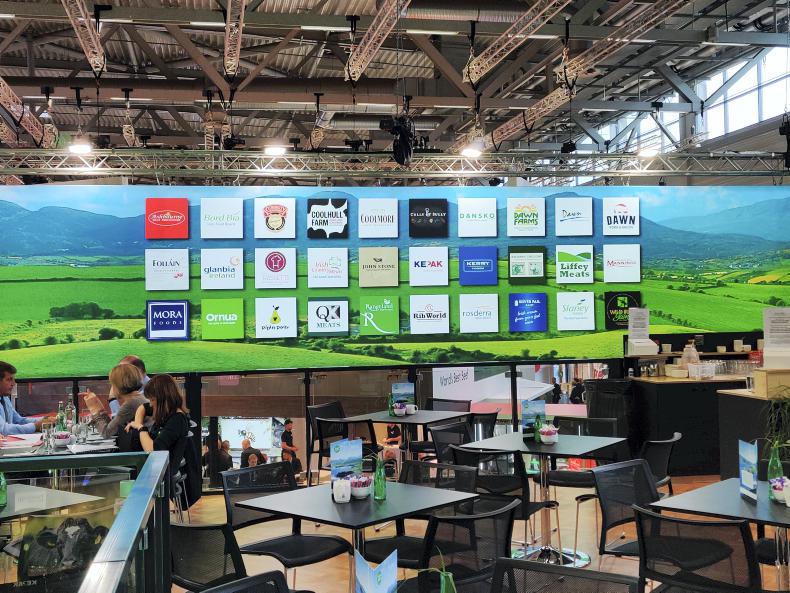

Irish factories moved to the Anuga food show in Germany this week, where the world's food and drink buyers gathered.

Irish factories gather in the dedicated meat hall, which increasingly was featuring meat substitute products, another worrying development for the under pressure sector.

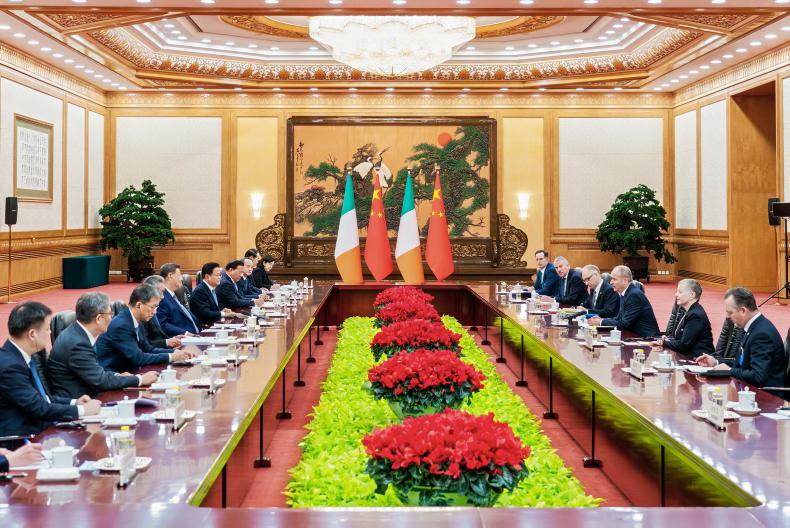

While the trade in Britain and across the EU continues sluggish, there is some optimism for business outside the EU.

Such is the demand coming from China, partly driven by the deficit of pigmeat, that beef is being taken from the South American countries in huge volumes, as well as Australia and New Zealand.

In turn, it is reported that the Australians will only fill 40% of their lucrative 400,000t USA quota, which suggests the EU will also be out in global markets looking for supplies of forequarter beef.

Trade holding

However, nothing happened to give the Irish trade a boost so far this week.

With wet weather still pushing cattle out, factories are able to pick and choose the stock they kill, as business hasn’t fully returned to normal.

Reports from around the country suggest that priority is being given to cattle coming up to 30 months and with it being peak season for killing cattle, it is young bulls and cattle that are gone over 30 months that are being forced to wait.

Price seems to be holding for steers and heifers, with €3.45/kg the going rate for steers and €3.55/kg for heifers.

In exceptional circumstances, 5c/kg extra can be secured, but this is the exception, with the Liffey deal now an outlier.

Cows

Cows took a hit last week and are trading from €2.65/kg to €2.80/kg for P+3, with O3 grades rising to €2.75/kg to €2.90/kg and R grades making between €3.00/kg and €3.20/kg.

U grading cows are rare, but will get between €3.20/kg and €3.30/kg where a factory is interested.

As always with cows, finding a factory that is keen to kill cows is essential to get best value.

Bulls

Bulls continue to be a problem and appear to be down the priority list for factories, as they concentrate on steers and heifers.

The going rate seems to be €3.40/kg to €3.45/kg for R grades, with U grades rising to between €3.50/kg and €3.55/kg. This is where factories will accept a booking.

Weights are also an issue, with many factories not interested in anything over 420kg or 430kg, but there are still factories that will accept 450kg or even higher, but they are increasingly difficult to find.

SHARING OPTIONS