The fallout from the Russian ban on EU food products continues this week as more European agribusinesses count the cost of the embargo.

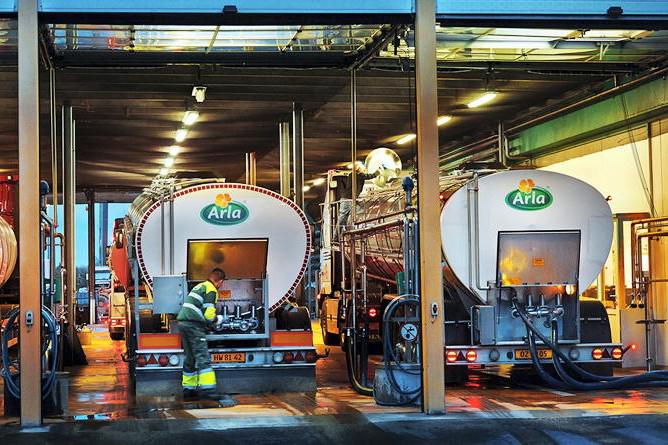

Arla, the Danish dairy giant, has announced the loss of 79 jobs across five different production sites in Denmark, as a direct result of the ban. The Russian market makes up about 1% of Arla’s total global turnover but is seen as a growth market.

Speaking to the Irish Farmers Journal, a spokesperson for the company said “Before this ban, we expected to reach sales of nearly €161m this year.”

Dutch dairy processor FrieslandCampina said it is taking measures to minimize the impact. In 2013, Friesland had sales of €320m in Russia while exporting over 50,000 tonnes of cheese there.

Last week, Finnish dairy company Valio announced it will begin talks with employees over possible job losses as the Russian market accounts for 85% of total exports.

While European dairy processors are clear losers from the Russian food ban, Brazil is a country that has the potential to be a major winner.

Russian authorities recently approved 90 Brazilian meat processing plants for export to Russia and JBS is predicting that sales to Russia will rise to between €450m-€600m. Last year, JBS sales to Russia amounted to around €190m.

SHARING OPTIONS