harvested as silage in late September and many farmers will plaster it in slurry, plough it and sow hybrid and Italian ryegrass. This will be ready for first-cut silage in February or March and, weather permitting, ready for second cut in late April before being ploughed up for maize silage again. The double cropping system produces on average 18tDM/ha annually, with about 12t from maize and 6t from grass. In a good year, over 20t/ha of dry matter will be grown.

On most of the dairy farms, over half of the diet is bought-in concentrates, fed in a total mixed ration with the maize and grass silage. Management on the farms is good, with the three farms visited by the Irish Farmers Journal producing over 10,000 litres of milk per cow from high genetic potential Holstein Friesian cows, milked two to three times per day.

EDF

Galicia in Spain was the destination of the European Dairy Farmers (EDF) annual congress. The organisation is made up of 325 farmers from across Europe who share their costs of production figures. The Irish branch has 11 members from across the country. Ireland will host the congress in 2020.

Steffi Wille-Sonk collects and assimilates the cost of production data from each member. There are two key figures presented, the farm’s break-even point and the milk price received. The difference is the entrepreneur’s profit. The break-even point is the milk price needed to just break even after all the costs are paid, debt repayments are made, family and own labour is paid for and interest is charged on all assets, whether owned outright or borrowed for. Decoupled subsidies are excluded from this break-even point.

This levels the playing field between members and between countries. Table 1 shows the median break-even point and average milk prices for the EDF members in each country. It is important to note that this is not a representative sample or average for the country. It is simply the milk price and the break-even point for the EDF members from these countries. EDF members tend to be progressive farmers, so you would expect that their figures outperform the national average. All figures are based on energy corrected milk at 3.6% protein and 4% fat.

Most EDF members are not making a profit. The median break-even point is 33c/kg

It is important to note that not all countries are using the same time period. The data for most countries is based on the 2017 calendar year, which was generally a good year for milk price. But some countries (UK, Germany, France and Holland) include a proportion of 2016 data, which was a poor year for milk prices so their figures might look worse than they are when compared with 2017 figures for other countries.

Looking at the table, it is clear that the Irish farmers in EDF have a comparatively low median break-even point, the second lowest in Europe with only the Czech farmers lower at 28c/kg milk. But at 29c/kg, the Irish break-even point is considerably higher than the Teagasc profit monitor figures for 2017 which showed costs of production to be 22.4c/kg of milk.

Of course, the profit monitor doesn’t account for family labour or capital employed, so the EDF figures, albeit from a small number of farmers, are much more reflective of reality.

It shows that half of the Irish farmers in EDF need a milk price received of 29c/kg (28.13c/l) to get a full return on their labour and assets.

The other thing that jumps out is the fact that most EDF members are not making a profit. The median break-even point is 33c/kg. Steffi presented a chart showing the range in break-even point and milk price for EDF members over the last 10 years.

Median break-even point has ranged from 32c/kg to 38c/kg of milk while milk price has fluctuated more, going from 26c/kg to 39c/kg of milk. So farmers in high-cost production systems lose money as often as they make it. The other thing worth noting is that median break-even point for the Irish farmers in the study has increased over time, meaning costs of production on these farms is increasing.

Part of the congress involves visits to EDF member farms in Spain. One of the farms we visited was owned by a farmer co-operative. The Galician Co-operative Society offers technical advice to its members, a farm relief service and gives advice on purchasing inputs. This co-op owns two farms and an ice cream company. The ice cream is sold in shops owned by the co-op in Spanish cities and also to restaurants and other shops.

One of the co-op’s farms is Granxo O Cancelo. The 36ha farm produces 1.34m litres of milk from 90 cows milked three times daily. Cows are housed all year round and are milked all year round. One of the striking things about this farm is the low solids being produced. Average fat content is 2.76% while average protein is 3.33%. Only 10% of the milk produced actually goes for ice cream, the rest is sold on a price-per-litre basis.

The farm has 90 cows, 15 calves and 55 heifers which are all housed full-time. The herd is all Holstein Friesian from US genetics. The milking cows are fed a total of 26.5kg DM/day from a TMR mix of maize silage and purchased straights and brewers grains. The diet costs €5/cow/day and the average milk yield is 44 litres per cow per day.

Labour units

There are 2.5 labour units on the farm, operating in two shifts. The first shift starts at 4.45am and finishes at 2.30pm with a 30-minute break. The afternoon shift goes from 11am to 2.30pm and from 4.30pm to 10.30pm. Employees get six days off a month and get 30 days holidays a year. The hours worked per cow per person per year is 80.

The break-even costs for 2017 was 30.6c/kg of milk while the entrepreneur’s profit was 3.6c/kg milk or a profit of €48,000 before the basic payment was factored in.

SHARING OPTIONS