It is now two years since African swine fever (ASF) hit China’s national pig herd and devastated production, with output falling from 54m tonnes annually to an expected 38m tonnes this year. The industry in China is expected to begin recovery in 2021, with an increase in production of 9% to 41.5m tonnes, according to a recent United States Department of Agriculture (USDA) report.

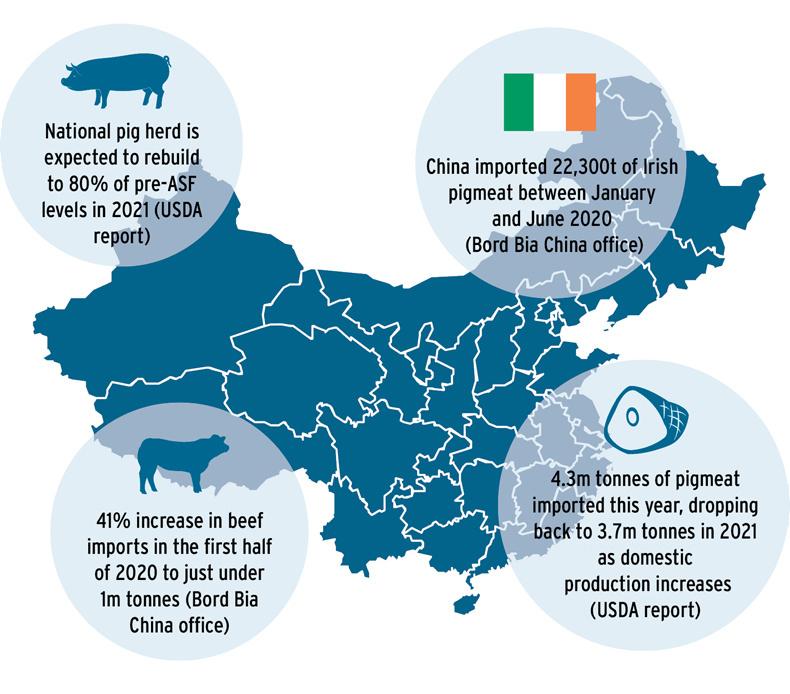

However, the sow herd is expected to rebuild to 31m and the number of pigs is forecast to reach 370m, 80% of pre-ASF levels. It is expected that it will take a further two years for pigmeat output to recover to previous levels.

The deficit in supply has been partially offset by an increase in imports, which are forecast to reach a record 4.3m tonnes this year, dropping back to 3.7m tonnes in 2021 as domestic production of pigmeat increases.

China is Ireland’s second-most important market for pigmeat, taking 22,300t in the first six months of this year.

€600 per cow government support

The deficit of pigmeat has created a knock-on demand for other meat and a huge expansion of poultry meat production. What will be of particular interest to Irish farmers is China’s approach to the expansion of its domestic beef industry.

According to the USDA report, the Chinese central government has promised to encourage farmers with grants between the equivalent of €30,413 and €60,827 for farms that slaughter more than 500 cattle or breed more than 50 cows in 2020.

Moreover, the huge level of government support has had no negative effect on the market price of beef, which averaged the equivalent of €4.67/kg at the end of July and has been consistently above the equivalent of €4.25/kg since this time last year.

The USDA also reports that the government has relaxed restrictions on the use of land for livestock farming, which, along with relaxed environmental protection policies, is designed to encourage the expansion of the beef sector in China.

Beef imports

While beef production is predicted to increase, so too will demand for beef imports, though not as fast as in recent years. The first half of 2020 showed China’s beef imports at just under 1m tonnes (product weight), a 41% increase on the same period in 2019. Almost three-quarters of this came from South American countries, with Australia and New Zealand contributing a further 21%. Irish exports were building a share of the Chinese market, until the discovery of a BSE case led to the suspension of exports in May.

Relevance to Irish farmers

Ireland is a huge net exporter of agricultural produce and China is our second-most important export market for dairy and pigmeat, and was a growing market for beef prior to the BSE-related suspension. It differs from other markets, in that it has had continued expansion of demand over recent years. The fact that it is a growing market for beef imports should be a big opportunity for our export industry, but this has been frustrated by the BSE-related suspension.

Meanwhile, the world’s largest meat company, JBS, as well as announcing a huge increase in profits for the second quarter of 2020, also announced a 53% increase in exports to China and Hong Kong. Brazil and Argentina are the main source of beef imports to China, while the US is the top pigmeat supplier, despite paying additional tariffs.

Brazil and Argentina enjoy a huge competitive price advantage, while Australia, despite having a higher beef price than Ireland at present, enjoys relative geographic proximity and is in a position to supply huge volume.

It is unlikely that China will be a huge volume market for Ireland, but it can be a significant one if present BSE difficulties can be overcome.

SHARING OPTIONS