Now that we finally have a Government, the focus must turn to the very real challenges of restarting the Irish economy.

On the positive side, the cost of borrowing plus national finances were in relatively good shape going into the coronavirus shutdown.

Equally importantly, the evolving EU-wide COVID-19 fund, while not yet fully formed or entirely to Ireland's liking, recognises the need for concerted action, rather than relying on the invisible hand of the markets or the dead hand of state aid-restricted government intervention as the sole policy.

This was the case in the last recession caused by the global financial crash in 2008 which lasted until 2015.

Massive challenge

There is a huge challenge ahead for the new Government as it attempts to get the economy going again in the midst of a post-pandemic global recession.

The slow emergence from lockdown and threat of further spikes restricts tourism and travel, with the knock-on impact on the food service and hospitality sectors, as pubs and restaurants will be operating with costly restrictions.

An unemployment rate of 15% or more is a serious possibility and there is the issue of a dysfunctional trading relationship between the UK and EU from the end of this year.

This could leave Ireland trading with and through a UK economy that diverges from UK norms and standards.

The long-standing housing shortage and health service problems remain to be addressed

Climate change is a global issue but there is a particular issue for Ireland in that ideology risks curbing the contribution the agri food sector can make to driving economic growth to the rural and regional economy.

There is also the paradox in the Irish economy where the successful multinational sector provides good top line economic performance figures, but unlike agri food, this money doesn’t circulate in the Irish economy.

Aside from the COVID-19 created problems, the long-standing housing shortage and health service problems remain to be addressed in a meaningful way by the incoming Government.

ESRI report

The challenge for the incoming Government is huge, but the ESRI has identified how and where it can get the best return for its investment in the economy.

In a report by Professor John Fitzgerald - Understanding recent trends in the Irish economy – he highlights that “while foreign multinational enterprises make a very valuable contribution to growth, the success of the economy now depends very heavily on the progress of domestic business”.

The focus and methodology of the report was to address the conundrum that is Ireland's “official GDP figures“ and by removing the impact of multinational profit repatriation and price transfers, establishes a more realistic and relevant view of the performance of the Irish economy.

The GDP measurement in Ireland can be distorted, as demonstrated in the second quarter of 2015

Prof Fitzgerald suggests that instead of using the GDP metric for Irish economy health, a stripped-back measure called net national product (NNP) is more realistic and more relevant to assessing true Irish economic performance.

The GDP measurement in Ireland can be distorted, as demonstrated in the second quarter of 2015, which recorded a 21% annual increase due to the lodging of international patents in Ireland and gave rise to the term 'leprechaun economics'.

Using the NNP measure, two major insights emerge into the real patterns of economic growth, according to Prof Fitzgerald.

Firstly, while foreign firms account for over half of the gross value added in the economy, they only account for one fifth of NNP and one quarter of the wage bill, and both foreign and domestic firms grew at a similar rate since the economy began to recover in 2013.

DEBE report on Irish economy expenditure

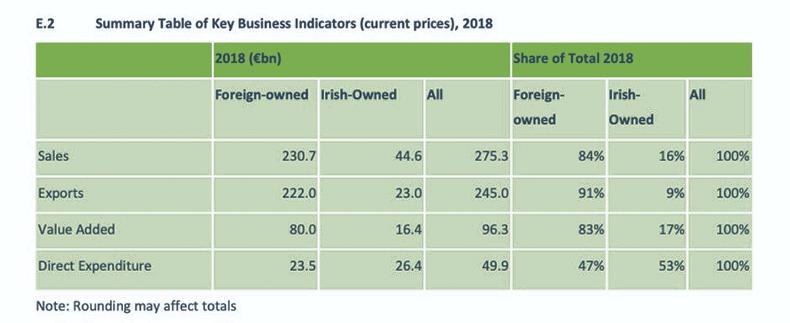

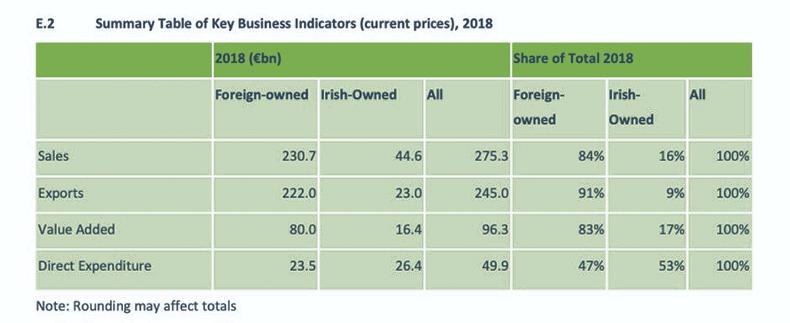

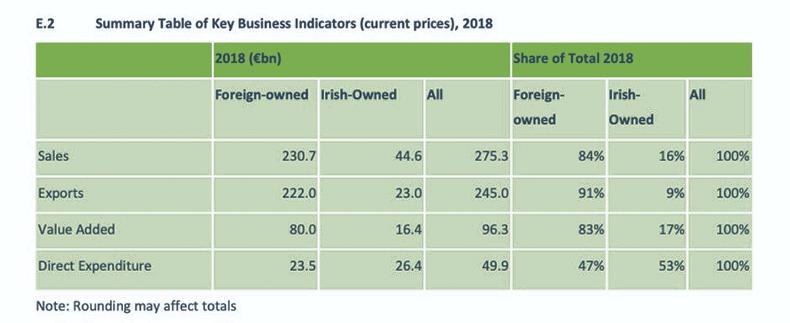

Additionally in May, the Department of Enterprise Business and Employment (DEBE) published a major report entitled The Annual Survey of Irish Economy Expenditure for 2018.

As per previous articles of mine, this annual report publishes analyses of total exports, sales, gross value added and, perhaps most importantly, expenditure in the Irish economy by all firms in all sectors, indigenous and foreign multinationals.

This report is based on a survey of approximately 4,200 client companies of Enterprise Ireland, IDA Ireland and Údarás na Gaeltachta with 10 or more employees in Ireland and comprises the manufacturing and information, communication and other internationally traded services sectors. All data is in current prices.

The points below best illustrates the huge difference between the perception of the value of sales or exports by the multinational companies through the Irish economy and the reality of the much lower figure of their expenditure in the Irish economy.

While sales and exports from the FDI sector were running at €220bn and €230bn respectively in 2018, direct expenditure in the Irish economy amounted to €23bn.Moreover, direct expenditure by domestic companies was higher at €26.4bn. In economic multiplier terms, for every €10 of multinational exports, €1 is spent in the Irish economy.For domestic Irish companies including the food and drink sector, the ratio is €10 exports to €11.50 spend in the Irish economy (€23bn exports versus €26.4bn Irish economy spend)

Multinationals good but indigenous better.

Indeed, if we look deeper into the DEBE survey as per the chart below, you will see that spending in the Irish economy by the food and drink sector was over five times greater than any of the individual FDI sectors including pharma/chemicals, ICT and medical devices.

The bottom line is that while multinationals make a contribution to the Irish economy, the proportion of their sales and exports actually staying in the Irish economy is tiny.

On the other hand, the value created by indigenous Irish companies stays in the country and the greatest contributor of all is agri food where raw material from Irish farms is processed in multiple sites across rural Ireland and exported with the value returned to the local economy.

In an economic and accounting world full of global flows and capital transfers, nailing down specific Irish economy impacts is the only true way of gauging where Irish economy jobs and economic impact will flow.

The key purpose in highlighting these two reports is to provide a focus for the Government's reboot programme that highlights how the best return to Irish economy terms is likely to be achieved.

Furthermore, the profile of real Irish economy champions needs to be properly understood if industrial policy is to be aligned with the ambitions for economic reboot and economic growth. This did not happen after the 2008 economic crash.

While clearly there were budgetary constraints, there was too much hope and aspiration that the low corporation tax policy on its own was a silver-bullet solution to economic recovery.

Over-reliance on foreign direct investment

This sole focus of policymakers on the foreign direct investment (FDI) sector has, for example, distorted whole-Irish economy assessment of WTO impacts or bilateral trade deals.

This has led to support for trade deals on the basis of claiming benefits in sectors that represent solely transfer pricing activity, where minimal benefits accrue to the Irish economy.

At the same time, the negative impact of trade deals on indigenous companies in agri food whose Irish economy impact or NNP is higher has been down played.

There is a huge incentive for these companies to locate and pay their pan-EU profits in Ireland

Low corporation tax works in incentivising high-earning well-established companies to locate in Ireland - that is companies who have very high profit margins and/or patents that will generate future high margin or profit.

Indeed, a measure of the scale of this incentive is the ratio of profit repatriated at €160bn annually, compared with just €23bn direct expenditure in the Irish economy.

Clearly, there is a contribution that these companies make to the Irish economy, but even more clearly there is a huge incentive for these companies to locate and pay their pan-EU profits in Ireland.

But as the ESRI and Professor Fitzgerald analysis, and the more granular focus on Irish economy expenditure, demonstrates, low corporation tax does not raise all boats in economic development terms, particularly in the context of a range of vital business finance supports.

Low corporation tax cannot replace long-term investment and it cannot provide the substantial capital investment supports that are necessary to drive market diversification post-Brexit, nor drive a transformation to higher value added across the SME and agri food sectors.

Low corporation tax will not provide high-cost investment in transformative climate mitigation measures such as green gas infrastructure.

It cannot replace competitive business finance or risk mitigation support for SMEs and indigenous large company sectors such as the food and drink sector.

Diversification

FDI does not provide essential market diversification mechanisms such as trade credit insurance, which is recognised across the EU as a must-have policy instrument for continuing trade and will be even more vital as Ireland addresses the trade diversification challenges of Brexit.

This is not available in Ireland, despite requests from industry since early April to match state supports in all EU member states plus the UK.

The relevance and timing of the key insights provided in the ESRI/John Fitzgerald report and the DEBE annual survey of Irish economy expenditure could not be more timely as the new Government is attempting to put together a programme for recovery.

This programme will specify where Ireland will place its investment bets in order to best address the post-lockout recovery in the immediate short term.

It will also seek to focus in the medium to long term on rebooting economic growth and mitigating climate change impacts and managing Brexit - a tall order calling for not just a large stimulus package, but a diverse and multi-focused one also.

The importance of indigenous industry cannot be overlooked.

Now that we finally have a Government, the focus must turn to the very real challenges of restarting the Irish economy.

On the positive side, the cost of borrowing plus national finances were in relatively good shape going into the coronavirus shutdown.

Equally importantly, the evolving EU-wide COVID-19 fund, while not yet fully formed or entirely to Ireland's liking, recognises the need for concerted action, rather than relying on the invisible hand of the markets or the dead hand of state aid-restricted government intervention as the sole policy.

This was the case in the last recession caused by the global financial crash in 2008 which lasted until 2015.

Massive challenge

There is a huge challenge ahead for the new Government as it attempts to get the economy going again in the midst of a post-pandemic global recession.

The slow emergence from lockdown and threat of further spikes restricts tourism and travel, with the knock-on impact on the food service and hospitality sectors, as pubs and restaurants will be operating with costly restrictions.

An unemployment rate of 15% or more is a serious possibility and there is the issue of a dysfunctional trading relationship between the UK and EU from the end of this year.

This could leave Ireland trading with and through a UK economy that diverges from UK norms and standards.

The long-standing housing shortage and health service problems remain to be addressed

Climate change is a global issue but there is a particular issue for Ireland in that ideology risks curbing the contribution the agri food sector can make to driving economic growth to the rural and regional economy.

There is also the paradox in the Irish economy where the successful multinational sector provides good top line economic performance figures, but unlike agri food, this money doesn’t circulate in the Irish economy.

Aside from the COVID-19 created problems, the long-standing housing shortage and health service problems remain to be addressed in a meaningful way by the incoming Government.

ESRI report

The challenge for the incoming Government is huge, but the ESRI has identified how and where it can get the best return for its investment in the economy.

In a report by Professor John Fitzgerald - Understanding recent trends in the Irish economy – he highlights that “while foreign multinational enterprises make a very valuable contribution to growth, the success of the economy now depends very heavily on the progress of domestic business”.

The focus and methodology of the report was to address the conundrum that is Ireland's “official GDP figures“ and by removing the impact of multinational profit repatriation and price transfers, establishes a more realistic and relevant view of the performance of the Irish economy.

The GDP measurement in Ireland can be distorted, as demonstrated in the second quarter of 2015

Prof Fitzgerald suggests that instead of using the GDP metric for Irish economy health, a stripped-back measure called net national product (NNP) is more realistic and more relevant to assessing true Irish economic performance.

The GDP measurement in Ireland can be distorted, as demonstrated in the second quarter of 2015, which recorded a 21% annual increase due to the lodging of international patents in Ireland and gave rise to the term 'leprechaun economics'.

Using the NNP measure, two major insights emerge into the real patterns of economic growth, according to Prof Fitzgerald.

Firstly, while foreign firms account for over half of the gross value added in the economy, they only account for one fifth of NNP and one quarter of the wage bill, and both foreign and domestic firms grew at a similar rate since the economy began to recover in 2013.

DEBE report on Irish economy expenditure

Additionally in May, the Department of Enterprise Business and Employment (DEBE) published a major report entitled The Annual Survey of Irish Economy Expenditure for 2018.

As per previous articles of mine, this annual report publishes analyses of total exports, sales, gross value added and, perhaps most importantly, expenditure in the Irish economy by all firms in all sectors, indigenous and foreign multinationals.

This report is based on a survey of approximately 4,200 client companies of Enterprise Ireland, IDA Ireland and Údarás na Gaeltachta with 10 or more employees in Ireland and comprises the manufacturing and information, communication and other internationally traded services sectors. All data is in current prices.

The points below best illustrates the huge difference between the perception of the value of sales or exports by the multinational companies through the Irish economy and the reality of the much lower figure of their expenditure in the Irish economy.

While sales and exports from the FDI sector were running at €220bn and €230bn respectively in 2018, direct expenditure in the Irish economy amounted to €23bn.Moreover, direct expenditure by domestic companies was higher at €26.4bn. In economic multiplier terms, for every €10 of multinational exports, €1 is spent in the Irish economy.For domestic Irish companies including the food and drink sector, the ratio is €10 exports to €11.50 spend in the Irish economy (€23bn exports versus €26.4bn Irish economy spend)

Multinationals good but indigenous better.

Indeed, if we look deeper into the DEBE survey as per the chart below, you will see that spending in the Irish economy by the food and drink sector was over five times greater than any of the individual FDI sectors including pharma/chemicals, ICT and medical devices.

The bottom line is that while multinationals make a contribution to the Irish economy, the proportion of their sales and exports actually staying in the Irish economy is tiny.

On the other hand, the value created by indigenous Irish companies stays in the country and the greatest contributor of all is agri food where raw material from Irish farms is processed in multiple sites across rural Ireland and exported with the value returned to the local economy.

In an economic and accounting world full of global flows and capital transfers, nailing down specific Irish economy impacts is the only true way of gauging where Irish economy jobs and economic impact will flow.

The key purpose in highlighting these two reports is to provide a focus for the Government's reboot programme that highlights how the best return to Irish economy terms is likely to be achieved.

Furthermore, the profile of real Irish economy champions needs to be properly understood if industrial policy is to be aligned with the ambitions for economic reboot and economic growth. This did not happen after the 2008 economic crash.

While clearly there were budgetary constraints, there was too much hope and aspiration that the low corporation tax policy on its own was a silver-bullet solution to economic recovery.

Over-reliance on foreign direct investment

This sole focus of policymakers on the foreign direct investment (FDI) sector has, for example, distorted whole-Irish economy assessment of WTO impacts or bilateral trade deals.

This has led to support for trade deals on the basis of claiming benefits in sectors that represent solely transfer pricing activity, where minimal benefits accrue to the Irish economy.

At the same time, the negative impact of trade deals on indigenous companies in agri food whose Irish economy impact or NNP is higher has been down played.

There is a huge incentive for these companies to locate and pay their pan-EU profits in Ireland

Low corporation tax works in incentivising high-earning well-established companies to locate in Ireland - that is companies who have very high profit margins and/or patents that will generate future high margin or profit.

Indeed, a measure of the scale of this incentive is the ratio of profit repatriated at €160bn annually, compared with just €23bn direct expenditure in the Irish economy.

Clearly, there is a contribution that these companies make to the Irish economy, but even more clearly there is a huge incentive for these companies to locate and pay their pan-EU profits in Ireland.

But as the ESRI and Professor Fitzgerald analysis, and the more granular focus on Irish economy expenditure, demonstrates, low corporation tax does not raise all boats in economic development terms, particularly in the context of a range of vital business finance supports.

Low corporation tax cannot replace long-term investment and it cannot provide the substantial capital investment supports that are necessary to drive market diversification post-Brexit, nor drive a transformation to higher value added across the SME and agri food sectors.

Low corporation tax will not provide high-cost investment in transformative climate mitigation measures such as green gas infrastructure.

It cannot replace competitive business finance or risk mitigation support for SMEs and indigenous large company sectors such as the food and drink sector.

Diversification

FDI does not provide essential market diversification mechanisms such as trade credit insurance, which is recognised across the EU as a must-have policy instrument for continuing trade and will be even more vital as Ireland addresses the trade diversification challenges of Brexit.

This is not available in Ireland, despite requests from industry since early April to match state supports in all EU member states plus the UK.

The relevance and timing of the key insights provided in the ESRI/John Fitzgerald report and the DEBE annual survey of Irish economy expenditure could not be more timely as the new Government is attempting to put together a programme for recovery.

This programme will specify where Ireland will place its investment bets in order to best address the post-lockout recovery in the immediate short term.

It will also seek to focus in the medium to long term on rebooting economic growth and mitigating climate change impacts and managing Brexit - a tall order calling for not just a large stimulus package, but a diverse and multi-focused one also.

The importance of indigenous industry cannot be overlooked.

SHARING OPTIONS