Irish wool merchants remain downbeat about the prospects for the new-season wool trade.

Discussions with merchants this week paint a picture of ongoing challenges in both moving significant volumes of wool and securing a price that is capable of delivering a workable margin over costs. Merchants report that there have been some false dawns in the market in recent months and that brief improvements have failed to develop into any constant recovery.

Price prospects remain bleak, with lowland wool looking like it will continue to trade at producer level for 15c/kg to 20c/kg for greasy wool.

Some merchants report they still have significant volumes of 2020 season wool on their hands

Wool from Scottish Blackface sheep continues to face an even harsher trading environment, with white Scottish wool quoted a price of 5c/kg and merchants having little interest in grey or black Scottish wool due to limited market outlets and no demand.

Some merchants report they still have significant volumes of 2020 season wool on their hands, although some also report a significant reduction in the volume of wool they were offered.

This follows some producers opting to store wool in the hope of improved prices while others decided on composting it to recycle nutrients and a small cohort dumped and even tried burning it.

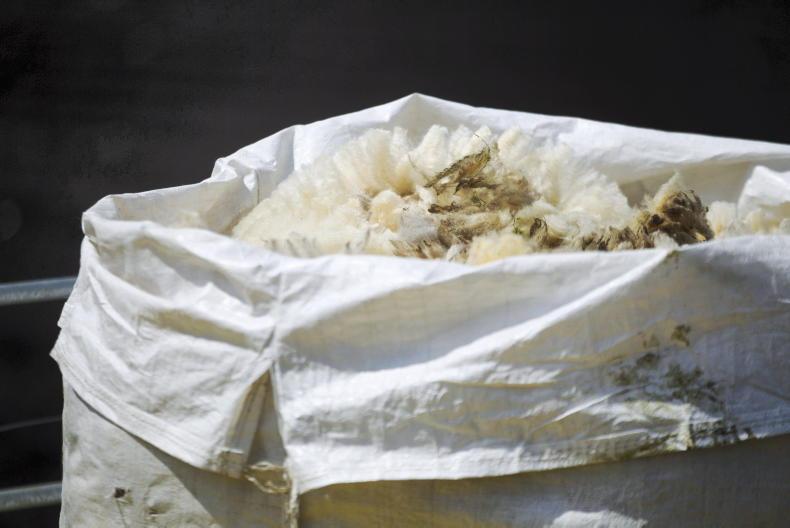

Merchants cite a deterioration in the quality of wool presented from some producers. Where wool is wet and contaminated with daggings or straw, it will leave it practically worthless.

Fewer collection points

Reports in recent weeks point to the possibility of fewer intake points for wool, with some general agricultural merchants opting at present to forego handling wool.

A slowdown in the textile and manufacturing industry has seen demand for wool in China, the world’s largest consumer and processor of wool, collapse

The most high-profile of these is Quinn’s of Baltinglass, with the company citing poor demand internationally as its reason for not taking in wool from farmers at present. The global wool trade continues to be badly hampered by the coronavirus pandemic.

Where farmers are opting to store wool they should ensure it is stored clean and dry to maintain its value as close to maximum as possible.

A slowdown in the textile and manufacturing industry has seen demand for wool in China, the world’s largest consumer and processor of wool, collapse. Some wool merchants comment they have seen major fluctuations in the trade before but not to such a weak level. They predict the fortunes for wool will turn again, but question how much damage may be done to the industry by the time this happens.

Brighter prospects

Ulster Wool, in contrast, is predicting brighter prospects for the 2021 wool season. Its optimism is based on clearing the stock overhang from the 2019 season and finishing the 2020 shearing year with minimal stock on hand.

A statement released by the co-op also highlighted an auction price of 67p/kg as opposed to 50p/kg to 55p/kg for much of the last 12 months as a significant turning point.

Mule and Blackface breeders will receive a balancing payment in the region of 15p/kg and 5p/kg to 10p/kg, respectively

The company has announced it is not in a position to make any additional payments for fine and medium wool grades to the upfront payments made at the start of the 2020 season, which averaged in the region of 20p/kg to 25p/kg.

Mule and Blackface breeders will receive a balancing payment in the region of 15p/kg and 5p/kg to 10p/kg, respectively.

A significant change being introduced in 2021 by Ulster Wool is the switching from the upfront and balancing payment mechanism to full payment in arrears at the end of the season.

Irish wool merchants remain downbeat about the prospects for the new-season wool trade.

Discussions with merchants this week paint a picture of ongoing challenges in both moving significant volumes of wool and securing a price that is capable of delivering a workable margin over costs. Merchants report that there have been some false dawns in the market in recent months and that brief improvements have failed to develop into any constant recovery.

Price prospects remain bleak, with lowland wool looking like it will continue to trade at producer level for 15c/kg to 20c/kg for greasy wool.

Some merchants report they still have significant volumes of 2020 season wool on their hands

Wool from Scottish Blackface sheep continues to face an even harsher trading environment, with white Scottish wool quoted a price of 5c/kg and merchants having little interest in grey or black Scottish wool due to limited market outlets and no demand.

Some merchants report they still have significant volumes of 2020 season wool on their hands, although some also report a significant reduction in the volume of wool they were offered.

This follows some producers opting to store wool in the hope of improved prices while others decided on composting it to recycle nutrients and a small cohort dumped and even tried burning it.

Merchants cite a deterioration in the quality of wool presented from some producers. Where wool is wet and contaminated with daggings or straw, it will leave it practically worthless.

Fewer collection points

Reports in recent weeks point to the possibility of fewer intake points for wool, with some general agricultural merchants opting at present to forego handling wool.

A slowdown in the textile and manufacturing industry has seen demand for wool in China, the world’s largest consumer and processor of wool, collapse

The most high-profile of these is Quinn’s of Baltinglass, with the company citing poor demand internationally as its reason for not taking in wool from farmers at present. The global wool trade continues to be badly hampered by the coronavirus pandemic.

Where farmers are opting to store wool they should ensure it is stored clean and dry to maintain its value as close to maximum as possible.

A slowdown in the textile and manufacturing industry has seen demand for wool in China, the world’s largest consumer and processor of wool, collapse. Some wool merchants comment they have seen major fluctuations in the trade before but not to such a weak level. They predict the fortunes for wool will turn again, but question how much damage may be done to the industry by the time this happens.

Brighter prospects

Ulster Wool, in contrast, is predicting brighter prospects for the 2021 wool season. Its optimism is based on clearing the stock overhang from the 2019 season and finishing the 2020 shearing year with minimal stock on hand.

A statement released by the co-op also highlighted an auction price of 67p/kg as opposed to 50p/kg to 55p/kg for much of the last 12 months as a significant turning point.

Mule and Blackface breeders will receive a balancing payment in the region of 15p/kg and 5p/kg to 10p/kg, respectively

The company has announced it is not in a position to make any additional payments for fine and medium wool grades to the upfront payments made at the start of the 2020 season, which averaged in the region of 20p/kg to 25p/kg.

Mule and Blackface breeders will receive a balancing payment in the region of 15p/kg and 5p/kg to 10p/kg, respectively.

A significant change being introduced in 2021 by Ulster Wool is the switching from the upfront and balancing payment mechanism to full payment in arrears at the end of the season.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: