The 2016 budget announced on Tuesday will be the last of the 31st Dáil, with a general election likely to be held in the spring. With much of the measures well flagged in advance, there was no surprise at some of the significant concessions announced by the Government.

From a farming perspective, there was plenty of good news, with Minister for Finance Michael Noonan increasing expenditure at the Department of Agriculture, Food and the Marine by €109m for 2016 to over €1.35bn.

Listen to our special Budget 2016 podcast below:

Some of the most important changes are as follows:

Agri-environmental schemes

The Department of Agriculture says it has allocated €203m of funding to past and present agri-environmental schemes, with €142m of this set aside for GLAS. This will allow a further 13,000 places to open for the scheme next week, bringing the total in the scheme up to 40,000.

TAMS

The Department announced an allocation of €35.8m under TAMS for 2016, with the Minister stating that funds will now be available for pig, poultry and sheep fencing, dairy equipment, as well as organic capital investment. The minister added that funding for grain storage would also be provided for as part of this.

Rural Development Programme

Funding for the Rural Development Programme (RDP) has been increased by over 12.5% to €494m for the coming year. Minister Coveney said the RDP schemes will see an investment of €4bn in the Irish agriculture sector between 2014 and 2020 helping to provide investment capital for the rural economy and support family farm incomes.

Research & Development

The Department also announced that over €31m will be allocated in 2016 for the R&D and training sector. The Minister said that in order to meet the targets set out under Food Wise 2025, the Government needed to invest in agri-food research.

Areas of Natural Constraint (ANC)

The funding for ANC will remain at €195m for the coming year.

Beef Data and Genomics Programme (BDGP)

The funding for the BDGP will also remain unchanged at €52m for 2016. Of this funding, €6m has been allocated for the beef sector through the Bord Bia Beef and Lamb Quality Assurance Programme.

Basic Payment Scheme

Direct funding for farmers under the EU Basic Payment Scheme remains the same, with €1.2bn set aside for basic payments in 2016. The minister also reiterated that farmers will begin to receive 70% of this year’s basic payment from next week to ease cashflow problems being experienced by farmers due to price volatility.

General taxation

Perhaps the changes that will have the greatest bearing on the income of farm families are the changes to general taxation and Government expenditure announced by Minister Noonan and Minister for Expenditure Brendan Howlin.

The three lowest rates of the Universal Social Charge (USC) are all to be cut. The 1.5% rate will be cut to 1%, the 3.5% rate will be cut to 3%, while the 7% rate will be cut by 1.5% down to 5.5%. The Minister also announced a new €550 tax credit for farmers and self-employed people.

This, together with the reduced USC rates, will see a farmer with an average farm income of €26,000 gain an additional €800 in net income. There will also be a €5 increase in child allowance to €140 per child per month.

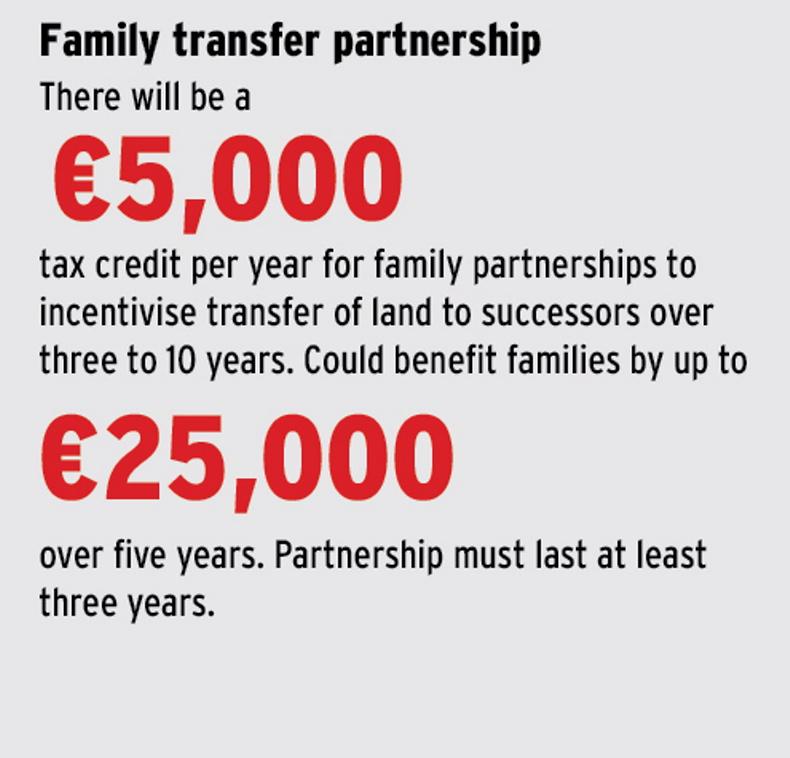

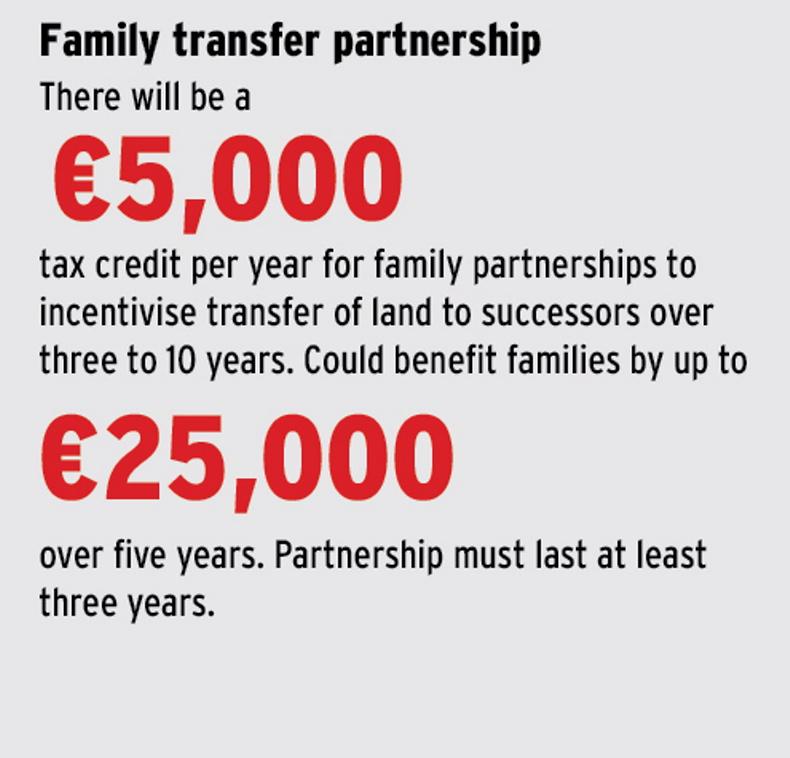

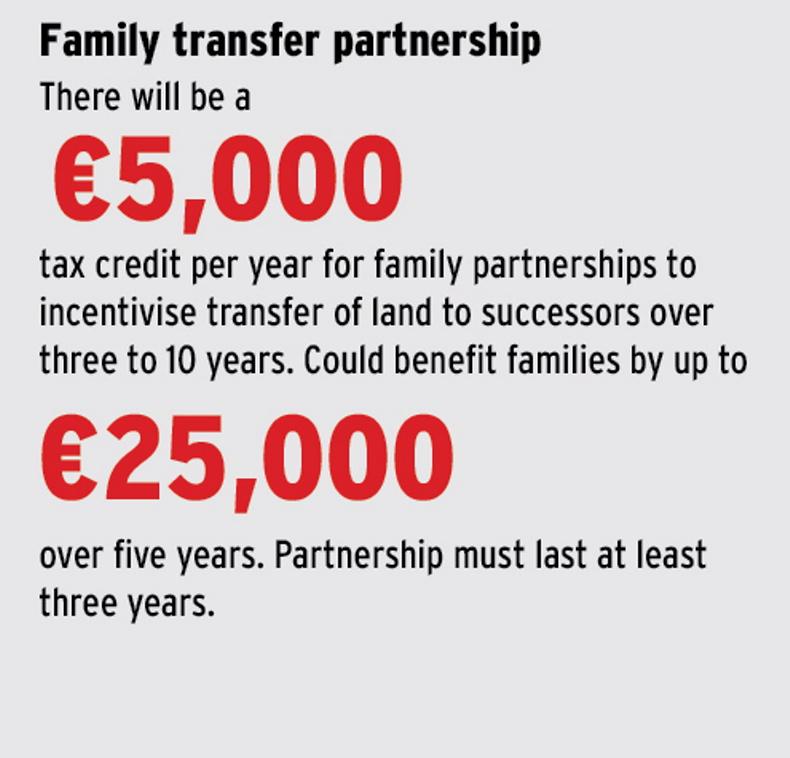

The minister also announced plans for making the transfer of farm ownership easier. The scheme, which was first talked about last year, will see a tax credit of €5,000 each year for up to five years if they commit to transfer the farm in a phased basis over a 10-year period.

Minister Noonan also announced the general stock relief, the stock relief for young trained farmers, the stock relief for registered farm partnerships and the stamp duty exemption for young trained farmers will be extended for a further three years to the end of 2018.

Motor benefits

Another benefit for farmers will be the restructuring of the motor tax rate system. Commercial motor tax rates will be simplified, with the 20 existing rates to be replaced by five new rates. The new road tax band will range from €92 to €900. Under the previous band the maximum rate was almost €5,200.

For forestry farmers, the upper tax-free income limit of €80,000 has been abolished, meaning that forestry farmers can now clear-fell tax-free from 2016.

Read more

Full coverage: Budget 2016

13,000 GLAS places to open next week

Budget to cut cost of transport of farm and food goods

The 2016 budget announced on Tuesday will be the last of the 31st Dáil, with a general election likely to be held in the spring. With much of the measures well flagged in advance, there was no surprise at some of the significant concessions announced by the Government.

From a farming perspective, there was plenty of good news, with Minister for Finance Michael Noonan increasing expenditure at the Department of Agriculture, Food and the Marine by €109m for 2016 to over €1.35bn.

Listen to our special Budget 2016 podcast below:

Some of the most important changes are as follows:

Agri-environmental schemes

The Department of Agriculture says it has allocated €203m of funding to past and present agri-environmental schemes, with €142m of this set aside for GLAS. This will allow a further 13,000 places to open for the scheme next week, bringing the total in the scheme up to 40,000.

TAMS

The Department announced an allocation of €35.8m under TAMS for 2016, with the Minister stating that funds will now be available for pig, poultry and sheep fencing, dairy equipment, as well as organic capital investment. The minister added that funding for grain storage would also be provided for as part of this.

Rural Development Programme

Funding for the Rural Development Programme (RDP) has been increased by over 12.5% to €494m for the coming year. Minister Coveney said the RDP schemes will see an investment of €4bn in the Irish agriculture sector between 2014 and 2020 helping to provide investment capital for the rural economy and support family farm incomes.

Research & Development

The Department also announced that over €31m will be allocated in 2016 for the R&D and training sector. The Minister said that in order to meet the targets set out under Food Wise 2025, the Government needed to invest in agri-food research.

Areas of Natural Constraint (ANC)

The funding for ANC will remain at €195m for the coming year.

Beef Data and Genomics Programme (BDGP)

The funding for the BDGP will also remain unchanged at €52m for 2016. Of this funding, €6m has been allocated for the beef sector through the Bord Bia Beef and Lamb Quality Assurance Programme.

Basic Payment Scheme

Direct funding for farmers under the EU Basic Payment Scheme remains the same, with €1.2bn set aside for basic payments in 2016. The minister also reiterated that farmers will begin to receive 70% of this year’s basic payment from next week to ease cashflow problems being experienced by farmers due to price volatility.

General taxation

Perhaps the changes that will have the greatest bearing on the income of farm families are the changes to general taxation and Government expenditure announced by Minister Noonan and Minister for Expenditure Brendan Howlin.

The three lowest rates of the Universal Social Charge (USC) are all to be cut. The 1.5% rate will be cut to 1%, the 3.5% rate will be cut to 3%, while the 7% rate will be cut by 1.5% down to 5.5%. The Minister also announced a new €550 tax credit for farmers and self-employed people.

This, together with the reduced USC rates, will see a farmer with an average farm income of €26,000 gain an additional €800 in net income. There will also be a €5 increase in child allowance to €140 per child per month.

The minister also announced plans for making the transfer of farm ownership easier. The scheme, which was first talked about last year, will see a tax credit of €5,000 each year for up to five years if they commit to transfer the farm in a phased basis over a 10-year period.

Minister Noonan also announced the general stock relief, the stock relief for young trained farmers, the stock relief for registered farm partnerships and the stamp duty exemption for young trained farmers will be extended for a further three years to the end of 2018.

Motor benefits

Another benefit for farmers will be the restructuring of the motor tax rate system. Commercial motor tax rates will be simplified, with the 20 existing rates to be replaced by five new rates. The new road tax band will range from €92 to €900. Under the previous band the maximum rate was almost €5,200.

For forestry farmers, the upper tax-free income limit of €80,000 has been abolished, meaning that forestry farmers can now clear-fell tax-free from 2016.

Read more

Full coverage: Budget 2016

13,000 GLAS places to open next week

Budget to cut cost of transport of farm and food goods

SHARING OPTIONS